Home › Forums › Chat Forum › Euro downgrade: beginning of the end?

- This topic has 44 replies, 19 voices, and was last updated 12 years ago by derekrides.

-

Euro downgrade: beginning of the end?

-

choronFree MemberPosted 12 years ago

Reckon this is much more interesting and important than the Ed Balls flip-flop-athon.

I’m going to go for a spiral of: sovereign downgrades -> commercial downgrades (dominated by financial institutions with increasingly dodgy assets) -> austerity measures -> falling GDP -> sovereign downgrades ->…

Next big event should be a hard Greek default (probably Q1), followed by (best case) IMF bailout of Italy/Spain or (worst case) Chinese recession.

What do you guys think?

CaptainFlashheartFree MemberPosted 12 years ago*Pulls up a chair. Pours a nice glass of Meantime IPA (Available in Sainsburys or Waitrose stores nationwide) and waits for the inevitable*

clubberFree MemberPosted 12 years agoI think it’s only a matter of time before uncle TJ tells us all with absolute certainty what will happen.

And then shortly afterwards there will be another repetive discussion over whether the Euro is failed/failing/fine – the usual xenophobes will show themselves for what they are.

and then TJ will claim that people aren’t listening/don’t understand anything other than their pov. He’ll probably insult a few people then get grumpy when others insult him back.

Saved you doing it TJ, nothing to see here 😉

TandemJeremyFree MemberPosted 12 years agoTa clubber

You did forget the bit where I prove people wrong and they get all stroppy and start with the ad hominen attacks. 🙂

marsdenmanFree MemberPosted 12 years agoOn the train back north, having spent a day in that there London. Thanks for posting this up, will kill the next 2 hours 🙂

clubberFree MemberPosted 12 years agoY’see you’ve started already. IMO there’s justification for either viewpoint so both are legit. Only history will show which is correct.

so there 😉

TheFlyingOxFull MemberPosted 12 years agoIf you want a more informed view on all this, try here:

Is the end nigh for the Euro? PIGS going bust? This Autumn?Seems like they’ve called exactly what’s going to happen at least 2 months before it happens, for the entire time this trainwreck has been in progress.

teamhurtmoreFree MemberPosted 12 years agoChoron – TJ will be fine. Copy the Germans – they have the perfect model don’t they. So as Angela Merkel said today, “governments should implement tough fiscal rules immediately”. Is that right TJ? I could have got it wrong?

Or are the French right? ““Putting in place drastic spending cuts in the current economic context would be a major risk to growth. We will not to do it.” (Fillon)

Remind me which hymn sheet they are singing from so that if the UK ever gets invited back to the meetings they will know where everyone stands – well at least the two main European big-hitters

TheFlyingOxFull MemberPosted 12 years agoDidn’t you hear? France were downgraded. They aren’t big hitters anymore. They are the Rose and Onslow to Germany’s Hyacinth and Richard.

teamhurtmoreFree MemberPosted 12 years ago

teamhurtmoreFree MemberPosted 12 years agoCluuber, no – I’m off. I stand by my scenarios in December. We all know where this is going and it isn’t going to be pretty.

TandemJeremyFree MemberPosted 12 years agoOh look – ad hominen attack from teamhurtmore. What a surprise.

clubberFree MemberPosted 12 years agoYou’re as bad as TJ on this 🙄

No one knows for sure what’s going to happen right now.

TheFlyingOxFull MemberPosted 12 years agoI think TJ learned a new term today, but not its definition 😕

PeterPoddyFree MemberPosted 12 years agoYou did forget the bit where I prove people wrong

Is it possible to prove someone wrong in an argument about something that’s not happened yet?

I suspect not.

choronFree MemberPosted 12 years agoErr.. feel like I should point out that the OP was not trolling: I reckon this place can actually be an interesting place for this type of discussion due to the variety of opinions (even TJ, Elf et al), much more so than an econ/finance forum.

