- This topic has 772 replies, 74 voices, and was last updated 9 years ago by DrJ.

-

Greek election – extreme left won

-

jambalayaFree MemberPosted 9 years ago

@gofaster I think it’s all ego for the European politicians and their quest for the European superstate.

@ernie Argentina has been lurching from one debt crises to another since the 70’s, default or restructurings. The Greek don’t want the same as they know how devastating it would be hence from Election day Syriza have made it clear their mandate is to stay in the euro. The PM just said today that they will honour the terms of the bailout. Argentina’s experience also shows how fortunate Greece where to get an EU/IMF bailout where they can deal with organisations with political objectives rather than hard nosed business people, Argentina has fought and lost a number of court cases on its debt and has very little room for manouver.

As for Argentina why not post up some graphs of inflation or unemployment, I’ll relate one the stories of my ex boss who’s married to an Argentinian. When they visit he has to ensure he only has one or two bottles of beer an evening as that’s all his wife’s local friends can afford, those with jobs anyway. I’d wager very few people in Greece want to be in the same situation as the Argentinians

jambalayaFree MemberPosted 9 years agoI wonder whether a defaulted / euro exited Greece could remain in the EU ? There would be no credibility and we have the old favourite issue of freedom of movement. Greece has seen a number of waves of emigration, to the U.S. to Australia etc. I could see a defaulted Greece leading to another big wave of emmigration.

Also poll in Germany showed 76% of the people asked where against a Greek debt restricting / bailout #2. Syriza aren’t even bothering to go to Germany to meet the finance minister. Paris earlier me London this evening I understand

ernie_lynchFree MemberPosted 9 years ago@ernie Argentina has been lurching from one debt crises to another since the 70’s, default or restructurings.

The default was in December 2001. In the 70’s Argentina was following neo-liberal right-wing economics (as was the rest of Latin America) precisely the sort of policies you incessantly champion on here.

.

As for Argentina why not post up some graphs of inflation or unemployment, I’ll relate one the stories of my ex boss who’s married to an Argentinian.

You claimed nothing had improved with the Argentine economy since they defaulted, this is clearly nonsense so I posted graphs to show that.

But now since you’re asking here is a graph showing unemployment levels since Argentina defaulted :

Inflation in Argentina is very high, this is the natural consequences of the inflationary policies they have pursued, the spectre haunting Greece due to very different policies is a deflation – a far greater evil that truly destroys confidence/demand/jobs than inflation.

I’m sure your ex-boss can tell you some very interesting stories about Argentina – the policies followed there for the last 13 years have been very good for vast numbers of poor people (and a great many middle-class/professional people became penniless when the neo-liberal experiment collapsed in December 2001) and very bad for some very rich people.

I was in Argentina in January 2002 and saw the some of the utter despair caused by the collapse of the neo-liberal economic experiment. And I have more family in Argentina than anywhere else in the world. This doesn’t make me right of course – someone with a right-wing point of view will argue the complete opposite to my conclusions, but I hope it will help you to understand that I don’t give a monkeys what your ex-boss, or his wife, has to say 🙂

teamhurtmoreFree MemberPosted 9 years agoAfter devaluing and defaulting, it only took one quarter for Arg to start to recover. Greece should look here and to Korea not to Berlin.

gofasterstripesFree MemberPosted 9 years agoMissstripes works in debt management. ‘S pretty much what she thinks.

jambalayaFree MemberPosted 9 years agobut I hope it will help you to understand that I don’t give a monkeys what your ex-boss, or his wife, has to say

haha touché !

tmh Greece should look here, ie the UK ?

jambalayaFree MemberPosted 9 years agoFinance minister in London, has made it clear to private lenders/investors that they will not default on the privately held debt. Makes sense as if they get a sniff they will start preparing legal action which will make life troublesome to say the least.

