MegaSack DRAW - This year's winner is user - rgwb

We will be in touch

So, Gideon is laying out his plans... couple of things that have caught my eye in the build up, the so called 'google tax' and the potential for a big stamp duty change for properties above £250k.

What I've picked up so far;

Global economic crisis of 2008: Labour's fault. Coming global economic crisis: the world's fault

It's be a feel-good statement with less than 6 months till the next election.

The major headline I've seen is "£2bn for the NHS!!!"

Of course the small print says "£2bn will come from other departments within the Health Department"

which is akin to breaking into your kids piggy banks and then acting like you're doing them a favour by giving it back.

25% Google tax.

There's bound to be a way around it. That's something the tax accountants and lawyers will be playing with for a while.

[quote=P-Jay said]

Of course the small print says "£2bn will come from other departments within the Health Department"

Got the source for that ?

World War One debt to be repaid

😯

stamp duty reform. about bloody time...

wwaswas - Member

What I've picked up so far;Global economic crisis of 2008: Labour's fault. Coming global economic crisis: the world's fault

Funny, just heard a labour spokesman telling us that

'Global economic crisis of 2008: worlds fault. Coming global economic crisis: Coalitions fault'

@Pies, the government's confirmed £750m of the "new NHS funding" is old NHS funding moved to a new column in the spreadsheet but I don't know about the rest.

By some accounts, the new funds just close the budget gap created by the government's ongoing NHS funding freeze- NHS costs naturally increase year on year due to demographic and treatment changes but there's been no funding to match that. So if that's the case it's essentially a trumpeted fix, for a hole they've created themselves.

[quote=ninfan]Funny, just heard a labour spokesman telling us that

'Global economic crisis of 2008: worlds fault. Coming global economic crisis: Coalitions fault'

What about the Worldwide "spunking of the nation's finances on vanity projects" crisis™ * ?

* the word crisis is a trademark of The UK Labour Party

[i]25% Google tax.

There's bound to be a way around it. That's something the tax accountants and lawyers will be playing with for a while.

[/i]

Yes, they can't implement it until the G7/Worldwide agreement is in place maybe?

Finally, the Stamp Duty reform seems a perfectly sensible idea. Saying that, in my circumstances, my last house move would have cost an additional £340 under the new rules (£392k house) and given that the average house price is now something like £280,000 (according to Zoopla - England only) I do question how 98% of the population will be better off.

Do 98% own a house. Obviously a "miss speak"

and given that the average house price is now something like £280,000 (according to Zoopla - England only) I do question how 98% of the population will be better off.

I just did some quick sums and a 275k purchase would be ~4k less under the new scheme.

House purchases below £937,000 pay less, above more. By my calc around £499,999 it's the same but then less at 500,000 as you don't have the jumps

Top end stamp duty is up a lot

£1.5m old 5% new 6.25%

£2m old 7% new 7.8%

£5m old 7% new 10.6%

£10m old 7% new 11.56%

£25 old 7% new 12.13%

I just did some quick sums and a 275k purchase would be ~4k less under the new scheme.

Yeah, no doubt they will be better off, but I question that 98% of the population will be.

Do 98% own a house. Obviously a "miss speak"

He was referring to 98% of house buyers

Yeah, no doubt they will be better off, but I question that 98% of the population will be.

BBC says 98% of home buyers.

House purchases below £937,000 pay less, above more.

Hang on, I missed that there is no tax on the first £125k....

Gets calculator back out....

EDIT: I would be £2,160 better off now.

I think the other point of interest is there seems to have been "one in the eye" for Scotland. Northern Ireland will get control of corporation tax (and he hinted perhaps Wales to be announced shortly). However the Scots DO NOT get control of corporation tax just personal tax bands.

The World War 1 debt is a bond (famous in the financial markets and known as "The Warrior") with no maturity (ie it never pays you back principal only interest) which had a historically low interest rate which actually looks high today as interest rates are so low. So it makes sense to redeem it. I am sure there will be many government bond dealers who will be nostalgic for the loss.

Hope none of you guys are trying to buy a house just below 250k or 500k

jambalaya - MemberI think the other point of interest is there seems to have been "one in the eye" for Scotland. Northern Ireland will get control of corporation tax (and he hinted perhaps Wales to be announced shortly). However the Scots DO NOT get control of corporation tax just personal tax bands.

