Home › Forums › Chat Forum › Should I forgive the Labour Party?

- This topic has 434 replies, 58 voices, and was last updated 9 years ago by duckman.

-

Should I forgive the Labour Party?

-

wreckerFree MemberPosted 9 years ago

are part time workers not entitled to buy houses?

If they can afford it. Owning a house is no more an entitlement than owning a german luxury car.

jambalayaFree MemberPosted 9 years agoIt’s interesting there isn’t really anything much happening today election wise, we are all arguing about other stuff.

edward2000Free MemberPosted 9 years agoWhen people come out with meaningless hyperbolic soundbites like this it’s very difficult to take them seriously. Have you ever considered a career as a politician?

The irony.

The country was on the brink if bankruptcy. George Osbourne felt it necessary to release an emergency budget caused by the debt the nation was in

Labour broke the country.

grumFree MemberPosted 9 years agoIt was also based on a huge creation of public sector jobs.

Oh noes – giving people decent jobs to do useful things that help people. How awful.

The country was on the brink if bankruptcy.

What a load of utter bollocks. Can you provide some evidence for this please? Or is it just another one of those things that ‘everyone knows’? 🙄

edward2000Free MemberPosted 9 years agoQuite a few. Start with this one

http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/5816377/Is_Britain_going_bankrupt/

grumFree MemberPosted 9 years agoThat blog is pure speculation.

Here’s what the (Tory) Treasury Select Committee chairman had to say:

The chancellor, George Osborne, came under fire today from MPs on the Treasury select committee, charged with “misleading the public” for claiming the UK was near bankruptcy in the weeks after he took office. He was accused of using inflammatory language to justify massive public spending cuts.

The committee chairman, Tory MP Andrew Tyrie, said Osborne’s claim that Britain had been “on the brink of bankruptcy” was “a bit over the top”. He also challenged the chancellor’s claims that his emergency budget had been progressive, accusing him of “over-egging it a bit”.

Or here’s Lord Turnbull, former head of the Civil Service:

An interesting exchange at Treasury select committee this morning, where Lord Turnbull – former head of the civil service – seemed to question George Osborne’s claim that Britain was on the brink of bankruptcy until now.

Chuka Umunna: “You said that you didn’t think the issues that had been raised in relation to sovereign debt and the UK were relevant. What did you mean by that?”

Lord Turnbull: “Well I always thought that we were capable of producing a financial settlement that wouldn’t take us into Irish and Greek problems. Secondly, a very large part of our debt was domestically held. If people are going to sell gilts they’ve got to buy something else. Who are these great shining examples of people who are issuing rock solid debt you want to buy?”

Chuka Umunna: Do you think it is accurate to describe the UK as being on the brink of bankruptcy?

Lord Turnbull: No, I don’t.”

Or Nobel-prize winning economist Paul Krugman’s view:

The narrative I’m talking about goes like this: In the years before the financial crisis, the British government borrowed irresponsibly, so that the country was living far beyond its means. As a result, by 2010 Britain was at imminent risk of a Greek-style crisis; austerity policies, slashing spending in particular, were essential. And this turn to austerity is vindicated by Britain’s low borrowing costs, coupled with the fact that the economy, after several rough years, is now growing quite quickly.

Simon Wren-Lewis of Oxford University has dubbed this narrative “mediamacro.” As his coinage suggests, this is what you hear all the time on TV and read in British newspapers, presented not as the view of one side of the political debate but as simple fact.Yet none of it is true.

But no – carry on boldly stating the Tory party line as if it’s uncontrovertible fact. 🙄

