Home › Forums › Chat Forum › Living beyond your means…

- This topic has 291 replies, 25 voices, and was last updated 6 years ago by uggski.

-

Living beyond your means…

-

benjii19Free MemberPosted 6 years ago

That’s refreshing to hear, the only debt we technically have is the mortgage… I have a lot of wants but try to hold back.

apple watch is currently a want…so far I’m holding back. It’s probably another piece of tech that nobody actually needs

uselesshippyFree MemberPosted 6 years agoI’m as tight as arseholes, the rest of the population however, it appears to be different.

molgripsFree MemberPosted 6 years agoMe.

It’s not a case of ‘ooh I have £10 let’s buy this thing at £20’. More like, you make plans that should work, but then something goes wrong. More a case of insufficient pessimism. Then shit piles up and before you know it as frugal as you are you can only just manage, then the car breaks down or something.

GrahamSFull MemberPosted 6 years agoEdit: deleted due to accusations of humble bragging.

In short, no, we have a decent income and we’re tight.

thegeneralistFree MemberPosted 6 years agothis thread appears to be turning into a “I’m considerably richer than yaw” fest.

What I’m intrigued about is whether that’s what OP wanted. I think he did….

benjii19Free MemberPosted 6 years agoIt was inevitable…

i have one mtb..not 3 and carbon it ain’t

my car is a 10 year old Ibiza

i have an iPhone but it’s a 6s that’s on its arse

i have an iPad….it’s about 6 years old.

I live in a 3 bedroom end terrace with an apparent leaky roof.

nixieFull MemberPosted 6 years agoNo, it’s a fools game. You can still have nice stuff* and live within your means.

*Yes I realise I’m lucky to be in this position and not everyone is.

benjii19Free MemberPosted 6 years agoWandering around places like Meadowhall it’s absolutely crazy what people appear to be spending…oh and what have you bought posts on here…

anagallis_arvensisFull MemberPosted 6 years agoNo, it’s a fools game. You can still have nice stuff* and live within your means

Not for everyone.

Only last week on the news was stuff about people paying £500 for £250 washing machine via HP. Makes you think doesnt it, if our washing machine broke tomorrow we’d buy a new one the day after without having to think about it and I’m pretty sure most on here are considerably richer than me.

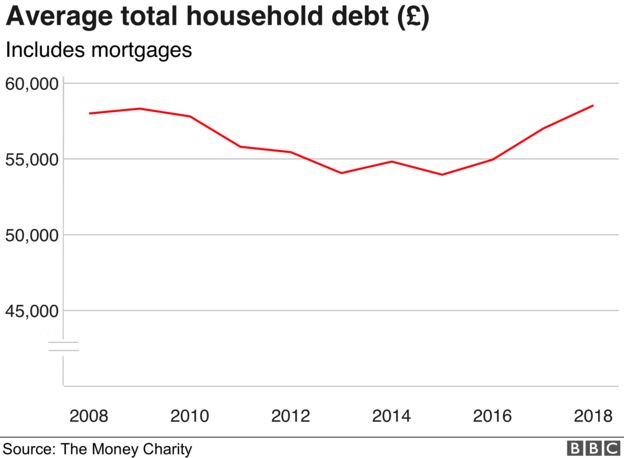

scotroutesFull MemberPosted 6 years ago

Assuming those figures are accurate, I’m amazed it hasn’t changed much in 10 years.

GrahamSFull MemberPosted 6 years agoBabies was always the thing that blew me away.

Saw so many young couples that didn’t have a lot of money struggling to buy stuff from “premier” rip-off places like Mamas and Papas because they wanted best for their baby.

Meanwhile we happily picked up pretty much everything second-hand for buttons from family, friends and jumble/NCT sales.

“Only a small poo stain on it. Call it 20 pence then.” 😂

DaffyFull MemberPosted 6 years agoYes, or at least I will do once interest rates rise.

Student loans (check)

Ridiculous mortgage (check)

Credit Card (check)

Car Finance (check)

items 1 and 2 were an inevitable consequence of going to uni later in life, moving from the northwest to the south-west and not getting on the housing ladder until 2014. Items 3 and 4 were a consequence of 1 and 2 and the costs of childcare.

breadcrumbFull MemberPosted 6 years agoGot a chunk of mortgage to pay but no other loans.

I’ve got a heap of wants, most fizzle out but if they remain long enough I look into them.

Not rich, not poor.

GrahamSFull MemberPosted 6 years agoMakes you think doesnt it

Yeah that side of it absolutely stinks.

It seems that once you genuinely can’t live within your means, the system conspires to make sure you stay that way.

whatyadoinsuckaFree MemberPosted 6 years ago@scotroutes it would be interesting to see that graph split by age groups, I guess the 50 somethings and 60 plus who got on the housing ladder before the massive uplifts in house prices are considerably lowering the overall, than the next generation decade and so on and so on..

That generation never had iPhones and cheap flights all over the world to contend with and more likely saved up than bought on credit, like the younger generations

sofaboy73Free MemberPosted 6 years agoYep, kind off but it’s just about under control. The crash was not kind to me as over night my salary went down by 2/3 in 2008 (recruitment- and yes I should of saved money in the good times but I blew it on booze, coke and fast cars – there’s a George best quote struggling to get out there somewhere).

have just about hot and even keel after having living in credit cards for four years post crash. It’s taken a while and only just turned the corner this year, but thank god we have a stable economic future ahead of of us.

oh hang on a minute….

andybradFull MemberPosted 6 years agoyup. in debt. lots of it.

I basically hemorrhage money. Ill happily give it away, the wife , thankfully, is the opposite.

P-JayFree MemberPosted 6 years agoNot any more, we did when Kid 2 turned up unexpectedly. It wasn’t nice seeing the credit card balance going up at the same time as being potless.