Syriza do seem to be dealing with the spending side, ie spending more/reducing asset sales without any plans yet for how they will pay for it including stating they don’t wish to take the euro 7bn bailout payment due at end of Feb. It’s just not clear how they expect to pay for these spending decisions, where’s the money going to come from ? They has said they won’t default on the EU/IMF debt. Nothing adds up.

binnersFull MemberPosted 9 years agoSyriza aren’t even bothering to go to Germany to meet the finance minister.

To be fair to them, they know full well what the German finance minister will say, as the German government do all their talking via leaks to the German press. I doubt they’d learn owt new, or make the remotest difference to German intransigence over everything in the Eurozone. So why bother?

DrJFull MemberPosted 9 years ago“You cannot keep on squeezing countries that are in the midst of depression”

“At some point, there has to be a growth strategy in order to pay off their debts and eliminate some of their deficits.”

Seems like Obama hasn’t been listening to you …

DrJFull MemberPosted 9 years agoSo why bother?

To drop off some money in Switzerland on the way? Oh no .. that was the last lot.

binnersFull MemberPosted 9 years agoSeems like Obama hasn’t been listening to you …

Or perhaps he just has a grasp of Economics, that isn’t clouded by inflexible Political Dogma?

teamhurtmoreFree MemberPosted 9 years agotmh Greece should look here, ie the UK ?

No I didn’t, I meant Argentina and Korea. But funnily enough our effective devaluation and exit from pegging to the D-mark was perceived as a disaster but was actually a blessing and major boost to the economy.

nothing adds up

Of course not!!! 😉

That’s the fun bit to watch and analyse. Obama is correct. The current proposals condemn Greece to a downward spiral. But the solution is verboten. Hence the can gets another kicking….

jambalayaFree MemberPosted 9 years agoSeems like Obama hasn’t been listening to you ..

@PrJ Pretty easy political positioning for Obama, he wants a strong Europe to buy more stuff from the US and he and the US taxpayers aren’t a lender. So he’s free to say what he wants. If you’d ask him he’d be delighted to tell you the EU state spending is far too high, that’s his primary policy suggestion to reduce the deficit. Americans see Greece as the perfect example of how left wing / socialist government spending ruins an economy.

Even if you assume the political “elite” and the bankers took a cut of the euro 340 billion borrowed by Greece it would be a tiny drop in the ocean of money that’s gone “down the drain” (Syriza/Greek finance ministers words BTW)

jambalayaFree MemberPosted 9 years agothat isn’t clouded by inflexible Political Dogma?

Like honouring a contract you’ve signed, paying back money you’ve borrowed or at least the interest ?

teamhurtmoreFree MemberPosted 9 years agoGreece is not the problem per se. The numbers are small change. The issue is the secondary effects and that is what scares the Eurocrats.

Messy, messy, messy…..if only it was Messi, Messi, Messi…..although not with regards to tax affairs!!

DrJFull MemberPosted 9 years agoLike honouring a contract you’ve signed, paying back money you’ve borrowed or at least the interest ?

Well, as has been stated a million times, they can’t pay that money. It simply doesn’t exist. So at that point, what do you do? Stick to your schoolroom principles and insist that the entire nation goes down the toilet, women and children first? Or come up with a pragmatic solution that results in everyone getting something?

In fact I am in that position myself. Someone owes me money. I have a signed agreement from made him in a court to pay me back x over y time. He hasn’t paid me a penny. What shall I do? Bankrupt him, and get nothing, or give him time to get a job and back on his feet?

binnersFull MemberPosted 9 years agojambalaya – theres a degree of pragmatism needed here. We are where we are. And its a ****ing mess. But its not going to be improved by lobbing accusations about about who’s fault it is/was. Theres blame on both sides.

Now we have to look to the bigger picture, and concentrate on the more pressing issue. How to resolve the situation. Since the imposition of austerity, the Greek economy has contracted by 25%, and is continuing to contract. That isn’t sustainable. And you can’t continue to service debts in that situation.

If you were the one who was owed all the money, surely you’d countenance a degree of flexibility, to ultimately improve your chances of ever seeing it again?

