MegaSack DRAW - 6pm Christmas Eve - LIVE on our YouTube Channel

A long post and a tricky topic but a subject I am interested in and that causes much debate and resentment. The government have set up [url= http://www.dilnotcommission.dh.gov.uk/ ]The Dilnot commission[/url]to look into this.

One of the fundamental issues is should people be forced to sell their house to pay for care? On the surface this seems unfair but if they don't then the taxpayer has to pay instead and it makes no difference the person in receipt of the care, all that happens is their children get to inherit.

Why should the taxpayer pay so that the children of middle-class parents still inherit? On the other hand why should one person who built up an asset have to sell it when the person next to them gets the same care but spent all their money?

The key[url= http://www.guardian.co.uk/money/2011/jul/04/elderly-care-proposals-dinot-report ] dilnot proposals are[/url] a cap on the amount that people should have to contribute and a large increase in the threshold below which you don't have to contribute.

This will mean a significant increase in taxation to ensure this is so - are you prepared to pay more taxes so that other folk get to inherit?

This nettle needs to be grasped however - state funding of private care home places has not kept up with costs - hence the collapse of southern cross care homes and recently homes are surviving by cross subsidy - overcharging private payers to subsidise the state funded. This clearly will decease if these proposals are adopted. Nursing homes are so cash strapped that they really struggle to pay staff decent rates so cannot recruit and retain quality staff - this leads toe the various scandals over poor care standards.

So - is this the right way to go - and how much extra tax are you prepared to pay?

[i]should people be forced to sell their house to pay for care?[/i]

Absolutely - all of your assets should be included - whether it's money in a bank account or invested in bricks and mortar.

The argument that it'll discourage people from saving for their old age is a fallacy, although I can see all sorts of 'early inheritance' loopholes allowing property to be passed on to children for those with the nous and funds to exploit them

So - is this the right way to go - and how much extra tax are you prepared to pay?

yes, 5%

yes, 5%

Prividing the care is provided based on th individual's care needs and not just their age.

Whats been happening over the last twenty years is the division of our society into property owners (some of whom own multiple properties) and 'the rest' who realistically haven't got a cat in hells chance of getting onto the property ladder.

Whyon earth should the latter pay for the former to pass their good luck (for it is mainly luck rather than judgement) onto their children, while looking to people who will never share this good fortune to cover the cost of their care.

I'm sorry, but its just further entrenching the already ridiculously wide division in our society

i vote for binners. binners for prezidant x

should people be forced to sell their house to pay for care?

Hmm, this old chesnut?

I'm going to say no. Someone who has saved and put money aside (be that in property or savings) should not be made to pay more than someone who has made no provision for this. Given you can't withold the care for people who don't have funds available then you have to provide a completely state funded care system.

[troll]how about we cut some pensions to pay for it? That we we give with one hand and take away with the other.[/troll]

Lunge - so you will be prepared to pay significant extra taxation - around £200 a year - so that middle class people can inherit their parents wealth?

So the state should subsides peoples inheritence?

Edit - the reason for the post is the Dilnot commission proposals which are an attempt to get an answer for this

I'm sorry, but its just further entrenching the already ridiculously wide division in our society

No it's not, it's providing equality of care to people regardless of their financial situation.

Edit - the reason for the post is the Dilnot commission proposals which are an attempt to get an answer for this

Yeah, right! 🙄

Personally, I think the answer is euthanasia.

Charlie - actually thats why I started this - read the summary of the proposals to see if you think thats the right way to go.

To me they are just a messy comprimise

Couger - when people reach retirement age... BANG bullet to the head.

No need for pensions then.

No it's not, it's providing equality of care to people regardless of their financial situation.

And that's completely unaffordable. So somethings got to give. Either the quality of care is done on the cheap and universally crap! Or people with resources (that they're just going to pass onto their brattish offspring - while, if Dave has his way, paying no inheritance tax) contribute in some way.

Or we go down cougars route and replace Sunny View Rest Home for the Terminally Bewildered into Dignitas. Actually.... that gets my vote 🙂

El Presidente

Or people with resources (that they're just going to pass onto their brattish offspring............contribute in some way

In the same way as they do for their NHS health care or state pension?