Still, we’re reducing debt by £400 a month and saving at nearly the same rate. We’re actually solvent for the first time in years -yay!

Currently, 1 modest PCP car covered by a car allowance, £2k on an interest free CC, a loan we took to help when baby came that ends in a few months and that’s about it. I’ve enjoyed clearing things off more the last year than I have buying stuff.

GlennQuagmireFree MemberPosted 6 years agoOpposite here also.

Without meaning to sound flippant, if I want something I will just buy it – no need to check the bank balance.

But…I will deliberate long and hard before buying – I still respect the value of money and the effort of earning it.

NorthwindFull MemberPosted 6 years agoMore or less at my means. Which is a shame because I think I need to be saving about 50% of my entire wages if I’m ever going to be able to afford both a house, and retirement.

bikebouyFree MemberPosted 6 years agoThis society is geared that way, like most western societies.

Sell credit, sell more credit, keep debtors in debt to enable a low wage economy and mental health plummets as a result.

Sell debt, create bad debt economy, sell credit to debtors at vastly inflated interest rates that are “just” bearable, and mental health plummets.

Create chance games that promote easy get out options, create unrealistic expectations, sell more gamble based products, and mental health and families suffer.

Thought you lot would understand how western civilisation works by now.

matt_outandaboutFree MemberPosted 6 years agoIt seems that once you genuinely can’tlive within your means, the system conspires to make sure you stay that way

This is very true.

We have mortgage and a loan that’s 1/3 the value of the cars it was taken out to buy.

We do struggle to stay out of the overdraft some months. But you try buying three teens shoes, uniforms and bits in August…

DezBFree MemberPosted 6 years agoOn the edge of my means, probably. It’s bloody hard to adjust going from a 2 salary household, to one salary, which is then cut by £20K! 4-5 years down the line and I still can’t get used to it. Not in debt though, so I suppose I’m managing. Just can’t afford winter holidays anymore! I guess if I was a living beyond type I’d book the hols anyway.

bigblackshedFull MemberPosted 6 years ago“I’m not tight, I’m saving up to be!”

I’m careful with money, after a an early start of being very flippant with not a lot, followed by 5 years of on and off unemployment, I now appreciate what I earn and how lucky I am.

As AA said up there ^^^^ there are a lot of people, the vast majority I’d say, that would be royaly screwed if the fridge or washing machine went bang, or the car broke down.

tjagainFull MemberPosted 6 years agoI am in an odd situation where whilst being in my mind profligate ie I buy what I want without caring about the price I am not spending all my modest salary each month ( 1900 ish take home). I can’t quite get my head around it. all the rest of my life I have struggled to make ends meet but now have money left over. My wants are low tho so I guess thats it.

rene59Free MemberPosted 6 years agoNo debt and my (very low) living expenses can be covered multiple times over by my (decent) salary.

sofaboy73Free MemberPosted 6 years agoYou know how it is. £5k a month and barely scraping by…

Not sure if a flippant comment or not. But not a million miles off myself gross, and while I wouldn’t use the the word ‘scraping’, I would say barely getting by described it well.

awaits the self righteous hordes who’ve never had to lean on debt to get you thougha tough situation and who accuseme me of being a debt monger, whilst knowing nothing of my life situation

yours, the squeezed middle class 😃

nealgloverFree MemberPosted 6 years agoIn the fortunate position of having cleared our mortgage (I am 47 so I’m happy with that!) and having enough income to live reasonably modestly without debt.

Both drive relatively old cars, and other than my new ebike, both our mountain bikes are 5+ years old (and were bought cheap as last years stock)

So we don’t live the high life, but we don’t shrimp (and crepe) to get by.

(Edited to elaborate on autocorrect errors 👍)

tonFull MemberPosted 6 years agono.

kids both gone. mortgage gone. no credit cards.

but in your 50’s this is the norm?

in my 20’s 30’s and 40’s it was a very different tale.

pslingFree MemberPosted 6 years agoWe all know we should live within our means but some of the wealthiest people I know live pretty much entirely on some form of credit or other. I’m talking people with multiple properties, driving Bentleys, generous entertainers… they don’t see living off credit as a millstone, they see it as a means to an end.

Me? I’m too conscientious and couldn’t do it. I do wonder who’s the fool sometimes but generally I’m happy with my lot.

matt_outandaboutFree MemberPosted 6 years agobut in your 50’s this is the norm?

The way house prices rose between when you bought, and when I (40’s) and now 30 something year olds, mortgages won’t be paid off in my 50’s…

onandonFree MemberPosted 6 years agoFor many years I was severely in the red but that taught me to cut back, pay the debt and get back in the black.

once you have that mentality it’s easy to live within you means.

bikebouyFree MemberPosted 6 years agoYou know how it is. £5k a month and barely scraping by…

He’s made reference to a comment I made in the last Debt thread, and the one before that and the one before that and so on.

I simply stated that £5k nett isn’t a lot to live on if you reside in London, plenty of folks backed my statement up but typically the backlash was that I was belittling those that didn’t take home that much.

Hey ho 😜

GrahamSFull MemberPosted 6 years agoThreads like this always go one way.

And to be honest I think that is indicative of the problem.

For whatever reason, our society tells us that talking about money is terribly crass and boorish, especially if you mention actual figures (gasp) and unfortunately that gets in the way of perfectly sensible conversations about it.

stewartcFree MemberPosted 6 years agoFor many years I was severely in the red but that taught me to cut back, pay the debt and get back in the black.

once you have that mentality it’s easy to live within you means.

+1 This for me.

I think its impossible these days for people in their 20-30’s not to have to live with some debt bar the Bank of Parents stepping in.

The topic ‘Living beyond your means…’ is closed to new replies.