But they can’t do that because they’ve painted themselves into a corner defending the indefensible. A single currency that was a disastrous idea to begin with, and whose effects continue to be catastrophic for a massive chunk of the European population. But we can’t admit that now, can we?

dazhFull MemberPosted 9 years agoLike honouring a contract you’ve signed, paying back money you’ve borrowed or at least the interest ?

Much as I admire your commitment to keeping by your word, in the real world circumstances change and contracts need to change with them. The case for changing the contract/agreements in this case are obvious to everyone but the most blinkered. Just shouting ‘A deal is deal!’ at the people you’re contracted to isn’t going to solve the problem.

gofasterstripesFree MemberPosted 9 years agoAmericans see Greece as the perfect example of how left wing / socialist government spending ruins an economy.

Uh, really? I thought it was lack of tax collection/declaration and dodgy backroom deals.

https://www.transparency.org/country#GRC

“

You are currently –Home

What we do

Corruption by countryCorruption by Country / Territory

Country/TerritoryOverview

Data & Research

Public Opinion

Legal Framework

Our workCorruption challenges

Government and politics

The public sector suffers from substantial integrity gaps in both law and practice. Some public officials have acted without transparency or effective oversight for decades. As a result, there is a trend to demand and accept bribes. But these actions tend to go unpunished. A 2010 report indicates that only 2% of misbehaved civil servants are subject to disciplinary procedures.Recent large scale corruption scandals also highlight the risk of conflicts of interest between public office and the private sector. Due to the volume of scandals, citizens’ distrust in public service has proliferated.

Tax evasion

A poor system of tax inspections, aided by an opaque tax code, allows individuals and companies to bribe inspectors and evade taxes. According to a 2011 survey, the cost of bribing tax inspectors to “arrange” tax audit activities is reported to range from €100 to €20,000. And estimates show that €120 billion may have been lost to illicit money from bribes and tax evasion in the first decade of 2000.Private sector

The business sector’s complex legal and fiscal environment, excessive bureaucracy, and frequent policy changes create an atmosphere conducive to corruption. This in turn prevents effective competition, development and growth. Furthermore, while listed Athens Stock Exchange companies operate with reasonable corporate governance, non-listed firms function in a state of almost complete opacity.Public procurement

Due to a lack of access to public contracts and procedures, public procurement in Greece remains vulnerable to corruption. Weaknesses are furthered by the country’s inadequate transparency requirements and enforcement. Effective implementation of public contracting rules and processes is also”” Recommendations

Private sector needs stronger transparency requirements and tough rules obliging businesses to disclose information, especially on tax liability.

The revolving door between government and businesses needs to be stopped. Politicians and civil servants should make their private interests, assets and salaries public. These measures should also be enforced. A register for lobbyists as well as Parliament codes of conduct are also needed.

Online transactions between businesses and public authorities should be introduced. This can be done through the use of bank accounts, e-banking and the internet to lessen bureaucracy and reduce corruption risks.

Stronger penalties for tax evaders are needed. More independent tax administration, a simplified tax code and the implementation of alternative auditing functions will improve tax collection and enhance tax authorities’ accountability.

Public procurement corruption and bribery can be reduced by implementing Integrity Pacts. This pact is an agreement between government agencies and bidders for a public sector contract to abstain from corrupt practices. An independent external monitor also ensures the pact is not violated.“

“

Corruption Perceptions Index (2014)Rank:

69 /175Score:

43 /100OECD Anti-Bribery Convention (2011)

Enforcement:

NoneBribe Payers Index (2011)

—-

Control of Corruption (2010)Percentile Rank:

56%Score:

-0.120842147Global Competitiveness Index (2012-2013)

help expandRank:

96 /142Score:

3.86 /7Judicial Independence (2011-2012)

help expandRank:

85 /142Score:

3.3 /7Human Development Index (2011)

Rule of Law (2010)

Percentile Rank:

67%Score:

0.615028759Press Freedom Index (2011-2012)

Rank:

70 /179Score:

24.00Voice & Accountability (2010)

help expandPercentile Rank:

73 %Score:

0.898

“Liars and cheats riot – gfs

etc

dazhFull MemberPosted 9 years agoWhat shall I do? Bankrupt him, and get nothing, or give him time to get a job and back on his feet?

