Home › Forums › Chat Forum › Double dip recession

- This topic has 559 replies, 84 voices, and was last updated 12 years ago by teamhurtmore.

-

Double dip recession

-

TandemJeremyFree MemberPosted 12 years ago

Yawn

Your premise has been shown to be wrong so you misquote, distort and make personal attacks.

Shows the poverty of your position 🙄

TandemJeremyFree MemberPosted 12 years agoTandemJeremy – Member

” quote THM -There are two consistent arguments on this thread that I am countering – (1) that the recession has been caused by Tory cuts and (2) that the policy mix being pursued in the UK is signicantly worse that elsewhere. This does not make me a Tory apologist not does it mean that I agree with their policy mix – I don’t. But that does stop me commenting on factual errors/BS. “

Tory policy has create the double dip recession – this is not a factual error – this is a simple fact. UK and US and german growth was the same until the first tory budget – when we started performing worse.

Also other countries are doing significantly better because they are are creating growth we are not – why – the tory policies

Note where the divergence is – after the tory election. German and US economies are now bigger than they were before the recession IE they have recovered – we have not. whats the difference – tory cuts agenda here / economic stimulus in those countries

ernie_lynchFree MemberPosted 12 years agoAnd finally on austerity – for Tim Harford in the FT, “So if this is what happens when government services are still expanding, you might enjoy comtemplating what will happen when austerity really kicks in.”

Well Tim Harford isn’t being very honest then. Although if you read his whole article he corrects that by claiming “government and other services”, the other services includes private education and private healthcare.

Furthermore he refers to an expansion of “more than 5 per cent since 2008” bearing in mind that Labour were in power for half that time, and according him “health and social care has expanded particularly strongly” it’s hardly surprising is it ?

I’m disappointed with you teamhurtmore.

TandemJeremyFree MemberPosted 12 years agoAs Davies puts it they have made a crucial error, ……………….But this doesn’t mean that the strategy is wrong.”

And yo quote this piece of illogic as evidence 🙄

trailmonkeyFull MemberPosted 12 years agoGerman and US economies are now bigger than they were before the recession IE they have recovered – we have not. whats the difference – tory cuts agenda here / economic stimulus in those countries

from the ft

Drastic public spending cuts totalling more than €80bn ($96bn, £66bn) were unveiled by Angela Merkel, German chancellor, on Monday, combined with up to 15,000 job cuts in the public sector, as part of a sweeping austerity package

There will be more means-testing of benefits for the unemployed, and cuts in child allowances for unemployed parents, as well as cuts in pension contributions for the jobless.

i don’t think that your model of tory cuts/agenda here ,not in germany really holds water. seems to me that they’re doing the same shit there as here.

teamhurtmoreFree MemberPosted 12 years agoWell TJ you stated that I was talking rubbish (the personal bits) and that is not the case. Simple facts and your quotes and points exactly.

So I can take the conclusions of ” a nurse with no economic training” (your words, not mine) or one of the most respected economists and government advisors in the UK. Hmmmm….???

Ernie – the Harford point is simple and merely re-inforcing what I said earlier. “Austerity” is a sloppy adjective because it has yet to happen, hence Davies comments about the more rabid Tories (my words, not his) being disappointed with GO. It is going to happen, and that is worrying giving the balance of current policy. So let’s examine its affect at that time. Simple? (Harford is using ONS definitions so a little harsh to call him dishonest and Ernie I was ve careful to talk about both parties. I wasn’t falling for that)

But its a little difficult to sell newspapers, 24 hours news, political parties etc on the idea that the economic news is devestaingly boring and will remain so. Tiny MoM or QoQ noise around a very, very dull long term trend of sub-trend growth (a misnomer if flat!). I am asleep already. On top of that, most policy mixes are broadly similar across parties and largely impotent due the triple sources of deleveraging Davies states. Yawn. And one of our biggest export markets is also in an unhealthy trinity of economic, political and social chaos. Great. You can see the headlines already………

But perhaps Murdoch et al, simply adopt the STW mantra of “never let the facts get in the way of a good argument!”

