Home › Forums › Chat Forum › Best learner drive insurance?

- This topic has 30 replies, 17 voices, and was last updated 4 years ago by DezB.

-

Best learner drive insurance?

-

krixmeisterFull MemberPosted 4 years ago

We have a learner driver in the family now. We could simply add her to existing car insurance, but wanted to see if there were any recommendations on separate learner driver insurance policies, especially on a daily basis. Thoughts?

sharkbaitFree MemberPosted 4 years agoI’ve got my two with Veygo at the moment, the prices all seem pretty similar. I’ve previously used Dayinsure who were OK also – I guess you don’t know how good they are until someone prangs the car!!

I think it’s easier to use a dedicated learner policy as it’s cheaper than adding a learner to your policy (they’re not learners for ever… hopefully).

Don’t forget that a learner policy stops the second they pass their test so you’ll need to add her to your policy before she can drive.eskayFull MemberPosted 4 years agoI have been looking at this as well!

I am going to use Collingwood because we picked up a cheap car for my son last week and a lot of learner insurance won’t allow them to insure their own car for some reason.

Around £80 first payment then £22 per month thereafter with no cancellation charge when they pass

MoreCashThanDashFull MemberPosted 4 years agoWas about to start a learner thread myself – our circs are different as we need to get him a manual to learn in anyway, so it will have to have separate insurance.

matt_outandaboutFree MemberPosted 4 years agoWe have done this now twice – I’ve added the next one to insurance this week…

– the stand alone + ‘normal’ insurance made no financial sense, plus I was confused about some of the terms they imposed…

– going for a black box saved us a couple of quid, which went to £200 cheaper when he passed. However, we tried the Aviva app for a fortnight as the car is shared by mrs_oab and I. We were marked down for traveling on back roads, early starts before 8 and going round corners. We live on edge of Highlands, I travel all over for work and Mrs_oab has two rural nurseries she works at, both starting at 8… So we avoided a black box. Listening to eldest_oab’s pals it can be a pain too – penalised for an early shift at work etc. Funnily the costs only ever go up…

– doing the homework on a company that would actually cover the learner when they pass. We were with a company that wouldn’t add him. So we had to cancel and go elsewhere.I wouldn’t worry about learner costs. The day they pass…

Full business cover, 10+ years ncb, 12k a year, 2012 Ibiza 1.4 16v.

Mrs_oab and I – @£250

Mrs_oab, I and learner – £600

Mrs_oab, I and 17yr old passed – £1300

Mrs_oab, I, now 18yr old, new learner – £1230Most quotes post test for 17yrs were £2k+ and black box.

sharkbaitFree MemberPosted 4 years agoAround £80 first payment then £22 per month thereafter with no cancellation charge when they pass

So this is on top of your own policy on the car? I just did a quote (2014 1L Fiesta) with one of my daughters being the owner (so no other policy required) and it was £206 for 8 weeks.

Just for comparison I’m paying £69 for 6 weeks on the same car but with an existing policy.Collingwood seems a little spendy – plus it only covers the learners…. so you can’t use it.

sharkbaitFree MemberPosted 4 years agoMrs_oab and I – @£250

Mrs_oab, I and learner – £600I think it’s cost me a total of £450-ish since May 2019 to insure both the twins as they’ve learnt using standalone policies. (I’m still annoyed that I have to take two separate policies out!)

tthewFull MemberPosted 4 years agoWe went with Co-op a couple of years ago. In our circumstance it was cheaper to have a separate learner policy than add to the normal insurance.

martinhutchFull MemberPosted 4 years agoThe quote we got from Adrian Flux was the lowest. And that was also for twins – some of the other insurers refused to insure both of them on the same vehicle.

DezBFree MemberPosted 4 years agoBest thing to do is go through the comparison sites (I find confused.com usually come out cheapest).

Spent ages googling learner/new/young driver insurance, and nothing could beat comparison site quotes.

Ended up with a company called A Choice – they do a cheap learner insurance, which goes up to a bonkers amount when you pass, or, the one we took, which is a fixed amount while they are learning and for the first year’s driving. You can’t take your test within 60 days (or thereabouts) of taking out the policy. It was around £1200. And doesn’t use a black box.

