Home › Forums › Chat Forum › Living beyond your means…

- This topic has 291 replies, 25 voices, and was last updated 6 years ago by uggski.

-

Living beyond your means…

-

squirrelkingFree MemberPosted 6 years ago

These things are all relative, I can see where bikebuoy and sofaboy are coming from in that even at higher incomes you can live beyond your means (this was the question, yes?) however those people could downsize and relieve the burden. Well, in Sheffield anyway, I have no idea how far out of London you would have to go to do that. Probably Sheffield.

Personally we’re doing alright though there have been a few tight months, a year and a half in fact (how time flies when you’re having fun) thanks to unplanned expenditures (car maintenance, funeral costs – the usual). Not beyond our means by any stretch and doing rather well but there is a clock ticking on my job and right now I have no idea what I’ll be doing in 6 months never mind 6 years.

tjagainFull MemberPosted 6 years agobikebouy – what you actually mean is you are struggling to have a comfortable middle class lifestyle in London on £100 000 a year. Its utter nonsense to suggest you are struggling in absolute terms.

Do you live in a crowded insecure rented flat? Or have you bought a house? Own a car or get the bus to work? Ever had to use a food bank?

Seriously dude – you need a large dose of reality and to get a clue what the reality is for most folk. You are among the richest few % of the countries population. that is a simple fact.

tomhowardFull MemberPosted 6 years ago5k a month net is a good income.

However if you live in the South East/London commuter belt then it won’t go very far.

Yeah, we know. We get all the details from BB every time there is a money thread. TJ disagrees. Edit: As illustrated above.

funkmasterpFull MemberPosted 6 years agoOut of curiosity, how many are arranging the finances in preparation for Brexit?

I logged a shit tonne of hours on various Fallout games before the kids came along, does that count?

GrahamSFull MemberPosted 6 years agoBy decent I mean comfortable home, holidays, good food. What any reasonable person would expect a working family to be able to afford.

I think a big part of the problem is that the modern housing market means that, for those that didn’t get on the ladder early enough, the “comfortable home” part of that equation accounts for more than two-thirds of their take-home pay.

lungeFull MemberPosted 6 years agoWe’re OK. I have a pretty good job, but Mrs Lunge is now earning just under half what she was a year ago. Thankfully, we have a small mortgage, 1 old car that’s cheap to run and relatively cheap habits. I do have a bit of a spending habit but am really trying to chop it down at the moment, doing more running (cheap) than cycling (expensive) is certainly helping that.

I could/should save more and I could/should be more careful.

gobuchulFree MemberPosted 6 years agoa comfortable middle class lifestyle

That’s because a £100k a year isn’t “middle class” anymore if you have to spend nearly half of it just to pay for your house, before you even heat it or feed yourself.

Do you live in a crowded insecure rented flat? Or have you bought a house? Own a car or get the bus to work? Ever had to use a food bank?

The things you are highlighting are things people living in poverty have to do.

IMO Bikebuoy is a typical example of the modern UK, you can be an established professional person, with apparently a good income and have way less disposable income than someone in a similar position did 30 years ago.

tjagainFull MemberPosted 6 years agoHow any family can have a decent standard of living on less than £3k a month net, is beyond me. By decent I mean comfortable home, holidays, good food. What any reasonable person would expect a working family to be able to afford.

This is the reality for vast numbers of people in our country. those things are so far beyond them that they will always remain a dream.

GrahamSFull MemberPosted 6 years agoOut of curiosity, how many are arranging the finances in preparation for Brexit?

Only thing I’ve done so far is make sure that we’ve bought into some “excluding UK” funds under my daughter’s JISA to spread the risk to her savings a bit.

Not honestly sure what else we should do? Don’t really hold any investments beyond the trust funds for the kids. And we’re fortunate in that I don’t think our job security is likely to be impacted.

tjagainFull MemberPosted 6 years ago£100 000 a year not “comfortable middle class” Utter nonsense. It puts you firmly in the richest part of our society

If living in a insecure rented flat is poverty then half the country are in poverty. If not owning a car………..

Some of you really have no idea what the reality is for huge amounts of people in this country

DezBFree MemberPosted 6 years agoWasting your breath TJ. It’s like trying to explain the NHS to a Tory.

rene59Free MemberPosted 6 years agoThat’s because a £100k a year isn’t “middle class” anymore if you have to spend nearly half of it just to pay for your house, before you even heat it or feed yourself.