Zulu-ElevenFree MemberPosted 12 years agowhats the difference – tory cuts agenda here / economic stimulus in those countries

Any figures on this?

You’ve showed a pretty graph of the GDP, you’ve alleged the US has been following a stimulus plan that is greater than ours, but you’ve not given us any comparative figures.

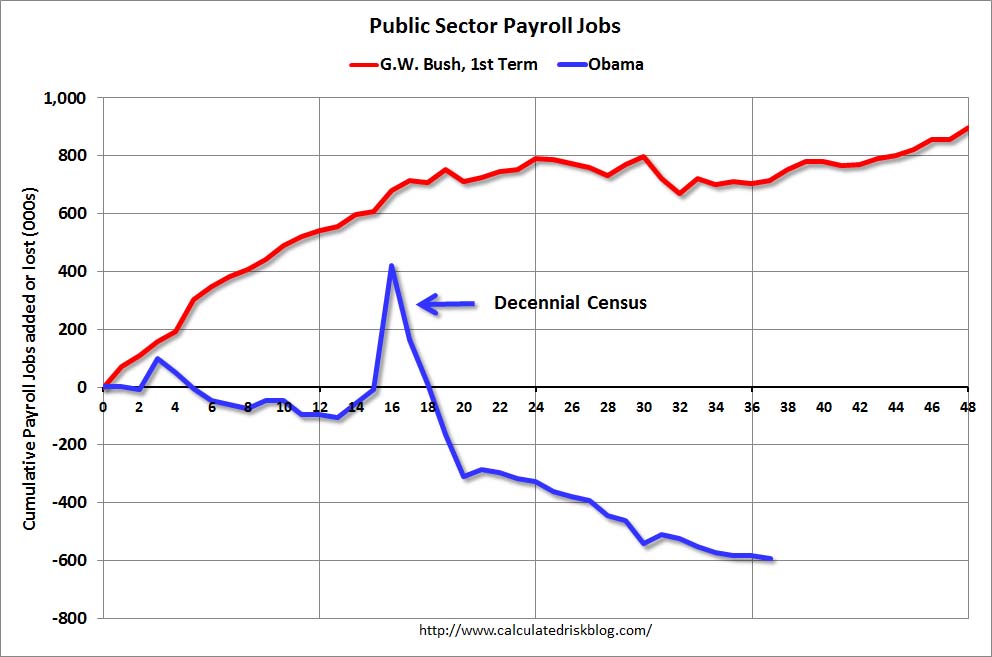

I’ve already shown you a graph of US public payroll that demonstrates huge cuts in public sector employment in the US, so can you back up your claims of this mythical stimulus?

C’mon TJ – this is exactly what you’ve been arguing against! exactly what you’ve been telling us was wrecking the UK economy – why is it working so well in America?

ernie_lynchFree MemberPosted 12 years agoseems to me that they’re doing the same shit there as here.

15,000 job cuts in the German public sector doesn’t quite compare with 270,000 UK public sector job cuts, specially as Germany has a population almost a third bigger.

Osborne’s austerity drive cut 270,000 public sector jobs last year

TandemJeremyFree MemberPosted 12 years agoteamhurtmore – Member

Well TJ you stated that I was talking rubbish (the personal bits) and that is not the case.

Yes it is as I have shown.

You said there is no alternative policy possible – there is as I have shown other countries doing so

You claim that the Tory policy is not making things worse here – It is as I have shown.

You are unable to refute these two things . Two things you claimed as facts that I have shown to be false.

Zulu-ElevenFree MemberPosted 12 years ago15,000 job cuts in the German public sector doesn’t quite compare with 270,000 UK public sector job cuts,

The US graph shoes a million public sector jobs cut from the peak though Ernie

(albeit, that included the census, but still 600 thousand cut from the point where Obama came to power!

Why is it working so well there?

the US figures show categorically that cutting public sector jobs does not lead to recession, in fact your own argument indicates that its helping them and Germany grow!

teamhurtmoreFree MemberPosted 12 years agoSo run out of trumps and trying a finesse?

