MegaSack DRAW - 6pm Christmas Eve - LIVE on our YouTube Channel

Currently renting a 2-bed flat. It's a nice flat, not massive but a nice place to be. Bikes are all in the spare bedroom, not ideal but ok (although lack of place to clean them means MTB has seen limited use over the last year and I'd like to change that)...

The area is nice enough, not amazing but ok, and I have off-street parking which is a godsend, esp when putting the bike in the back of the car (I live in SE London).

I finally have the ££ to buy and the owners of my flat have expressed an interest in selling but I could afford to spend more if I wanted to.

So the question is, buy a house (so I have a garden) in a nicer area by borrowing lots (affordably, but lots), or buy the flat I like and keep the spare cash aside for saving, investing, pension...

Essentially I'm talking about getting a bigger mortgage (debt) so the postcode snob and cyclist in me is happier... 😉

I'm single, no wife or kids so the decision impacts only me 🙂

Auntie Hels says: don't get a mortgage more than 3 times your income (if single person), and buy a place that suits your needs now, and as well as you can estimate your needs for the next ten years. Don't get silly. Buy some pot plants.

P.S - no wife and kids you say ? Wash your bike in the bath !!

The general perceived wisdom used to be stretch yourself to the limit as inflation will erode the debt and pay rises will make the mortgage more affordable.

However, we are now in a period of low inflation and bugger all pay rises, so I would suggest a more conservative approach.

Personally I've not upgraded as I have no wish to take on any more debt.

If you like the flat and the price is right buy it unless there are other reasons that you would like a house of your own.

Bear in mind interest rates are so low at the moment and will not stay like this forever so the cost of that affordable mortgage on a house may not be so affordable in the future.

Stick the rest of the money away, see what happens to the housing market, mortgages etc over the coming years and you should have some equity built up on the flat if you decide to move on in the future.

I'm going to be really boring and add the caveat that this is just my personal opinion and that anything I have put should not be construed as any form of advice financial or otherwise.

Cheers

Danny B

If you buy your flat, will you be in debt at all? If not, then I'd say go for it. Because at least then you'd have huge peace of mind and not have the uncertainty of possibly ending up in a situation where you could default on your mortgage and lose your home (as is increasingly happening to many people who borrowed too much).

You can't put a price on peace of mind.

Don't get silly. Buy some pot plants.

Best advice you'll ever get. 🙂

Are you saying you can afford to buy the flat without a mortgage? or just a small one?

If you buy the flat is there the possibility of putting a secure shed on the off street parking so the bikes can go outside?

thx1138

Good point. It has struck me that getting a mortgage which is well within my affordability means I can overpay and be mortgage-free in 10 years 🙂

You've obviously not started looking properly yet. When you do you will find the two universal truths of house buying.

1) You can't afford anything you like.

2) You don't like anything you can afford.

buy the biggest & best you can afford, your salary will only go up, I presume living in London you have a half decentish job with prospects? Having a garden is great, having a garage is even better. Move north if you can, for the price of a 2 bed flat in london you'll be able to get a decent house with large garden and garage in the midlands or further.

Don't calculate what you can afford on today's interest rates, they may not last forever. I would say buy the best you can afford with a decent safety margin. I went above what I needed but well within what I could afford when I last bought 12 years ago and would struggle to buy the same today if I'd gone for a cheaper option earlier. In your position I'd also calculate the potential rental return on whatever I was buying.

Another vote for "somewhere in between".

Don't stretch too much, affordability could take a big knock from interest rate rises.

But on the other hand, make sure your property suits your plans for the medium term (5 years?). I've seen mates with flats get stuck with them as prices dropped. Couldn't take the equity hit, so have had to keep them and ended up renting houses as their priorities changed.

Shouldn't really happen in London, but I'd recomend buying with an eye on it being "good enough" for you now and for 5 years minimum.

London's not a good place for a MTBer, coz there's no hills for miles and miles and miles. I cycle out my front door, in stunning countryside within 10 minutes.

somewhere in between with room to extend if needs be - ended up with a 3 bed & 2 garages that takes 1/3rd of our joint income (but could be serviced with only one of our incomes). with opportunity to extend with 2 bedrooms and a dining room off the kitchen if i need the space later.

or that was my thinking anyway.

ive got colleagues up here that just cant shift flats without taking a huge hit on them - its over supply of flats meaning that they are really fetching bottom dollar prices. - i really didnt want to buy a flat for that reason.

certainly wouldnt be stretching my self in this climate., we can speculate about the damage that interest rate rises would do but one day they will go up - and on that day i know quite a few folk that will be in the poop.

