Home › Forums › Chat Forum › Brexit: Low Pound, FTSE at record levels.

- This topic has 23 replies, 17 voices, and was last updated 8 years ago by flixton29ss.

-

Brexit: Low Pound, FTSE at record levels.

-

thekingisdeadFree MemberPosted 8 years ago

Is anyone considering changing / cashing in some of their share holdings before what appears to be a hard brexit kicks in next year?

Thanks to company saving schemes etc Im now amassing more & more shares in a single company (which I acknowledge brings its own risks) and am now wondering whether now is the time to cash in and remove some risk from my holding.

footflapsFull MemberPosted 8 years agoDepends on how much you think the stock price will be affected by a hard Brexit, which is still more than 2 years away. The large oil / tobacco / pharmaceutical companies will be pretty unaffected as they have such an international market.

The high values are a bit deceptive, in $ terms they haven’t changed at all, do you’re not selling at a high now, just a low in the £. The long term purchasing power of your money hasn’t changed much.

donaldFree MemberPosted 8 years agoLeaving Brexit to one side I would never recommend having too many eggs in one basket so yes, I would diversify.

just5minutesFree MemberPosted 8 years agodepends if your holding is in a company that earns most of its income from overseas operations.

If so then holding on to the shares might be a good thing – if the £ weakens further then profits *may* rise depending on where the operations are and where any raw materials are procured.

If the shares are in a UK listed company that imports a significant volume of raw materials I’d think twice.

The future probability of tariffs is worthy of some consideration – but in many cases the likely tariffs for UK producers coupled with devaluation of sterling will steal mean goods offered for sale overseas will be cheaper in the future than they were 12 months ago in relative terms… so exports **may** be ok.

Also agree on above point re: eggs in basket.

thekingisdeadFree MemberPosted 8 years agoDepends on how much you think the stock price will be affected by a hard Brexit, which is still more than 2 years away. The large oil / tobacco / pharmaceutical companies will be pretty unaffected as they have such an international market.

Good point, thanks. International company so probably less affected than others, although leaving the trade union, as appears to be the way ‘we’ are going will obviously have implications.

Trade in $ too so the weak £ will have a positive effect (in the short term).re: eggs in basket, its always my plan to diversify, just a matter of *when* 😕

tthewFull MemberPosted 8 years agoThanks to company saving schemes etc Im now amassing more & more shares in a single company (which I acknowledge brings its own risks)

You’ve answered you own question there IMHO.

I recently took out all my company shares, (which have been steadily falling for 5 years due to the way the German energy market has been interfered with to some extent) and put the value in an overseas stocks and shares ISA. Every single other of my colleagues decided to keep them until ‘they go back up again’ Time will tell who’s right, but I think mine is the less risky decision.

jonbaFree MemberPosted 8 years agocompanies in the FTSE100 might not be that affected by Brexit since in general they are global. If the pound drops in value then the share eprice may yet increase as they become cheaper options for foreign money.

At this point diversification is generally the best policy as no one knows for sure what the long term situation will be globally.

Sure someone will be along to tell you to buy gold soon though.

reluctantlondonerFull MemberPosted 8 years agoThe counter-intuitive point of view – as elegantly articulated by Koch in the book of the 80/20 rule – would be to double down at the moment and go deeper into what you’re into (assuming it is working).

Whatever you do, don’t forget to continue to rail with incandescent rage at the politicians and t**** (like Jamba of this parish) who have landed us in this ridiculous and unnecessary position of impending recession and legitimised xenophobia/racism/imperialism/traditionalist/fixed mindset thinking.

There again, it might be an opportunity to show the Brexiteers what it means to take back control – take back control as best you can of your own finances.

As opposed to take back control of our country from a democratically elected parliament in Europe, and hand it to an unelected prime minister with no mandate for the changes she proposes to make. And that will likely be waved through by an unelected upper chamber (and which is even less likely to be democratically reformed now that the country is lurching to the right).

I’m not sure what drugs you would need to be on as a person in the street to see the situation we are now facing as being more in control than we were. Mind you, they’d be good drugs. And they’re the sort we’ll need to get through the shitstorm ahead of us. Ho hum.

mikewsmithFree MemberPosted 8 years agoI thought standard advice was you have never had it so good, enjoy the good times and make lots of money…

P-JayFree MemberPosted 8 years agoreluctantlondoner – Member

There again, it might be an opportunity to show the Brexiteers what it means to take back control – take back control as best you can of your own finances.

