Subscribe now and choose from over 30 free gifts worth up to £49 - Plus get £25 to spend in our shop

If Mercedes don’t give Russell a seat next season, someone else could make him an offer.

Bottas already has a contract for next year. The only way Merc would sign Russell for next year is the unlikely event of Hamilton deciding he wants to quit. However, my money is on Russell replacing Bottas in 2022.

Red Bull and Alpha Tauri don't want him because he's a Merc driver and will leave the moment a seat at Merc opens up. Ferrari don't want him because they have two drivers already signed. Renault don't want him because they have two drivers already signed. McLaren don't want him because they have two drivers already signed. Haas don't want him because they have two drivers already signed. Alpha Romeo don't want him because they have two drivers already signed. Williams do want him. Therefore, he will be at Williams next year, the place where he has a contract signed and is wanted.

contract signed

It’s nice that you think that matters to a company with a budget the size of merc, when coming up against one with the size of Williams...

All footballers are contracted and they always wait to the end of their contracts to move, right?

I agree with the footballer thing. Mrs BigJohn gets a bit fed up when I shout "no it doesn't!" when on the news they say "... signed a 3 year deal, which keeps him at the club until 2023".

Merc signed a contract with Bottas because they want him to partner Hamilton next year. If they had wanted Russell, they would have signed a contract with him. I think Russell will probably be in a Merc in 2022, but there's zero chance Merc will dump Bottas for next year.

Wow, it's all kicking off about Nikita Mazepin today.

Mazepin does sound like a bit of a ****. Let's see if he does a Gachot and winds up in prison, creating a seat for M. Schumacher Nico Hulkenberg.

What's going on? - I know he had a bit of a time of it the in F2 race last weekend! 🙂

Aye - not a good look! 😬

Haas really know how to mix with the finest of people.

What's the bet that he actually has no intention of learning anything from this?

https://twitter.com/joshfdez_/status/1336618804437278720

Seems like a nice guy...

I'm sure this goes on all the time in the murky world of Russian Criminals Business. Probably thinks it's normal behaviour.

I haven't seen the video in question, but Mazepin's behaviour prior to his Haas contract is well documented. To have caused such acute embarrassment to his new team within days of being signed doesn't bode well, but he's hardly the first junior racer to have behaved abysmally.

Mazepin sounds delightful

Someone asked us to post the pit stops from Sunday on our Instagram Reels.

But Reels can only be 30s. Sorry.

From Mercedes' Twitter feed

Seriously? Chapeau! 🙂

One thing that's baffled me this season is why F1 teams can't design a face-mask that doesn't slip down from peoples noses when they talk!!? 🤣🤣

McLaren seem to have started a new series to replace the Tooned one they ran back when Button and Lewis were there:

I'm suddenly craving Jaffa Cakes.

Hamilton is back

Anyone else disappointed that Russell won't get the opportunity to shine this weekend?

Yep. I suspect not as much as he is... 🙂

One thing that’s baffled me this season is why F1 teams can’t design a face-mask that doesn’t slip down from peoples noses when they talk!!?

They're always pushing the edge of what's allowed to see what they can get away with.

Wow the Ferrari CEO Camilleri has stood down with immediate effect, he has also left Philip Morris as well.

https://www.autosport.com/f1/news/154108/ferrari-ceo-camilleri-announces-shock-retirement

And Binotto's sick with a mysterious unspecified illness too. Like the Kremlin in the 1980s with leaders dropping dead every few months.

If Mercedes don’t give Russell a seat next season, someone else could make him an offer.

I'm guessing that, financially, Mercedes could pay Bottas to sit on his sofa all year and still bring in more sponsorship revenue with Russell in the car.

Giving Hamilton everything he wants next season is shortsighted. I always think of Alex Ferguson at United who was constantly bringing in new talent. Standing still is going backwards. If Russell comes in next year and Hamilton still wins then Mercedes win. If Russell wins then they still win! They will also have 10x more exposure and credibility for doing the correct sporting thing.

Remember a young Hamilton coming in to challenge Alonso - that's what should happen.

They signed Bottas because they are satisfied with his performance. Everyone is impressed with Russell, but there is zero chance that Merc will dump Bottas to put Russell in next year. 2022 is another matter.

Nice touch by Russell

[img] https://pbs.twimg.com/media/Eo8UQCIXYAodInN?format=jpg&name=large [/img]

Of course that'll fuel the theories that he's saying goodbye to Williams the team rather than Williams the family.

That's absolute class from Russell.

Sky F1 commentary team, particularly Ted Kravitz, not mincing their words on their opinions of Mazepin’s off track (and on, tbh) shenanigans...

No comments yet for the final race?!