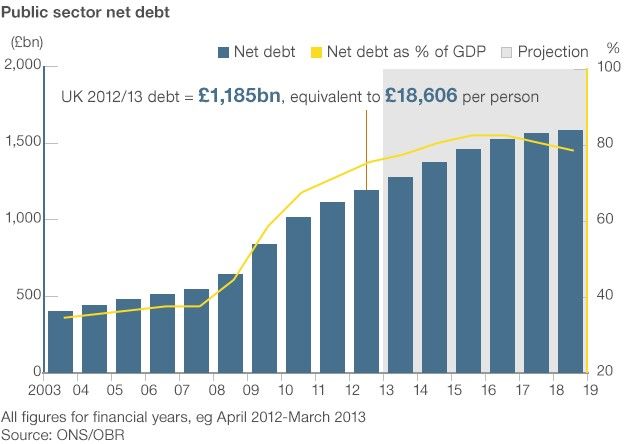

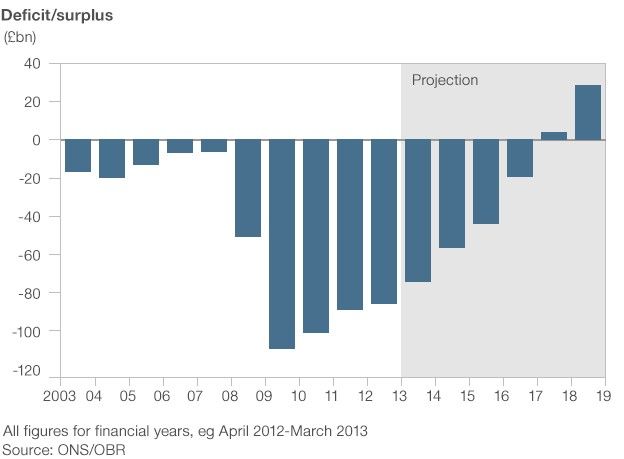

Ben_HFull MemberPosted 9 years agoDigga – there has been no reduction of debt; it has more than doubled since 2010. Arguably, this is due to austerity economics.

jambalayaFree MemberPosted 9 years agoDigga – there has been no reduction of debt; it has more than doubled since 2010. Arguably, this is due to austerity economics.

What is clear is how much worse the debt / economy would have been without austerity. France tried the “Labour Plan” of increased spending and big tax rises on the wealthy and its failed totally

jambalayaFree MemberPosted 9 years agoHave you got some more up to date figures or is this another one of those things that ‘everyone’ knows, so you don’t need any evidence?

@grum that piece you linked to showed London and the South East accounted for 19% of the Help to Buy purchases, so thanks for posting a link to make my point 😉From memory the North West was the biggest user. The Help to Buy price limits are quite low with respect to London prices

kimbersFull MemberPosted 9 years agojambalaya – Member

It’s interesting there isn’t really anything much happening today election wise, we are all arguing about other stuff.after yesterdays ‘dead cat’……… a Lynton Crosby meme- throwing a dead cat on the table when loosing an argument- saw fallon pushed in to calling milliband a backstabber to get away from the damaging (for the tories) non-dom debate

everything seems a bit flat- dead cat success!

jambalayaFree MemberPosted 9 years agoAnyone lookup UKIPs Johnny Rockard. I have to confess I checked some of his material really wished I had not 😥

diggaFree MemberPosted 9 years agogrum – Member

Oh noes – giving people decent jobs to do useful things that help people. How awful.I don’t mind jobs being done, but any rational person should object to non-jobs being created, just for the sake of it and just to buy votes. Cynical and wrong.

For the record, governments cannot, strictly, ‘create’ jobs; they can raise funds – through taxation or debt – to fund a job. And that does not necessarily mean it is a real, worthwhile job for the country or the employee.

jambalayaFree MemberPosted 9 years agoGovernment jobs. Yes a good idea to create local employment in much needed areas and usually at a lower cost, the downside is that when the government needs to cut spending you are at risk. The big issue is why we have so little private sector job creation outside London and the South East.

diggaFree MemberPosted 9 years agoBen_H – Member

Digga – there has been no reduction of debt; it has more than doubled since 2010. Arguably, this is due to austerity economicsSmashing, so you’d advise an endebted mate to go out and apply for a few more loans and credit cards?

That the debt increased despite austerity ought to tell you something about the magnitude of stupidity the coalition treasury inherited.

The deficit is being cut but the mess cannot be unraveled in one go without even more drastic measures which, I am guessing, neither you nor I would want to see. I am not a particular supporter of the coalition, but have to say (especially compared to France for example) they have managed well.

Fill your boots on facts: http://www.bbc.co.uk/news/business-25944653

kimbersFull MemberPosted 9 years agodigga – Member

That the debt increased despite austerity ought to tell you something about the magnitude of stupidity the coalition treasury inherited.or that austerity isnt the solution?

grumFree MemberPosted 9 years agoThat the debt increased despite austerity ought to tell you something about the magnitude of stupidity the coalition treasury inherited.