[b]And that's completely unaffordable.[/b] So somethings got to give. Either the quality of care is done on the cheap and universally crap! Or people with resources (that they're just going to pass onto their brattish offspring - while if Dave has his way paying no inheritance tax) contribute in some way

False premise. Besides, the rich (should) have paid more tax throughout their lives why should they continue to subsidise the other lot?

Or we go down cougars route and replace Sunny View Rest Home for the Terminally Bewildered into Dignitas

and we could use the old people's bodies to solve the great meat shortage!

i think this should also apply to people who retire early and those who don't work full time.... as i feel its only fair that people work as hard as me and don't have more money/opportunity/fun than me.

and we could use the old people's bodies to solve the great meat shortage!

Speak for yourself. There's no shortage of my meat.

we can have free universal social care for the elderly if you want - but there is a cost and it is not small. Care to a reasonable level cost £35 000 PA minimum. State funding is under £25 000 pa

And how long do you really think NHS health care and state pensions are going to remain universal?

Anyway... thats not the same as paying for someone to sit around sucking Werthers Originals and pissing themselves

when people reach retirement age... BANG bullet to the head.

Absolutely!

Nah, obviously that's not what I was meaning. But quality of life should be taken into account. We are so fixated on extending life as long as possible that we'll do it at all costs; there must be a point where someone isn't going to get better, is in a lot of pain, has lost their marbles, whatever. Prolonging their agony is selfish and cruel.

There's plenty of people who [i]want[/i] to die and we won't let them. Look at Terry Pratchett - he knows he's not going to get better and he's chosen to have an assisted suicide when he gets to a point where he's not himself any more. For this he has to go to a different country.

In his situation I'd make the same decision, and I'm pretty sure I'm not alone. But if I go senile I've got no option other to sit drooling in a chair whilst strangers feed me soup through a straw, where the only challenge I've got to look forward to is not shitting my pants. Bugger that.

State provided, but, and this is important... Only state provided, no private care allowed at all on pain of death and deportation to foreign.

If the only care you can get is state provided, then everyone has a vested interest in making it as good as possible, so will pay the tax.

Works better for education, but still.

There's no shortage of my meat.

Have you considered the iDave diet?

Lunge - so you will be prepared to pay significant extra taxation - around £200 a year - so that middle class people can inherit their parents wealth?

No, but I am prepared to pay an extra £200 per year to get everyone an equal level of healthcare in their latter years irrelevent of financial situation.

Dilnot seems a reasonable compromise.

My mum worked hard and saved all her life to give me and my siblings an inheritance, she's gutted she'll now have to blow it on care, as I would be.

TandemJeremy - Member

Lunge - so you will be prepared to pay significant extra taxation - around £200 a year - so that middle class people can inherit their parents wealth?

£4 is "significant taxation" WTF?

Seems to me those that can save should be rewarded - they will likely have paid more taxes than those with no savings (and of course most likely were bron into better circumstances)

Lunge - in order to do that you would have to pay a lot more than that in taxation and ban private care.

Remember this is not healthcare as such - its social care mainly.

I'm absolutely amazed how many middle class people regard inheriting a property as some kind of divine entitlement, passed down through the ages from god himself. It isn't!

And if you are going to inherit it, its a windfall, so top bleating about having to pay tax on it

They should pay for it themselves. God damn baby boomers enjoyed affordable housing, cheap money, accessible education, cheap fuel, stable, well paying jobs with great pensions, the list goes on and on - they had it all and what did they do? Poisoned the earth then set about systematically tearing apart for future generations the systems that provided the benefits they themselves enjoyed. They haven't even got the decency to die early.

binners - Member

I'm absolutely amazed how many middle class people regard inheriting a property as some kind of divine entitlement, passed down through the ages from god himself. It isn't!

Well given that in our society you have been able to choose what happens to your money on your death for a fairly long time, I'd have to disagree a bit, it's a legal entitlement at least.

I guess it matters less to those with less to bequeath/inherit.

Haven't read the report but I basically agree with binners - there's no reason why people should pay more tax so that others can inherit money. There must be some way that state care payments can be sort of added up and then added on as a sort of inheritence tax when the person dies, and if there isn't enough in the estate then the outstanding amount is written off - that seems to be fair to everyone, tax is increased for those who can afford it but we don't all end up paying for other people's inheritence. I'm sure someone else will have proposed this and no doubt there are all sorts of problems with it though - there always are with tax!

randomjeremy pretty much sums it up perfectly. They made sure they pulled the ladder up behind them!

