Home › Forums › Chat Forum › Property market – renting & buying. Madness!

- This topic has 112 replies, 58 voices, and was last updated 3 years ago by boombang.

-

Property market – renting & buying. Madness!

-

cookeaaFull MemberPosted 3 years ago

My parents are (unintentionally) part of the problem.

They bought their current 4 bed detached place in Dorset during the mid 90s, when they had 3 kids.

So now they’re mortgage free, empty nest boomers, with 25 years+ of accrued equity sat “tying up” a family home in a good catchment area. They’ve talked about downsizing several times in the last decade but it’s never been a good time, and now dealing with the Covid housing market doesn’t appeal to a couple in their 70s…

Most of their neighbours are now about my age with kids, and knowing how much those houses are valued at and what the local job market looks like, I’m not totally sure that many people could afford to buy them. I’m guessing It’s going to be couples with highish dual incomes and/or remote working financial sector types. Basically London is driving house prices a significant distance away. The SE bubble is stretching.

Funnily enough I am now in Reading, closer to the epicenter of the madness, in a similar sized house, but still probably worth a good £100k less, and we would find buying my parents home 100 miles away in Dorset a stretch I reckon…

I do think post CV19 with increased WFH will help change the national housing market further, as “London commuter belt” becomes “occasional trip to head office belt”…

But also there is still a boomer bubble, people like my parents sat on significant equity in family houses that when they do go back on the market probably won’t be affordable for a significant chunk of the population…

MoreCashThanDashFull MemberPosted 3 years agoBought my house for £36k with a £30k mortgage in 1990, aged 21. The other £6k was from 3 years constant overtime, no holidays, restricted social life while I saved. Convinced if I didn’t do it then I’d never afford it.

Sold it in ’96 when I moved for work,got £30k for it which at least covered the mortgage. Meh!

Gone well since, but only cos we headed north on a whim to buy a house we could afford on one salary while we had a young family. Lot to be said for transferable skills and being prepared to start again at the bottom.

sockpuppetFull MemberPosted 3 years agoProperty tax forget the fact that properties (and areas) change in value, or people add value by working on their property or there income changes. Its an incredibly unfair tax. The value in your property you live is meaningless, you have a house, a place to live, that is its value. Realising its value means selling the property.

A big part of the point of property tax is to redistribute *wealth*. Especially from the top to the bottom (as ever, via government, which is often peoples’ problem). For the good of the whole.

It’s very good at this, and levels & thresholds can do a lot. Some parts of ‘the whole’ lose out, and don’t like this.

One of the other biggest benefits is it that tends to influence people towards lowering the valuation of the property on paper to avoid the tax – which is kind of the point, depending on implementation!

As with inheritance tax it’s a very effective way of stopping the richest keeping *all* the money, so is often subject to massive vocal objections and charm offensives because those are the same folk with the loudest voices in society.

And as we know it’s how things read in the paper that counts, not what’s really going on.

FWIW I think property taxes aren’t the answer, on first properties at least. Possible for second homes. Other taxes on multiple ownership should keep going up. That will cost some people, and they will hate this. I’m ok with that.

I’m also ok with inheritance tax, and would like it simplified (ie ways of getting g out of paying it reduced). Most folk after all are no where near paying it, £325k each – more for houses – is a lot to have left at the end.

Yes, it affects some. Those people should pay as small fraction back for the public good.

I’ll get off my smug soapbox now. But I mean all that. Sincerely.

scandal42Free MemberPosted 3 years agoLove how threads like this turn into a boasting orgy of Northerners slagging off the south and saying how perfect life is up north.

Northerners are turning into southerners more by the day…………

Rockape63Free MemberPosted 3 years agoLove how threads like this turn into a boasting orgy of Northerners slagging off the south and saying how perfect life is up north.

Northerners are turning into southerners more by the day…………

Ha….was thinking the same! 🙂 Its also the long threads about how people have made money that no one except them are interested in! lol

MrSmithFree MemberPosted 3 years agoThe moral of the story is – you don’t have to live down south and you’re mad if you do. It’s far from grim up North.

35 million people think differently to you.

flickerFree MemberPosted 3 years agoNortherners are turning into southerners more by the day…………

😮

I don’t think I’ve ever been so insulted 😀

zilog6128Full MemberPosted 3 years agoLove how threads like this turn into a boasting orgy of Northerners slagging off the south and saying how perfect life is up north.

to me it just reads that they’re desperately trying to convince themselves, not anybody else 🤣

MoreCashThanDashFull MemberPosted 3 years agoI’m a smug Midlander – couldn’t afford the lifestyle we have if we’d stayed down south, the time and opportunities we’ve given the kids.

