I'm sure the way the tale has been spun (corrupt Greece) doesn't help with that.

Not only that, the way the Greek government has behaved over the last 6 months is bizarre, they've gone out of their way to insult all their lenders. If Germany held a referendum on whether to just let Greece sink, I'd bet it would be 60% Yes, let Greece go **** itself.

The European project is still evolving.

Evolving?

😆

Nice choice of word. I'd say 'imploding' is presently more applicable.

[url= http://www.theguardian.com/commentisfree/2015/jul/03/greece-referendum-euro-destroying-european-dream-deficit-fetishists ]Very interesting articla about how the single currency is destroying the entire ideal of Europe[/url]

[quote=footflaps ]The Euro project was never about economics it was a Political project driven by a fear of another WWII in Europe.

Originally. Originally it was just a trading zone without any economic integration. Whilst the original threat has gone (though the current situation isn't exactly providing the best platform for sustained peace - is anybody involved paying any attention to history here regarding the required conditions for war?) other political aims have taken over - to a large extent the EU is now an organisation which is mainly about sustaining and growing itself rather than anything which benefits individual people.

Though I'm sure it helped that the strongest and largest countries involved benefited from the economic side effects.

Not only that, the way the Greek government has behaved over the last 6 months is bizarre

Not really bizarre - Tsipras had to keep the Left Platform element in Syriza on board. Plus they have been treated appallingly by the troika and its various hangers on, and vilified in the press in every country of the EU, with little nobodies coming out of the woodwork to give their 2 cents.

to a large extent the EU is now an organisation which is mainly about sustaining and growing [s]itself[/s] Germany

FTFY

Nice choice of word. I'd say 'imploding' is presently more applicable.

No journey is ever straight forward though, you always have setbacks. I'm not defending the Euro by any means, but I really don't see this as a nail in the coffin, more like a puncture. They'll patch it up and carry on and in 5 years everyone will be glad they can holiday in Greece for £7.50 as it will return to being a 2nd world country with a 3rd world country government and some nice sunny islands in the Med.

Not really bizarre - Tsipras had to keep the Left Platform element in Syriza on board.

Unless of course you need the very people you're insulting to give you money to stop you staving or diabetics dropping dead in their thousands as you've run out of insulin.

Unless of course you need the very people you're insulting to give you money to stop you staving or diabetics dropping dead in their thousands as you've run out of insulin.

I guess it never occurred to the Greeks that their lenders would literally sacrifice lives just because they didn't like being called names. Is that really the calibre of people we're dealing with?

binners - Member

Irrisponsible lending.

Aye, well, that depends on how you look at it. Are you the one that's chasing for the loans? Or are you the one that's benefited from the loans to Greece, and have now transferred your money out of the country? Or are you the masses left in Greece to looking at a massive bill.

Guess it depends on where you are on that (very simplistic)chain how irresponsible the lending looks.

That 39% voted to go with what the banks wanted tells a story, imo.

Greece is just an extreme version of what's happening all over Europe i reckon, debt transfer. It's just a battle now for who foots the bill, and I guess we all know ultimately who that will be.

Is that really the calibre of people we're dealing with?

Did you mean the Greek government who is happy to sacrifice lives to prove a point / save their reputation?

Most of the large payouts were from the US Treasury, so nothing to do with Europe.

eer --selective memory footflapper- uk taxpayers, ie us had no choice did we-banks carry on as if nowt has happened --but of course its in all Their intersts for people to swallow that line --there is no alternative to the market, hogwash--its a con trick -banks breed off debt !

[quote=Yanis Varoufakis]austerity is like trying to extract milk from a sick cow by whipping it

class

eer --selective memory footflapper-

No, we bailed out the UK banks, but the US Treasury spent far far more bailing out US banks with absolutely no strings attached.

footflaps - Member

Most of the large payouts were from the US Treasury, so nothing to do with Europe.

They set up 'extraordinary accounting controls' and then printed stacks of cash, IIRC. Money from thin air.

And it was nothing to do with Europe, this Global crash?

banks breed off debt !

True, that is one of their main functions.

The Euro elite need to wake up fast to the simple fact that fiscal stabilisation is a critical part of a currency union especially in combatting the loss of FX flexibility. Fiscal risks HAVE to be shared across the union otherwise it is doomed to failure.

Did you mean the Greek government who is happy to sacrifice lives to prove a point / save their reputation?