This is one element of ‘Brexit’ that bothering my ego a bit – in work we’re working harder than ever to grow and become more profitable, we’re flat out ‘doing the biz’, knowing that this impending storm is coming – there doesn’t seem much to stop it, which is odd because I feel that if another vote was taken today, it would go the other way, but it seem that our new unelected PM is hell bent on ‘Brexit means Brexit’ despite her being in the remain camp – I suspect she knows it’ll be a shit show, but the Tories see this as an opportunity to kill UKIP forever, either we all go down in flames and there’s a backlash against anti-EU feeling, or it’s not so bad and there’s no point in UKIP anymore which I get a sense of anyway – I don’t see this 1 MP party lasting past 2020.

Anyway, rant over – no the thing that bothers me – work our arse off, weather the storm, avoid disaster and what we will get from the Leave Brigade? “Told you so”. The self-destructive, egotistical part of my brain it sort of hopes we all end up bankrupt.

reluctantlondonerFull MemberPosted 8 years agoP-Jay – I hear you – and sympathise. You’ll see clearly enough from my post what side of the argument I was on, and the upset I feel at May and the lickspittles who have landed us here is growing rather than diminishing.

My wife is an immigrant – who I might say paid handsomely for the privilege (circa £7k – not that you ever see that in the Daily Wail) – and yesterday we got sucked into an argument with a pro-leaver who banged on about immigrants. I pointed out he was talking to one and he responded: “No, you’re fine, you’re just like us.” In other words white and with English as a first language. It upsets me so much that we are retreating to petty nationalism and insularity when we should be more open than ever.

We will leave the UK in due course as it is no-longer somewhere we want to be or part of (not to mention the havoc Brexit is already causing our industry) and I feel awful for the remainers who will be left behind in reduced circumstances, but the leavers, well, I hope your path is paved with nails and broken glass.

Ro5eyFree MemberPosted 8 years agoYou’ve answered your own question re diversification.

Brexit has really only highlight your situation and helped you out a little… but really, in my eyes, it’s got little to do with whether you keep the shares or not

You WORK for this company …. So the HEN is in the basket along with lots of eggs 😆

I always sell my company shares asap.

GreybeardFree MemberPosted 8 years agoMy guess is that the FTSE will fall again at some point, so I’m contemplating selling half my FTSE tracker funds. What they’re worth in dollars isn’t the point; with interest rates as they are, I need to get the best value out my retirement pot. I generally believe in choosing investments and leaving them alone, minimizing fees, but these are not normal times.

our new unelected PM is hell bent on ‘Brexit means Brexit’ despite her being in the remain camp

Based on her recent speech, I don’t think she was really a Remainer – she knew DC wanted her to says she was, so she waited until she thought his side were going to win and then said she was.

The counter-intuitive point of view – as elegantly articulated by Koch in the book of the 80/20 rule – would be to double down at the moment and go deeper into what you’re into (assuming it is working)

I haven’t read the book, but I thought the point was doubling down after a fall in price, not at a possible peak?

this ridiculous and unnecessary position of impending recession and legitimised xenophobia/racism/imperialism/traditionalist/fixed mindset thinking

Agreed

reluctantlondonerFull MemberPosted 8 years agoI haven’t read the book, but I thought the point was doubling down after a fall in price, not at a possible peak?

There is definitely nuance in the book and you’re assumption is on the right track – but the principle he espouses is that balanced portfolios and diversification dilutes returns. It’s provocative and interesting. Correct? No idea!

thecaptainFree MemberPosted 8 years agoHaving a large holding in the company where you work is a bad move in terms of risk – if the company goes belly-up you lose your job and savings together. A diverse range of investments is widely agreed to be the best choice. As for brexit, well where else are you going to put your money anyway? It’s not like bank accounts give a useful return, and buying property is probably lots more hassle and risk (though having some shares that include some exposure to property is sensible enough).

surroundedbyhillsFree MemberPosted 8 years ago

Not good for usin general, but then I’m in the tourism business so good for some..

teamhurtmoreFree MemberPosted 8 years agoTitle is deceptive as you are not talking about FTSE

As others have noted, rise in FTSE and fall in are directly related due to number of companies with £ revenues and £ costs. This will continue but with frequent ST corrections. One may be due soon for the traders

Sounds like your issue is much more about risk of exposure to one company. Always worth considering diversification of risk. Plus have you wrapped it up into a sensible structure e.g. ISA?

