Home › Forums › Chat Forum › How do you decide which crypto currency to buy?

- This topic has 1,278 replies, 179 voices, and was last updated 4 weeks ago by sirromj.

-

How do you decide which crypto currency to buy?

-

andrewhFree MemberPosted 3 years ago

Loads of financial advice on here so…

Yes, I know it has no intrinsic value so only play with money you can afford to lose.

.

If i want to buy a share in a company I can look at the company accounts, what’s happening in the industry, it’s products, it’s competitors, it’s management, etc, etc and work out if I think it’s a good bet.

.

What should I look at with crypto currency? There’s loads to choose from, most I suspect will be abject failures, the bebos and Myspaces to bitcoin’s facebook.

Obviously no-one knows the right choices but what indicators can you look for to turn a wild stab in the dark into a calculated risk?davrosFull MemberPosted 3 years agoGo to Reddit and choose a crypto cult based on how annoying the various memes are.

curiousyellowFree MemberPosted 3 years agoDollar cost average into BTC and ETH. Maybe some XMR if you want to take a punt on something because you “believe in the tech”.

doris5000Free MemberPosted 3 years agoYeah i’d appreciate some advice!

I decided to have a dabble recently. Bought some XRP, smallish amounts, and basically I couldn’t even fart without making a 30% profit. So I very cleverly decided that this currency trading lark must be really easy, and launched a grand at it. Which is currently worth about £700 😆

So I’ve gone back to £20 at a time. I’ve got a few open positions in some smaller currencies, which are all gently in profit.

