Home › Forums › Chat Forum › Is it worth getting into 'stocks & shares' as the everyman with everyman funds?

- This topic has 45 replies, 19 voices, and was last updated 7 years ago by monkeycmonkeydo.

-

Is it worth getting into 'stocks & shares' as the everyman with everyman funds?

-

plyphonFree MemberPosted 7 years ago

Hello,

I’ve seen this topic come up on here a few times so thought i’d ask.

As a dude with a modest amount of money with aversion to loosing said money, is ‘worth’ getting into stocks & shares? Or am I better just leaving it in my ISA until I buy a house in 2 years-ish time?

If so, where should I start reading?

Cheers

perchypantherFree MemberPosted 7 years agoIt’s just gambling isn’t it.

Everyone who buys a share is betting on it increasing in value over time.

Everyone who sells a share is betting on it decreasing in value over time.

This means that in every single share trade that ever happens, one of the parties has got it wrong.

You’d be as well going down the bookies and sticking it on a horse at even odds.

Disclaimer: The value of your investments can go down as well as up. Do not take financial advice from pretend melanistic leopards on the internet.

kelronFree MemberPosted 7 years agoGeneral advice I’ve seen is no if you’re going to need the money in the next 5 years.

For long term investment/saving then yes.

johnnersFree MemberPosted 7 years agoDefinitely not if you’re going to want the money in 2 years time. You can probably do better than most ISAs for cash savings though, especially if you’ll consider a fix.

johnnersFree MemberPosted 7 years agoIt’s just gambling isn’t it.

Everyone who buys a share is betting on it increasing in value over time.

Everyone who sells a share is betting on it decreasing in value over time.

This means that in every single share share trade that ever happens, one of the parties has got it wrong.

You’d be as well going down the bookies and sticking it on a horse at even odds.

Only the second of those is true.

fifeandyFree MemberPosted 7 years agoNot an expert at all, but from what I could work out when I looked into it, if you’ve only got a modest amount to invest over a shorter term then trading fees are going to eat a massive chunk of any return you may get.

Most advice suggests they make a better long term investmentsomewhatslightlydazedFree MemberPosted 7 years agoAs well as the short term/long term thing, think about what you want the money for.

If you can’t afford to loose the money, keep it somewhere safe.

FuzzyWuzzyFull MemberPosted 7 years agoTo me the rewards don’t really justify the effort you need to put in unless you have a decent amount of cash to play with (£10k+), if it interests you as a hobby (as it seems to for a lot of small investors) then that’s a bit different.

nickjbFree MemberPosted 7 years agoI procrastinated for ages, keeping my rainy day money in a cash ISA (where it was getting about 1%) then a couple of years ago I went for it. Just bought a managed fund. Still in an ISA. No buying and selling or shouting “sell, sell, sell” down the phone like on the tele. It went up 28% in the first year and is up 8% over the last 6 months. I know that it wont keep doing that but I’m pretty happy with my choice so far and I’ve put some more in.

mike_pFree MemberPosted 7 years agoMost of us are already investors but are unaware of it, because we have defined contribution pensions. The more you understand it and take ownership of it the better chance you have of providing for yourself in retirement. A stocks & shares ISA is an ideal place to start – my first investment was £750 into a simple index tracker, which was the beginning of an ongoing and very necessary 20yr learning process. Do it.

footflapsFull MemberPosted 7 years agoOnly the second of those is true.

Nope, not even that one. If you’re buying for income, you care about the dividend not the share price.

Long term it’s been a better best than saving cash.

plyphonFree MemberPosted 7 years agoSo the Stocks and Shares ISA sounds like where I’m at – I don’t intend ending up shouting SELL down any phone lines any time soon.

Is a stocks and shares ISA the same as a managed fund?

Off to do some googling I go….

footflapsFull MemberPosted 7 years agoIs a stocks and shares ISA the same as a managed fund?

The ISA bit is just a tax efficient wrapper.

Within the ISA you can buy individual stocks, or trackers or managed funds, or bonds etc.

mudsharkFree MemberPosted 7 years agoI wouldn’t be putting any money into the stock market I wanted to spend in a couple of years – so much risk around Brexit.