He would still be on that, if the lad had kept his low insurance group car.. but he needed something snazzier, so now has a black box and is paying around £1700* to the rip-off-merchant-bastard-moneygrabbing-scumbags that call themselves insurance. I have no chip on my shoulder, oh no siree.*that’s with me as a named driver, with 1 accident on my record. It was slightly more without for some unknown reason.

tthewFull MemberPosted 4 years agoIt was slightly more without for some unknown reason.

If you declare say 6000 miles/year with only one young, (high risk) driver then that risk will be there for the whole 6000 miles. If a second, lower risk driver does some of that 6000 then the average risk of the policy drops and therefore gets cheaper. My dad got a £10 refund, even after the admin fee, when I got added to his policy.

eskayFull MemberPosted 4 years agoMember

Around £80 first payment then £22 per month thereafter with no cancellation charge when they passSo this is on top of your own policy on the car? I just did a quote (2014 1L Fiesta) with one of my daughters being the owner (so no other policy required) and it was £206 for 8 weeks.

Just for comparison I’m paying £69 for 6 weeks on the same car but with an existing policy.Collingwood seems a little spendy – plus it only covers the learners…. so you can’t use it.

It was for a stand-alone policy in my son’s name (holding a provisional license) with me as a named driver (no extra cost). The total cost was around £300 for a year (from memory) but if you pay upfront you will get some refunded, or pay monthly as I mentioned in original post.

The fact that he actually owns the car rules out quite a few insurers (bizarrely)

CheesybeanZFull MemberPosted 4 years agoMate used Diamond ins for his daughter , seemed very competitive and didn’t insist on her having a black box fitted .

CraigWFree MemberPosted 4 years agoI have used Marmalade for add-on learner insurance. They seem fine, maybe not the cheapest. Easy to sign up for 30 days at a time if you want.

Not sure if it’s really that helpful for learning anyway. Will they just pick up your bad habits? Better to pay for proper driving lessons.

sharkbaitFree MemberPosted 4 years agoIt was for a stand-alone policy in my son’s name (holding a provisional license) with me as a named driver (no extra cost). The total cost was around £300 for a year (from memory) but if you pay upfront you will get some refunded, or pay monthly as I mentioned in original post.

OK, gotcha. Yep it’s a bit cheaper to go for the 12 month policy although in my case it may not work as this car is used by 3 kids (eldest passed her text 18 months ago).

Good to know though.MoreCashThanDashFull MemberPosted 4 years agoFor anyone not happy at the price of insurance for young drivers, it was cheaper back when I was claims handling as medical science tended to leave the injured passengers dead. Nowadays, the insistence on improved vehicle safety features and a desire to save lives means that funding 50-60 years of 24/7 care for the injured passengers is a bugger.

Interesting about black box restrictions though – now he’s earning a bit playing music there’d be late nights to consider.

Simon-EFull MemberPosted 4 years agoBeen with Co-Op for a number of years now.

At age 17 (Sep 2018) adding my son was going to cost an extra £1,000 on the £220 policy for my Skoda Fabia 1.2. Ha ha, on yer bike sunshine!A year later he’s 18 and the additional premium was £450. OK, I can just about stretch to that.

By the time he’d had some lessons and I put him onto the policy in mid-January it only cost me £204 for 8 months. I was pleasantly surprised 🙂

He will need his own car once he starts work later in the year. Co-Op do a young driver policy (he’s very sensible and would be happy to have a ‘black box’ fitted) so we’ll contact them for a quote when the time comes.

nukeFull MemberPosted 4 years agoVeygo…way cheaper than adding to our lv insurance, easy to get a quote and to renew and even found discount codes online that worked. Not looking forward to the quotes when he’s passed though 😬

eskayFull MemberPosted 4 years agoVeygo wouldn’t insure my son because he owns the car.

My eldest has just had his renewal (second year) and it has gone from 1100 to 750. It is definitely worth getting them on their own policy so they (hopefully) start building no claims.

Admiral quote was also 1100 for my youngest when I did a speculative check for the car he has bought (1.4 fiesta). That is without blackbox as was my eldest’s insurance. The black boxes can be quite restrictive if they have part time jobs at restaurants etc when their shift finishes late.

DezBFree MemberPosted 4 years agoThe black boxes can be quite restrictive if they have part time jobs at restaurants etc when their shift finishes late.

Find one that doesn’t penalise late driving – not all of them do. £600 was added to my son’s policy just for having a part time job (loss of student discount 😠)

jkomoFull MemberPosted 4 years agoBe careful of Black Boxes, a friend of mines son had a couple of ‘mistakes’ and had his insurance cancelled whilst miles from home.

