Home › Forums › Chat Forum › How much debt?

- This topic has 198 replies, 120 voices, and was last updated 8 years ago by NZCol.

-

How much debt?

-

bearnecessitiesFull MemberPosted 8 years ago

Personal finances in general are complicated. If anyone is genuinely having sleepless nights about their circumstances and debt, then it is they who should have a voice on this thread, and hopefully would get advice/support on a way out of it.

Not stealth blah-blah-ing about how much you ‘have’.

That wouldn’t get much traction on here though, would it?

nickcFull MemberPosted 8 years agosavings, pension, no mortgage, no personal debt. 6 year old bike, and 8 year old car

I’ve done this wrong haven’t I?

shootermanFull MemberPosted 8 years agoI agree this thread may be a vehicle for some to wallet wave but it does serve a bloody useful purpose too.

As P-Jay has said, I have also looked at folks who “had it all” locally. Through work I had to deal with a couple who lived in THE executive development, had the cars, clothes, holdays etc. Turned out it was all funded by nearly £300k of debt, about £100k of which was unsecured. Property market crashed and their goose was cooked.

That was my epiphany and realised it’s just smoke, mirrors and debt with a lot of people and don’t get sucked into debt yourself trying to keep up. You’re not “doing it wrong”.

Kids and childcare is a killer. In my early to mid 30’s it really felt like I was slogging my guts out just to pay bills but I found it does get easier.

mpottsFree MemberPosted 8 years agoFor those that are seriously worried about their debt then speak to someone like Stepchange[/url].

They are incredibly helpful and not judgemental. I got into a whole heap of trouble with over £40K of CC debt and £30K of unsecured loans on top of a £190K mortgage.

With the help of Stepchange and a DMP it is all paid back and other than the mortgage which now stands at around £140K on a £250K house I have no outstanding debts.

My Credit Score is probably as bad as it gets but that no longer matters really as we save for everything.

Don’t be too proud to ask for help. I wish I’d done it sooner.

dirtyriderFree MemberPosted 8 years agoloads, but YOLO, no one says on their death bed “i wish id been more frugal”

suburbanreubenFree MemberPosted 8 years agoloads, but YOLO, no one says on their death bed “i wish id been more frugal”

I’m sure some do.

theotherjonvFree MemberPosted 8 years agomaybe their kids do when they have to get a loan to pay for their funeral

binnersFull MemberPosted 8 years agoI know what you mean Jammers. I frequently lie awake all night fretting over asset values. It’s the cross we all have to bear.

butcherFull MemberPosted 8 years agoI don’t like the idea of any kind of debt. I have a student loan (though I see that more as a tax) and I have been deep into my overdraft in the past. But outside of that I have never owned a credit card, wouldn;t even know how to buy anything on credit, only had one loan and regretted it, and if I want to buy anything I make sure I have the money for it first.

Don’t know if that’s a good or a bad thing really. I know I could own a lot more stuff. Drive some nice cars, live in a nice house. But at the same time I’m pretty sure I would be more stressed about it all.

sideshowdaveFree MemberPosted 8 years agoNever liked having to pay companies (banks) to service debt so by 29 I was mortgage free, 34 I bought another house but didn’t borrow a penny. I have a nice car, a few nice bikes and more importantly a happy life. Was planning to retire at 50 but then had kids (well one child) so will work until their education is over to help and not let her adult life start in debt.

molgripsFree MemberPosted 8 years agoI don’t like the idea of any kind of debt.