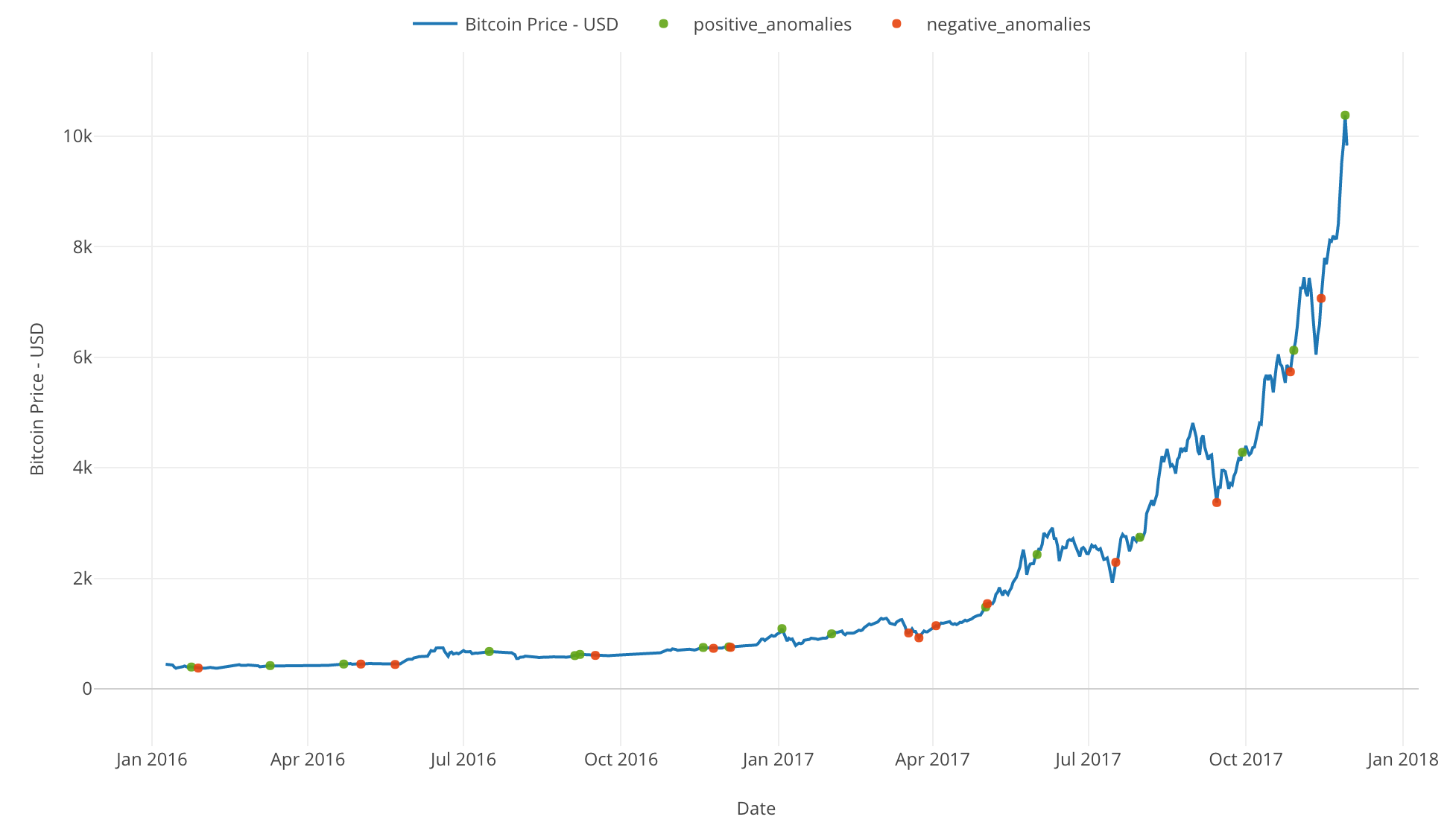

But every time I look at them, they just seem to be in a massive bubble. Everything seems to be on a massive tear, and although I’ve got massive FOMO there’s just no way I want to be buying in as a novice to something that looks like this:

So I don’t. And then it goes up by another 50% in a week…!

I’ve got a few alerts set up. I got one alert when ETH was trading at 1280. But by the time I noticed the alert, it was back up to like 1350 and I figured I’d missed that boat. It’s now up near 1750….

<edit – image not working. But just imagine an exponential curve>

AdamTFull MemberPosted 3 years agoI think crypto is becoming more mainstream, so I wonder if the volatility will decrease as these currencies become more mature? I saw recent news that both PayPal and visa are doing more around crypto which points towards it being generally accepted. My teenage boys keep up to date with the meme’s which helps! I’m up so far, but only gambled an amount I’m happy to lose.

Slight disclaimer. I’ve spent the last 27 years using FPGAs and the last 15 working for Intel that make them. These devices are often used for mining, so I’m hopeful this market will pick up! 👍

CougarFull MemberPosted 3 years agoSlight disclaimer. I’ve spent the last 27 years using FPGAs and the last 15 working for Intel that make them. These devices are often used for mining

I can only assume then that you’ve invested heavily in AMD shares. (-:

finbarFree MemberPosted 3 years agoThere is bitcoin and then there is everything else (s***coins).

ETH is the only other one I would consider but even that, unlike Bitcoin, has a theoretically unlimited supply, so hard for me to buy into the concept.

jimmyFull MemberPosted 3 years agoWatch Crypto Diggy on YouTube.

Before Christmas he gave his top 10 coins to be invested in, including AAVE which was $32 at the time. Now ~$500. I didn’t buy any, a mate did.

jimmyFull MemberPosted 3 years agoAlso check out crypto mining companies, e.g. ARB, KR1 and Coinsillium.

curiousyellowFree MemberPosted 3 years agoRecently there was a bit of a pump and dump on XRP. I’d be careful if I were you.

As a technology, XRP has potential, but in all honesty, I can’t see it ever gaining mainstream adoption. More likely, the tech will be mimicked to make settlement faster for things that need it.

At the beginning, I just took a bunch of money I could afford to lose and just put it into a bunch of things that I liked the look of. These days, it may make more sense to just buy the 2-3 big players. It’s still just for fun though.

In my opinion, the ones that are just tokens are useless.

IvanDobskiFree MemberPosted 3 years agoIf anyone fancies having a bit of a play with the various currencies Coinbase do educational rewards for several – watch a video, get some of that currency.

In total you can make about £50 doing it at no cost so for messing around with its pretty good.

They’re also doing 10% sign-up bonus on $100 bitcoin purchases with a referral code. If you want a code let me know and I can get the 10% as well!

With either you can easily cash out so worth looking at.

footflapsFull MemberPosted 3 years agoI’ve got massive FOMO there’s just no way I want to be buying in as a novice to something that looks like this:

FOMO is pretty much all you’re looking at, strip that out and there’s nothing left.