So £50k a year with no housing costs isn’t enough to live as “middle class”?

Delusional.

w00dsterFull MemberPosted 6 years agoUsed to be absolutely useless with money. I earned a lot and spent even more. Got into my early 30’s, carried on earning good money but equally spending an awful lot more than I was earning. The vast majority of what I was spending the money on was junk, regular expensive trips away with pals, boozy nights out etc.

Got divorced about 10 years ago, that was expensive. Not just the legal side of it, but the first 18 months I was providing house / food / bills etc for my family. I also went off the rails a lot, got in even more debt. Took me a while to sort my self out.

I re-married the ex who divorced me, one of our problems in the marriage was my spending and my living beyond our means. Whilst I still spend, everything is saved for cash first. All loans, overdrafts cleared. Expensive cars finance ended and now I drive a paid for Citroen Berlingo. It can be a bit frustrating but I realise we are very lucky to be in the position we are. Wife deals with money, I’m given “pocket money”, once its gone its gone.

I do regret my lifestyle through my late 20s and 30s though. If I’d have saved I wouldn’t need to still be working in the field I do. I really detest my line of work – but I’m now trapped in it due to my financial mistakes I made when younger.

I really really want a new Bird hardtail, but having to stop myself!

Regarding the fridge packing in etc, I’m sure we pay about £10 a month to cover all of our household appliances. Our fridge freezer packed in about a month ago, replacement parts fitted and back up and running within a couple of weeks – same as washing machine before that. Appreciate not everyone has the £10 per month for the appliance insurance, but ours covers quite a few expensive to replace items, including the boiler.

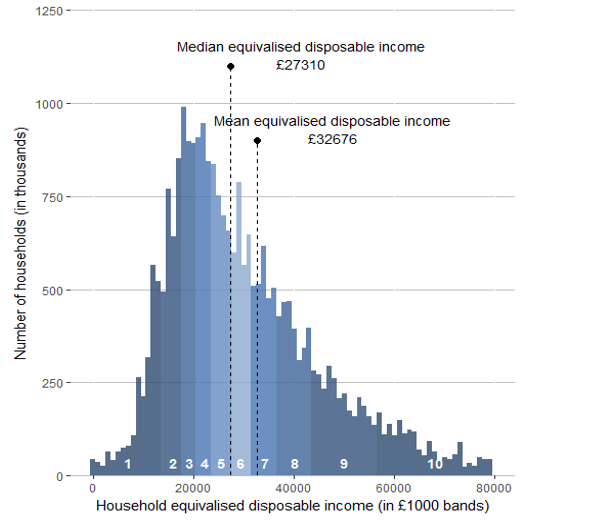

tjagainFull MemberPosted 6 years agoTry this calculator to see how you compare to the population

https://www.ifs.org.uk/tools_and_resources/where_do_you_fit_in

Or have a look at this graph

GrahamSFull MemberPosted 6 years ago

GrahamSFull MemberPosted 6 years agoInteresting to see the standard pissing contest has been inverted into a “I’m considerably poorer than yow” 🙄

@idiotdogbrain makes an excellent point: the question was about living beyond your means. Anyone can do that, regardless of their income.Not being able to talk openly about that because it offends people on a lower income is a big part of the problem.

idiotdogbrainFree MemberPosted 6 years agoThe mortgage thing also assumes you’d actually get given one..

As an example, let’s create a fictitious couple: both in decent jobs, one earning £45K gross, one £30K. Been gifted, or saved, £25K for a deposit. Two kids, so 3-bed house needed. At current mortgage allowances, 3x the largest salary plus the smaller, plus the deposit is £190K. Crappy 3-beds in less-than-desirable areas near me start at £240K, so they’ve no chance to buy a family home. On a combined salary of £75K! So, they’re stuck renting, or having to move and start again..

rene59Free MemberPosted 6 years agoAnyone can do that, regardless of their income.

No one is saying they can’t do that. Pointing out the ridiculousness of saying £100k a year isn’t a lot is not the same thing at all.

whitestoneFree MemberPosted 6 years agoAt the moment as I’m technically unemployed then I’m living beyond my means in that my outgoings are definitely more than my income. BUT, the previous ten years were good in that my net salary was nearly double what I spent – I wasn’t profligate in my spending but equally I wasn’t tight fisted, just that I bought what I needed rather than what I wanted (mostly).