One thing that I forgot to mention is the exploding ECB balance sheet due to structures such as LTRO/EFSF/ESM: these ensure that a very real risk is shared by even the most secure core euro countries (Germany etc). When things go wrong, they will really go wrong…

teamhurtmoreFree MemberPosted 12 years agoJust looking for clarification TJ, not an attack at all. There are “no other viewpoints” and Germany has the answers. I just needed explanation about this fiscal cut stuff that Merkel was talking about. I will check back in the morning for the answer.

Sorry choron, excuse the behaviour. You are spot on with the ECB and other central bank balance sheets. Very scary and telling. Clearly showing failure of QE and the risks that the banks know remain in the system. A very, very bad sign. And yet Osborne continues to push that piece of string?? Actually when you place these trends into the typical IS/LM debate between Keynesian and Monetarists, it becomes really very interesting. I wish some of the clever economists in the BoE or ECB could publish their analysis on this.

Gavyn Davis wrote interesting piece on this in Jan 8 FT. Worth a read.

[edit: excuse me TJ, I will go back and find both those examples]

TandemJeremyFree MemberPosted 12 years agoI proved teamhurtmore wrong on a couple of other threads and he has spent the time since making stupid personal attacks like the one above.

“they don’t like it up ’em”

clubberFree MemberPosted 12 years agoNeither do you as was proved on that home insulation thread, TJ…

Zulu-ElevenFree MemberPosted 12 years agoYou did forget the bit where I prove people wrong

I think that, collectively, we’ve all forgotten that bit TJ 😆

learned a new term today, but not its definition

PMSL

TandemJeremyFree MemberPosted 12 years agoclubber – a different argument and I simply gave up attempting to explain to people why what they suggested was not possible / forbidden on my building.

mrmoFree MemberPosted 12 years agowhat is fairly clear is that the current idea that paying down deficits is the way forward isn’t going to work. Look at Ireland cut spending, no wages, no tax, cut spending, repeat.

At some point it will get messy when the majority realise they are being taken for a ride.

As for the Euro, brilliant idea, but implementation leaves much to be desired, implementation being politicians grandstanding again.

clubberFree MemberPosted 12 years agoWell it’s going to the formula so far 😀

(TJ, you took major offense to being treated the same way you regularly treat people – that was the point)

grantwayFree MemberPosted 12 years agoCould well be has they don’t have anymore money to bail any of the countries out.

Don’t think there are any drastic changes for a while yet But this will certainly rock

the financial sector and will be interesting on Monday to see the first day of trading.But at the end of the day there is no true value in the Euro

and interesting to see what the out come of the Two tier system

will be, and could well be the start of a break away and maybe the

start of reintroducing there own currency as I don’t see how one

minute say the Peseta was Two to the pound and then the next minute

the Euro valued at 1.17€ to £1.00p to the pound in SpainloumFree MemberPosted 12 years agoSorry I’m not quite up to speed here, but what’s the relevance of home insulation.

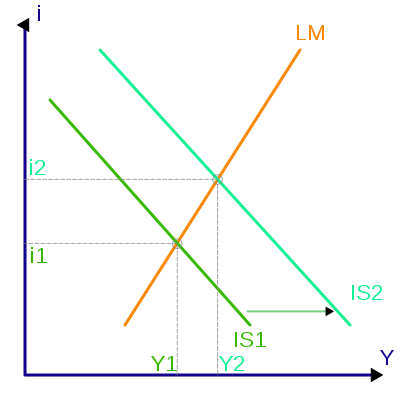

teamhurtmoreFree MemberPosted 12 years agoChoron – the interesting thing to me is how politicians are forgetting their basic A level, first year Uni macro economics. Basic theory tells you that the whole Keynesian/Monetarist debate can be illustrated by classic ISLM curves that consider the relationship between the goods and money markets. Keynesian policies work better when the LM curve is flat and the IS curve is steep. When you have a banking crisis as we have now (an as shown by the build up of the ECB’s balance sheet), the LM curve flattens making monetary policy less effective.