Al - are you talking about the common peasantry interfering with your birthright 😉

Lunge - in order to do that you would have to pay a lot more than that in taxation and ban private care

Fine, I was going on your original number. But the principle still stands, yes, I would be prepared to pay the tax.

As usual, science gives us the answer...

I hope I have something to pass on to my children (or brats if you will) when I'm old and p*ssing myself (regularly). If there's a chance that what I have gets taken away from them, then Cougars hit the nail on the head. For that reason some sort of state funding compromise and subsequent tax increase is my vote.

[s]Caring for[/s]Looking after people is expensive, if you pay people to do it. So is fixing cars, decorating, gardening, laundry and bringing up children. Why have we chosen to sometimes outsource some of these from the family home and not others. When my mother was ill my family each took turns going and staying with her. My father knows that as soon as he needs it there is a home with us, or another of the family. I'm not looking forward to the time with great relish, but just seems the right thing to do, perhaps because my grandmother lived with us for her last fifteen years or so. Oh and I don't see £200pa going very far if universal provision is to be paid for.

The £200 per year per taxpayer is just the amount of money to implement the dilnot proposals. Universal free provision would be very much more

£200 seems cheap to me.

Binners - I suppose, it's a shame working classes are allowed on teh internet really.

Re. inheritance, I would suggest that if you remove the right for people to pass on their money when they die then most people would make sure they had spent and/or already passed it on before the time came.

What would then happen is that the people who died suddenly would get to pass nothing on where as those that had time to plan would have already shifted things.

I know. Its an inevitable consequence of them being allowed to

a) breed

b) vote

c) not be hunted down and killed or enslaved by their superiors

Christ only knows where its all going to end?

Lunge - hard to do when its a house and various ways of dealing with this already - remember thats what currently happens - people sell their hous e to pay for their care

£200 extra tax is £8000ish over a working life. so you are happy to pay £8000 extra tax to ensure i can inherit more? Thanks

TJ, still yes, absolutely.

Fairy snuff

People's view on housing as a function of their age:

People in their 30's: My house is my pension.

People in their 40's: My house is my pension.

People in their 50's: My house is my pension.

People in their 60's / 70's: I'm not selling my house, give me a pension!

My mother in law currently needs almost round the clock care. Can't really be left alone for longer than 2 hours. But as all the family live fairly locally I've set the house up with wireless broadband, coffee machine, cable TV, comfortable guest room with double bed, spare room with desk etc. and we offer family members £60 a night to stay, but expect a couple of day sessions as well.

It works well, We arrived at the price by gradually upping the amount until we filled the schedule. Supply & demand etc.

In the long term there is no justification for the state to pay carers simply in order to protect middle class inheritances. That's all it is.

And as the population grows older, we're all going to have to revert to the nuclear family. From what I see of Indian & ****stani families, (and I visit quite a lot in my job) they've got it right. They get a great big house and everybody lives there together. It's like a party every night as well.

Sounds like a sensible and pragmatic approach BigJohn

Society needs cleaners and it needs doctors. No matter how hard some try they will not get well paid jobs. Should we support all parts of SOCIETY, or should we say I am all right jack now f*** off.

We seem to have got ourselves into a serious problem here. The main issue is that we are living longer so that the number of people who need care is increasing and will keep on increasing.

Add to this the determination of a greater number of people who want pass on a large sum of money/house to their children and see this as a right.

Add to this a number of people who have decided that the state shall look after them when then get old

And this is compounded by the breakdown of the traditional family, where older people would be looked after by their family normally in the family home.

Whatever solution is proposed there is always some group which will be deeply opposed to the solution. As with most complex problems, there is no good solution, only a set of compromises that offends everyone.

However the 'right' of people to hand over money/property if they need it for their care is not a right. You have saved for your retirement and as such you should be expected to use you savings and investments to pay for it. If you have none then the state should only expect to meet a certain level, above that and you fund it.

In additions we will all need to pay more taxes for this, however if you do care for an elderly people you should be able to claim certain tax breaks to 'reward' you for doing this.