Alternative polices stated repeatedly: change balance of monetary, fiscal mix. Less reliance on former. More focus on capital investment not wasting time on factually incorrect arguments about current expenditure which is yet to be cut YoY. A flexible exchange rate policy so that we don’t do a Europe and force massive wage devaluation on workers. Umm, hence a bit of a challenge that £ * is going up but at least that may temper inflation, oh but we need that to erode our debt levels. How odd all these things are linked together?

18 months of flat economic activity. So policies not making things worse, not making them better, merely leaving us with dull, low and flat economic activity. And policy mix not unique to Tories. So yes, Tories are not guilty of making things worse but guilty of not making them better. Dull headline that for personal point scoring though!!!

* and the pound is going up because ……..?!?

trailmonkeyFull MemberPosted 12 years ago15,000 job cuts in the German public sector doesn’t quite compare with 270,000 UK public sector job cuts, specially as Germany has a population almost a third bigger.

conceded, but £66b is still to be cut from public spending with a focus on targeting welfare provision so claiming that germany aren’t proceeding with a similar agenda doesn’t seem that accurate to me.

teamhurtmoreFree MemberPosted 12 years agoOn the contrary, stick to what I have been saying. Your OP was a simply misguided attempt to score a political point/troll with the barely hidden hope of scoring a personal one subsequently. Neither stand up to scrutiny – the recession date is statistical noise, the accusation of vandalism frankly absurd and the personal stuff relied on on- going misrepresentation. Still with the rain pouring down it was all faintly amusing. But the sun’s out now so further amusement will have to wait.

Do try the Sandel book though. Robust criticisms of markets based on fact have so much more lasting impact albeit without the humour/silly factor.

Btw you have consistently argued that a rising exchange rate is a vindication of economic policy with reference to the euro. Is the £ an exception or dare I ask, why is the pound going up……?

chewkwFree MemberPosted 12 years agoTandemJeremy – Member

So you now admit you were wrong in your claims THM.

TJ Dear Leader Wannabe …

As your Supreme Dearest Leader to maggots kind I must say you points/arguments are of a disappointment …

You keep on going in circle with steadfast determination of the collective mindset insisting on the Tories causing the economy turmoil, but you have failed big time in even trying to convince. The govt has only been in power for two years … so damage or not I doubt they can screw it up that badly … I remember the Parliamentary PM Q time (Dearest Leader will put your entire family to hard labour for daring to think let alone voice) during the first few weeks of new govt and that one Mr Balls guy has already started attacking the govt policy … he is a clown isn’t he? Even my grandma six feet under would laugh at Balls.

The conclusion … TJ you failed as an apprentice to become the future Dear Leader you capitalist! Only capitalist argues about economy etc … in the world of Dearest Leader there is only truth and it is the Dearest Leader. The rest are just maggots.

😆

SoloFree MemberPosted 12 years agoWow !.

You puppies still arguing over that bone ?.

😯Look. Do any of you honestly believe that TJ will all of a sudden.

Roll over and post:” Yeah, you know what ?, you’ve convinced me and I’d like to say that I now agree with your opinion as you have outlined an alternative and very valid point of view “.

” Thank you for enlightening me “.Personally, I’d expect hell to freeze over first.

Some of you lot seem to be intelligent.

So therefore, surely you must see.

It TJ’s way, or its a troll-tastic argument.Carry on !.

:loopy:TandemJeremyFree MemberPosted 12 years agoBtw you have consistently argued that a rising exchange rate is a vindication of economic policy with reference to the euro. Is the £ an exception or dare I ask, why is the pound going up……?

I have? news to me.

It really does amuse me the way yo accuse me of doing what yo do consistently. Misrepresentation, selective quoting and personal attacks.

Very funny

So do you agree there are alternate policies available that are being used by otrhe countries with more success? On this thread you have claimed both yes and no to this point.

meftyFree MemberPosted 12 years agoBtw you have consistently argued that a rising exchange rate is a vindication of economic policy with reference to the euro. Is the £ an exception or dare I ask, why is the pound going up……?