Verstappen on his first pole.

Just waiting for the start. Interesting to see how Mercedes protect Bottas’ 2nd overall.

Interesting to see how Mercedes protect Bottas’ 2nd overall.

I think he just needs to finish fifth or better and he has second. I'm pretty sure Hamilton would let him past if it came to that.

Christ this is dull.

Was really looking forward to this too.

ANYONE but Max for the win. Please.

Christ this is dull.

Yep, even the commentators are bored senseless and have nothing left to talk about.

I had to fast forward through the highlights it was that dull 😕

A dull end to a an season that had some interesting tracks and races - if the the championships.

I just crunched the numbers and if I've not screwed up (I probably have) then Mercedes could have told Bottas to sit out 2020, and not replaced Hamilton when he was sick, and still have won the WDC and WCC (by 3 points over Red Bull). That car with Hamilton at the wheel was just that good.

I just crunched the numbers and if I’ve not screwed up (I probably have) then Mercedes could have told Bottas to sit out 2020, and not replaced Hamilton when he was sick, and still have won the WDC and WCC (by 3 points over Red Bull). That car with Hamilton at the wheel was just that good.

Apart from Bottas soaked up 223 points that would have been awarded to other people if he hadn't been there so the WCC would have not been theirs.

I accounted for that - at least I think I did - I moved everyone up one place and re-added the points up, I even added the point for fastest lap to the second fastest driver for the two that Bottas got...

I had to fast forward through the highlights

Fell asleep a few times. Dull.

Yeah. Just watched the highlights and that was a boring race....although it always is, I think.

although it always is, I think.

Hence having it as the last race to add jeopardy/give the drivers something to try for (but the championship is normally sorted by then...) and then tried the double points thing to guarantee it was settled there/the drivers were up for it.

I’d happily see it dropped but money ensures a shit racetrack keeps its place at all costs. Did any overtakes happen outside of DRS?

Agreed it doesn’t matter hire bad the track is off the money is good. Look at Monaco

Look at Monaco

Something tells me the money AD put up will make Monaco’s fee look like pocket money.

https://f1i.com/news/267302-monaco-pays-race-fee-low.html/amp

God that race was crap. Sack that circuit off IMO, along with Socchi and Barcelona.

I think Mercedes gave that one to Red Bull as a concellation prize.

Nursing engines - just why!? Not like they'll be used again. Everything's in the bag, just whack them up to full power and if they blow, they blow.

As others have said though, Abu Dhabi is as boring as hell. Not what was needed as a send off to a cracking season of racing.

Well don't forget everyone expected the final race in Bahrain was meant to be dull. Several things made that one quite exciting. Don't forget we were set to see Perez fight his way up the grid till his engine went pop, poor bugger.

Nursing engines – just why!? Not like they’ll be used again. Everything’s in the bag, just whack them up to full power and if they blow, they blow.

If Verstappen won and Bottas finished sixth, Verstappen would have taken second place. Also, it doesn't make very convincing marketing if both your cars blow their engines.

Abu Dhabi is pretty much always a humdrum race. Proper calendars finish in Brazil or Japan 🙂

Anyway… bets on who’s in the Red Bull next year? Close call… I’d probably put a few pennies on Albon but not much more.

Other than that, I’m looking forward to seeing what McLaren come out of the blocks with next year. If they integrate the new engine well and get the aero right, could they be mixing with Mercedes and Red Bull? Three way title fight between Hamilton, Verstappen and Ricciardo? That would be something to look forward to 🙂

If they integrate the new engine well and play the aero right, could they be mixing with Mercedes and Red Bull?

I'd say unlikely as they have to use their tokens on the engine integration which will limit development elsewhere. Be nice if I'm wrong though.

Aero is free development, though, I think?

Aero is free development, though, I think?

Yup, but aero works in conjunction with things like suspension and if you can't change that then it impacts what you can do.

Ted Kravitz on the 'notebook' after the race seemed to think Perez is going to RB, and Albon will be benched

Anyway… bets on who’s in the Red Bull next year? Close call… I’d probably put a few pennies on Albon but not much more.

According to Kravitz on his Notebook show on youtube we can expect an announcement from Red Bull over Albon being demoted to test driver and Perez in the seat. Presumably if Perez has the same problem with the Red Bull as Albon it gives them a chance to bring him back and keep the Thai backer happy.