At both the latest redundancy (the whole office closed down) and the previous one I went through my/our baseline costs. We’ve no debts other than small short term amounts on credit cards which get paid off at the end of the month. In roughly descending order: Council Tax; heating oil; house insurance; car insurance; utilities (we are on private water and sewage so the only cost is £50 every other year to empty the septic tank). That lot comes to around £4K pa. Food for us and fuel for the car, another £4k-£5k. Everything above that is discretionary spending/disposable income.

tonyg2003Full MemberPosted 6 years agoThe OP does really say but the thread shows that amongst those living beyond their means they are split to those who have “chose” to (they know/knew that that are/were living beyond their means and those who’s circumstances have dictated that they are living beyond their means. However I agree completely with TJ – those with good salaries (higher paid tax payers) should be more sensitive and realistic. No matter where you are in the UK the salaries mentioned could give you a better standard of living and they give you the financial power to make the choice of where you live and hence whether you are living beyond your means.

gobuchulFree MemberPosted 6 years agoNo one is saying they can’t do that. Pointing out the ridiculousness of saying £100k a year isn’t a lot is not the same thing at all.

£100k a year should make you “rich”. But it doesn’t.

Generally speaking it would mean a professional qualification and a fairly senior position with a lot of responsibility.

30 years ago the rewards of a similar position would of been far more than they are today.

That’s how **** up the UK is.

edhornbyFull MemberPosted 6 years agoGobchul makes good points – 5k takehome in Greater Manchester would be a very generous income but I would imagine that most people who earn that would spend it on a house in somewhere pricy in the Cheshire commuter belt with all the residual costs so the lifestyle is the same.

the big question is whether the debt you have is risky in the event of the loss of income – if you can handle it then the decisions are yours but if not it’s IVA time if you’re not careful and despite what the daily wail would have you believe, an IVA isn’t an easy option.

GreybeardFree MemberPosted 6 years agoAs I said, it’s a cultural thing. Expectations have changed.

Two kids, so 3-bed house needed

I shared a bedroom with my brother and thought nothing of it. Going back a generation, my parents dated for six years before my dad had a job that paid enough to support a family, and only then did they get married. That’s what you did in those days. The difficulty that today’s younger generation have is that those changed expectations put pressure on. If they chose to live as my generation did, I think they’d be looked down on by their peers.

JakesterFree MemberPosted 6 years agothose with good salaries (higher paid tax payers) should be more sensitive and realistic.

Why? It’s all relative: what might seem a lot to one person may simply be adequate to someone else. It depends entirely on individual circumstances: if the higher-earner’s outgoings are proportionately higher then, to them, it may seem like they are less affluent than to someone looking at it from the outside.

CloverFull MemberPosted 6 years agoIf you’ve managed to rack up chunky debt – for whatever reason – then you don’t have much choice about paying it back and that can take up a lot of your monthly pay. I had a business that never quite paid me a decent wage but always seemed to be just about to – whilst also having a ‘flexible’ interest only mortgage with savings account. Obviously this means that I was also ‘just about to’ start properly paying into the savings account. It also meant that I racked up debt in the form of loans to fix falling down house issues (tried and failed to sell it) and also some financial fall out from a rubbish relationship…

A few years of a part time proper job augmenting own business and now consultancy work and I’m finally catching up with paying into the savings account which means that whilst I’m earning the best money I have for a considerable time, I’m basically squirrelling it away into the vast house shaped hole rather than spending it.

It’s weird as I would never have thought of myself as the living beyond my means type but on paper I have done and am just about getting it under control now. I worry about Brexit a lot and am trying to get savings up so that the outstanding mortgage is as small as possible by next March. I don’t really know how it will impact on what I do and it’s already had an impact on my other half’s business so the best plan seems to be to have as few commitments as possible.

kerleyFree MemberPosted 6 years agoTry this calculator to see how you compare to the population

I got the following message;

In conclusion, Your income is so high that you lie beyond the far right hand side of the chart

I know I am rich and would describe myself as so but I still live a pretty simple life and don’t have loads of spare money at the end of each month so see why others in same position may not feel rich. All about perspective…

kayla1Free MemberPosted 6 years agoThe ‘decent’ jobs thing is interesting, it all depends on a given value of ‘decent’ doesn’t it? Working your arse off 5 or 6 days a week for lots of money so you can afford to pay for stuff you’ve already ticked-on but don’t have the time to appreciate isn’t a (mentally) healthy way to be on.

rene59Free MemberPosted 6 years ago£100k a year should make you “rich”. But it doesn’t.