I have? news to me.

It really does amuse me the way yo accuse me of doing what yo do consistently. Misrepresentation, selective quoting and personal attacks.

Well you have said this and similar on many occasions, so THM’s suggestion is hardly misrepresentation.

To the folk who think the euro is in such trouble – why is it highly valued? Mch higher than the £ right now and doing well against the dollar IIRC. Wehre would you rather have your money? £ Euro? Dollar? Yen?

CaptJonFree MemberPosted 12 years agoThis is worth a read:

http://www.ilo.org/wcmsp5/groups/public/—dgreports/—dcomm/documents/publication/wcms_179450.pdf

Here’s an interesting extract:

The worsening situation reflects the austerity trap in advanced economies, primarily in Europe …

Since 2010, and despite the job-friendly statements in successive G20 meetings and other global forums, the policy strategy has shifted its focus away from job creation and improvement and concentrated instead on cutting fiscal deficits at all costs. In European countries, cutting fiscal deficits has been deemed essential for calming financial markets. But even in countries which have not suffered from the effects of the crisis this remedy is being applied for pre-emptive reasons – fiscal deficits are being reduced to avert any negative reactions from financial markets. This approach was intended to pave the way for greater investment and growth, along with lower fiscal deficits.In addition, as part of the policy shift, the majority of advanced economies have relaxed employment regulations and weakened labour market institutions (Chapter 2), and more deregulation measures have been announced. These steps are being taken in the hope that financial markets will react positively, thereby boosting confidence, growth and job creation.

However, these expectations have not been met. In countries that have pursued austerity and deregulation to the greatest extent, principally those in Southern Europe, economic and employment growth have continued to deteriorate. The measures also failed to stabilize fiscal positions in many instances. The fundamental reason for these failures is that these policies – implemented in a context of limited demand prospects and with the added complication of a banking system in the throes of its “deleveraging” process – are unable to stimulate private investment. The austerity trap has sprung. Austerity has, in fact, resulted in weaker economic growth, increased volatility and a worsening of banks’ balance sheets leading to a further contraction of credit, lower investment and, consequently, more job losses. Ironically, this has adversely affected government budgets, thus increasing the demands for further austerity. It is a fact that there has been little improvement in fiscal deficits in countries actively pursuing austerity policies (Chapter 3).

With regard to deregulation policies, the Report finds that they will fail to boost growth and employment in the short term – the key time horizon in a crisis situation. Indeed, the employment effects of labour market reforms depend heavily on the business cycle. In the face of a recession, less stringent regulation may lead to more redundancies without supporting job creation. Likewise, the weakening of collective bargaining is likely to provoke a downward spiral of wages, thereby delaying recovery further.

In general, the Report confirms findings from earlier studies that show there is no clear link between labour market reforms and employment levels. Interestingly, within the range in which the majority of countries lie, adequate employment regulations tend to be positively associated with employment. Beyond that, badly designed regulations may adversely affect labour market performance. In these cases, there are grounds for considering reforms as part of social dialogue and in conjunction with social protection measures. This policy has been successfully pursued in the recent past in countries such as Austria and Brazil.

loumFree MemberPosted 12 years agoThe revised figures are in.

Rather than debating whether the government could have done more to avoid or prevent the country’s double dip recession, the data shows that this government’s cuts are directly responsible for it.From The Independent: http://blogs.independent.co.uk/2012/05/11/how-spending-cuts-delivered-the-double-dip/

(The tables haven’t copied to the quote below, but are available through the link above.)

Today’s updated construction figures for the first quarter of 2012 from the Office for National Statistics are disappointing.

Despite the claims of many City analysts that last month’s estimates of 3 per cent fall would be revised up, they’ve actually been revised down by the ONS today. The ONS now thinks the sector shrank by 4.8 per cent over the three months.

And if you dig into the entrails of the ONS release there’s an interesting public/private divergence going on (click to see full table):

New public housing construction over the three months is down 10.9 per cent, driven by deep cuts to councils’ house building grants from central government. Private housing construction, however, was actually up 1.3 per cent.