Everyone makes the choices that suit them though.

mark88Free MemberPosted 3 years agoMy parents are (unintentionally) part of the problem.

Same with mine. They’re trying to downsize but demand for 2 beds means anything decent gets snapped up straight away, usually above asking price.

His point was the average house price today at 1991 mortgage rates would be crippling…..as it was back then

Current generation of first time buyers just face that crippling expense before they buy. I’ve been saving for a deposit whilst paying rent. My mortgage payments will be 1/3 of what I’ve been paying/saving.

Personally I was hoping for things to calm down after that post lockdown rush, but the extension to the stamp duty holiday seemed to have caused another surge.

I made an offer above asking price on a place in Sheffield in October and was told I was significantly outbid (still not sure on how much it went for). Covid restrictions came back and made viewing hard so I put it on hold. Now I’m actively looking again there appears to have been a notable price increase over the last 6 months and things seem to be selling quicker than ever. Very frustrating.

binnersFull MemberPosted 3 years agoLove how threads like this turn into a boasting orgy of Northerners slagging off the south and saying how perfect life is up north.

The choice of olives is somewhat limited 😀

the-muffin-manFull MemberPosted 3 years agoMy parents are part of the problem too. They’re rattling around in a large 4 double bedroomed house but they’re both in their 80’s and I honestly think the mental stress of moving would kill them off. We’re currently looking at making the downstairs liveable (installing wet-room), and moth-balling the upstairs.

To be honest I’m 53 and the stress and hassle of moving puts me off too. Ideally I only want one more move.

zilog6128Full MemberPosted 3 years agoI honestly think the mental stress of moving would kill them off.

that’s fair enough, moving house in the UK is such a horrifically stressful experience, why on earth would you put yourself through it if you didn’t have to! Whole system needs some kind of overhaul to make it fairer & less painful, don’t know what though!

johndohFree MemberPosted 3 years agoYep – my in-laws in the same boat – large 4 bed detached house with a mahoosive garden ie, in one tiny corner of it is a tractor shed for the full-sized tractor (not sit-on lawnmower) which he needs for the acres of field they also have.

But they built it from a dilapidated shell and the family grew up there so their emotional ties to it are huge.

ta11pau1Full MemberPosted 3 years agoI’ve lived all over and just happened to end up down here in Kent due to work availability and family.

Grew up in Lincolnshire out in full on fen country (which is the midlands), then in Bristol for a while, now in Kent.

If I moved up north I’d bypass the region from the Humber north and just go straight to Scotland. 😀

chrishc777Free MemberPosted 3 years agoA work colleague and friend bought a £300k do-er-upperer and has grafted his absolute arse off for 15+ years. He had it valued at £850-900k leaving them with £400k ish for a final ‘forever’ mortgage free home.

So assuming that 15+ is about 18 years he’s grafted his arse off for 22k a year? Doesn’t sound like such a great deal to me. And that’s before you take off the interest he’s paid on the mortgage, assuming 3% that’s 9k a year meaning lots of graft for 13k

nukeFull MemberPosted 3 years agoGiven how accommodation is such a fundamental necessity i can’t help feel that house price growth should be managed in the same way there’s is an inflation target of 2%….delicately adjusting the base rate to counter the steep rises seems prudent to me. Simplistic view i know but i just don’t see it as healthy to the economy to let house prices run away like they are currently doing

sharkattackFull MemberPosted 3 years agoI’m another one that wouldn’t have a house if it wasn’t for the consideration of the seller. He started his own business and was not short of cash. He’d already bought his next house and needed a quick sale. We were first time buyers with an agreement in place and free to move in asap.

We got the chance to meet him and his housemate and I explained that our maximum offer was literally our maximum and we couldn’t take place in a bidding war. He sold it to us despite being offered quite a bit more from other people.

This was in October 2019. Our next door neighbours house just went up on Rightmove on Monday for 40k more than we paid and 2 days of viewings were fully booked by Tuesday. There’s no way we could get into a similar house if we waited any longer and being on lockdown for the last year with our previous living arrangements would have been unbearable rather than merely tedious. We used to live in one room in a house miles from anywhere.

So we feel pretty fortunate but don’t feel like we’ve gained anything financially. We’ll be staying put long term and can’t cash out any time soon.

TexWadeFull MemberPosted 3 years agoI know the London bubble is being pushed out due to WFH but there comes a point where firms will stop paying London salaries for people who don’t travel to or actually live near London.