Ah so we’re back to – the debt keeps increasing (and the Tories have failed on their promises on the deficit, let along the debt) and it’s still Labour’s fault, despite them not being in power.

If the debt had been cut would you be thanking Labour, or is it only their responsibility when things go wrong?

What is clear is how much worse the debt / economy would have been without austerity.

Ah someone else with the magical ability to predict alternate realities with complete certainty. 🙄

wreckerFree MemberPosted 9 years agoI think it was more a comment of the state it was in when handed over (and let’s be fair, it was f***ed).

binnersFull MemberPosted 9 years agoIf the finances really are that screwed, then you can see why the SNP are making headway against the two main parties. By stating the bleeding obvious….. that spending £100 billion+ on some big boys toys, so we get to wave our willy around on the world stage, may not be the best use of taxpayers money

ninfanFree MemberPosted 9 years ago

ninfanFree MemberPosted 9 years agoor that austerity isnt the solution?

Indeed, as we can see from the consistent economic growth outshining our own in those neighbouring countries which pursued a stimulus rather than austerity model!

Oh…

grumFree MemberPosted 9 years agoAs a Conservative I have no pleasure in exposing David Cameron’s deficit claims. However, as long as the party continues to talk down the economy via the blame game, confidence will not be given an opportunity to return. For it is an undeniable and inescapable economic fact: without confidence and certainty there can be no real growth.

Below are the three deficit claims – the mess. The evidence comes from the IMF, OECD, OBR, HM Treasury, ONS and even George Osborne. The claims put into context are:

CLAIM 1

The last government left the biggest debt in the developed world.After continuously stating the UK had the biggest debt in the world George Osborne admits to the Treasury Select Committee that he did not know the UK had the lowest debt in the G7? Watch: Also, confirmed by the OECD Those who use cash terms (instead of percentages) do so to scare, mislead and give half the story.

Its common sense, in cash terms a millionaire’s debt would be greater than most people. Therefore, the UK would have a higher debt and deficit than most countries because, we are the sixth largest economy. Hence, its laughable to compare UK’s debt and deficit with Tuvalu’s who only have a GDP/Income of £24 million whilst, the UK’s income is £1.7 Trillion.

Finally, Labour in 1997 inherited a debt of 42% of GDP. By the start of the global banking crises 2008 the debt had fallen to 35% – a near 22% reduction page 6 ONS Surprisingly, a debt of 42% was not seen as a major problem and yet at 35% the sky was falling down?

CLAIM 2

Labour created the biggest deficit in the developed world by overspending.Firstly, the much banded about 2010 deficit of over 11% is false. This is the PSNB (total borrowings) and not the actual budget deficit which was -7.7% – OBR Economic and Fiscal Outlook March 2012 page 19 table 1.2

Secondly, in 1997 Labour inherited a deficit of 3.9% of GDP (not a balanced budget ) and by 2008 it had fallen to 2.1% – a reduction of a near 50% – Impressive! Hence, it’s implausible and ludicrous to claim there was overspending. The deficit was then exacerbated by the global banking crises after 2008. See HM Treasury. Note, the 1994 deficit of near 8% haaaaaah!

Thirdly, the IMF have also concluded the same. They reveal the UK experienced an increase in the deficit as result of a large loss in output/GDP caused by the global banking crisis and not even as result of the bank bailouts, fiscal stimulus and bringing forward of capital spending. It’s basic economics: when output falls the deficit increases.

Finally, the large loss in output occurred because the UK like the US have the biggest financial centres and as this was a global banking crises we suffered the most. Hence, the UK had the 2nd highest deficit in the G7 (Not The World) after the US and not as a result of overspending prior to and after 2008- as the IMF concur.

CLAIM 3

Our borrowing costs are low because the markets have confidence in George Osborne’s austerity plan and without it the UK will end up like Greece.Yes, the markets have confidence in our austerity plan and that’s why PIMCO the worlds largest bond holder have been warning against buying UK debt.

The real reason why our borrowing costs have fallen and remained low since 2008 is because, savings have increased. As a result, the demand and price for bonds have increased and as there is inverse relationship between the price of bonds and its yield (interest rate) the rates have fallen. Also, the markets expect the economy to remain stagnate. Which means the price for bonds will remain high and hence, our borrowing costs will also remain low.