As for being a ‘novice’, everyone buying it is a novice, no one knows what will happen and when – it’s just pure speculation / gambling.

the-muffin-manFull MemberPosted 3 years agoI’m just a very low level beginner with this and in reality missed the boat with Bitcoin and Etherium without chucking big money in.

With my very basic research the only one I can see potential decent profits is XRP – it’s cheap so you can buy a lot for not much cash – and in 5 years time it may be worth 3 figures.

I’m just playing with £30/£40 a month at the minute. Money I can afford to lose.

Or it might completely bomb! 🤣🤣🤣

beicmynyddFree MemberPosted 3 years agoIvandobski and Finbar are spot on.

Take a look at the interviews that Michael saylor has been putting out this week, this is

What may be helping the price increase today.AdamTFull MemberPosted 3 years ago@Cougar…. Let’s just say that it’s good practice to diversify one’s portfolio. 😉

steviousFull MemberPosted 3 years agoI bought some Ripple because I was hungry and wanted some raspberry ripple ice cream.

I have now made enough profit to buy some ice cream so it worked for me.

doris5000Free MemberPosted 3 years agoWell from today’s small-time piffling, I have just closed a couple of positions that netted me a tidy £3.64 in profit. All the self-satisfaction, none of the risk. Another day of this and I might have enough to buy the wife a pint.

squirrelkingFree MemberPosted 3 years agoThere’s loads to choose from, most I suspect will be abject failures, the bebos and Myspaces to bitcoin’s facebook.

Shite analogy, both were hugely popular at the time until the next big thing came along. If its popular now you’ve already missed the boat.

wzzzzFree MemberPosted 3 years agoMany many years ago I got sent 10p of bitcoin.

It’s now become my retirement plan.

FlaperonFull MemberPosted 3 years agoThe power consumption of Bitcoin is about 75TWh/year. That’s *dodgy back of the envelope maffs* equivalent of pointlessly turning on fifty billion electric fires and then running air conditioning to cool the room down again.

I don’t want any involvement in it and urge everyone else to avoid it for the same reason.

EarlFree MemberPosted 3 years agoSame power consumption as Chile.

But same argument as gold. Spent all this energy digging it out of the ground, transporting and keeping it safe. We use it as a store of value – same as what bitcoin is turning out to be And apart from dentistry, gold doesn’t do much else all day long.

Could also argue bitcoin is a network and settlement layer. It electricity used also performs the transactions. So if comparing apples with apples we should also include the energy to run the all the international banking/swift servers.

It’s a tricky argument thought. A lot of power goes into the bitcoin network. I would love all the computation to go to something like astro/seti/Cern or even cloud commerce type thing. Probably can’t happen technically for some reason?????

footflapsFull MemberPosted 3 years agoAnd apart from dentistry, gold doesn’t do much else all day long.

mattyfezFull MemberPosted 3 years ago

mattyfezFull MemberPosted 3 years agoIt’s a bit like forex trading I guess, as it’s essentially a currency.

fatoldgitFull MemberPosted 3 years agoJust for fun and cos I can’t lose much I’m looking at DOGE,

Currently around 6 cents, and realistically overvalued even at that cost

BUT… and it’s a big but … if the wsb apes get lucky and by some miracle it does hit $1 ( highly unlikely ) it should then take off as a result of the FOMO factorWhen I say looking at I have to admit it will only be very small punt (£25 ish )

nickcFull MemberPosted 3 years agoNo-one ‘decides’ which bitcoin to buy, you discover which bitcoin you bought, the morning afterwards

EarlFree MemberPosted 3 years agoDid not know gold was used in electronics. Ok this is productive. If that was a world chart – then is that saying 37% of all the gold mined per year goes into electronics?

What wedge does gold bars go under?

Official coin and jewelry – store of value.

Other – whiskey with gold flakes is for w**kers

footflapsFull MemberPosted 3 years agoDid not know gold was used in electronics. Ok this is productive. If that was a world chart – then is that saying 37% of all the gold mined per year goes into electronics?