I live in Bristol and asked (tongue in cheek) to be transferred to the London office – the extra pay would more than cover the odd trip to London (and I travel to London already for meetings).

exseeFree MemberPosted 3 years agoWe need a not-for-profit estate agent🐒

Buyers and sellers could then sign up with differing requirements instead of the biggest wallet wins20 years of local voluntary work might actually outweigh the ‘I worked my arse off for my own financial gain’ brigade

andrewhFree MemberPosted 3 years agoYep – my in-laws in the same boat – large 4 bed detached house with a mahoosive garden ie, in one tiny corner of it is a tractor shed for the full-sized tractor (not sit-on lawnmower) which he needs for the acres of field they also have.

But they built it from a dilapidated shell and the family grew up there so their emotional ties to it are huge.

Sounds like mine. 34 years in the same place, restoring it, seeing the garden develop over that time, the woodland they’ve planted mature. Very hard to walk away from even if the actual building is too large. They converted a barn to a holiday let so also means giving up an income stream which goes with it.

But really a huge amount of emotional attachment to the place and are comfortable enough not need to sell for financial reasons so why they should they?

.

.

I have two suggestions for property tax reform.

Easy – change stamp duty so sellers pay it. By definition helps first time buyers and is then paid by people who are receiving quite a lot of money.

Harder/more controversial. Remove the primary residence exemption for capital gains tax. Big revenue stream for the government, makes houses more of a home and less of an investment. Not heard either suggested anywhere, am I missing something?

.nickjbFree MemberPosted 3 years agoThey would be reasonably fair taxes but they would massively stop people moving. That will cause more house blocking and reduce social mobility. There’s always unexpected consequences

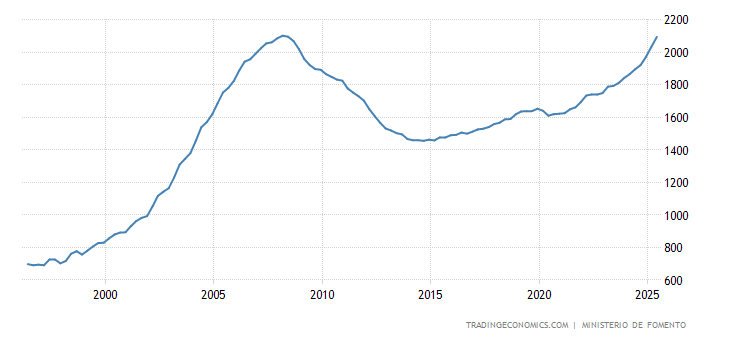

thisisnotaspoonFree MemberPosted 3 years agoIt’s a uk thing, Spain and Germany have stable prices, my friends just sold a nice villa for what they paid 20 years ago. They enjoyed living in it, did not want a profit, hopefully the new owner will do the same.

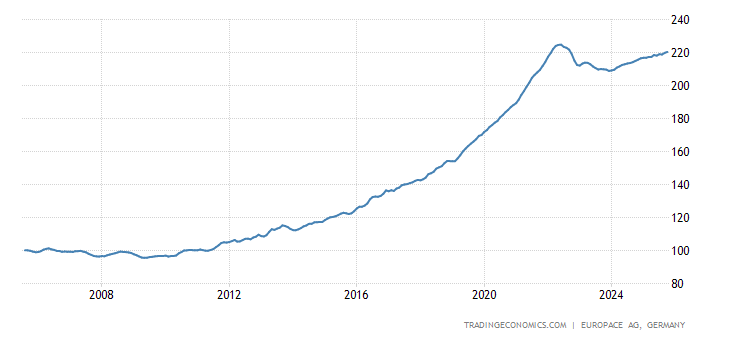

Not strictly true though…….

Germany, doubled in the last 10 years.

Spain, went up and crashed.

They would be reasonably fair taxes but they would massively stop people moving. That will cause more house blocking and reduce social mobility. There’s always unexpected consequences

Not sure stamp duty would have an impact, everyone (moving up the ladder) would just be paying it on the cheaper property, you’d still be paying it. I think it would be better done by reforming “council tax”, make that ~10% of what stamp duty currently is, and charge it every year. Sure it’ll “hit pensioners hardest”, especially those living in big houses in parts of the country with more jobs than housing, thus forcing them to move to that nice seaside cottage on Arran linked above and leveling out prices!

CGT won’t help. If you tax profits at 20% people still want to make a profit, they might even need to make a larger one to move up the ladder. You’d also be able to offset any losses against your other taxes, which would just encourage government policy to push house prices up.

ChewFree MemberPosted 3 years agoHarder/more controversial. Remove the primary residence exemption for capital gains tax. Big revenue stream for the government, makes houses more of a home and less of an investment. Not heard either suggested anywhere, am I missing something?

That would stop people moving

Bought your house in 1980 for £50k, but its worth £200k now.

Having to pay capital gains on the growth (after some form of allowance) would stop people moving.Supply needs to go up.