On the other hand, we love it! 🙄

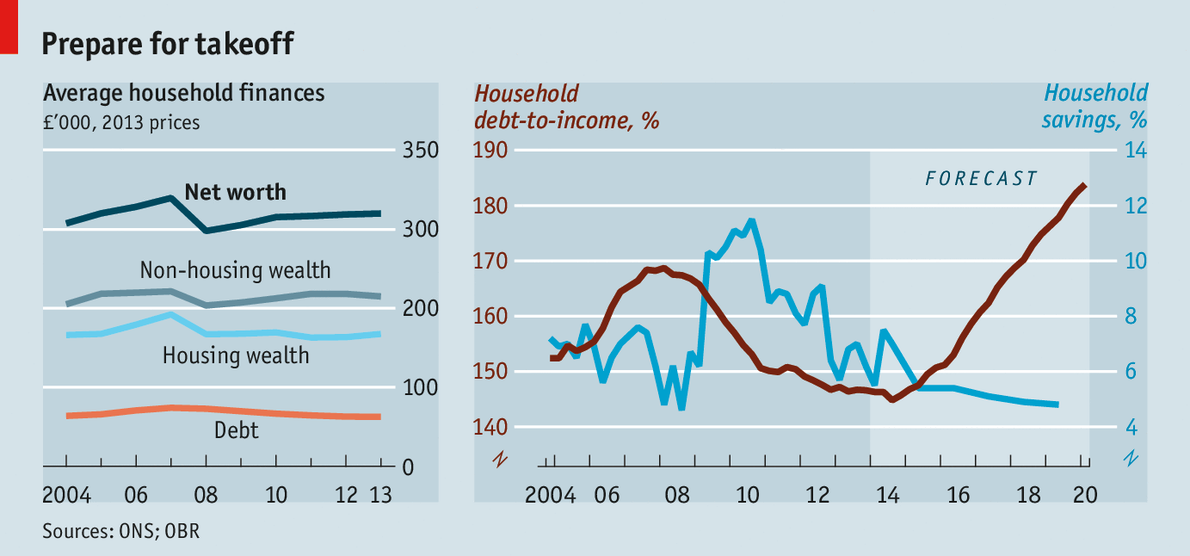

brooessFree MemberPosted 8 years ago8 years into a still unresolved debt crisis and this chart is terrifying…

To be fair we don’t know the driver of the increase. I asked a friend of mine who works as a data analyst at the Bank of England and he said it was availability of credit. Looking at the sums being doled out in massive mortgages and especially BTL, and in PCP deals on cars, I suspect that contributes a lot to this chart. Maybe some people are living off credit just to pay bills, I don’t know.

I guess there’s plenty my mate knows about the state of things but can’t tell me, sadly! He doesn’t subscribe to the ‘economic growth forever’ thesis, I know that.

We’re going to have to pay it all back one day… or in the case of mortgages, we’ll just force the younger generation into a lifetime of crippling debt to keep the whole pyramid going a little longer… I can’t quite believe we’ve got ourselves into such a dire place in such a short space of time.

It’s interesting that we’ve been stuck on emergency low interest rates since 2008 to help keep the debt from overwhelming us but those rates are now playing havoc with banks’ ability to make a profit – so we’re stuck. Raise rates and a load of bad debts lead to a banking collapse, keep rates as they are and see debt increase still further and banks crash as they’re unable to make a profit!

dantsw13Full MemberPosted 8 years agoBrooess – on closer inspection I see nothing terrifying on those charts. It shows a drop in people’s debt:earnings in recent years, and the alarming spike is just a forecast with a compressed y-axis to make it look sensationalist.

captain_bastardFree MemberPosted 8 years agoReally interesting thread, debts a big part of a lot of people’s life’s

debt is sold as freedom, exotic holidays, nice cars, etc etc. In reality it’s exactly the opposite. Some time ago I read about how with the advent of production lines in USA they had trouble getting anyone to work on them (Henry Ford had to employ 10 people for each job as 9 would walk out)

The answer was, as a leading economist put it “to keep people greying in the harness” the answer was debt. What we know as marketing was invented at the same time

Myself, made some mistakes, less than 10 years ago had a 180k interest only mortgage plus 10k in cc etc. This year I will be completely debt free, including mortgaged (downsized). TBH i don’t feel massively different, but I certainly sleep better. It is allowing for my mid life crisis mind, in a couple of years my daughter is off on a gap year, I’m also going to take a year out travelling, with the house rented I won’t feel like I have to come back

wwaswasFull MemberPosted 8 years agoloads, but YOLO, no one says on their death bed “i wish id been more frugal”

I’m sure some do.