Hence the current dilemma and the puzzle with people like Balls and Osborne who know this basic economics. Basic macro analysis tells us that governments should be placing a greater emphasis on keynesian policies rather than monetarist ones. So why are they not doing this? Why are they pursuing QE etc when it isn’t working. Because of the deficit constraint on fiscal policy?? This is why the current situation is so scary and why the politicians of all parties are frankly out-of-their depth and out of policy options.

So it leaves you with final really puzzling question. If you are correct in the risks that this has for all Euro countries (and I believe you are) why were people prepared to lend to Germany and the UK last week at negative interest rates – ie pay them to borrow?

choronFree MemberPosted 12 years agoteamhurtmore – I completely agree that the monetarist approach isn’t working: it seems to me that all QE has achieved so far is a big chunk of (commodity price) inflation. LTRO seems to me to be an incredible misappropriation of capital/risk as banks either engage in a sovereign carry (spanish bond @7% – ECB base rate @1% = 6% free money), or simply park the money back in the ECB deposit facility and artificially improve their capital ratios. These strategies do nothing for the macro situation, and simply inflate bank profit/T1C for a HUGE risk on the ECB balance sheet.

I’m not sure if I agree that the UK government are constrained by the deficit when it comes to pursuing Keynesian spending policies though: we (along with the US and Japan, neither a model of fiscal health) control our own currency and therefore are not at risk of hard default. The bond market knows this and therefore prices our debt accordingly: making us effectively the best looking horse(s) in the glue factory.

My feeling with the real reason for the current trend for austerity is that it is simply political opportunism. Due to the consumer debt overhang a great number of people are worried about their personal circumstances and are currently in the process of deleveraging. I think that there is some overflow from anxiety about personal balance sheet problems to anxiety about national balance sheets: hence the entirely fatuous comparisons between sovereign debt and credit cards / household finances that have been made (initially by Osbourne, but increasingly by Balls & Alexander). These guys know that the comparison is entirely inappropriate, but they can make significant political capital by engaging in this kind of scaremongering around election time. They then have to keep that advantage by setting out on an austerity agenda, even though it is clearly an insane proposition.

More than anything, I’m wondering exactly how much worse things can get before they start to improve. If we really need a big stimulus then maybe WW3 is the only thing that would really push governments in that direction. The fundamental fact is that one man’s saving is another man’s borrowing: sovereign, commercial and domestic deleveraging all at the same time is never going to work.

teamhurtmoreFree MemberPosted 12 years agoActually interesting to read what Ed Balls really said today

http://www.edballs.co.uk/blog/?p=2784

especially the stuff on Keynesianism (the middle section) and to see how politics/media etc muddy the waters of forming the correct policies.

Love him or hate him as a person, his analysis today was pretty astute including on Europe. No surprise he has a first from Oxford in PPE and a scholarship to read Economics at Harvard. Ironical that he gets blasted for it!!

teamhurtmoreFree MemberPosted 12 years agoInteresting choron and agree with a lot of what you say apart from WW3!!

I like your comments on the horse and the glue factory – far better than the claptrap that gets spouted on here about the topic.

The reaction of the consumer and particularly if folk continue to save despite the disincentive of low and negative real interest rates is telling. What is happening right now (even for poor old tesco) is that increased saving aggravates monetary policy further by also flattening the LM curve.

Hence I disagree with clubber about no-one knows for sure (not in an ad hominum way!). Actually you can make a pretty close bet that the € will fail for the simple reason that rather than WW3 the only policy option really open is a new currency regime with much weaker currencies for SE/periphery economies. But how do you do that without creating a run on the banks, further distress etc.