We decided not to stretch ourselves, and put spare cash into overpaying the mortgage. This means some security if your circumstances change, and if they don't, your mortgage is paid off far quicker.

Don't forget maintenance charges if you buy a flat.

How old are you as well? You mention putting the rest of the money aside for savings, pension etc.

If you are 20's then this probably isn't as big deal as if you are 40/50's!

I'd look at how much money you need each month to do the stuff you like doing, beers, biking, clothes, hookers......*

Then you'll really see what you can afford, don't forget bills as well.

Don't buy a house at the expense of your life.

*edit: just thought, you might be a lady - Wine, biking, clothes/shoes, chippendales.......

Find something that allows you to ride your bikes. Integral garage was a must when we were looking. A sage decision, as it turned out. I wasn't that bothered about the house, mind 😉 .

No wife or kids. Then get something with a spare room + en-suite that you can rent out for extra ([url= https://www.gov.uk/rent-room-in-your-home/the-rent-a-room-scheme ]mostly tax-free[/url]) income.

as chaos, see spareroom.co.uk (there are others)

*you need to tell your house insurer (*and I suspect mortgage holder) but in my case there was no charge BUT if lodger nicks stuff not covered.

*you could also try and get a Mon-Fri let only for week away commuters and that means house is your own at weekends

if you get a family bathroom and ensuite or two ensuites that helps etc.

works if you get the right person (and you are happy to have a 'stranger' in the house and can work as a live in landlord)

I was told to stretch to the max, and I'm glad I did. We paid £36k for our house in 1984 and it was a struggle for a few years, but now its all paid for 🙂

And its on the Quantocks too.

Ignoring the market state at the moment, I have noticed that there has been a big rise in the value of my house since 2000 when I bought it (paid 220k, now 'worth' 385k), but there has been no increase in the price of my wife's flat, which has stayed at about 140k.

Plus a flat has maintenance charges and no freehold normally.

I stretched my budget and sank every penny into my house on the basis it's somewhere I actually really want to live in... out the door into countryside and as good riding as you'll find in the south south (as opposed to SW or SE) - I still spend less extra on my mortgage than most people I work with spend on their cars.

Wouldn't touch a flat myself, but I had the luxury of choice.

Do you want to be able to move in the next 10 years?

If so...

Put the money into some long term savings and rent something you like.

Calculate the lifetime interest payment on a mortgage, repair, renovations etc. and aim to pay that into savings also.

The myth of rent is dead money is starting to get eroded.

At that point you will either have a much bigger amount saved and be able to buy something even better or be happy that you don't have a mill stone around your neck when you try and move. UK property prices have a long way to go before they realign with earnings...

I would say go with the flat, its amazing the difference a small mortgage makes to you quality of life. With a big one you will always be scared of losing your job, you will have no/a lot less disposable income (council tax, bills and possible rate increase)and you will have all your money in property (fairly inaccessible if you need to use some in the future). Also, gardens are a pain if you are not into that sort of thing.

Depends where you live, there's no way I could have earned the same return on savings as my house has gained in value (factor of 3x difference over the last 15 years).

I would say go with the flat, its amazing the difference a small mortgage makes to you quality of life.

Wise words....

Depends where you live, there's no way I could have earned the same return on savings as my house has gained in value (factor of 3x difference over the last 15 years).

On paper but currently the value of your house does not exist, only when you find somebody to pay that amount does it have a value, you were also lucky enough to buy something before one of the biggest house price booms going - see another one coming?. House price rises were aided mostly by vastly over stretched mortgages and an abundance of cheap credit and a growing economy to a point where they mostly sit way ahead of earnings. Until people can afford to buy and enter the market it will not be growing.

As the small print says past performance is no gaurantee of future performance

No shortage of buyers where I live and several houses in my street have sold for above asking price already this year. Demand far exceeds supply in Cambridge, it has done for decades and will continue to do so as more and more hi-tech companies relocate here.

that would make you the lucky one, that doesn't mean buying there now is as good an investment as it was when you bought your house. If it triples in price over the next 15 years how many could afford to live there - having seen what my brother paid and seen some other houses round there he was looking at further price rises didn't look that sustainable.