No, it excludes bullion – ie gold used as money. Pretty much every electronic device will have a tiny amount of gold used to plate all the contacts as it doesn’t corrode and is an excellent conductor of electricity.

BruceWeeFree MemberPosted 3 years agoI don’t want any involvement in it and urge everyone else to avoid it for the same reason.

If that’s your only concern then stick to currencies that use Proof of Stake rather than Proof of Work.

Etherium should go completely over to Proof of Stake in the next year or two but there are plenty other currencies that already use it.

chevychaseFull MemberPosted 3 years agoPut it this way – we’re 31 posts into a crypto thread on a bike forum and nobody (but me) has used the word “Tulips” yet.

Penny is dropping. Crypto’s here to stay. It’s still cheap.

polyFree MemberPosted 3 years agoIt’s a bit like forex trading I guess, as it’s essentially a currency.

Except that most forex is not hugely volatile, and you can link many of the fluctuations in value to political or economic things in the world. So you can take a view on whether Biden is going to help or hinder the dollar, whether Brexit has bottomed out the value of the pound, and more niche details like whether a single case of covid escaping from quarantine in Australia will hit the economy, or how a new technology that relies heavily on a particular raw material might boost individual countries etc. Of course there’s hype and market effects too, but with crypto it’s all hype and market dynamics.

andrewhFree MemberPosted 3 years agoThanks all. That’s basically what I was asking Poly, other markets have things you can look at to inform your decisions, those you mentioned in the case of currencies, I gave the example of shares, for say the market in grain futures you could look at forecast demand, crop yields, weather patterns, rules around GMOs, all other markets have things you can look at to inform yourself and you to make predictions.

People obviously disagree on the conclusions to draw, hence some buy and some sell, but they all look at information to make their decisions.

What can we look at with crypto currencies besides market sentiment, what other drivers are there that we can examine and try to learn from?beicmynyddFree MemberPosted 3 years agoThe big institutions are now looking and investing clients money into crypto, and in the US the SEC this is what will push up the prices.

chevychaseFull MemberPosted 3 years ago@andrewh – you need to look at the project.

What does it offer? What function does it serve? What potential does it have? Is it inherently secure? What are it’s weaknesses? What are the barriers to it’s uptake? Can it be transformative in an apparently crowded space?

schrickvr6Free MemberPosted 3 years agoI’ve been thinking about dipping a toe into the water, is anyone using Binance? I don’t mind the complexity of it but there are a lot of bad reviews about withdrawals going missing.

justinbieberFull MemberPosted 3 years agoI’d be buying more Bitcoin – https://techcrunch.com/2021/02/08/tesla-buys-1-5b-in-bitcoin-may-accept-the-cryptocurrency-as-payment-in-the-future/

footflapsFull MemberPosted 3 years agoWhat can we look at with crypto currencies besides market sentiment, what other drivers are there that we can examine and try to learn from?

Nothing.

There is nothing unless you can measure a combination of human greed / FOMO and then work out how much of those Crypto will attract before people loose interest or find something else.

I’d be buying more Bitcoin

Doesn’t really mean anything. If Tesla set their prices in Bitcoin and then converted to other currencies, that would mean something.

As all their costs are in $, their car prices will be determined in $. BC etc are far too volatile to be useful as a currency.

It’s just a gimmick.

BruceWeeFree MemberPosted 3 years agoNothing.

There is nothing unless you can measure a combination of human greed / FOMO and then work out how much of those Crypto will attract before people loose interest or find something else.

It would be interesting to know what you’re basing that on. Is it after extensive research?

I’ve been studying crypto currencies for a while and I’m still getting my head around the technology. How long did it take you?

Personally I believe that there is a crisis of confidence approaching when it comes to fiat currencies and people are not going to put their faith in gold this time around. Gold is too difficult to secure and any government can decide you’re not allowed to own it any time they want.

Even China wasn’t able to stop it’s population owning crypto and if the Chinese government can’t ban it what chance do western governments have?

I think the end game for most governments is to have some form of digital currency but one that they control rather than one that is decentralised. How they deal with the current crypto currencies is the question.

We’re in for a turbulent few years in my opinion but writing off crypto because it’s difficult to understand would be a mistake, I reckon.

You must be logged in to reply to this topic.