Only if you don’t let it make you “rich”. Dress it up all you want citing expenses for this and outgoings for that, but all you are doing is making excuses for bad money management and spending choices. I don’t make £100k a year, I still make a lot though and I know how well off I am. Maybe the difference is that I grew up in poverty and all of my extended family and friends were also poor. It wasn’t until my 30’s before I started to make a good salary so I know what both situations are like. If you think you need to live in a house with a separate room for each child, multiple cars on HP/PCP and two annual holidays just to be classed as a decent life then you are either stupid or trolling.

bombjackFree MemberPosted 6 years agoI’m constantly amazed by what my friends (and also my wife tbh) see as essentials for life. Need a new bike? pop it on finance, got a car that’s done over 100,000 miles? get one on PCP. Shopping in Waitrose rather than Aldi ’cause the food looks nicer… Having been to the edge of bankruptcy its not something I’d wish on anyone, and even now am still paying the price. And the interest…

The biggest issue seems to be comparing ourselves to others and the expectations it brings. Just because bob has a shiny new car and a skiing holiday every year doesn’t mean we need, or can afford it. For all you know he’s up to his eyeballs in debt (or dealing smack)

tjagainFull MemberPosted 6 years agoI know we are rich on a household income a bit over half of Bikebouys. We live in a small flat tho never having been able to afford a house within cycling distance of work. We don’t own a car and we don’t buy stuff on credit. According to that calculator we are richer than 70% of the population

JakesterFree MemberPosted 6 years agoIf you think you need to live in a house with a separate room for each child, multiple cars on HP/PCP and two annual holidays just to be classed as a decent life then you are either stupid or trolling.

Conversely, that sounds like trolling to me.

If someone wants to live like that, why be so judgmental? It doesn’t affect you in any way.

rene59Free MemberPosted 6 years agoIf someone wants to live like that, why be so judgmental? It doesn’t affect you in any way.

Doesn’t bother me what they live like, each to their own. Just don’t pretend you aren’t well off at the same time.

gobuchulFree MemberPosted 6 years agoIf you think you need to live in a house with a separate room for each child, multiple cars on HP/PCP and two annual holidays just to be classed as a decent life then you are either stupid or trolling.

Just to be clear, I am not pleading poverty.

We don’t have kids and I am on a very good wage. Had a very busy 12 months and with the Mrs business, earned a substantial amount of money. I do make a lot of sacrifices for work, away from home a lot but I’ve done it for 30 years and can’t imagine anything different.

We did take a bigger mortgage a couple of years ago to buy the business but are currently hitting it as hard as we can before the interest rates go back up, so we are not saving anything, all going on the mortgage. The plan is to be mortgage free in about 5 years, then I will throttle back at work and go self employed, picking and choosing projects.

I don’t spend much money on cars, we do have a boat, which is probably my biggest “luxury” expense. However, it only cost what some spend on their 3 or 4 bikes.

I don’t feel “rich” as any spare cash goes against our, still substantial, debt. That was our choice though and is a means to an end.

The point I was making earlier, is that if you haven’t had to pay SE property prices then it’s quite hard to appreciate how difficult it is.

I have lived in the SE and worked in London. At the time I was earning about £70k a year and I was far from “rich”. By the time you have paid the mortgage and your train ticket, then there is not a lot left. We had a pleasant 3 bed bungalow but it was hardly extravagant and still more than a hour door to door commute to work.

I knew some who were on less than that and with an income of £50k a year, living in a similar house and with kids, they would only be 2 or 3 months away from losing their house if anything happened to their jobs.

mrwhyteFree MemberPosted 6 years agoI suppose there is a big difference between living beyond your means and not earning enough to make ends meet.

Anyone with disposable income at the end of the month is probably doing quite well, once paid for house, food, bills etc. Those essentials that we need. Not private schools, car finance etc.