Infrastructure construction is down a whopping 15.9 per cent. Now, the ONS doesn’t split this into public and private, but the majority of big projects are commissioned by government, so that reflects state spending cuts too.

This chart illustrates the divergence:

Private sector construction is clearly pretty weak by historic standards. But public sector construction is weaker still.

Construction was what dragged GDP into negative territory in the first quarter. If you strip out the sector – which makes up around 8 per cent of output – the economy would have been flat since the ONS estimates that the massive services sector grew by 0.1 per cent over the three months (see page 7 of the ONS first estimate of GDP). And, of course, the fall in GDP in Q1 was what delivered the technical recession and the double dip.

This raises the possibility that, if the Chancellor had cut less on infrastructure and public housing, other things being equal, construction would not have fallen by the same degree*, GDP growth in the first quarter would have been 0, and Britain would not now be in a double dip recession.

* Using the above table I calculate that if new public housing, infrastructure and public new work had remained flat over the three months construction output would have been £26,454m, rather than £25,622m. This would imply a 1.7% fall, rather than a 4.8% drop. A 4.8% drop knocked 0.2% off total GDP, according to the ONS. So a 1.7% drop would have knocked off a percentage of GDP statistically insignificant from zero.

teamhurtmoreFree MemberPosted 12 years ago“Austerity is a myth to con financial markets.”

I am glad that I am not the only one, who would prefer the debate to be framed correctly.

Tullett Prebon, a bond trader, said that “public expenditures have hardly been reduced at all” and that claims of a “big cut in public spending is bare-faced deception”. Figures highlighted by the firm show that public spending actually rose during 2010-11 and fell by just 1.5 percent last year. Government spending is more than £22 billion higher than it was in 2008 when the financial crisis erupted. The majority of extra money required by ministers to fill the black hole in the finances caused by the recession is being raised from extra taxes rather than cuts in Government spending.

Dr Tim Morgan, the global head of research at Tullett Prebon, said: “It’s high time that this mendacity was exposed for what it is. Government has done very little about its spending, has appropriated three-quarters of all gains in economic output for its own use, has carried on piling up debt – and has tried to pass all this off as ‘responsible austerity’.

This is not to suggest that the “spun” policies are correct, merely to point out that we should at least call them what they actually are. Good to see that someone else can see that the Emperor is wearing no clothes after all!

ernie_lynchFree MemberPosted 12 years ago“Austerity is a myth to con financial markets.”

So basically David Cameron is no different to a spend spend spend lefty who wants to hammer the City.

The City – them special people what create the nation’s wealth, for us all to enjoy, bless their little cotton socks.

And apart from his sinister plan to con the financial markets, Cameron is clearly also a barefaced liar…….with all his fancy talk about so-called “cuts”.

You must be gutted that you voted Tory teamhurtmore.

Or did you vote Labour ?

teamhurtmoreFree MemberPosted 12 years agoErnie, you are correct, I am gutted. But you are incorrect about the reason. I am gutted (1) because the poor performance of the UK economy affects our welfare and (2) the misdiagnosis of our problems by political parties, the media and people who should know better reduces our likelihood of a meaningful recovery.

If the diagnosis is wrong, it’s unlikely that the cure will be correct. Simple. Ed Balls is correct with the term, “flatlining” but incorrect in the “cutting too far, too fast.” How can current policy failures be corrected if the opposition to them fails to identify what is wrong. We have had restrictive taxation and no cuts. gov spending is above the trend of a Labour government apart from their final splurge. So what is this austerity that people go on about? Simple rhetoric rather than reality. But perhaps politics is like STW, why let facts get in the way of a good argument!

Government and Opposition talking economic nonsense, no wonder we are flatlining! The only good thing is this is the third similar article to be published in the last week. Perhaps eventually we will diagnose our economic problems correctly so that the correct solutions can be found. Alternatively we will simply become collateral damage to the next Euro crisis.