Just my thoughts anyway spurred on by listening to a few different view points on the future of housing and the own vs rent debate.

Its a really tough call

I was told to stretch to the max, and I'm glad I did. We paid £36k for our house in 1984 and it was a struggle for a few years, but now its all paid for

Tis seems unlikely to be true again. People I work with have properties that are not going up in value. The mortgage as a share of value is quite static as are there incomes. the days of a few tough years being followed by easy payments seem to have gone

Put the money into some long term savings and rent something you like.

Calculate the lifetime interest payment on a mortgage, repair, renovations etc. and aim to pay that into savings also.

The myth of rent is dead money is starting to get eroded.

At that point you will either have a much bigger amount saved and be able to buy something even better or be happy that you don't have a mill stone around your neck when you try and move. UK property prices have a long way to go before they realign with earnings...

That's an interesting thought but again its far from clear cut. Based on this year £1000 pounds in the bank will buy you less after a year not more. This as inflation is more than interest rates. It would be a really interesting spread sheet and I guess would depend a lot on whether rent was less than the mortgage. This seems to vary a lot between areas

My advice is get on the internet and visit a good 10 to 20 properties across the budget range and see how you feel about them. Don't buy your flat just because its an easy option

Until people can afford to buy and enter the market it will not be growing.

except that they can, and are...

rents are as much as a mortgage, and often more.

buying at the top of the market is risky because of potential negative equity, but that is only really an issue if you don't intend to stay there long term, long term house prices outstrip most things.

If you buy somewhere you like and your mortgage isn't much different than rent, then what's to lose, as long term you will definitely reduce the amount you owe if you are on a repayment mortgage, and paying off early is even better.

No shortage of buyers where I live and several houses in my street have sold for above asking price already this year. Demand far exceeds supply in Cambridge, it has done for decades and will continue to do so as more and more hi-tech companies relocate here.

Yes very true in Cambridge. But hardly a basis for a decision else where

Apt post for me (sorry, us). Live in a similar sounding flat to OP, albeit space outside to clean the bikes.

Looked at a house at the weekend twice the value of this with a garage, big garden but in real times no extra living space in the house. We signed up... and then backed out. But it's the same situation where ever we look and after years of wanting to move out, I now see this place in a different light, ie cheap(ish) living (for Edinburgh).

Yes very true in Cambridge. But hardly a basis for a decision else where

But the general point is you have to take account of the local fundamentals when assessing how likely a property is to accrue value faster than inflation, in which case buying makes more sense than renting.

OK

Some rough numbers...

£300k mortgage over 30 years interest at a generous 5%

Monthly repayment of around £1600

Total interest paid on the loan £280k

So assuming you had a 15% deposit a £350k house paid off over 30 years comes in at £580k.

More recently in the places I have lived you can get a far nice place rented for less than the mortgage price. At this point we haven't even included stamp duty (about £10k) or any running repairs just to keep the house going. Chuck in a new bathroom of kitchen after 10 years and the numbers go up.

At this point you are relying on a doubling of the house price. After years of indoctrination that home ownership is the most important thing it does take a big effort to step back and look at it. Also there are plenty of people like Footflaps there that got in at the right time

[img]  [/img]

[/img]

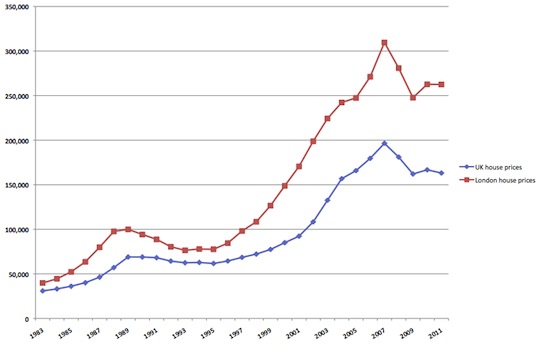

There is a lovely rise there for about 10 years if you got in at the right time...for those that didn't house prices started to rise faster than we earned money.

None of this is a science but it's worth considering the facts and figures before jumping in.