You've got that a bit mixed up. It's not the Greeks who turned off the money taps and prevent the purchase of insulin, it's the EU intent on showing who's the boss.

footflaps - Member

Most of the large payouts were from the US Treasury, so nothing to do with Europe.They set up 'extraordinary accounting controls' and then printed stacks of cash, IIRC. Money from thin air.

And it was nothing to do with Europe, this Global crash?

The OP on the bailouts was inferring that given the banks were given loads of cash why moan about giving loads of cash to Greece. My point was that most of the cash given to banks came from the US Treasury who doesn't consider paying for Greek's early retirement a primary objective.

My point was that most of the cash given to banks came from the US Treasury who doesn't consider paying for Greek's early retirement a primary objective.

Only the American banks, ff.

All I'm trying to say, ff, is: lets apply the same rules here as we did for the banks when they came to us, cap in hand.

To do anything else is hypocritical at best, callous at worst.

You've got that a bit mixed up. It's not the Greeks who turned off the money taps and prevent the purchase of insulin, it's the EU intent on showing who's the boss.

The Greek government chose to play brinkmanship with the Troika. They didn't have to, it was their choice. They put their egos before the peoples well being. Holding a gun to their own head and saying 'give me more money or I'll shoot' is a very unusual negotiating tactic. All the EU have said is 'have a few days to think about it'.

But the EZ have been pouring money into the Greek banks to keep them afloat. Problem as we all know is the Greeks can't print their own money, so are reliant on the EZ.

.....with little to no requirement for them to change business practices so far:

That isn't true, see the new FCA rules coming in 2019 requiring ring fencing of high street from investment arms of the banks.

We live in a world of multinationals. I doubt trying to pin this down to a country is worth the effort.

dragon - MemberThat isn't true, see the new FCA rules coming in 2019

My point exactly 🙂

Crisis was, what, 2008, '09? 10 years without reform? You couldn't make this up!

All I'm trying to say, ff, is: lets apply the same rules here as we did for the banks when they came to us, cap in hand.To do anything else is hypocritical at best, callous at worst.

Except they are totally different scenarios. The 2008 crash came out of nowhere and in a panic the banks were recapitalised at the tax payers expense in a matter of days fearing a global banking meltdown (a bit like Greece now, but in every western economy at the same time).

The Greek problem has been a long time coming and they've had plenty of opportunity to try and do something about it. Every reforming commitment they have made they failed to implement. Thus the ECB started QE which effectively isolates the Greek tragedy from the rest of Europe. If Greece implodes Portugal, Ireland and Spain will be fine, the ECB will just buy their bonds. This is just one country, who expects every else to take the blame for their profligate spending and then carry on giving them free money.

The Greek government chose to play brinkmanship with the Troika

In fact they didn't - they simply stated what is in fact clear - that the situation is untenable. The rest is the thrashing of the tail of the wounded lion.

The 2008 crash came out of nowhere

😉

codybrennan - MemberThe 2008 crash came out of nowhere

Hindsight is a wonderful thing, but I don't recall you shorting all those stocks and making a killing from it?

Crisis was, what, 2008, '09? 10 years without reform? You couldn't make this up!

Again not true for instance Basel III rules on capital, but don't let that get in the way of believing what's written on Facebook.

This thread is rather similar the the scenario as it's bening played out in the news: determined side-taking, over-simplification and blaming everyone else.

Let's face it, the component parts of this issue are all out there for everyone to see. And, if we really want a condensed version: politics, money, power, hands in the till.

Crisis was, what, 2008, '09? 10 years without reform? You couldn't make this up!

Indeed, so as Dragon pointed out, good job that this is not the case.

rudebwoy - MemberMost of the large payouts were from the US Treasury, so nothing to do with Europe.

eer --selective memory footflapper- uk taxpayers, ie us had no choice did we-banks carry on as if nowt has happened --but of course its in all Their intersts for people to swallow that line --there is no alternative to the market, hogwash--its a con trick -banks breed off debt !

All I'm trying to say, ff, is: lets apply the same rules here as we did for the banks when they came to us, cap in hand.

https://en.wikipedia.org/wiki/Lehman_Brothers

We've (well the EU/Germany) done exactly the same this time. The debt was held by banks, the banks have the publics assets so weren't allowed to fail, thus they were bailed out to protect the publics savings. Where the banks had no "high street" operations they weren't bailed out. Greece hasn't been able to afford it's repayments for years hence all these bailouts which have effectively transferred the loans form banks to the ECB.

There is no easy way out for them, money can't continue to be thrown into Greece, that'll lead to inflation/devaluation of the Euro, if Greece collapses that'll lead to inflation/devaluation of the Euro.

