- This topic has 62 replies, 22 voices, and was last updated 10 years ago by teamhurtmore.

-

UK economy growing at fastest rate since 2007…..

-

teamhurtmoreFree MemberPosted 10 years ago

It’s not illegal

There is no fiscal harmonisation across Europe

Some countries like to compete on the basis of low tax rates

Companies “locate” to those placesThis is what wee eck wants to do in Scotland among other things

olddogFull MemberPosted 10 years agoteamhurtmore – can you post a link to the ONS stuff on income inequality please

teamhurtmoreFree MemberPosted 10 years agoWill do, but ONS website is playing up on my iPad at the moment. Will post it when I can.

deadlydarcyFree MemberPosted 10 years agoReally, who gives a shit about income inequality thm? Tell us about wealth inequality? Who’s got all the dosh? Does anyone even know where it’s stashed? Can we even believe te income figures for the top earners anyway? How much does Philip Green earn? How much does his wife earn?

Top earners “suffering”. I’d laugh if it wasn’t so unfunny.

binnersFull MemberPosted 10 years agoIt’s a terrible comparison, millions of people depend on RBS, whereas BL made sh*t cars no one wanted. Typical rubbish analyisis you’d expect to see in the papers and why they are losing money as fast a BL did.

millions of people depend on RBS? Surely that just goes to show how utterly dysfunctional our ‘too big to fail’ banking system still is

RBS is/was at best utterly incompetent, and at worst (and IMHO definitely) utterly and completely corrupt! This is why it ended up financially as well as morally bankrupt. If it had a business model worth keeping alive, it wouldn’t continue to haemorrhage tens of billions of (our) cash

What we have here is state dependent socialism for the banking sector. We the taxpayer are acting as de facto guarentors of an insular, self-interested out-of-control system, that seeks only to line its own pockets. RBS is ****ed because in some situations it actually drove businesses to the wall, to profit from it. It actively mis-sold (conned) its own clients, again to profit itself. Theres a whole list of its appalling actions. And they just keep coming. Does anyone think this is the end of it? Seriously?

And we deem this behaviour worthy of state support? FFS!!! It has actively hindered the British economy! And continues to do so. While rewarding the people who do it with utterly obscene salaries and bonuses

And lets not even get into QA?! Whose benefitted from that then?

Capitalism, red in tooth and claw for the rest of us though. Not of this state supported socialism. Everything else, including the NHS, must (and will) be privatised. But th state-owned banks will continue to leech tens of billions per year off us

Capitalism is ****ing brilliant, isn’t it?!

NorthwindFull MemberPosted 10 years agoteamhurtmore – Member

See edit on previous page. Then tell me if income inequality is higher now than in 2007 or lower?

Nope. Instead, I’ll just keep rubbing your nose in the nonsense. Reducing income equality doesn’t mean that

“The top earners are suffering the worst”

. It means that the difference in how much richer they are is smaller. In no way does that equate to the poor souls suffering the worst. It is sickening to suggest it does tbh.

When the top earners stop heating their homes because they’re in fuel poverty, I shall start listening.

teamhurtmoreFree MemberPosted 10 years agodeadlydarcy – Member

Really, who gives a shit about income inequality thm?A lot of people apparently including you judging by the rest of the quote.

Binners you keep blaming capitalism and then citing the opposite. The government owns @80% of RBS. It is effectively state controlled. Similarly, QE is the state (well actually not the state, an unelected body called the BOE) artificially and deliberately depressing interest rates in order to mis-price risk. It’s the antithesis of a free market. Interest rates are artificially controlled by the state (at the wrong price). So you seem to be against state intervention rather than against capitalism here.

teamhurtmoreFree MemberPosted 10 years agoKeep rubbing then, these are two different things as you know. But feel free to ignore the edit, I know it’s a habit. I already accepted that my original wording was open to misinterpretation. But the welcome fact is that income inequality in the UK (end ’12 data, source ONS) was the lowest since 1986. Spin that as you may.