Not a pretty solution, but a totally state funded solution is a non-starter, likewise a total private sector solution is also a non-starter.

TandemJeremy - Member

£200 extra tax is £8000ish over a working life. so you are happy to pay £8000 extra tax to ensure i can inherit more? Thanks

Nope, so I inherit more 😀

I'm absolutely amazed how many middle class people regard inheriting a property as some kind of divine entitlement, passed down through the ages from god himself. It isn't

Surely if you own something you have the right to give it to someone else. What is wrong with that idea?

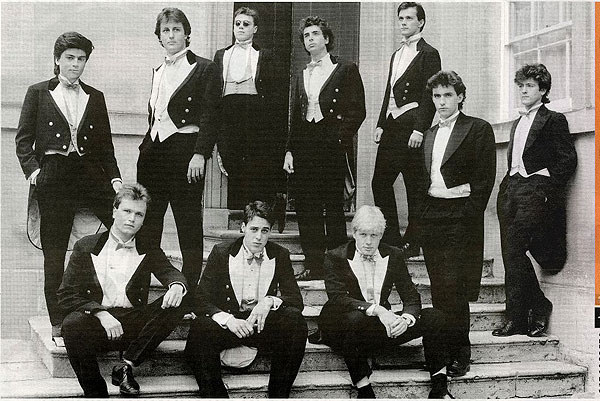

Al and friends impatiently await the arrival of their inheritance

Al was in the Human League???

good thread TJ.

Personally I have very mixed feelings about it. My folks struggled all their lives, and to them the end result was a small house which they wanted to go to their kids. As a direct result of this my mother point blank refused to have any help and when she was severely ill refused to go to hospital for fear of losing her one asset. Ultmately, I had to have her sectioned to get her proper medical care, she died in hospital and left the house to the kids. I would have given my right arm to get her proper residential care.

Conversely my mother and father in law lived their whole married lives in a council house. F-i-L went down with alzheimers and they were moved after much faffing (on their part about whether this home was right or the other was) into sheltered accomodation. F-i-L dies, and M-i-L remains there in accomodation of exceptionally high standard, contributing not one penny. She is constantly giving her children and grandchildren money to manage her assets at below the threshold whereby she has to pay.

Bottom line: Its not a simple equation and there are many twists and turns in it. Personal view is that whatever you do, don't suddenly change the rules creating a situation where people who have had an understanding of how things will be all their life in their retirement, suddenly receive another body blow, of the "oh and by the way" type.

PS: F-i-L was a Japense POW wounded and captured during the fall of Hong Kong, He was subsequently torpedoed by the americans while on a hell ship being transferred to Japan as Slave labour, he saw his war out in Kobe, where his camp was bombed several times. He was one of only 92 men in his battalion to survive the war. He was unable to work for any sustained period of time after the war due to the physical and mental injuries he suffered. M-i-L's financial issues relate to inheriting his compensation payment of £10,000 paid by the Japanese government a few years back.

Ha ha...you wish I am a man of the people! Me and TJ both! 😀

Seriously though while I am middle class through and through, my mum worked her socks off after my dad died in 1971 to bring up 4 of us - OK the mortgage was paid off when he croaked but his life insurance pay-outs got de-valued by inflation, she then went back to work part time then full time, on an NHS wage. She's now saved a fair bit through being thrifty, lost a bit in the recent recession.

I'm not looking for sympathy for her or us, but she seems a pretty deserving cause to not have to blow her savings to pay for her care. As has been said above, if the savings had been p*ssed up against the wall then the tax-payer would be paying.

Surely if you own something you have the right to give it to someone else. What is wrong with that idea?

Not it you're sat on a pile of property, worth an insane amount compared with what you actually paid for it, while expecting the taxpayer, a lot of whom will never ever ever have the opportunity to own property, to meet the costs of your care.

Anyway... the middle class offspring they're so concerned about handing this property too will just spunk it all in Hoxton Bars and trips to Goa!

If the choice is between Granny going in a home or kids inheriting a few thousand quid, I wonder how many little old ladies will 'fall down the stairs'...

I don't think that a person who has scrimped and saved to own a house should have to sell it to be entitled to the same benefits as another person who lived care free spending every penny they have earned or received in benefits.