I heard this yesterday;

“He died unexpectedly solvent”

Not sure if I want to die with massive debts, massive savings or a clean slate, really.

the only thing that stops me going with the last option is that I reckon my kids will never be able to afford a house in SE England unless I pop my clogs and leave them a big chunk of money.

trail_ratFree MemberPosted 8 years agoNot sure if I want to die with massive debts, massive savings or a clean slate, really.

seeing what my family had to deal with when my gran died unexpectedly and young its not as simple as rack up debts and the debt dies with the person…..can make life very difficult for surviving partners ESP when they come a knocking for the assets back (ie house) to service the debts left behind…

footflapsFull MemberPosted 8 years agoSo maybe it’s not so bad after all! I might be worth something net!

You have children right? By the time you’ve paid their deposits for a house plus subsidised their poverty wages, you’ll be back in debt again 😉

GrahamSFull MemberPosted 8 years agothe only thing that stops me going with the last option is that I reckon my kids will never be able to afford a house in SE England unless I pop my clogs and leave them a big chunk of money.

Life & Critical Illness Insurance helps cover that eventuality.

Me being diagnosed with something terminal and then popping my clogs is probably the best outcome all round for my family 😯

weeksyFull MemberPosted 8 years agoMe being diagnosed with something terminal and then popping my clogs is probably the best outcome all round for my family

Aint that the truth. Mortgage done and £400k-500k in the bank for them…. it’s all good.

Not ideal for me though I have to say.

P-JayFree MemberPosted 8 years agowwaswas – Member

loads, but YOLO, no one says on their death bed “i wish id been more frugal”

I’m sure some do.

I heard this yesterday;

“He died unexpectedly solvent”

Not sure if I want to die with massive debts, massive savings or a clean slate, really.

the only thing that stops me going with the last option is that I reckon my kids will never be able to afford a house in SE England unless I pop my clogs and leave them a big chunk of money.

“I want the last cheque I write to bounce”

I also like the idea of passing something onto my kids, but I think times have changed – No I don’t want them to have to pay for my funeral, but hopefully they’ll be looking at retirement themselves before I shuffle off, rather than trying to buy a place or start a business or whatever.

In regards to the whole YOLO thing, it’s absolutely true – some people refuse to admit they’re going to die one day and are always looking towards the future and they’ll be the richest guy in the Cemetery, but on the other hand, if you pick through the thinly veiled boast posts there’s a fairly common theme of people who go a bit mad in their twenties, end up in a world of pain and then spend their 30s trying to fix it all – it’s a shit place to be.

Personally, to be as happy as I can be, or perhaps a stress free as possible financially I’d like to have a place of our own with a mortgage, a months salary in savings and zero other debt – the last 6 years for me has been tough, starting a family, getting married and made redundant twice – it seems almost silly, but having a nice buffer of disposable income each month, makes me happy, happier than having lots of things and a credit card bill that sucks all my ‘fun money’ up – I’m not quite there yet, but with luck I will be soon.

Ben_HFull MemberPosted 8 years agoI remember growing up in the 1980s with parents worried about mortgage interest rates of 15% and having a family kitchen table conversation about potentially having to move to a smaller house. I remember my parents “borrowing” from my 9-year-old savings and that when Birmingham Midshires (like many de-mutualised building societies) gave me a windfall, that I got £50 while the rest disappeared to presumably keep a roof over our heads.

That was all in quite a middle class household (my dad was a uni lecturer) and it really shaped my attitude to money and debt – as did typing thousands of case letters for 2 years about people’s debts when I worked at a Citizens Advice Bureau as a student. Many people are just a short illness away from penury, stress and strife; often for much lower debts than you’d have thought would trouble them.

My grandparents – and especially my grandad, who grew up in the Depression and walked from Sunderland to London in the 30s to find a job – always said that debt was a terrible thing and couldn’t understand why my parents took a mortgage (which was very much the norm by the 1980s). They had seen people endure serious hardships and detested the “never never”. They’d always rented houses and took great pleasure in occasionally buying nice things (new cars, clothes) from savings … working class people who did well for themselves and proudly achieved independence in many senses of the word. They didn’t have any property assets, just enough cash savings and pensions to live comfortably.