The key to going the rented route is to actually do something useful with the extra money....

mike while i agree to a point with what you are saying,

three points i want to make

if you own/buying a house being evicted tends not to happen

decorating the house, putting up a few pictures, having a pet, etc no problem

when you retire paying rent from a crap pension is not a problem

Max out now, in 10 years time it will either be affordable or repossessed

mrmo I agree with you there, hence the importance of doing something sensible with the money saved which most struggle with.

A shift in thinking (which is tough to do) could go some way to redress the rental market rules and regs. Currently telling people that they need to own their won home to be a success or safe etc. has left a generation laden with debt and a chunk in negative equity. It will be interesting to see what happens 10 years down the line - unless you have crystal balls nobody actually knows though 🙂

Personally I'm very apprehensive about entering the market despite having a deposit. We're still on the bubble, which is being propped up by parents' boom profits being used to buy their children's first homes, and also by harebrained schemes like the one just announced whereby public funds are used to inflate house prices to the tune of 20%. I just think it's got to end somewhere, house prices must be allowed to re-align with means, and I don't want to be a homeowner when that happens. I'd rather be evicted than marooned in negative equity.

At what point do 'over inflated house prices' just become the norm, I.e. never returning to 3 x average salary?

For whatever reasons, the government (lab / condems) have held off a crash through this recession through close to zero interest rates, we haven't seen the same number of repos that previous recessions have seen, which would usually trigger a crash.

Yesterday's budget provided more stimulus for price rises, not a crash.

All this making money in house price growth etc is completely irrelevant unless at some point you want to sell out of the market. So what if my £100k house is now worth £275k. I'm not going to cash it in anytime soon. If I sell I'm going to buy back into the same market, so all the profit is recycled. It is a dangerous illusion of wealth that help overfuel the economy and led to unsustainable borrowing. Cmon, it's only 4 years ago it all went tits up.

The real problem with property inflation is that it makes it increasingly difficult to get on the housing ladder for first time buyers. But eventually, the economics of supply (of lending) and demand (at over inflated prices) mean that this causes stagnation until lenders catch up with the market. The budget may help start the market again, depends how the flow of new property meshes with the supply of mortgage guarantees.

Tbh i think it's a good time to buy if your job is secure/has prospects. My advice is, buy something you want to live in, not just for investment. Work out what you can afford and still be happy with your life, this may be significantly less than the banks will lend, or maybe not in the new world.

Mikesmith

so you are saying that you'd rather have a slightly niver house for 30 years and then pay rent for another 30 years through retirement. Over a slightly less nice house for 30 years followed by a free house for the rest of you life?

Your choice but it doesn't sound like a no brainer

rents are as much as a mortgage, and often more.

The hurdle for most is the deposit not funding repayments

ampthill - Member

Mikesmithso you are saying that you'd rather have a slightly niver house for 30 years and then pay rent for another 30 years through retirement. Over a slightly less nice house for 30 years followed by a free house for the rest of you life?

Not really, the overall cost of the mortgage, improvements, repairs etc vs the cost of renting for the 60 odd years I have left may be equivalent. As somebody who started work in 97 and watched houses hit escape velocity very quickly I have though about this.

With careful saving of the difference and investing in pensions etc I could be possible to have a more comfortable retirement without owning a home.

[img]  [/img]

[/img]

Whatever you think of the long term the figures still show housing vs income above the late 80's levels. Wonder how long that can go on for?

I bought my house on the basis that it was a house I wanted to live in, in a place I liked - great for biking, climbing etc and has shops selling beer, cake, chocolate - and was within my range of affordability.

Ultimately you're buying somewhere to live, you can agonise over the possible ups and downs of the housing market etc, but the baseline is that unless you view your life as a series of investment opportunities - which is why the country is going to hell in a handcart fwiw - you're actually buying a home, somewhere to live.

What's 'affordable' for you is one of those fluid things which depends a bit on your job stability, employability and how big a mortgage you feel is tolerable - I'd rather not have to pay out so much that I'm effectively locked into a particular high-earning job - I wish...

I blame Thatcherism for turning home-ownership into some sort of investment game/status ****fest. And if you can afford to buy a flat in London you could probably land a five-bedroom detached farmhouse with a whole barn to store your bikes in up here... 😉