The only government to actually cut spending was the Lloyd George coalition in the 1920s. The result of his cuts was the Liberals being out of power from then to the current coalition. So perhaps, this is why they all lie to us!!! But Ernie, if you prefer lies/spin to the truth then so be it!

ernie_lynchFree MemberPosted 12 years agoBut Ernie, if you prefer lies/spin to the truth then so be it!

I’m a right sucker for the lies and spin of governments THM ……. as you have undoubtedly noticed.

Some people might think that I’m just being naive and gullible, but I prefer to see as not wanting to trouble my head with things what I don’t understand.

teamhurtmoreFree MemberPosted 12 years agoWell it’s all our futures – so its worth understanding. Otherwise, forget the paddles, we wont even have any canoes to navigate this creek, and that will be messy 😉

{but do read the Skidelsky article from “my bible” 😉 today [link on relevant thread], its well written and by someone who understands Keynesian economics properly]

teamhurtmoreFree MemberPosted 12 years agoVersion 4 tonight on Newsnight and a frankly depressing debate. Cue Tory MP talking twaddle about cutting the deficit and implementing austerity and getting basic facts wrong, an economist who should know better and the abrasive Terry Smith quoting his colleagues analysis above. At least, Smith was basing the argument on fact. And we wonder why we are in such a mess?

Hopefully with the Beeb airing the question about whether talk of UK austerity is correct, we may start to have some open and honest debate. Then, an only then, we can address the real issues facing the UK economy.

ernie_lynchFree MemberPosted 12 years agoThen, an only then, we can address the real issues facing the UK economy.

Oh go on…….address the real issues facing the UK economy now. Don’t bother waiting.

So what are the real issues then ?

teamhurtmoreFree MemberPosted 12 years agoBlimey Ernie, you have to ask? Stated several times on this and other threads! In brief, and ignoring the structural longer term issues. Current levels (and the outlook) for aggregate demand are weak. Why? Very simply we have all the major economic players – households, companies, banks and the government in the process of deleveraging. I will leave the blame game out of this for the moment! But the key is that this is happening simultaneously. The BOE Inflation report published yesterday laid this out very clearly – look at domestic demand (current gov pls take note). Consumption very weak as households face declining real incomes and are starting to save more (deleveraging). Business investment is still well below pre-crisis levels due to weak demand, uncertainty, and lack of available credit. Output from manufacturing and services is flat but construction as you will know is weak (hence the current double-dip). And the banking industry remains over-leveraged and in intensive care. Despite all of this, addressing over-leverage has only just begun. Really, only just. Which is why I have argued before that this is going to be a very slow process. The BOE euphamistically stated yesterday, ” even if a credible an effective set of policies are successfully implemented, the scale of the necessary adjustments suggests that a prolonged period of sluggish growth and heightened uncertainty is likely. ” Thank you Merve!

And then, and only then, we have economic, social and political uncertainties (the polite version) among our major trading partners in Europe although external demands impact on overall aggregate demand is not currently a big deal largely because imports have been weak. But it obviously doesn’t help.

And then policies. Despite the BS frequently spouted, policy choices and options among the three main parties are broadly the same and, as Gavin Davis put it, probably correct in the long term. But the Tories have been misguided in their belief that the mere act of deficit reduction alone would rekindle growth. Given the four powerful forces of deleveraging described above that was as absurd here as it is in the rest of Europe. Plus an over-reliance on accommodative monetary policy is wrong given shape of IS-LM curves and the broken banking system.

Other than that, everything is fine and dandy and the proper debates about austerity (sic) finally happening 😉

ernie_lynchFree MemberPosted 12 years agoBlimey Ernie, you have to ask? Stated several times on this and other threads!

Well I had to ask what you think the “real issues” are as I’m afraid that sometimes I don’t pay enough attention to what you say. Sorry.

Still, I’m glad to see that according you right there at the very top of the list of “real issues” you have placed low wages and a lack of investment in construction – which you point out has resulted in double-dip recession.

And the fault of deeply dippy double-dip Osbourne.

It’s good to see how much we share much in common teamhurtmore, despite out differences…..what with me being a Marxist-Leninist and you being a Thatcherite Tory.