If you visit an hospital they don't ask you to sell everything you've got before they treat you so why shouldn't the same principals be given in old age. I'm sure if you had an accident on your bike and ended up crippled then you would expect the system to care for you then so why age play a factor.

I'm not sure what the answer is but people need to become more responsible for themselves and provide for their older age be it through a pension scheme or insurance for their future care. The prospects of your family caring for you in your later years isn't always feasible as the majority of family members have to work full time to pay the bills and cannot commit the time required to provide proper care without help.

[i]but people need to become more responsible for themselves and provide for their older age be it through a pension scheme or insurance for their future care.[/i]

Which is easy to say when you have employment, or the advantages that some of us have, but less easy when you are not as well off, or you are a woman who hasn't worked because you looked after the kids until your hubby ran off with the milkman, or you have the misfortune to be born in an area where all the heavy industry gets closed down, or you are born to alcoholic parents, or blah blah..

Not it you're sat on a pile of property, worth an insane amount compared with what you actually paid for it, while expecting the taxpayer, a lot of whom will never ever ever have the opportunity to own property, to meet the costs of your care

But you are a tax payer as well, and you will have to pay inheritance tax

Everyone who owns a house for a good few years will have a house worth an insane amount of money compared to buying price. But that's the nature of owning a house. You think just because something you own is worth more, not necessarily in real terms, than you paid for it you cannot give it away? Didn't someone on here buy a type 2 camper for £3k new?

I'm always fascinated by the "I've paid more tax than you" argument.

Tax isn't a savings scheme - it pays for the here and now. So, if you think the tax burden of state helath and social care is high now, wait to see how much it will take up when all the baby boomers are ill or living in state funded care homes....

I've yet to hear of a better proposal than Dilnot's, itself being very far from perfect.

CharlieMungus - Member"I'm absolutely amazed how many middle class people regard inheriting a property as some kind of divine entitlement, passed down through the ages from god himself. It isn't"

Surely if you own something you have the right to give it to someone else. What is wrong with that idea?

Indeed - but by the same token why should the state pay for your care if you can by selling that house?

The children could provide the care for you

As bermbadit alludes to and as I said in the original post - its unfair however you look at it. Disregard the house as an asset and then the taxpayer subsides your kids inheritance, sell eh house and it penalises thrift.

Indeed - but by the same token why should the state pay for your care if you can by selling that house?

Because the state should pay for everyone's care regardless of their situation

WE have however not really discussed teh proposals which are to increase the threshold for paying for care from £23 000 to £100 000 and to put caps on the annual amount yo have to find to self fund.

To my mind this will do little to stop the unfairness whilst costing a fair amount - £200 pa per taxpayer.

So if yo have a house worth £250 000 you can pay fees for 5 years not 3 and leave £100 000 not £23 000

To my mind its an attempt to pacify the daily wail and its also going to be very hard for the tories to swallow.

spunk it all in Hoxton Bars and trips to Goa!

What are these Hoxton bars? Do they do 700mm risers?

CharlieMungus - Member"Indeed - but by the same token why should the state pay for your care if you can by selling that house?"

Because the state should pay for everyone's care regardless of their situation

Why should it?

You prepared to pay the tax? To do that will be far more than the £200 a year figure per person for the Dilnot proposals- more like £1000- pa per taxpayer of several % on the basic tax rate. This stuff is expensive

Why should it?

Because it has a duty of care to its citizens

You prepared to pay the tax?

Yes

To do that will be far more than the £200 a year figure per person for the Dilnot proposals- more like £1000- pa per taxpayer of several % on the basic tax rate. This stuff is expensive

Fine, if it means that we all get looked after when we get old.

Lets face it: There's going to be no such thing as a pension soon. Debating all this nonsense is academic already. We'll basically work until we drop.

A decent(?) private pension might keep you off the street for a couple of years, when your health fails you, but that's about your lot. I suspect most of us will work til we keel over, then spend your last few weeks lying around in your own poo eating gruel, before being put out of our misery with a bolt gun, abattoir style

The baby boomer generation will have finally managed it. Had their moment in the sun, to the insurmountable cost to everyone who came before or after them.

One more reason not to pack in smoking anyway 🙂

One more reason not to pack in smoking anyway

Suddenly your motivation becomes clear!