Just went back to the first page of this thread to see how predictions worked out. Highly selective quotes follow:

bombjack

If Red Bull keeps Albon then expect him to beat Verstappen soundly, and many toys to be thrown out of the pram.... Renault to walk rather than spend cubic dollars developing tech that keeps getting banned.... But hey, theres 25 races!

scotroutes

Full Member

Would 2021 be the first season there are more races than cars?

andytherocketeer

I can see Max outscoring Albon in races where they both finish, but Albon outscoring overall due to consistency, and not getting involved in stupid mistakes that lead to DNFs.

hols2

Ferrari seem to have an excellent engine, two good drivers, and have sorted out their aerodynamic problems, but they just keep dropping the ball. I think they’ll improve next year, but it’s hard to see LeClerk and Vettel not having a falling out if the car is competitive.... Haas are so unpredictable that they could finish anywhere from fourth to last.

richmtb

It also puts Vettel in an interesting position.Surely the guy with a 5 year contract in his pocket is the defacto No 1 driver.

shermer75

Free Member

I’d be surprised if they sign Vettel again

shermer75

Free Member

There’s a fair few drivers that could put in a considerably more consistent drive (the kind of consistency that they’ll need to win a constructors championship) at a whopping 90% discount as compared to Vettel including Raikkonen, Hulkenberg, Ricciardo, Sainz and maybe even Perez. That said though, the day Ferrari start making rational decisions will also be the day when Formula 1 becomes a lot less interesting to watch lol

retro83

Free Member

Yep. Seb seems to need a very stable rear axle.

Bikingcatastrophe

Free Member

I suspect this will be a much closer, tighter season. It will depend on how competitive the cars are. I still maintain that Ferrari had the better (certainly faster) car for the first half of last season and Vettel messed it up.

Free Member

Verstappen’s contract for 2020-23 is indicative that Honda will commit to Red Bull beyond 2021.

Those predictions should be relabelled as mad guesses 🙂

Nah, just space out a variety of predictions through the first few pages- Hamilton will win; Verstappen will win, Albon stays; Albon goes.....then this time next year quote the accurate post.

Nah, just space out a variety of predictions through the first few pages- Hamilton will win; Verstappen will win, Albon stays; Albon goes…..then this time next year quote the accurate post.

Hamilton will win seems like a safe prediction.

Hamilton will win seems like a safe prediction.

Assuming he isn’t too badly affected by long COVID over the off-season...

long COVID

I know everyone is different, but I was positive 2 weeks ago. Had sniffles, cough, headache and occasional trouble getting a full lungful when breathing. He’s a lot younger and fitter than me so I doubt it was that bad. If it was o can’t see him being let near the car.

If it was o can’t see him being let near the car.

He looked knackered after the race, and said he wasn’t back to 100% and that it had really knocked him for six, sounds like he’s had a much tougher time of it than the Racing Point pair.

That's brilliant, but isn't it Aston Martin mocking themselves!?

Aston Martin Honda mocking Aston Martin Mercedes?

Well red bull have been known to burn their bridges in the past (Renault, for example) so I don't see them worrying too much about annoying a sponsor who is leaving to become a direct competitor...

.

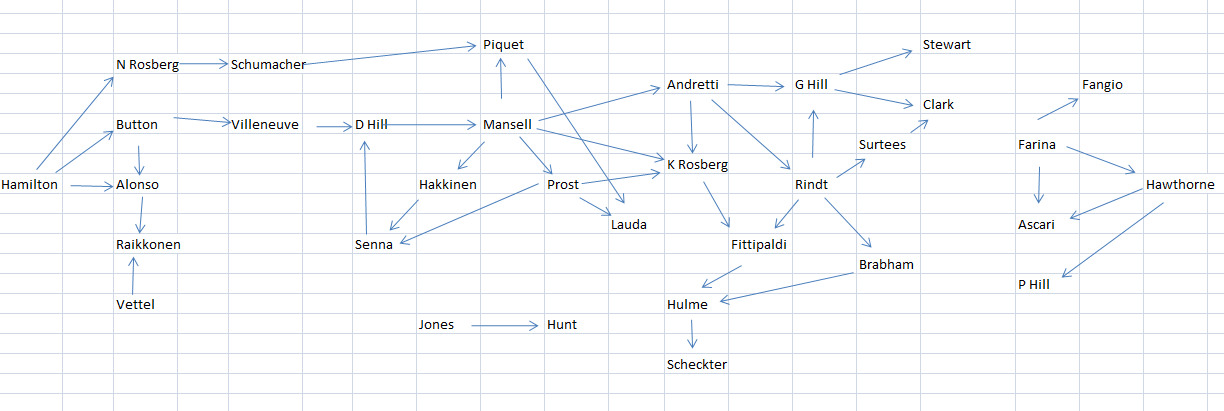

Someone spotted I had missed Hill/Prost at Williams in 1993, doh!

Turns out I had also missed Villeneurve and Alonso doing three races together at Renault in 2004.

Anyone else spot any others?