Obviously you should follow the example of Greece’s creditors and break the legs of anyone who has ever completed a financial transaction with your debtor as they have willingly and culpably conspired with him to rob you of your money.

DrJFull MemberPosted 9 years agoObviously you should follow the example of Greece’s creditors and break the legs of anyone who has ever completed a financial transaction with your debtor as they have willingly and culpably conspired with him to rob you of your money.

Oh. OK. I was just going to sell his children into slavery, but your way works too. Or as well.

ernie_lynchFree MemberPosted 9 years agojambalaya – Member

Americans see Greece as the perfect example of how left wing / socialist government spending ruins an economy.

Except that it was right-wing Greek conservative governments whose spending ruined Greece, not left/socialist governments.

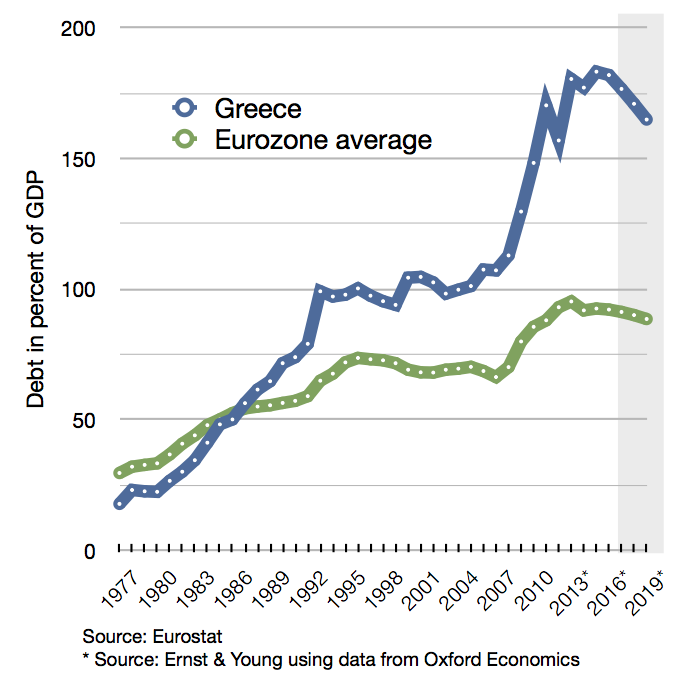

Since you apparently like graphs have a look at this one :

The Greek conservatives, the New Democracy Party, got elected in 1989. You will note how Greek debt compared to the Eurozone average shot up under their rule.

Then in 1993 PASOK got elected to government and stayed in power until 2004. Now you will note that Greek debt compared to the Eurozone average leveled off.

And then in 2004 the conservative New Democracy Party again got elected to government, they stayed in power until 2009. During this period Greek debt went through the roof leading to the present dire economic situation.

Contrary to your claim jambalaya Greece is a perfect example of how right-wing/conservative governments can ruin an economy.

As I said on the previous page jambalaya you need to be less causal with the facts – it might make your arguments more convincing 💡

dazhFull MemberPosted 9 years agoContrary to your claim jambalaya Greece is a perfect example of how right-wing/conservative governments can ruin an economy.