But of course, after all we are better together. And remember, it'd be completely impossible for different parts of the sterling currency union to diverge on fiscal matters 😉

Hope no of you guys are trying to buy a house just below 250k or 500k

But you'd pay the same or less - this is good news (unless the seller decides to jack up the asking price which is very possible)

below 250k is no change or less? used to be 1% every up to 250k, now 2% on the 125k-250k band.

Can someone tell me the new figure on a £300k purchase please ?

The stamp duty thing of 98% better off comes from the Treasury. Does this affect Scotland with immediate effect as they were planning to introduce something similar in April? So presumably this a sop to English voter while sticking it to the SNP at the same time. If you are a Tory win, win.

wooo hooo - stamp dutysaving for me and my buyer. Great news, thanks George!

Can someone tell me the new figure on a £300k purchase please ?

I think it's £4k

EDIT: £2,750.

I am rushing and not thinking.

@weeksy £5k by my calc - first 250k is 2,500 plus 50k at 5% is another 2,500

(I am sad enough to have made a spreadhseet, needs full testing and verification of course 🙂 )

WTF ! That's brilliant !

Woo HOO !!!!

whats the difference on a 325k purchase?

I think the other point of interest is there seems to have been "one in the eye" for Scotland. Northern Ireland will get control of corporation tax

Surely this is to enable N.I. to counter the Ireland corporation tax levels rather than having a go at Scotland?

new tax is 6,250 (vs prior of 6,500 ? 2% ?)

£1250 on first £250k (first £125k is exempt) + 5% on remaining £50k + £3750. (on £300k)

I THINK!

@dragin - yes I think so, I posted that on another thread, I admit I am guilty of a bit of a Scottish wind up ! It is interesting and quite material though, lets see what the SNP has to say

(unless the seller decides to jack up the asking price which is very possible)

Unless

Unless

Good luck with that

Houses at those levels the vendor was at a big disadvantage ... no longer.

Reckon a 5% rise on those properties

Sovereign wealth fund for north of England shale gas proceeds!

That'll upset the anti frackers... 😈

£325,000...

£1,250 + £3750 = £5,000

(basically it's £1250 on first £250k, the remainder is taxed at 5% (but ONLY on the portion over £250k, not the whole amount as before).

@Ro5sey the stamp duty saving is less than 5% but I think you could well be proven right

That'll upset the anti frackers..

and the Scots 😉

What do we reckon about the "google tax"? Seems like an obviously good and fair idea to me, just with questions over practicality... But the question I've not seen answered is, why are we talking about tech companies (and if tech companies, why are amazon mentioned?). I think maybe it's just shorthand (though if it's not just internet why is it a "google tax") but there's other "profit reduction" strategies, as made famous by Starbucks...

[quote=jambalaya ]new tax is 6,250 (vs prior of 6,500 ? 2% ?)

was 3% over 250k so 9750 on a 325k house.

@jambo - its 5% above 250

Party night tonight and going out for a meal now 🙂

@Northwind - yes I'll be interested to see how this works, its talked about as a tech tax but this rule will impact Starbucks too I think as they "artificially move profits abroad"

it was 3% on the whole price over 250k. you now pay £6250 vs £9750 under the previous scheme. £3500 saving is pretty substantial.

Doesn't wind up anyone, just gives ammunition to the nationalists.jambalaya - Member

@dragin - yes I think so, I posted that on another thread, I admit I am guilty of a bit of a Scottish wind up ! It is interesting and quite material though, lets see what the SNP has to say

No Air Passenger duty for kids (u12 intially then u16) - that's good news

Sod's law - moved this summer and would save a fair bit with this new stamp duty. C'est la vie...

Anyway, it'll be interesting to see how the 'google tax' is applied. My understanding is that the companies simply charge their subsidiaries for use of the company name to the value of the profits. If that is somehow limited, I suspect it'll just be something else and we're never going to clamp down on money transfer in itself given that's what the finance industry is founded on.

Sod's law - moved this summer and would save a fair bit with this new stamp duty. C'est la vie...

Actual sale/purchase price will simply shift to reflect the change so I wouldn't lose sleep over any perceived 'loss'.