When they do this they remove your access to the app where all your T&C’s are so you can’t even argue the decision.

Now he is faced with trying to get insurance after having it cancelled.

IMO black boxes seem like an amazing idea but they are best avoided.

And PRINT OUT ALL THE T’s and C’s.MoreCashThanDashFull MemberPosted 4 years agoMy brother in law nearly got his step daughters black box policy cancelled by driving like a idiot. He thought it was hilarious while sharing the tale at a big family dinneer. I told him what an idiot he was, atmosphere wasn’t great during dessert. Her mum thanked me for speaking up after 😄

jrawarrenFull MemberPosted 4 years agoSo apologies for the slight tangent, but what is everyones view on whether a new learner now should bother learning manual, or just go for automatic? I’m thinking with cheap small autos now, and electric cars firmly on the horizon, that learning auto might be a better long term bet (and easier to learn), but then mentally aruging that manual teaches you better car control and therefore likely makes you a safer driver of either manual or auto?

Asking as my daughter will start learning in under a year.

krixmeisterFull MemberPosted 4 years agoThanks all for replies, BTW! @JRA – I would argue manual. I see your points, but renting a car in a lot of places (Europe and Asia) is still going to be more likely a manual for next couple of decades, and I know the first car for my daughter is going to be a crappy, tiny-engined manual!

Unless there’s a real concern she’ll struggle with a manual, I’d say manual.

the-muffin-manFull MemberPosted 4 years agoMy wife works in insurance and she has just insured our daughter on her car with Marmalade.

She thinks they are the best while learning to drive.

the-muffin-manFull MemberPosted 4 years agojrawarren – I’d say manual every time. Can’t see why you would restrict yourself so much unless you really can’t grasp clutch/gear control.

sharkbaitFree MemberPosted 4 years agoWhether the car is auto or manual is only a small part of the learning process – overall she’s better off learning in a manual. Manual cars are going to be around for a long time and it’s not a good idea to exclude her from driving them.

DezBFree MemberPosted 4 years agoIMO black boxes seem like an amazing idea but they are best avoided

Sometimes you have no choice. £1500 for Back Box insurance, or £5600 for without.

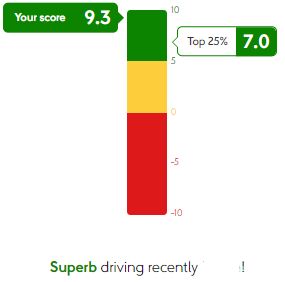

Still, my lad seems to be taking it as a challenge to get his “bonus” at quarter end (morethan, pay some premium back and call it a bonus lOlz)

hodgyndFree MemberPosted 4 years ago

hodgyndFree MemberPosted 4 years agoI’m not sure if this has been covered ..my son starts lessons next month and we have put aside a fairly decent sum of money to buy him a car ..

Are we better off putting it in maybe his mam’s name with him as a learner driver on the insurance or making him the owner straight away ..?

Apologies if this has already been covered ..PoopscoopFull MemberPosted 4 years agoOff topic a bit but when my son passed we went the black box route.

It was a costly nightmare. Penalised for where he drove, the time he drove, braking too hard,the speed going round a round about… You name it. He worked shifts which they evidently didn’t like but didn’t mention when I rightly called them.

I even drove the car one day at what I would consider driving mud daisy speeds…and got warned for the same round about as my lad.

In the end they basically kept upping the premium then said they didn’t want to insure him basically.

Paid a premium in the end to go for insurance with no black box. Wish we had done that at the start.

I’m not saying all new divers will have issues with a black box…but my lad actually said it was really making him nervous on the road as he was constantly worrying about the what the black box was reporting.

For the record, it never showed him speeding…but also penalised him for braking too hard. Yeah,I know,I know… he should be reading the roads better etc and I agree but he was driving in an urban environment and sometimes you need your brakes.

Anyway, as a dad that’s driven for over 30 years and never had a claim mate against me I was a little shocked at how massively restrictive these boxes are.

DezBFree MemberPosted 4 years agoHmm, I was just worried my lad would want to show off his 1.2 Turbo to his mates, but he seems to be coping just fine with the black box. Always been a little wise beyond his years I suppose.

Just to say, if people don’t want a black box, it’s VERY restrictive what type of car you can have… which I guess is where my boy wasn’t too sensible!

The topic ‘Best learner drive insurance?’ is closed to new replies.