Money breeds money, so by allowing unfettered transfer of assets between generations you are further restricting the chances of those born into poorer households. You end end up with a society where the best are not at the top rather the richest are. A situation that has between shown time and time again to fail a society.

But all members of a society need to pay in, you can't have the situation where people opt out and expect a free ride.

One more reason not to pack in smoking anyway

😯 😯 😯 😯

I just can't believe that anyone is daft/naive enough to believe that the pension system is sustainable in anything remotely resembling its present state. This idyllic dream of going out for lunches, jetting off on cheap holidays. Its a statistical blip, that the present crop of pensioners are benefiting from. The idea that its somehow the 'norm' is utterly preposterous to anyone who's capable of counting past 100

Time to wake up kiddies

Now i've read very little replies and I can see that this is a difficult issue and one that has probably polarised opinion.

My opinion is that Elderley people should pay (as far as they are able to) for the provisions of care. This for the following reason:

Once they have passed away the proceeds of their estate will be passed on (normally) to their children. If we are to create a society not equal but of equal opportunity the wealth of parents distorts this. Hence why should the state pay for those that are able to pay themselves (either directly or through the sale of assets).

I'm not even going to go into the baby boomer arguments. Essentially I expect nothing from my parents, they have supported me enough and if they spend my inheritence on holidays or care, good on them. I'm old enough to make my own way in the world.

Essentially I expect nothing from my parents, they have supported me enough and if they spend my inheritence on holidays or care, good on them. I'm old enough to make my own way in the world.

Amen to that. I keep telling them that too. They're not slacking on the holiday front though 🙂

Funny that ...neither are mine!

Presumably anyone who thinks that people should be made to sell off their assets to pay for their old age care also thinks that the NHS and healthcare should also be changed in the same way - eg so that anyone who can afford to pay for treatment costs should be made to pay at least a proportion of them?

Good news for the Tories, then...

The advocates non-hereditary policies are taking a very one dimensional view here. Ok, so if we do away with the inheritance, what effect do you think it will have on society, motivation to work, long term goals and planning? If all you have worked for comes to nothing, why would you work so hard all your life? I'm not sure if i am conflating opinions here, but if we believe that families need become closer and more supportive social units, surely removing that part of self sacrifice for the good of the family does not support that. In China many families make great sacrifices so that their children and their children can gain an education and enjoy a higher standard of living, Would they make those sacrifices if they though that, the next generation would have to start form scratch again?

It is a mistake to believe that the removal of inheritance of property will remove advantage. It will serve to exacerbate the divide. Those who can afford private education for their children (not the average middle class)will be able to buy privilege 'points' for their children to cash in and proceed to buy the same for their children. The very rich will be the one who will able to afford the accountants and lawyers and margins which allow them to continue to thrive. If you think we all start from a level footing each time, you're kidding yoursleves

Essentially I expect nothing from my parents, they have supported me enough and if they spend my inheritence on holidays or care, good on them. I'm old enough to make my own way in the world.

That may well be the case, but I'm sure they don't see it like that.

Charlie - you are not doing away with inheritance - you are asking people who have the means to pay for their care to do so. Its really not the same thing - its a small proportion of people who need this.

its not the same as healthcare, its social care in the main. The sort of thing that 50 years ago would be done by the eldest unmarried daughter.

Social changes mean that there are fewer families who can look after their own elderly. someone has to do it and the costs are huge. If no care is going to be means tested then you will have to pay a lot more tax than you do now.. This is why we are in this situation - privatisation of elderly care happened in the 80s and 90s precisely to reduce the costs on the taxpayer by moving from teh NHS to private care with the taxpayer picking up the burden for those who cannot afford to pay.

Think of it as a benefit that is paid to those with no money not a fee on those who have money.

Are you in favour of universal benefits for everyone? Eveyone gets child benefit etc? All pensioners get winter fuel payments?

Why should someone with half a million capital get a benefit from the state of 50 000 PA?

Charlie - you are not doing away with inheritance -

some are making this case

Why should someone with half a million capital get a benefit from the state of 50 000 PA?

Why shouldn't they?

Not on this thread that I have seen.

Its a really difficult one 'cos on the surface its unfair either way. Why should the taxpayer fund my inheritence and why should Bill has to sell his house to get care when Bert next to him spent all his money on whiskey fags and hookers?