Having said that I do have a lot of money invested across my ISAs and SIPP and other funds that I won’t be realising it’s just that I don’t need to do anything with it anytime soon.

oldnpastitFull MemberPosted 7 years agoEveryone who sells a share is betting on it decreasing in value over time.

Whatever.

mudsharkFree MemberPosted 7 years agoIndeed, I sold some when I bought my first house – and others when I thought something else would do better.

ircFree MemberPosted 7 years agoI’ve had cash in share trackers and in https://www.fundsmith.co.uk/ since 2010. Fundsmith has done better. Both have been far better than having it in cash.

Two years is short for a shares investment. But then if it is 2yrs-ish and might stretch to 3 or 4 then perhaps worth it. Or go half in cash half in shares/funds. Sure it’s a gaamble but then with inflation at 3% if you are getting less than that in interest then your savings losing real value is a cert.

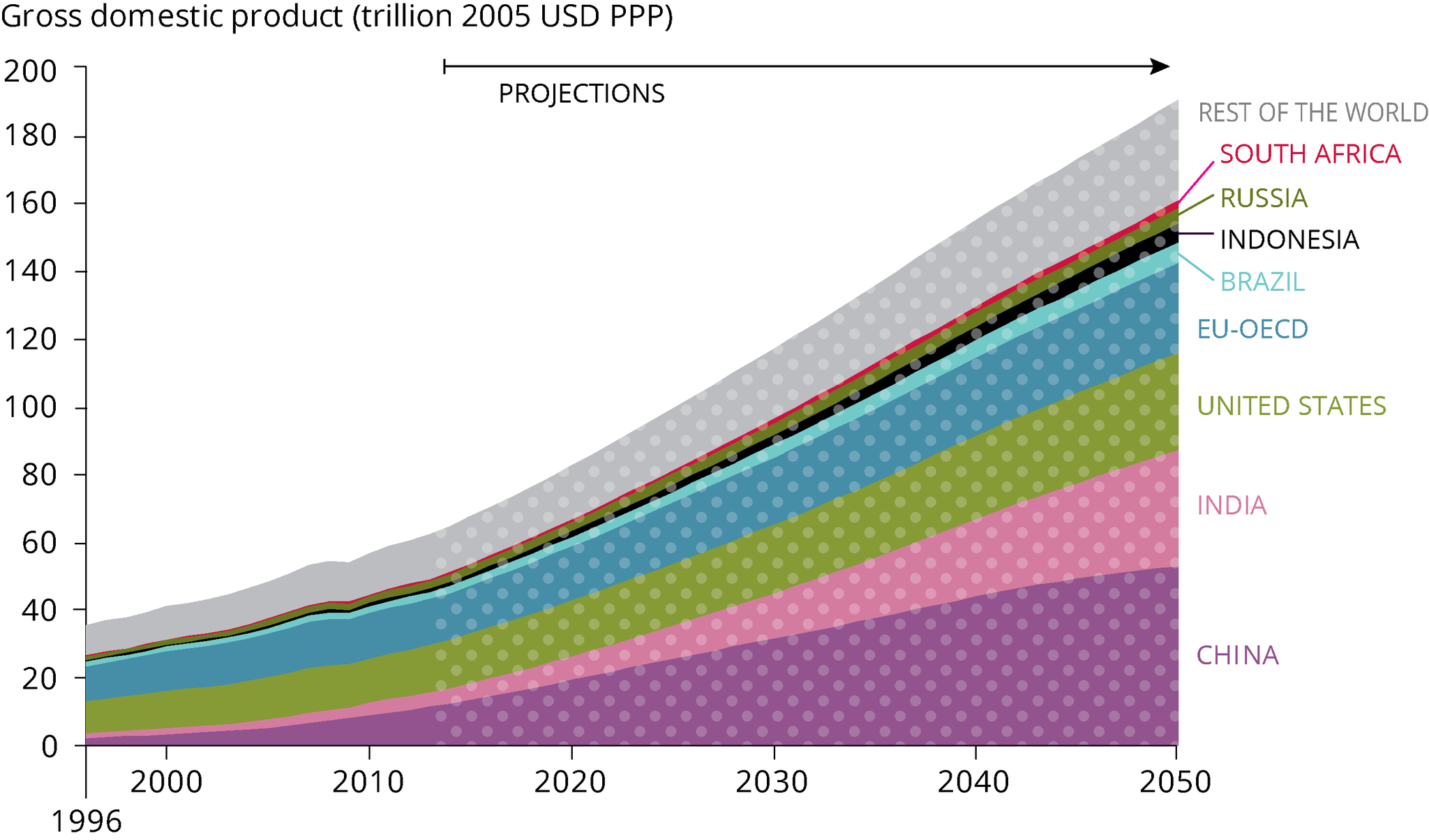

Tom_W1987Free MemberPosted 7 years agoInvesting isn’t a gamble in the long term, especially if you stick with tracker funds. The day these stop being a reliable long term investment, is the day when the planet has run out of resources to fund economic growth – if that ever actually happens.

You are pissing money up the wall by not beating inflation.

footflapsFull MemberPosted 7 years agoI’ve had cash in share trackers and in https://www.fundsmith.co.uk/ since 2010. Fundsmith has done better. Both have been far better than having it in cash.

Not really surprising given the bull market we’re still in. However, at some point there will be another big dip….

Tom_W1987Free MemberPosted 7 years ago

Tom_W1987Free MemberPosted 7 years agoNot really surprising given the bull market we’re still in. However, at some point there will be another big dip….

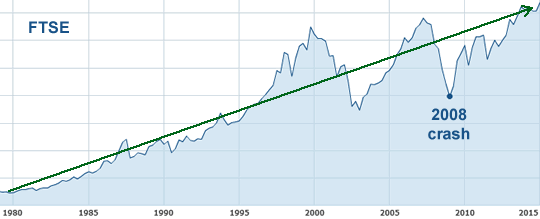

Of course there will, but look at the massive green general trend line, that’s the important bit.

mike_pFree MemberPosted 7 years agoThat chart shows just how much headroom there still is even at current valuations, and that’s before taking into account that markets are flooded with liquidity as a consequence of QE. But for all the political/Brexit uncertainty markets would be so much higher