I’m now close to old money. I’m talking about people who are squillionaires, but drive around in diesel Golfs and whose soft furnishings and clothes are patched-up and rarely replaced – but when they are, it’s with a quality item bought for cash. Money is vulgar; assets and markets are more of interest. Expenditure from savings is only for private schooling or houses: everything else is frivolous.

I’ve learned to consider that if today’s debt-led consumer society works for some people, then that’s great. But do be sure to know who’s in control and to prepare adequately for the downsides.

johndohFree MemberPosted 8 years ago48 with a £200k mortgage on a £600k house, £4k on an interest free credit card and £189 a month for another 18 months paying back an overpayment to HMRC (interest free so no need to pay off any quicker) + a few thousand in savings right now, but will be using some for house improvements over the next year.

Next year when the credit card and HMRC debts are paid off in full I will divert all that money into mortgage overpayments and aim to pay off by the time I am 55 – then continue to pay the same amount into additional retirement savings.

When I finally retire I then plan to downsize and buy two houses – one for my wife & I, the other as a rental income for our retirement.

When we both kark it, we then have a house each for our two daughters.

Or, as said above, I go now and use the insurance policies to set my wife and kids up instead….

hooliFull MemberPosted 8 years agoInteresting to read the answers, surprised how open and honest some people are. Also surprised there aren’t more answers of huge debt – perhaps these people have chosen not to answer?

The thing about the numbers being mentioned above is it is only part of the picture. A single person living in a shared flat earning £250k per year with £10k of debt is very different to a single parent of 4 working part time on £12k per year with the same amount of debt.

darryl1983Free MemberPosted 8 years agoI left uni in 2004 with about £15k worth of student loan, a maxed out overdraft and credit card and a few loans/finance agreements, so maybe £20k+.

Managed to buy my first house with my GF in 2011 after I got made redundant in 2010 with my redundancey money, having been lucky enough to find a new job pretty quickly.

Over the next 5 years or so, our house went up in value and we managed to clear most of our debt off, as well as getting married along the way.

We’ve just sold our first house for £105k (paid £78k) and brought a new build for £253k plus about £6k in extras using the help to buy scheme.

I’m now 33, and we are debt free minus the mortgage and my student loan. So currently owe £190k in mortgage and 20% equity to the government, currently about £50k. we’ve also got about £13k left over from the house move in the bank.

Hoping that in 5 years time we’ll owe between £180-£190k on the mortgage, but will have paid the h2b loan off and my student loan.

Currently don’t really have a pension, but am planning on investing a decent percentage once my company pension scheme starts next month.

ghostlymachineFree MemberPosted 8 years agoI also like the idea of passing something onto my kids

I’m hoping to get nothing from either of my parents, want them to live long enough to make the most of it, they were skint most of the way through my childhood and probably into my early 20’s. And I’m probably more financially stable now in my 40’s than either of them ever were, up to the point they retired.

I know one of them is mortgage free, and the other has a bigger mortgage than i do. (not to mention less savings and a smaller income)

ourmaninthenorthFull MemberPosted 8 years agoI have two mortgages: one on the books with the bank, and one off the books with the inlaws. Oh and a PCP on a car.

But PCPs on cars don’t count if the rate is cheap enough – you pay for the depreciation on every car*, so PCP is a means of managing cashflow of the same at an acceptable interest rate.

*Obviously not true for a number of classics and not so classics given the recent pensions-driven car boom.

trail_ratFree MemberPosted 8 years ago“But PCPs on cars don’t count if the rate is cheap enough “

who makes up these justifications for debt ? Is there a copy in print ? i’d like to see what i can acceptably have debt on.

trail_ratFree MemberPosted 8 years agoexcellent im off to fill my boots at the bike shop.