Secondly, the UK is considered a safe heaven because, investors are reassured the Bank of England will buy up bonds in an event of any sell off – which increases the price of bonds and reduces the effective rate. Note, how rates fell across the EU recently when the ECB announced its bond buying program. Thirdly, because, we are not in the Euro we can devalue our currency to increase exports. Moreover, UK bonds are attractive because, we haven’t defaulted on its debt for over 300 years.

David Cameron would like people to believe the markets lend in the same way as retail banks lend to you and I.

Overall, when the facts and figures are put into context these juvenile deficit narratives and sound bites (“mere words and no evidence”) simply fail to stand up to the actual facts. The deficit myth is the grosses lie ever enforced upon the people and it has been sold by exploiting people’s economic illiteracy.

So, David Cameron when are you going to apologise?

Cameron is playing the blame game to depress confidence and growth to justify austerity. Secondly, to use austerity as justification for a smaller state to gain lower taxes. Thirdly, to paint Labour as a party that can not be trusted with the country’s finances again. Therefore, we Conservatives will win a second term because, people vote out of fear. The latter strategy worked the last time in office (18 years) and will work again because, in the end, elections are won and lost on economic credibility. Hence, as people believe Labour created the mess they won’t be trusted again.

Finally, as the truth is the greatest enemy of the a lie I urge you to share this on Facebook, Twitter, blogs, text and email etc etc. So the truth can be discovered by all. Finally, have no doubt, people have been mislead by the use of the following strategy:

“If you tell a lie big enough and keep repeating it, people will eventually come to believe it” Joseph Goebbels

http://www.huffingtonpost.co.uk/ramesh-patel/growth-cameron-austerity_b_2007552.html

diggaFree MemberPosted 9 years agokimbers – Member

digga – Member

That the debt increased despite austerity ought to tell you something about the magnitude of stupidity the coalition treasury inherited.or that austerity isnt the solution?[/quote]I’ll ask the question again, because clearly some people are struggling with the practicalities of the situation, which is really very, very, very simple, even for someone who’s never properly thought about the subject and is finally getting to it on a Friday afternoon:

If someone (imagine someone you actually like) is badly in debt, would you advise them:

A.) Not to incur further debt and to try to consolidate or reduce debt, possibly also by reducing outgoings? Or,

B.) **** it, pile up some more debt (which eventually comes at higher and higher interest rates of course as the markets lose confidence) and, in fact, spend a bit more?Clue: there are no magic beans.

grumFree MemberPosted 9 years agodigga – people are not countries. Your analogy is completely invalid (and childish).

grumFree MemberPosted 9 years agoEric Pickles comes quite close.

😀

I’ll ask the question again, because clearly some people are struggling with the practicalities of the situation, which is really very, very, very simple

This is one of the key problems – it really isn’t that simple at all, but people like to try and bring everything down to a simple level because they struggle with more complex issues.

kimbersFull MemberPosted 9 years agodepends digga, what you are investing your borrowed cash in ?

are you putting it toward infrastructure, education, healthcare, social care, welfare that will ultimately benefit the nation

or taking the other path reducing spending on all those things so that short term growth slows to a trickle and long term leaves you with an uneducated, unhealthy, deprived and unsupported society….

of course keep it simplistic and abstract if you like , its a sunny friday after all

diggaFree MemberPosted 9 years agogrum – Member

digga – people are not countries. Your analogy is completely invalid (and childish).Debt wrecks nations just as surely as it bankrupts individuals. There is no magic solution.

People like to make it look and sound complicated – obfuscation has always been a neat way to hoodwink – but, in the end it is not.

Huffpost is a joke, try something more rigorous: http://www.economist.com/news/finance-and-economics/21605934-argentina-ponders-its-next-step-imf-suggests-new-rules-broke

kimbersFull MemberPosted 9 years agoDebt wrecks nations just as surely as it bankrupts individuals.

so mortgages wreck you? car loans?, credit cards? paying for american assistance in WW2 ?

keep em coming, I can see how you got your username 😉

grumFree MemberPosted 9 years agoPeople like to make it look and sound complicated – obfuscation has always been a neat way to hoodwink – but, in the end it is not.

Just because you struggle with more complex explanations doesn’t make these issues simple.

I’m not sure how posting a link to an article about Argentina that doesn’t even mention the UK is supposed to prove anything.