This is the politicians’ nightmare scenario and why I ultimately forgive them. Not only are they effectively powerless but they actually cannot tell the truth either!

rickmeisterFull MemberPosted 12 years agoQuite interesting following this thread from your insights Choron / thm… what would help is a crack the code here:

LTRO

EFSF

ESM

bank profit/T1C

IS/LMThink I got the others… what little is left!

donsimonFree MemberPosted 12 years agowhat would help is a crack the code here:

You mean tou don’t know? Thickie… 😛

StonerFree MemberPosted 12 years agoISLM is probably one of the more important theories the guys are getting at:

http://en.wikipedia.org/wiki/IS/LM

the rest is covered here:

http://en.wikipedia.org/wiki/LTRO#EU_emergency_measureschoronFree MemberPosted 12 years agoThe WW3 comment was a semi-joke. Although it seems like a remote possibility at the minute, financial crises always play into the hands of the nutters (see Hungary et al).

The Ed Balls speech is quite illuminating: it shows the political imperative to sound like a deficit hawk when you know that is not the best idea from a macro point of view. For what it’s worth, I also feel like some of the targets of the cuts are very valid targets, particularly higher education, the NHS and some benefits. The way the cuts have been handled so far seems very amateurish though, and leads me to think that nobody in government has much of an idea.

For my money the Euro breakup (to some degree) is already a dead cert. The interesting question is when and how, and what will be the major consequences. The big players are up for re-election soon and nobody can have any chance of campaigning while being the person who killed the euro. However, the longer the can is kicked down the road the worse things get (see the slow-mo bank runs in Greece and Portugal for evidence of this). For me the really critical moment will be (perhaps in the next year) when we have a major restructuring of the Euro and there will be (~6pm Friday evening) an EU/ECB announcement of capital controls across the eurozone. From that point all bets are off.

Maybe I’m just cynical, but I really don’t see that any politician(s) have the power to stop us getting to that stage. Once capital controls are introduced on a wide-scale basis then the crisis goes from empty shops and high unemployment which can be ignored or downplayed by at least some of the population, to a very real immediate crisis which affects even the very richest.

aracerFree MemberPosted 12 years agoIt’s good to see the EU bureaucracy still doesn’t get it:

The EU’s top economic official has criticised a decision by Standard and Poor’s to downgrade the credit ratings of nine eurozone countries.

Economic affairs commissioner Olli Rehn said the move was “inconsistent” as the eurozone was taking “decisive action” to end the debt crisis.

choronFree MemberPosted 12 years agoSorry, things were getting a little dense there. A few definitions and the like:

LTRO – long term refinancing operation (ECB providing short term cash to banks to counteract the current credit crunch that european banks are experiencing).

EFSF – european financial stability facility

ESM – european stability mechanism

(also EFSM – european financial stability mechanism)

These are investment vehicles by which the EU borrows money on the financial markets to lend to lend to countries (PIIGS etc) which cannot finance themselves directly on the bond markets (as their yields or effective interest rates are too high). This borrowing is guaranteed by EU member states, particularly Germany, but also France, UK etc.T1C – tier 1 capital: the amount of ‘really good’ assets (US government bonds, cash, gold etc) that a financial institution holds in case other ‘assets’ bought with borrowed money (or leverage) decrease in value. This is often described as a fraction of the total balance sheet of the institution and can describe the total leverage ratio of the institution. A good example is getting a mortgage with a 25% deposit. This would give you a tier 1 capital ratio of 25%, or a leverage of 4:1. For you to become insolvent (negative equity) your assets (house) needs to lose more than 25% of their value. For reference some really big and structurally important euro banks like Soc Gen now have a leverage of about 60:1, twice that of Lehman or Bear Stearns.

IS/LM – see post above

teamhurtmoreFree MemberPosted 12 years agoAh, the elections and politics. So Merkel and Sarkozy need domestic political support that requires them to take diametrically opposed positions on the € solution. Fascinating but ultimately depressing because political immediacy overtakes economic reality. It was ever thus!

But when/if capital controls announced OMG….I was discussing this after a tennis match this morning with reference to Argentina and how the government treated anyone with a guy who lived and worked there. Will Greece do the same?

And so know we know why the Greeks are buying up London property at the moment. Maybe one will buy Bolton?

The topic ‘Euro downgrade: beginning of the end?’ is closed to new replies.