Presumably some clever fininacial wizard at the ECB has now worked out that even if Greece defaults it won't completely ruin everything around it any more than continuing to print money to give them will do and the bailouts can stop.

You've got that a bit mixed up. It's not the Greeks who turned off the money taps and prevent the purchase of insulin, it's the EU intent on showing who's the boss.

So the Greek government has nothing to do with the problems in their country? At what point do they have to start taking some responsibility for their actions?

Is that the new finance minister? Might make more sense than the last one.

debts have and can be written off when it suits--err germany was forgiven all its debts so that it didn't go 'communist'----the present greek govt were elected as a result of incompetence/corruption of the previous regimes--shold they be held responsible for all their actions ?

the wealthy oligarchs of greece -the shipping dynasties are unaffected by any of this, just like camerons friends here when the wind blows cold for ordinary people ,so until Syriza find a way of making them types pay , they will always have this problem of wealth distribution -but at least they are showing that it is possible to do things other than by bankers blackmail..

Presumably none of this is at all the fault of Germany then?

If you were running a bank and somebody came in to ask for a personal loan, you asked them what for and they replied 'to pay my bills for the next year' would you lend it them?

Oh... hang on a minute.... thats not just Greece. I've inadvertently just summarised the problem with every single western, neo-liberal, capitalist economy, haven't I?

Sorry 😳

Is that the new finance minister? Might make more sense than the last one.

Well, since he said at the first meeting what it took the IMF 5 months to catch up with, your comment seems a little misguided.

footflaps - MemberThe Greek government chose to play brinkmanship with the Troika. They didn't have to, it was their choice. They put their egos before the peoples well being.

The other option they had, was to cave, and accept a deal which one of the 3 legs of the troika accepts was unsustainable and therefore pointless. The deal on offer is fundamentally the same as the last one- the shaft today, so you can come back to the table in a worse condition in a couple of years.

debts have and can be written off when it suits--err germany was forgiven all its debts so that it didn't go 'communist'

Not strictly true

The other option they had

was to actually follow through on some of the reforms they'd promised to and actually collect tax / sell off some assets.

They've basically been spinning their wheels for the last year hoping someone will just keep throwing free money their way.

Oh... hang on a minute.... thats not just Greece. I've inadvertently just summarised the problem with every single western, neo-liberal, capitalist economy, haven't I?

I thought it was the difference between:

"We're in a hole but we've got this plan here and here to get out of it by doing this and this, we just need some support in the mean time"

and

"We're in a hole, but we're not going to make any hard decisions to sort it out, just give us more money please thx"

.. but I've not been watching that closely...

https://medium.com/@gavinschalliol/thomas-piketty-germany-has-never-repaid-7b5e7add6fff

^^^ French Professor at the Paris School of Economics

Absolutely not. This is neither a reason for France, nor Germany, and especially not for Europe, to be happy. I am much more afraid that the conservatives, especially in Germany, are about to destroy Europe and the European idea, all because of their shocking ignorance of history.

I will be voting no come the referendum I think. The dream is dead.

Screw the EU, I will be voting no come the referendum I think. The dream is dead.

Luckily they might be asking more than just you to vote!

I thought you were a Zionist Tom, I I am guessing the EU dream doesn't fit the Zionist ideals

Screw the EU, I will be voting no come the referendum I think. The dream is dead.

Have you noticed how Nige and his chums on the Tory backbenchers have been pretty much silent through all this? They're happy watching Merkel and Hollande do their campaigning for a NO vote for them. Far more effectively than they could ever manage.

Cheers!

Luckily they might be asking more than just you to vote!

Of course.

[quote=binners ]Have you noticed how Nige and his chums on the Tory backbenchers have been pretty much silent through all this? They're happy watching Merkel and Hollande do their campaigning for a NO vote for them. Far more effectively than they could ever manage.

They've been doing a fantastic job haven't they? On the plus side, you'd think this would result in them giving some more concessions to CMD to try and encourage a Yes vote. On the minus side they've shown what intransigent bastards they are, so the likelihood of any concessions is low. I guess that means we're leaving? Not sure any more whether to feel happy or worried about that. I think as NW admitted above, I'm a fan of European integration and free trading, but not in the current form - though fall a bit more on the side of the correct answer to that being to leave.

On a more immediate note, Gideon will be using the Greek tragedy as justification for making the poor poorer and ramping up his Austerity rhetoric in advance of his child poverty special budget (he intends to have all children live in poverty by 2020).

