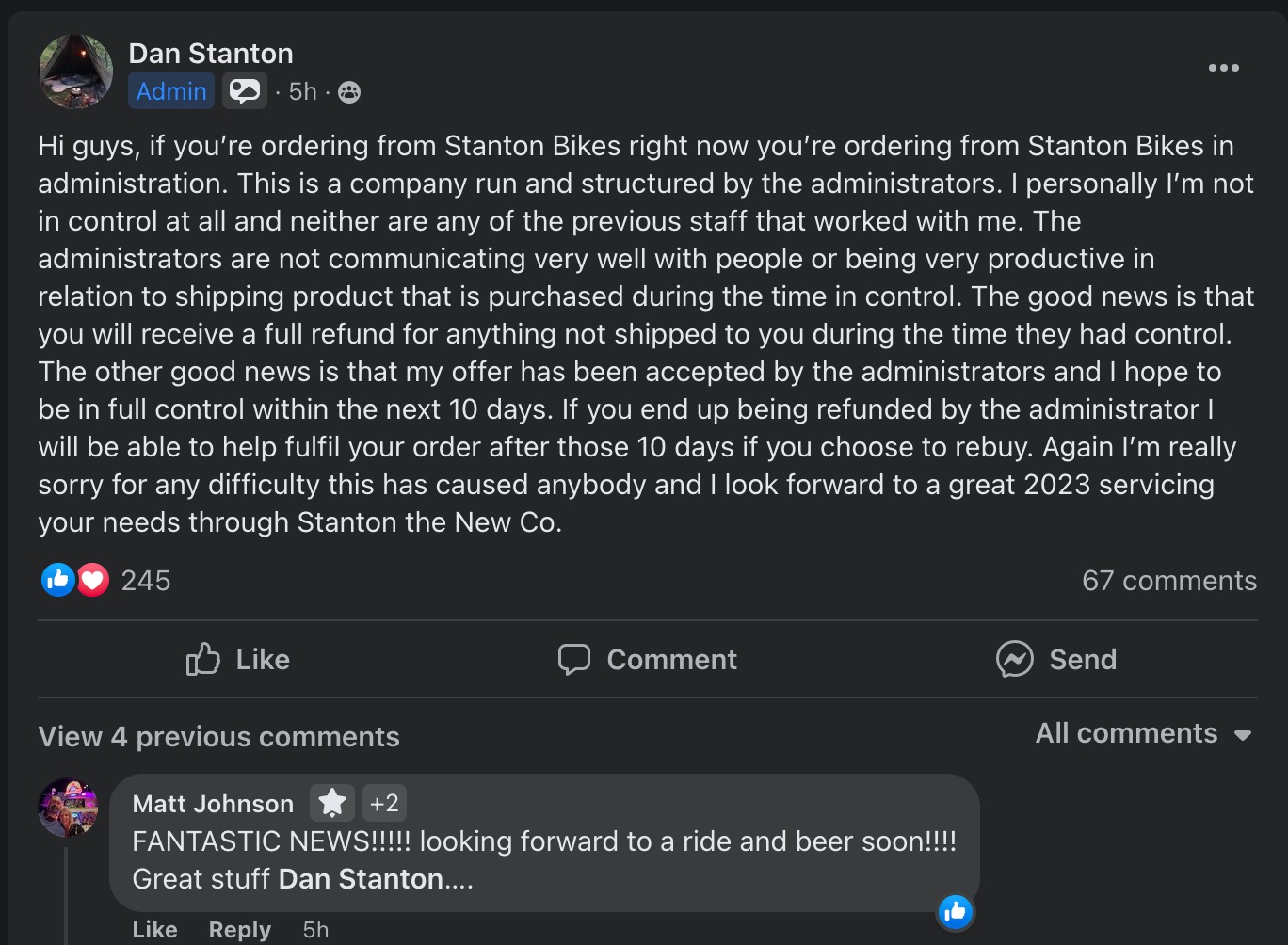

In a Facebook post to the Stanton Owners’ Group, Dan Stanton seems to indicate that he’s set to reclaim control of the company, and Stanton Bikes will be operating once more.

Anyone who has placed an order may be relieved to see Dan say that refunds will be issued to anyone that has not been sent their bike. And anyone who was dreaming of buying a Stanton may be pleased to see that he has made an offer to the administrators that has been accepted and he hopes to be back in control of the company within the next 10 days.

We’ve reached out to Dan to see if he can give us the full story of what’s happening. Watch this space.