I already posted a link to an article by a nobel prize winning economist – but obviously it was too complicated for you.

NorthwindFull MemberPosted 9 years agodigga – Member

If someone (imagine someone you actually like) is badly in debt, would you advise them:

A.) Not to incur further debt and to try to consolidate or reduce debt, possibly also by reducing outgoings? Or,

B.) **** it, pile up some more debt (which eventually comes at higher and higher interest rates of course as the markets lose confidence) and, in fact, spend a bit more?Analogies between people and countries are stupid. But, hey, it’s Friday.

My brother’s deeply in debt. But he borrowed more to invest in his business and as a result, he can sustain and repay that debt. Austerians would have had him keep using his old, outdated kit, then been surprised that he can’t make any money.

jambalayaFree MemberPosted 9 years ago@digga is absolutely right here

Many people don’t like austerity as they’d got used to living on borrowed money. Its quite compelling politically to have “the rich” pay for everything, because the “the rich” means someone else. Just look at furory creating by putting VAT up (to a similar rate the Germans and French had been paying for years btw), a tax paid by most instead of someone else. We still have one of the lower rates of VAT in the EU.

Austerity has absolutely worked. Many people may not be better off or even as well of as in 2007 but that should be no surprise as 2007 was an economy built on unsustainable levels of personal debt and a rising government budget deficit. With the changes in banking regulations banks couldn’t economically lend that amount of money today.

ninfanFree MemberPosted 9 years agoGrum

Ramesh Patel worked in finance from investments adviser with JMC Financial Assets, to commodities brokers in metal and currencies with Capital Assets. As well as a CEO for Proactive Internet Marketing and Brown Pound Publishing. Current working on a book on the UK deficit Myth and the real agenda of the right and left.I can’t find any information or trace on those companies he claims to have worked for, or anything further about him

Any ideas?

diggaFree MemberPosted 9 years agokimbers – Member

depends digga, what you are investing your borrowed cash in ?are you putting it toward infrastructure, education, healthcare, social care, welfare that will ultimately benefit the nation

The Weimar republic tried that – building Autobahns and so on. Didn’t work out well for them (or the rest of us, for that matter). An investment must improve either GDP or GDP per head, not all of the things you mention could possibly do that.

grum – Member

I’m not sure how posting a link to an article about Argentina that doesn’t even mention the UK is supposed to prove anythingIt is a real world lesson in where debt can land you. Fundamentally, how or why do you feel we are immune to it?

Looking at spending on public sector, it’s widely documented how, if this rises to too high a proportion of GDP it causes many difficulties. A real world example is Greece, right now.

jambalayaFree MemberPosted 9 years agoMy brother’s deeply in debt. But he borrowed more to invest in his business and as a result, he can sustain and repay that debt. Austerians would have had him keep using his old, outdated kit, then been surprised that he can’t make any money.

However in 2008 the general businesses environment in the UK and around the world would have meant that his investment would not have paid off, his business would have kept shrinking anyway.

France tried what you are suggesting and it hasn’t worked. Spectacularly so. But they did create a 66% tax rate (after the 75% one was declared illegal) and they did find many very rich people left and took many billions with them. They have a wealth tax there too btw, doesn’t work so well if the wealthy leave though. But hey how you can say nasty things about them in the press as being “unpatriotic”, so yo get to win points for the pantomime boo hiss

allthepiesFree MemberPosted 9 years agoSomeone else was sniffing around too.

http://brackenworld.blogspot.co.uk/2012/10/did-ramesh-patel-get-paid-for-this.html

grumFree MemberPosted 9 years agoHow about addressing the points raised rather than an ad hom? Are you going to try the same trick with Paul Krugman?

diggaFree MemberPosted 9 years agoThat article is from 2012 and has been widely discredited, not least because no one was actually making the specific claims it purports to bust.

Debt is fine whilst you can afford repayments. As Argentina and others have found, unlike with fixed loans, and even more so than with mortgages, the rate the markets demand from you can change rapidly.

ninfanFree MemberPosted 9 years agoI think I have found ‘Brown Pound’

Companies house no 05648211

Brown pound UK ltd, based in Wolverhampton, with Ramesh as director, listed as agents in the import of leather and textiles, then changed name to Autotrust breakdown services ltd…

How very curious

The topic ‘Should I forgive the Labour Party?’ is closed to new replies.