On a more immediate note, Gideon will be using the Greek tragedy as justification for making the poor poorer and ramping up his Austerity rhetoric in advance of his child poverty special budget (he intends to have all children live in poverty by 2020).

Yup, I don't see Germanys obsession with austerity being good for the left here. Can't quite believe Scotland wanted to leave the UK and align themselves closer with Europe.

Yes thank **** the tories are fighting against this tidal wave of austerity.

[quote=footflaps ]On a more immediate note, Gideon will be using the Greek tragedy as justification for making the poor poorer and ramping up his Austerity rhetoric in advance of his child poverty special budget (he intends to have all children live in poverty by 2020).

Now I'm confused. Are you in favour of austerity (Greek style) or not?

Yes thank **** the tories are fighting against this tidal wave of austerity.

🙂

Yes thank **** the tories are fighting against this tidal wave of austerity.

Not quite sure what the point of your sarcasm is here, as footflaps pointed out it's only going to embolden the right.

FF, Why would he want to do that?

Sadly unless the € elite show mettle and leadership in demonstrating an orderly solution for Greece (part if EU but without €) then the loony sections of the European debate will have a field day.

Hopefully, we will have some sensible proposals (3-tiers?) or simply back to the original notion before we have to out one to paper here.

Now I'm confused. Are you in favour of austerity (Greek style) or not?

Austerity isn't the root cause of the Greek problem and ending it wouldn't solve any structural problems, just allow them to carry on living above their means ie prolong the day of reckoning.

Austerity isn't the root cause of the Greek problem

Yes, it really is, they clearly need other reforms, but the austerity is crippling and very much the root of the problem.

Nope, the problem lies well beyond austerity, although ironic than an anti-austerity party is actually proposing a (less than previously) austere solution in the midst of a crippling econimic downturn, whereas a so-called austerity chancellor is doing nothing of the sort.

Funny old world!

Double post

ninfan - Memberdon't worry Sundayjumper - Ernie has a lob on for all things Argentine, particuarly Mother Christina. not long back he was regaling us with tales of the Argentine economic miracle, and how her central planning had led them to become the fastest growing economy in the world...

Posted 9 hours ago

Your capacity to talk shite and to shamelessly spout lies is quite frankly astonishing Z-11.

Do you use Richard Littlejohn as your role model ?

But of course you do make it up, time after time, like a veritable lie machine. No surprise there.

ernie_lynch - MemberI am not offering Argentina up as an example of an "economic miracle", there is no such thing as an economic miracle, despite the fondness capitalism's cheerleaders to constantly offer us examples of "economic miracles", which btw always end up in tears.....remember the economic miracles which were Greece, Italy, Japan, Ireland, Iceland, etc ?

Argentina will have problems in the future, it is still fundamentally a capitalist country, and capitalism is always fundamentally flawed - however much you tinker with it.

Posted 3 years ago

http://singletrackworld.com/forum/topic/with-austerity-biting-hard-across-europe#post-3433403

It's like your mam threatening to tan your hide on the count of three if you don't come in on time or something.

Germany/EU/IMF/CEB- "Greece, get in here now or I'll tan your hide for you"

Greece- "No. I'm fed up of having to come in on time, you're just so bossy all the time. You think you own the whole world."

Germany/EU/IMF/CEB- "Don't make me count to three. I'll make you leave the Euro if you make me count to three."

Greece- "Not listening to you any more. You're just a big, fat bully. I remember when you were poorly a while ago and I helped you out."

Germany/EU/IMF/CEB- "One... two... Are you listening to me? Don't make me count to three mind. Two and a half..."

Greece- "Whatever. I hear the Drachma is nice this time of year. Ouzo?"

Germany/EU/IMF/CEB- "I'm warning you. Two and a half... two and three quarters... two and four fifths... two and five sixths..."

etc.

Interesting article in yesterdays Guardian about [url= http://www.theguardian.com/commentisfree/2015/jul/06/greece-euro-unanswerable-austerity-democracy ]the Greeks are exposing just how fundamentally undemcratic the EU presently is[/url].

I notice how Merkel had a meeting with Hollande to make it look like Germany wasn't acting unilaterally when it does whatever its about to do. Nobody else was invited though. Apparently there are 28 countries in the EU. I believe they'll be asked along to stand outside the parliament building in Brussels for their photo op later this week, before they rubber stamp whatever it is Germany has decided.

Democracy? Yeah, right. What a ****ing farce!