monkeycmonkeydoFree MemberPosted 7 years agoLot of Newbies thinking of getting into shares at the moment.Historically,this would be a perfect indicator of a coming crash.

mike_pFree MemberPosted 7 years agoThat comment is akin to the proverbial stopped clock – inevitably right twice a day but only by accident and no-one knows when

monkeycmonkeydoFree MemberPosted 7 years agoI,m betting on a correction in the next two years.That exact enough for you Mike?

poolmanFree MemberPosted 7 years agoI like these threads…for a 2 year investment period and a house purchase trget i would not. I am in the same position so my thoughts are.

House prices are falling away, or the ones i am interested am. They increased by c 50% in 2 to 3 years so they have to really. Interest rates are moving up, so if house prices fall your cash pirchasing poweris increasing.

Ftse s at all time high, in 2 yearswho knows, brexit fears, trump too many unknowns. Yield is c 3.8% and a crash could be -20%, so you could be waiting 5 years worth of divis.

I d put the cash ino premium bonds, think the prize fund is 1.4% so you may win lucky.

surferFree MemberPosted 7 years agoInvesting isn’t a gamble in the long term, especially if you stick with tracker funds.

Its always a gamble over any period. Unless you think past performance is a guarantee of future? Also timing is everything.

Tom_W1987Free MemberPosted 7 years agoIt’s only a gamble if you think an event that is essentially world ending is going to happen during our lifetime – but you’re right, we may go into a period of economic decline on a scale unseen since the advent of written history, where billions starve to death. In which case, you’d be **** whether you invested or not, you’d have been better off invested in tinned foot and shotguns. In regards to timing, if you’d invested just before the 08 financial crash, based on that graph – you’d still be better off now. Unlike gambling where on a long enough timeline you lose, ALL historical data shows that if your investments are inline with growth – then over a long enough timeline you gain.

You’re logic is essentially the same as “World temperatures have been rising historically, but that is not an indication of future global warming”.

surferFree MemberPosted 7 years agoReally? One is backed by scientific rigor. The other isn’t. A bit like saying house prices are guaranteed to rise. Dont mistake the two.