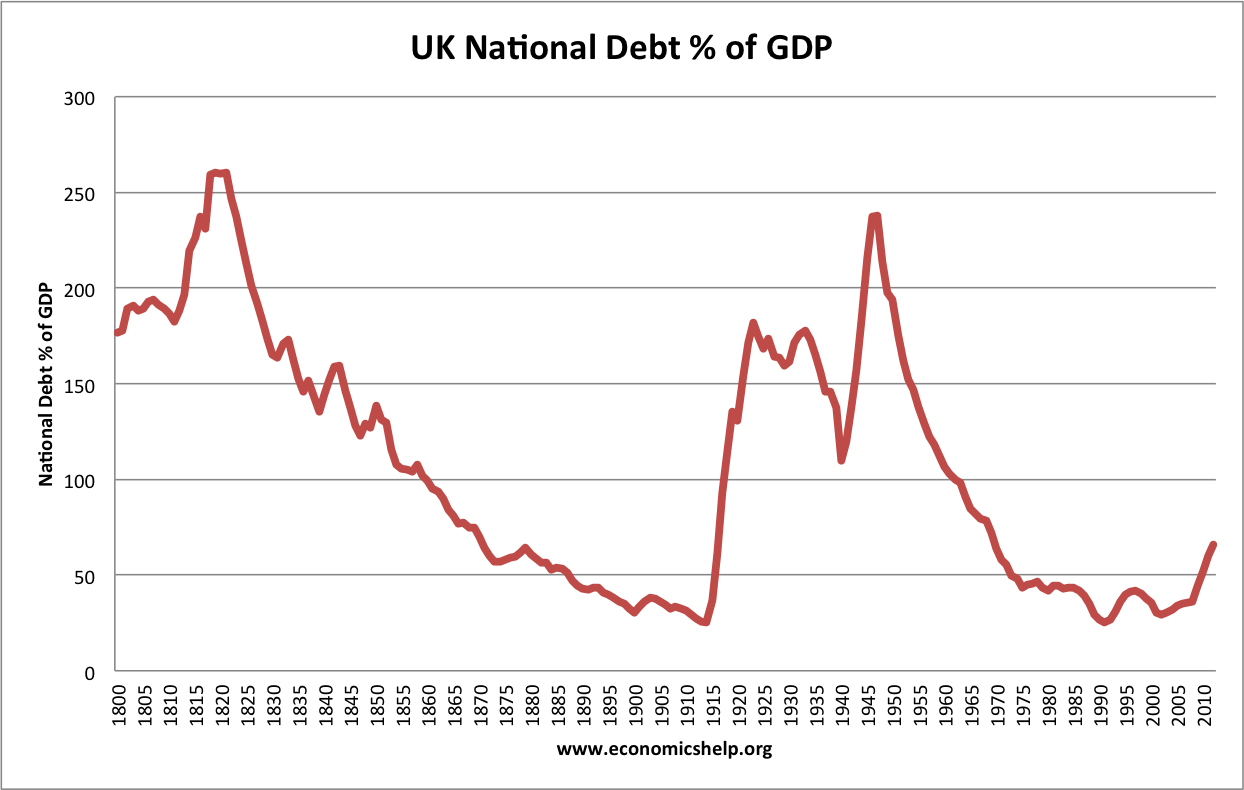

Mud shark that data ignores considerable off balance sheet data and is out of date. But anyway, ask yourself what happens to bring the line shown down – it’s not pretty. We (the UK) stole money off others (we defaulted) and off our citizens (financial repression). Neither make you feel good do they?

binnersFull MemberPosted 10 years agoBinners you keep blaming capitalism and then citing the opposite. The government owns @80% of RBS. It is effectively state controlled.

Erm… thats sort of my whole point

So you seem to be against state intervention rather than against capitalism here

I’m against the organisations that for years railed against state intervention in any way shape or form, then being the biggest beneficiaries of it this country has ever known, by some significant margin. While any other form of state support (i.e. a loan to Sheffield Forgemasters) is absolutely verbotten, as anti-competitive.