Open up development on brownfield sites/regeneration projects

Heavily tax second homes (if you can afford to buy a second home, you can afford extra costs)

Heavily tax BTL (see above)The second two wont be popular and not vote winners, but they do seem to being slowly introduced.

There has to be a correction at some point.

Historically average house prices were 4x average salaries, whereas its above 8x at the moment..

Most of that will come if/when interest rates go back to normal levels.

Debt is currently very cheap, but that cannot continue forever.poolmanFree MemberPosted 3 years agoOk ta for info, I heard German prices had been static it was on a finance pod. My 2 German friends think we in uk are mad with our obsession ‘re property, they rent their landlord is an insurance co so they may stay all their lives in the same properties.

There’s a wealth tax here in Spain, anything over 700k property and 300k cash is I think 1%. Problem with the cash element people just hoard cash at home.

The above proposal ‘re an annual charge of say 10% sdlt is a good one but there s loads of Tory votes in pensioners and they would be the biggest losers. Also, lots of pensioners are asset rich cash poor so couldn’t pay it.

MoreCashThanDashFull MemberPosted 3 years agoMy parents downsized and moved closer when they hit 70. Still had the energy and independence to do it themselves, spent 10 years and most of my inheritance getting their bungalow how they want it, and staying there till they can’t live independently any more.

Watching MrsMC dealing with her parents struggling now, I’m so glad mine did the sensible thing, and we intend to do the same.

chrishc777Free MemberPosted 3 years agoNot strictly true though…….

Germany, doubled in the last 10 years.

If you can’t even label your axes your hypothesis is null

boombangFree MemberPosted 3 years ago@w00dster how have you found the build quality?

We bought a new Bloor home around here in slight desperation, having spent 6 months living with parents after 3 purchases fell through one after the other.

The house itself was a cracking layout, had all we needed and more, but was let down by appalling build quality and finish – this was consistent across the first phase on the site and I am pretty sure it was down to terrible site management and poor quality workforce.

100+ snags over 6 sides of A4, our biggest issues were wet external walls and internal water leaks but on the same site a bay window came away on one house, another had electrical fires that resulted in a rewire, another where the roof wasn’t tied down (discovered when loft was boarded out)

It put me off ever buying a ‘new build’ from a big housebuilder, I’d happily still have a private builder do me a new house if could afford it though.

johndohFree MemberPosted 3 years agoThe stories about many new house builds makes me wonder why anyone would ever want to buy one. Of course for every dissatisfied house buyer there will probably be hundreds of happy ones but they wouldn’t be going to the press.

But Persimmon.

w00dsterFull MemberPosted 3 years ago@boombang This is my third new build. We actually wanted to build our own but time constraints meant we didn’t have the luxury so after a small amount of research and based on the area we wanted to move to decided on Bloor.

They have been massively better than David Wilson and Taylor Wimpey. We’ve had one major issue, this took a bit of arguing but was eventually fixed. The shared driveway had developed a large sunken area near to the drain. Bloor blamed us for a garden supplier delivering tiles with too large a truck. But was resolved.

Taylor Wimpey were shocking. Caused lots of stress. Bloor seem to be significantly better. My neighbours are similar, only minor snagging. But one of the houses on the estate does have a sign in the window warning people about Bloor taking the money and not helping with build issues.

Personally I’d buy again from them. Was pretty much fuss free.

And again, where I live, an older style property of a similar size would be about £100k more. A 4 bed with garage and same space would be at least £650k and then an additional amount to renovate. New build 4 bed is between £480 and £550k and ready to live in.

I’d have to live further away than I need to be to get in budget.Ro5eyFree MemberPosted 3 years agoSo bringing together this thread and the Retirees to the forum thread.

How much are you factoring in the equity in your house into fund retirement plans.

Will you have to? Will you chose to ? When, where and what will you downsize to ?

w00dsterFull MemberPosted 3 years ago@Ro5ey, at 48 I’m about 8 years away from retirement. My house is separate to my pension and retirement plans.

Lucky enough to have businesses that will continue to pay me a wage after I’ve retired.

My wife and I have regular discussions on our future living arrangements. She is very much of the opinion that we need a larger house when we retire to cater for the grandkids (our kids are 11 and 12 so no decision needed anytime soon. I’m of the opinion that we need a 2 bedroom apartment in the Canaries!boombangFree MemberPosted 3 years ago@w00dster really glad to hear that – like I said the design we had (Osterley IIRC) was superb and would work way better than what we have now and in fact all their designs were really intelligent uses of space.

Interestingly our shared drive (6 houses) was permeable and moved all over the place – Bloor tried to blame the council refuse lorries but eventually relaid most of it.

The topic ‘Property market – renting & buying. Madness!’ is closed to new replies.