Do you need cash? If so average out over next month i.e. Sell bits on strong days

jambalayaFree MemberPosted 8 years agoDepends on your views and whether you see Brexit as a huge global opportunity or doom and gloom for the UK

FTSE 100 is up as index is doninated by companies with global businesses generally conducted / measured in USD. As such weak £ / $ makes share price go up as thats in £. If you look at smaller companies outside 100 you may find better value. If you are negative on UK you can look at investments in international companies, not a recommendation but an example BP which is a UK stock with very little to do with the UK economy

To answer your specific question I personally have been bringing money back into the UK previously

invested in Asia. I am more bullish now than before. I have been very negative on Europe so have very little invested there and that won’t change.Making investments is complicated by all the QE and other government reaction to financial crises which have distorted the markets and made real “value” very hard to find

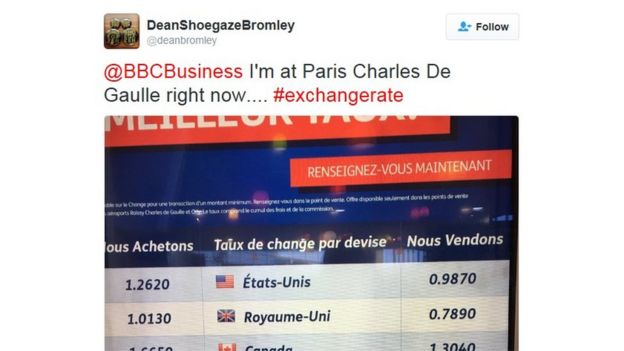

jambalayaFree MemberPosted 8 years ago@surrounded – Govt has made comments about airport fx rates which are robbery and no relation to market rates. Time for a state owned FX franchise I’d say, maybe a “review” of licences or an full “audit”. They areally are taking the p.ss as rate should be 1.06 / 1.16

FX companies are well aware of flight schedules and arrival / departure hall relative pricing and shade rates accordingly

footflapsFull MemberPosted 8 years agoAirport FX rates are poor mainly because the cost of having a booth in an airport is expensive, which is why there are very few real deals (if any) in ‘duty free’ shops in the UK.

Also, the ‘true’ FX rate is only available to large institutions converting large sums electronically. You’d never expect to get that will a handful of crumpled notes and some loose change, which is basically what the tourist at an airport is doing. I’d expect to get 10% worse just for converting cash.

mikewsmithFree MemberPosted 8 years agoFTSE 100 is up as index is doninated by companies with global businesses generally conducted / measured in USD. As such weak £ / $ makes share price go up as thats in £. If you look at smaller companies outside 100 you may find better value. If you are negative on UK you can look at investments in international companies, not a recommendation but an example BP which is a UK stock with very little to do with the UK economy

It is up because at this moment the export market is good mostly because the £ drop is as you say good for exporting UNTIL the imported raw materials and enablers such as oil kick in at which point it’s a hit on most steps of the process.

As winter kicks in and energy demands increase (imported oil, gas & coal or at lease $ traded commodities) things start to go up. That leads to a cost of living rise so even if exports pick up will it be enough to offset the rise in cost of living for the workers or the cost of production for the companies. Do we have enough businesses set up to export or manufacture internally?In the end even that mini or nissan made on shore will cost more in real or effective terms or probably both.

Working for a company who has to deal with some volatile currency rates at times it’s crap. We have a product that is significantly impacted when stuff goes up to the point we can be priced out of a market or we all have to take a massive cut at times.

spin it all you want but very few people in business agree with you.

As a bonus to me I can buy some more stuff from UK reatilers before they have to put their costs up (nothing I got from CRC/Wiggle/Morvelo/Rapha in the last 12 months was produced in the UK)

chewkwFree MemberPosted 8 years agomikewsmith – Member

spin it all you want but very few people in business agree with you.Fluctuation in the business environment is normal especially during the period of adjustment. Business should know and expect those sort adjustments. Most of those that complaint haven’t had it so good for so long, hence become much more concern about their ability to compete or cope.

mikewsmithFree MemberPosted 8 years agoMost of those that complaint haven’t had it so good for so long, hence become much more concern about their ability to compete or cope.

What you mean they knew what was working well and didn’t really want to put themselves at a disadvantage for no real reason other than some right wing loons circle jerk? Who would have thought that.

flixton29ssFree MemberPosted 8 years agoCanyon bikes have gone up, for sure (posting from UK). Pretty gutted, as they make a really sweet 105 clad hybrid I was eying up.

Oh well, back to weekend sale Boardmans I guess.

The topic ‘Brexit: Low Pound, FTSE at record levels.’ is closed to new replies.