The issue is that it is so easy get credit along with all the latest gadgets being advertised constantly and being told we need them, social media just shows us the good bits of peoples lives, so we automatically think everyone must have these amazing things so we need them. It is a massive cultural and economic problem which is not sustainable.

squirrelkingFree MemberPosted 6 years agoif you haven’t had to pay SE property prices then it’s quite hard to appreciate how difficult it is

Just move then. It’s that easy. Get another job. Both of you. 😉

In all seriousness, todays society has been engineered to make downsizing (ie. financial prudence) the less desirable option. I see it all the time in people (friends and family) that are either paying for their life through finance or want to move upwards with no financial means of doing so. Society has pressurised people into thinking they need to fly to some sandy shithole every couple of months, have a “cracking deal” on an over priced and over specced car on the never ever or upgrade to the latest and greatest niche fads and standards every year. Everyone is at it, and I’m by no means sitting by looking on smugly as I feel the draw of shiny baubles and wanting to go places as much as the next person.

The issue is that it is so easy get credit

Yup. Paypal credit is a very dangerous thing, one click and oops! Suddenly my monthly allowance for the next year has been wiped out.

How any family can have a decent standard of living on less than £3k a month net, is beyond me. By decent I mean comfortable home, holidays, good food. What any reasonable person would expect a working family to be able to afford.

I missed that one. Holidays and “good” food are both luxuries, of course you can make decent food with considerably less outlay if you plan properly and buy sensibly. It also depends where in the country you are, around here (Largs) you could get an upper 3 bed quarter villa (cottage flat?) for 80k.Of course all that is dependent on being approved for a mortgage but to be honest if you can afford to rent you should generally be able to afford a mortgage.

gobuchulFree MemberPosted 6 years agoHolidays and “good” food are both luxuries

A holiday is pretty much essential for general well being. Depending on how much you spend on it determines if it’s a luxury or not.

Good food is not a luxury.

to be honest if you can afford to rent you should generally be able to afford a mortgage.

Where do you get your deposit from? Why do you think so many people rent? They can’t be bothered to fill in the mortgage application?

rene59Free MemberPosted 6 years agoif you haven’t had to pay SE property prices then it’s quite hard to appreciate how difficult it is

And you can get all that money back at the other end by selling up and retiring elsewhere with a big pot of cash. Swings and roundabouts. In order for me to come out at the other end with similar I would still have to make the same sort of payments only into savings instead of a mortgage.

bikebouyFree MemberPosted 6 years agoknow we are rich on a household income a bit over half of Bikebouys.

Another assumption you are making on my income, you are good at these tj.

You do not know how much I take home. So, whilst you are happy to divulge your financial status … I am not. But that doesn’t give you the right to make uninformed opinions about me.

Why not stick to the facts.

I shouldn’t have to explain again the reasoned argument I made, it gets boring and boorish explaining the same topic over and over again.

The basis for the argument (again, like you haven’t heard it too many times already) is:

Mort – £2k thereabouts

Car – £800

So, for the mathematicians that’s £2800 so far.. ok?

Food – £400

Schools – £1000

Sodding about being a human £800

And the total is ?? What d’ya reckon??

£5k

Boom!

No business of yours what bloody %entile they sit in, what social demographic they sit or aspire too.

Those figures are realistic, sorry if you don’t get the concept. Maybe read a book on it.

FantombikerFull MemberPosted 6 years agoOutside the basics to live I think the biggest discretionary spend is holidays. I am constantly amazed how high a percentage of net annual salary people will spend on an ephemeral experience (often on credit) whilst foregoing other enduring and enriching uses for the money.

rene59Free MemberPosted 6 years agoYou think being able to spunk £800 a month on a car, £1000 on schools and £800 dicking about doesn’t make you well off?

uggskiFull MemberPosted 6 years agoI missed that one. Holidays and “good” food are both luxuries, of course you can make decent food with considerably less outlay if you plan properly and buy sensibly. It also depends where in the country you are, around here (Largs) you could get an upper 3 bed quarter villa (cottage flat?) for 80k.Of course all that is dependent on being approved for a mortgage but to be honest if you can afford to rent you should generally be able to afford a mortgage.

The problem is that £80k flat in outer London will cost £350k. So a couple earning a good combined wage of £70k will still struggle to afford it

The topic ‘Living beyond your means…’ is closed to new replies.