Perhaps consensus politics will make a comeback ?

teamhurtmoreFree MemberPosted 12 years agoIndeed Ernie, it’s funny how easy it is to reach consensus when one sticks to the facts (I will ignore the repetitive misnomer this time!!!!) !! In effect we probably have more consensus politics in reality than is portrayed by the media and the politicians and of course we have it in a rudimentary and messy fashion now with the Condems!

But that is why it is important to pick up on BS such as the recession is caused by Tory cuts (sic) or the accuse them of economic vandalism. THe true economic vandals were the Labour Party, the BOE, the FSA, the bankers and everyone who over-leveraged themeselves in the gorge-fest during Labours time in power. OH and the biggest of the lot, the mighty Alan Greenspan. They oversaw and created a private sector growth mirage based on unsustainable leverage ( the ultimate economic high) and compounded that by embarking on a public debt explosion with spending far outstripping revenues. And then you get silly political games like Darling raising the MRT to 50% for no other reason than to pass a political hot potato onto his successor. A mini scorched earth policy. Some of this is about being in the wrong place at the wrong time. The Tories would probably have done much the same thing (albeit without the splurge in public sector debt) and ditto now the Labour Party would follow much of the current policies. Indeed re-read Ed Balls speech to the Fabian Society and his spending plans would have been faster and further than the current ones imposed by the Tories. Funny that……but when have facts ever got in the way of a good argument!!!!!

On wages, I am afraid to say that I fear that downward pressure on wages is only just beginning. Thank goodness then that we are not tied into a fixed exchange rate!

ernie_lynchFree MemberPosted 12 years agoI will ignore the repetitive misnomer this time!!!!

What me calling you a Thatcherite Tory ? 😀

Well what are you then ? Why don’t you unequivocally state where you stand politically ? I have no problem being open and honest about my political orientation.

Of course I understand the shortcomings of slapping labels on people’s politic views, but I have absolutely no problem with being labelled a leftist, a socialist, or a Marxist. Undoubtedly it throws up as many questions as it answers, after all, a Trotskyite can be labelled as all of those and I am definitely not a Trot ! But I can handle that, and it does give some clue to where you’re coming from.

No one should be ashamed of their politics, and if they are ashamed of their politics, then it clearly points to an urgent need to change them.

I suspect though teamhurtmore, part of your problem is that you don’t really know. Sure I have no doubt that things were much clearer for you before your world went pear-shaped and everything which you argued for wasn’t being challenged – you have no problem singing the praises of Thatcher’s premiership for example. But now that all the old certainties have all gone you have been left ideologically adrift, confused, and hanging on to bits of ideological wreckage.

The other part of the problem I suspect is simply the reluctance to firmly nail your colours to the mast because doing so leaves you open to critical attack…….how much better to leave people guessing what you actually believe in – at least they won’t be able to effectively attack you. And if they do attack you, leaving you unable to respond, you can go for the denial strategy – who are they to argue what you believe in when you haven’t even told them ?

we probably have more consensus politics in reality than is portrayed by the media

Yes of course, we don’t as in other simular European countries, currently live in a fractious society – it’s all just the invention of the media. Scenes like this yesterday didn’t exist.

So much consensus…..

SoloFree MemberPosted 12 years agoTypo !.

That should have been.

Guns don’t kill people, Rabbits do.

😉

tonydFull MemberPosted 12 years agoeasygroove – Member

get an e room you two+1, I can’t believe this thread is still going, put it out of our misery!

ernie_lynchFree MemberPosted 12 years agoWell tragically I thought it had died a death. So I’m particularly grateful that teamhurtmore breathed new life into it and bravely resurrected it. You can’t beat a good thread on a mtb forum in which the punters are vying for the Nobel Peace Prize in economics.

teamhurtmoreFree MemberPosted 12 years agoBlimey – where did that come from? And after the consensus leading previous thread!! Thought about replying but Tony you are correct. Best put out of its misery. Proper work to do!

The topic ‘Double dip recession’ is closed to new replies.