And yet, here we go again. Having taken the states handouts (that word doesn’t just apply to benefit claimants eh?) now the banks are back to their lobbying against state intervention – in the form of any regulation or change in the status quo. And, unbelievably for most of us, actually winning!!!! Then you look at the rich, cosy self-interested government elite making the decisions, and its no great surprise

The whole thing would be absolutely laughable, if the continuing fall out wasn’t continuing to wreck our ‘real’ economy. As an economic model, its ****ed!!! A huge state-owned infrastructure, absolutely essential to the entire countries economic welfare, is being entirely run by and for the interests of a tiny elite, to the total detriment of the rest of us – the mugs who are left paying for the truly enormous continuing losses

200% bonus anyone?

teamhurtmoreFree MemberPosted 10 years agoThe sad fact though Binners is that we allowed/encouraged our banks to become too big to fail, to be over-leveraged etc. When push came to shove, there was no option but to support them in the crisis. But I agree with you since then. The regulators have gone soft on leverage, on ring-fencing and on legal responsibility. And now the STATE will sign off £m bonuses in institutions that are destroying value. It truly is incredible.

olddogFull MemberPosted 10 years ago… its ok I found it – very interesting

The effect is both gini index and top v bottom fifth

I suspect the top fifth isn’t really what people think about in terms of wage inequality – it’s household incomes average £78k. This is interesting in two respects – firstly that it is double the average of the next highest fifth, and secondly ONS say it is an average – which I guess is the mean, so is skewed by a handful of mega high earners. I would like to see the distribution within that quintile – I guess a substantial majority of that fifth earn less than the mean the fifth.

Anyway technical stuff aside – wage inequality by the gini index peaked in 2001/02 and has fallen slowly and not consistently since then, but more before the crash than after. But this is after progressive and significant increases from 1977.

So that’s the data – but it does not indicate what is a fair level of income inequality – nor the experience of smaller groupings at either ends or distinct groups that sit with the distribution.

And most importantly it doesn’t indicate the impact of the recession on the lives of individuals – most of my friends are in the top fifth, many haven’t had a pay rise for three years, but they are not struggling as they had plenty some buffer, or delay unavoidable spending. Whereas someone living on the edge who has seen prices (n fuel, food, rent)outstrip a small income growth may be really struggling – despite a closing of the inequality gap – who is suffering?

deadlydarcyFree MemberPosted 10 years agoA lot of people apparently including you judging by the rest of the quote.

The rest of my quote details why exactly I’m not really concerned so much by income inequality – because the figures for the top earners can’t be trusted. I’m more interested in who’s got all the dosh and where it’s stashed. So we can get some of it back off them. Sorry you misunderstood my post – it looked deliberate, not that you’d ever deliberately misconstrue something to avoid answering a question, so it can’t have been, can it?

teamhurtmoreFree MemberPosted 10 years agoBeat me to it olddog.

So that’s the data – but it does not indicate what is a fair level of income inequality – nor the experience of smaller groupings at either ends or distinct groups that sit with the distribution.

Correct it doesn’t. What is a fair GINI coefficient or other measure? Who knows?

And most importantly it doesn’t indicate the impact of the recession on the lives of individuals – most of my friends are in the top fifth, many haven’t had a pay rise for three years, but they are not struggling as they had plenty some buffer, or delay unavoidable spending. Whereas someone living on the edge who has seen prices (n fuel, food, rent)outstrip a small income growth may be really struggling – despite a closing of the inequality gap – who is suffering?

Hence the fact that the political debate has shifted from the economy is screwed to who is benefitting. Given recent trends, it will need to shift at least once more, hence Balls’ comments this week re the budget surplus. Goalposts, goalposts…… 😉

(Deadly, it’s tough when people mix up wealth and income consistently in the same paragraph. Not the same thing are they, so better to be clear)

olddogFull MemberPosted 10 years ago…back to the original point of the post…

GDP up – good? – perhaps. We will see as it plays through and whether it represents sustainable growth.

National (structural debt) debt is not necessarily an issue – what matters is that economic growth exceeds (or at least matches) rate of growth in debt. If it does then, over time, debt falls as a proportion of GDP without necessarily paying back capital, therefore deficit economies are not necessarily bad, although surplus economies obviously better. TBH I would sooner have a Govt re-invest surpluses in measures to stimulate economic growth than repay old debt for this reason.