Even by Cameron's standards this is vile:

http://www.theguardian.com/uk/2012/jul/03/david-cameron-immigration-greece-uk?CMP=share_btn_tw

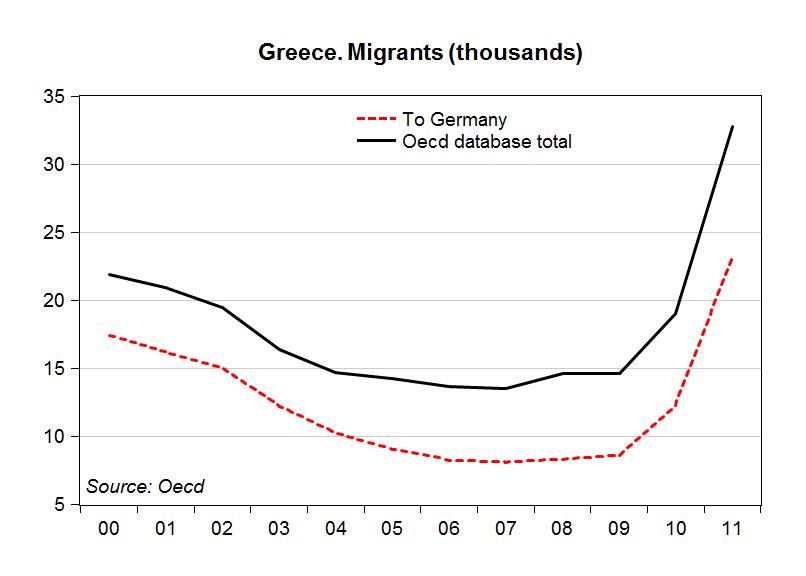

I was thinking about this .... In theory, couldn't the entire population of Greece just move to Germany and start claiming benefits?

Democracy? Yeah, right. What a ****ing farce!

OK, but if all 28 countries held a Referendum on whether to stump up more cash for Greece, do you think you'd get a Yes? I'd bet on No. As STW's offical German Apologist, I suspect Merkel's decision is in tune with German sentiment, so not that undemocratic.

I was thinking about this .... In theory, couldn't the entire population of Greece just move to Germany and start claiming benefits?

Then I would move to Mykonos and claim sovereignty.

In theory though, under Europes freedom of movement rules - which the Germans have said all along are absolutely sacrosanct - any Greek (and therefore EU - for now) citizen could move to Frankfurt or Bonn and start signing on?

DrJ - MemberEven by Cameron's standards this is vile:

http://www.theguardian.com/uk/2012/jul/03/david-cameron-immigration-greece-uk?CMP=share_btn_tw

I liked Osborne's line in the budget too- we've got to cut corporation taxes, cut inheritance taxes, cut the BBC, inflict more debt on students, cut the benefits cap... Because otherwise we'll end up like greece.

I suspect Merkel's decision is in tune with German sentiment, so not that undemocratic.

Turkeys in not voting for Christmas shocker.

In theory though, under Europes freedom of movement rules - which the Germans have said all along are absolutely sacrosanct - any Greek (and therefore EU - for now) citizen could move to Frankfurt or Bonn and start signing on?

yep, they could also come to the UK!!!

I was thinking about this .... In theory, couldn't the entire population of Greece just move to Germany and start claiming benefits?

Didn't the Greek government stated they'd actively start encouraging people to do so?

if that programme I caught on channel5 last night is anything to go by, it'd be much easier to move to UK to sign on, than Germany.

/foxnewsdailymail

Well, exporting the unemployed has worked for Lithuania to the extent that Red Daria the Stalinist Moll now presumes to give advice to others, so maybe it's a solution, of a sort.

So the economy that even the IMF says has totally unsustainable debts it has no chance of ever paying back, has been lent yet another 80 billion, with no write off of existing debt, and the samw conditions as the countless previous loans/bail-outs?

All in return for the same series of reforms, privatisations, and conditions they've been sayin they were going to implement for the last 5 years, but haven't.

The can gets hoofed down the road for another few months, until it all starts all over again. 🙄

Totally agree this is another can kicking agreement. And considering what's been agreed, what the hell was the point of the referendum last week??? Can't see Tsipras being that popular with the masses.

Not exactly. The new deal includes the specific programme for the pillage of the country:

"valuable Greek assets will be transferred to an independent fund that will monetize the assets through privatisations and other means"

so, given that the economy cannot recover (as every economist agrees) the result will be a gradual (or sudden) return to the stone age, with all cultivable land owned by Germany and no industry of any sort remaining. An inspiring achievement.