Highball 29er here i come 😀

mudsharkFree MemberPosted 8 years agoI’m adding money to my mortgage in order to put money into a couple of 123 a/cs, will cost me 1% and will get 3% and it’s all tax free 🙂

grenosteveFree MemberPosted 8 years agoI think when I was younger I wanted everything, and genuinely got a bit of high from owning something cool that no one else I knew had, but I’ve now realised that the novelty/high wears off fast!

I traded in loads of nice motorbikes in my 20s and “upgraded” to faster and nicer bikes every year or 9 months, loosing loads each time. I now know that any half-decent mid+ engine bike gives you the same pleasure and does the same job as a £12k BMW 1300cc super tourer!

I hate to think what I would have owed if I was into cars rather than bikes and did the same thing…

I’ve never got the holiday thing though, I like stuff, rather than experiences (that’s probably a whole other type of issue I have!), so wouldn’t borrow for holidays.

I don’t think there’s anything wrong with borrowing, but it seems some can live with it and others cant. After feeling trapped at a crap job because it paid well, and I needed the cash to make monthly payments, I don’t want it again personally.

Pawsy_BearFree MemberPosted 8 years agoclearing mortgages is one option, but there are better returns for the same money – like your pension. The tax advantages are pretty good. Just keep an open mind on return on capital. You may think your doing well as your pension and retirement slip away

suburbanreubenFree MemberPosted 8 years agoIn what way is the 3% tax free?

From April, up to £1000 interest pa is tax free, if you pay std rate tax.

brooessFree MemberPosted 8 years agoI don’t think there’s anything wrong with borrowing,

There isn’t necessarily. It’s when you do it to the scale we have (and now the Chinese appear to be too) that it becomes the systemic problem that it now has become.

It also depends what you get into debt for – something which is an investment for the future which provides a firm financial return (e.g. a student loan which allows you to get a better paid job and increases your lifetime earnings is a productive use of that debt. Companies will use debt to fund investments in machinery and people to drive future growth, revenue and profits)

However, our consumer debt appears to have mainly been run up spanking cash on shiny things and general consumerism (mainly depreciating assets), and BTL property (making heroic assumptions about ever-increasing house prices) or just normal property (boosting it to such a level in London and the SE that the repayments dominate our disposable incomes and leave nothing left for the real economy and therefore leave us with constricted economic growth over the long term).

The scale of our debt is the real problem – it’ll be a burden for a very long time and hold back economic growth and living standards whilst we pay it back. Assuming it doesn’t take us under again in the meantime. The nature of what we’ve spent the money on is also a problem as it largely will produce no longer term economic benefit.

We’ve been really quite stupid…

dirtyriderFree MemberPosted 8 years agothere’s a fairly common theme of people who go a bit mad in their twenties, end up in a world of pain and then spend their 30s trying to fix it all – it’s a shit place to be.

I’ve got £1200 left of my early/mid 20’s debt and I’m 35, its in an interest free repayment plan with Cabot, i could pay it off tomorrow, but id notice the £1200 gone, i barely notice the £50 DD that comes out a lot was wasted (shit car, high insurance) some paid to fund a 7 month sabbatical from work playing on boards and bikes in the Alps, i had a good time, but not a great time as one eye was on the ever increasing pile of full credit cards with zero income to pay them, ended up back in my old job, single, but i think it changed me for the better, i like to think it did, however there were dark days but I’m quite the optimist 😆

Denis99Free MemberPosted 8 years agoI’m at the other end of most people’s situation.

From 20 to about 55, raised a family of three with my wife, never had much spare cash or savings, wife stayed home to raise the children.

Even had a spell of four years without a car as we didn’t want any more debt.

Now 61, retired, no debt at all.

My savings, pension fund our modest lifestyle. No work, got back cycling in the last year, went a bit daft buying and selling some bikes which didn’t suit.

As a result, realised that having time to just enjoy riding, no debt, and a future of no more borrowing or working is very good.Can’t believe how much some of the forum members owe on a mortgage though, would have worried me to death.

Always worked all my life, but very few people are in control of their work and employment security.

I was made redundant twice.

The topic ‘How much debt?’ is closed to new replies.