The data for global warming goes back a lot more than the stock market.we may go into a period of economic decline on a scale unseen since advent of written history, where billions starve to death.

Or maybe stock markets will simply not rise 🙄

Tom_W1987Free MemberPosted 7 years agoAnd where is the evidence for a flatlining of the economy for the rest of our lifetimes? What is the confidence in that data/evidence?

Again, considering the developing worlds birthrates – this is also, pretty much a world ending scenario. Do you think, given the advances is robotics and space exploration, that humanity and all these FTSE 100 companies are going to allow their companies to flat line? No, when earth starts limiting our ability for economic growth – we will simply start exploiting the solar system.

The data for global warming goes back a lot more than the stock market.

It’s still a question of confidence isn’t it.

Beside, given interest rates, you are losing from the start anyway – so you may as well play the game.

mike_pFree MemberPosted 7 years ago>> I,m betting on a correction in the next two

>> years.That exact enough for you Mike?No, not in the least. I want to know whether I should sell up next year, or the year after? And wtf should I do with the proceeds while I await your prophesy – hide it under the bed? What if the market goes up 50% in the meantime?

Tom_W1987Free MemberPosted 7 years ago

No scientific vigour? Are you one of these types that dismisses all but the hard sciences?

poolmanFree MemberPosted 7 years agoThe ftse graph above excludes dividends i think, also, i read that there are 50 ftse 100 constituents left from the ftse 100 dot com era. Back then it was full of banks and dot coms, now miners and oil.

These correction periods are brilliant buying opportunities.

surferFree MemberPosted 7 years agoAnd where is the evidence for a flatlining of the economy for the rest of our lifetimes?

I havent seen any. You sound like some shady door to door salesman guaranteeing returns that cant be guaranteed.

monkeycmonkeydoFree MemberPosted 7 years agoLow inflation,low growth,massive debt and poor demographics could well produce an extended period of low/negative returns.The ten year Cape figures are historically speaking very high.This more so in the US.

monkeycmonkeydoFree MemberPosted 7 years agoIf your a proper investor and not a bookies runner you shouldn’t be selling at all Mike.This is a marathon not a sprint.You need to think about the magic of compounding and avoiding costs and taxes.The bear markets will give you an opportunity to top up some of your favourite shares.If they were great businesses in your view when you bought them,why sell due to temporary setbacks?That is,if you knew what you were doing to start with.

Tom_W1987Free MemberPosted 7 years agoYou sound like some shady door to door salesman guaranteeing returns that cant be guaranteed.

No, you are conflating confidence with gambling. With continual gambling, you will lose in the long run. The returns in gambling are high for a reason, because in the long run the bookies usually win.

The markets do have data behind them and we can produce projections with a level of confidence.

Just because something with a low probability may happen, does not mean you should act on that potentiality. Nor can most things in life be guaranteed, however 1) You are losing money everyday keeping it in a standard savings account. 2) If the status quo continues like it has for the past 200 years, you won’t lose.

If oil runs out tommorow or an asteroid hits and totals the world economy, you may do though – but you will have bigger things to worty about…. like how to butcher and cook your neighbours.

tjagainFull MemberPosted 7 years agoNot read the whole thread. MY dad dabbled in penny shares. Some years he more than doubled his money. Overall I think he turned around £3000 in over £40 000 in around 10 years.

However he spent a lot of time doing his research and he did lose money in places as well

YOu can make real money doing it but you have to spend a lot of time and energy on research and only do it with money you can afford to lose

Tom_W1987Free MemberPosted 7 years agoAgain, if your dad had just put the money in a tracker fund – forgot about it and did nothing for 20 years, he’d have probably been better off than spending all that time wasting energy on penny stocks trying to make a fast gain.

The old rich get this, the middle classes and working classes don’t.

fifeandyFree MemberPosted 7 years ago@Tom, trackers don’t always work out (i invested shortly before 9/11 😡 ). You need a decent lump sum to invest to begin with to let the growth really get to work in any sort of life changing way.

Much easier to be excited about 8% per year when its working on £100k rather than £1k. Perhaps why your ‘old rich’ get it and others don’t.

The topic ‘Is it worth getting into 'stocks & shares' as the everyman with everyman funds?’ is closed to new replies.