Sometimes I think that if the left could learn this skill of simply repeating the opposite of what is true ad infinitum so that everyone begins to believe it then the world would be a much better place.

gofasterstripesFree MemberPosted 9 years agoMaybe the key bit was

Americans see

In which case

“Who cares if it’s true – I dun saw it on Fox news” is probably the issue 😉jambalayaFree MemberPosted 9 years ago@gofaster and @ernie – I don’t think you could find a country with more left wing spending policies than Greece. They have had a series of governments who have been happy to borrow and distribute the money to the population via various benefits, early retirement etc etc. The population liked the handouts so they kept voting them in. You can find coverage in all sorts of American publications, remember the Democrats are to the right of the UK Conservatives, a refelction of the political landscape there. A country founded by poor immigrants with nothing has determined that’s the correct orientation for their nation.

Greece indeed has an level of debt which is likely unsustainable – no dispute there. The EU, and the Greek government, signed a deal in 2009 which allowed Greece to remain in the EU/euro without defaulting. They really where doing Greece favour, all concerned thought so.

If Greece doesn’t want to pay they can default and exit the EU. I personally would not be in favour them remaining in the EU having defaulted and been kicked out of the euro.

Greece is the perfect example that the euro doesn’t work without complete financial integration. Ultimately without a European superstate.

We’ll see the real ability of Syriza if they can actually collect some more taxes like they’ve promised. The change which was part of the EU’s requirement when the bailout was signed. There is no need for the Greeks to sell their children, they should collect some more taxes and address the rampant corruption at all levels of their society.

76% of Germans in a poll said, no debt reduction.

ernie_lynchFree MemberPosted 9 years agoI don’t think you could find a country with more left wing spending policies than Greece. They have had a series of governments who have been happy to borrow and distribute the money to the population via various benefits, early retirement etc etc. The population liked the handouts so they kept voting them in.

So now you are claiming that the policies of the New Democracy conservatives, that got Greece into this mess, were the most left-wing of any country in the world !

Your claims are getting more and more ridiculous and fantastic jambalaya.

And as for your claim of spending on “various benefits” for the population, the most significant area of spending when the Greek conservatives went on a spending spree was the military, I’m not sure how that benefited the population.

From the Wall Street Journal :

The Submarine Deals That Helped Sink Greece

Note :

“Greece, with a population of just 11 million, is the largest importer of conventional weapons in Europe—and ranks fifth in the world behind China, India, the United Arab Emirates and South Korea. Its military spending is the highest in the European Union as a percentage of gross domestic product. That spending was one of the factors behind Greece’s stratospheric national debt”.

Just like here in the UK, where according to the Tories we have all the money we need to spend on Trident replacement, for the Greek conservatives money wasn’t a problem when it came to military hardware.

And as for your claim that the Greek population “kept voting them in” that completely flies in the face of election results. Greek were clearly dissatisfied with their politicians which helps to explain why their governments changed!

JunkyardFree MemberPosted 9 years agoI don’t think you could find a country with more left wing spending policies than Greece.

Comedy gold even Jive would not type that

Its really hard to believe you mean the stuff you type on hereA country [USA] founded by poor immigrants

Your history is just as accurate

Even a stopped clock is correct twice a dayjambalayaFree MemberPosted 9 years agoLet’s discet the budget then when we have time. Greece spends heavily on the military due to its history of conflict with Turkey. It certainly provides a lot of jobs, soldiers stationed on every island, at least there was when Inlast visited 28 years ago.

Binners of course the economy has contracted hugely as such a big part of it was based upon borrowing which had to stop.

Ultimately Greece’s fate will be decided by the voters of the EU, I think the tax payers of Germany, France, Italy and Spain won’t be willing for stump up the lions share of €120bn for Greeks when they have their own domestic needs.

ernie_lynchFree MemberPosted 9 years agoGreece spends heavily on the military due to its history of conflict with Turkey. It certainly provides a lot of jobs, soldiers stationed on every island, at least there was when Inlast visited 28 years ago.

Ah, just like any self-respecting Tory you are quick to defend massive spending on weapons

“provides a lot of jobs” …… that sounds like a rather left-wing argument.

lol

meftyFree MemberPosted 9 years agoUltimately Greece’s fate will be decided by the voters of the EU, I think the tax payers of Germany, France, Italy and Spain won’t be willing for stump up the lions share of €120bn for Greeks when they have their own domestic needs.