The problem would occur if there was no-one able to lend money – ie someone wasn’t making a surplus to buy bonds from deficit economies – but I’m not an economist so don’t know whether this is in anyway possible or whether the system will balance.

teamhurtmoreFree MemberPosted 10 years agoIf you believe that governments can and should intervene in the economy, then its not an either or question regarding deficits and surplus. The standard Keynesian model (relevant to Ed Balls) is that you run budget surpluses during periods of positive growth so that you re able to run deficits in period of recession. This, in theory, smoothes the natural cycle of economies.

In the UK we rarely run budget surpluses BUT labour did at one point. Then in the “end of boom-and-bust” hubris of Brown and Balls they screwed up badly by running an increasing deficit at exactly the wrong time, thereby reducing the policy options in the crisis. As a Keynesian economist Balls has admitted as such (see previous speeches to Fabian Society), but not as a politician (see this week). The Tories were as bad in the previous recession to be fair, but there are fewer Keynesians in their camp who would know better!

Before you reduce the stock of debt you have to stablise it and there is simple formula

Public fiscal surplus (PFS) = taxes – expenditure ex interest on debt

The PFS that stabilises debt = the public debt ratio (debt/gdp) x (LT interest rate – nominal LR growth)So the higher the level of debt, the greater the gap that is required between IRs and growth. In the crisis, people started to believe that in some countries the PFS was impossible to achieve since the maths means that governments would need to raise taxes a lot or reduce expenditure a lot and that both/either/or wold have damaged the economies too much.

Of course, if growth > the interest rate on debt, things take care of themselves. At the moment that is not the case, so we need to run budget surpluses of 1-1.5% of GDP just to stabilise our debt. Try doing that in the middle of a slowdown! At least the dynamics are improving slowly.

Also before we give any Chancellor too much grief, just play with the sensitivities in that equation.

olddogFull MemberPosted 10 years ago… but the point I’m making is that if the growth in debt is lower than the growth on GDP, and IR is stable then the position is improving. Debt is not in itself a bad thing, as long as it fuels growth it is how business works as well as economies. As you say, UK, US have been running deficit economies for decades.

Govt do not need to pay down debt, just ensue that money borrowed is invested in an economy that is successful. How you deliver success is the point of debate for me and I tend towards social investment – education, training, research, welfare rathet than austerity measures to cut spending. But it is a valid debate and there is not an empirically proven result.

Apologies if this makes no sense, I’m on my phone and have not got my glasses so it’s a bit blurry to proof read.

ninfanFree MemberPosted 10 years agoBut GDP is by its nature volatile – so when it goes wrong, you find you’re even further in the hole than you were before

Of course – this does not matter if you’ve successfully managed to end boom and bust…

olddogFull MemberPosted 10 years ago… there are indeed lots of other issues , eg is real (ie non-inflationary) indefinitely sustainable . But it is the paradigm within in which public finance operates.

teamhurtmoreFree MemberPosted 10 years agoOlddog – correct debt per se is not a bad thing (see Modigliani/Miller) and if the returns exceed the cost of debt then it can be a good thing. The question however is at what point does the level of debt become unsustainable. Over the past few years there has been considerable debate about this not helped by the errors that were found in the main reference work on the topic (Reinhart and Rogoff)!!!

The challenge in the UK is that debt levels at the sovereign, corporate and household levels have been growing well above GDP for a sustained period – hence this whole crisis is a crisis of too much debt. So the debate now is how do we reduce the level of this debt, at what pace and by how much.

Going back to the suffering point – the scary stat is where this debt is being held (low income groups) and how vulnerable the holders are to relatively small adjustments in interest rates (back to normal “real” levels). Hence the BOE will do all it can to delay raising rates.

somafunkFull MemberPosted 10 years agoInterest rates : ^ that’s the point i’ve heard referenced with regard to the debt crisis, if interest rates were to rise by 1% or 2% then we’d be in a world of pain, It was after reading this article in the guardian that i got to thinking how near the edge many folk must already be.

teamhurtmoreFree MemberPosted 10 years agoExactly, those are the stats I was referring to. Scary reading indeed.

The topic ‘UK economy growing at fastest rate since 2007…..’ is closed to new replies.