If the Greeks default they won’t have a choice, they should have just bailed out their banks directly rather than through the medium of the Greek restructuring, which has neither served their taxpayers nor the Greeks well.

gofasterstripesFree MemberPosted 9 years agoOr let them fail, like Iceland.

(No idea how that worked TBH)

teamhurtmoreFree MemberPosted 9 years agoSo will Moodys call Varoufakis’ bluff?

Or will Lazard and co pull a subtle fast one? Clever if they get away with it……at least they have used their brains.

jambalayaFree MemberPosted 9 years ago@mefty it wasn’t about bailing out the banks in 2009. It was the country which was bust. Given the finance minister was a university lecturer he’s proven to be a fast learner politically in not answering the questions; are your banks bust, how will you not default ?

teamhurtmoreFree MemberPosted 9 years agoHave you guys not been reading the FT? The latest stunt is to promise a haircut that isn’t a haircut. Quite smart superficially but the ratings boys should see it for what it is ie “event of default.”

Shouldn’t be allowed really as creating false markets in Greek banks debt. This got mullered late today again despite this stunt. Very poor distortion of markets yet again. Plus ca change…

ernie_lynchFree MemberPosted 9 years agoWell I’m starting to change my opinion, especially the more I hear Yanis Varoufakis speak. I had previously thought that if EU conservative politicians and bankers weren’t prepared to throw a lifeline to the Greek conservative government and ease the pain they were inflicting on the Greek people then there was an even less chance that they would do so to a Syriza government.

But the more I hear the Syriza leadership talk the more I’m realising just how pro-EU and pro-Euro, and therefore ultimately bourgeois and anti-revolution, they really are. I did previously wonder whether Syriza’s pro-Euro rhetoric was something of a ruse so that when the inevitable eventually happened and they were forced out of the Eurozone (Greek public opinion is strongly pro-Euro) they could blame EU politicians/bankers and deflect criticism away from themselves.

I am now starting to realise that Syriza’s commitment to the EU and the Eurozone is actually even far greater and deeper than I had imagined, within the leadership at least.

Therefore it would be somewhat foolish if the right-wing EU politicians/bankers were determined to make the Syriza government fail. The consequences politically and economically cannot be accurately predicted, of course, but one thing which is fairly certain is that in the event of the government collapsing support for the fascists and communists parties will increase (support for the fascists dropped very slightly and support for the communists increased a little in last week’s general election) something which should be of some serious concern to the EU (quite apart from the fact that they are both anti-EU).

While they are still very small parties both the fascists and the communists enjoy more support today than Syriza did two general elections ago – so clearly things can change fairly rapidly in Greek politics.

Of course coming to an arrangement/agreement with the Syriza is highly likely to encourage anti-austerity parties in other Eurozone countries such as Spain, a dangerous situation. But I think there is now the slow and gradual realisation that austerity isn’t working, in fact rather than solving the problem it’s simply making it worse. So the argument in favour of deferring austerity at least until the Greek economy has experienced some substantial level of recovery is gaining ground.

For those reasons I am now starting to believe that some sort of accommodation might be reached with the new Greek government.

.

Have you guys not been reading the FT?

I know it’s very hard to believe THM but I strongly suspect that the answer might be “no”.

I can’t believe that some people don’t read the Morning Star.

🙂

ernie_lynchFree MemberPosted 9 years agoEdit to my previous post :

On reflection I suspect that support for the fascists has probably peaked, they lost one MP in last week’s election, and with many of their politicians arrested (including all their MPs) and waiting trial there probably isn’t many more people who are prepared to vote for them. In contrast the communists gained 3 more MPs last week despite the fact that many potential KKE voters quite likely decided to throw their weight behind Syriza and give them a chance, so there is a fairly strong potential for an increased communist vote – if Syriza are screwed.

The topic ‘Greek election – extreme left won’ is closed to new replies.