Im well pleased for my work pal who has been buying a house through the Government scheme and has been royally ****ed about by the Developer to the point where he had to sell his house and move into a holiday home while he awaits completion next week. So as he hasn't completed, I assume he will save £3000 on his £350k purchase?

Robert Peston tweeted;

[i]Here is mind-boggling OBR stat: in 2019 per head spending, without health & educ, £1290 real, down from £3020 in 2010 #AutumnStatement[/i]

That's one hell of a real terms cut in public spending in less than 10 years. More than halved.

and the Scots

Exactly, although I'd rather they started a "UK" wealth fund right now.

Actual sale/purchase price will simply shift to reflect the change so I wouldn't lose sleep over any perceived 'loss'.

Not convinced by that. Houses right on the bands were certainly affected by them (Eg houses went up to 250k and then tended to jump to 265k) but beyond that, I don't reckon so.

For anyone interested, HRMC website has an updated Stamp Duty calculator which will show the new and old rates for a purchase price.

http://www.hmrc.gov.uk/tools/sdlt/land-and-property.htm

if anything, it'll fill that difficult spot between £250k and £270k where barely anything is priced.

[i]its in real terms so inflation adjusted[/i]

it still means we'll be buying less than half of what we could in 2010 though?

I think that's government spending (ex health and education) per head, so the government is going to be spending a lot less. That deficit reduction. I do agree that seems a huge move although with current deficit at £90billion per anum and that targetted to be zero in 4 or 5 (?) years that is £1,500 a head reduction (£90 billion / 60 million people)

Robert Peston tweeted;Here is mind-boggling OBR stat: in 2019 per head spending, without health & educ, £1290 real, down from £3020 in 2010 #AutumnStatement

That's one hell of a real terms cut in public spending in less than 10 years. More than halved.

Now don't you come on this thread where all the greedy little right wingers have congregated to have their W**kfest over stamp duty, stating that there is a price for this bribery to be paid.

That's for other people to pay.

That's for other people to pay.

Yep, the poor, disabled and mentally ill will be paying with their lives.....

You're all talking STW bollox about House prices again.. Sooooooo 1998 chaps.

The most important thing is.. whats happening to :

Booze

Fags

Petrol

??

Everything else can be chatted ad nauseum in the Latte/Frappa/Cappa/Skiinytossingwhatnot high street coffee shop..

Off you go, form a queue 🙄

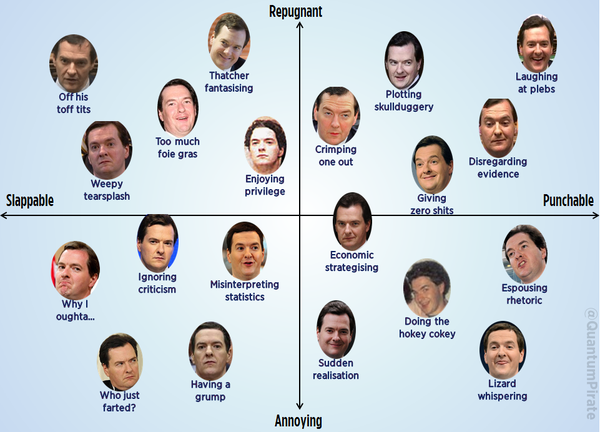

Which makes it all the more concerning that seemingly even he is more popular than Wallace...

@el-bent 68% of people in the UK and 98% of house purchasers will save money, hardly a right-wing w-fest is it ? The top priced properties will pay much more. What we saw today was a big shift in how property is taxed in favour of the lower/middle end.

What Osbourne didn't say was whether this move in stamp duty was revenue neutral. I suspect overall its a tax rise with the extra from more expensive properties being more than the lesser amounts received for more normal properties

How about the air passenger duty ?

As for the poor, Osbourne announced everyone on the minimum wage would pay no tax, this being achieved by raising the personal allowance.

As for the poor, Osbourne announced everyone on the minimum wage would pay no tax, this being achieved by raising the personal allowance.

Why is that a good thing? Increaseing the minimum wage to something that is liveable without the need for additional benefits from the government would surely be a better idea. Every pound that income tax isn't paid on is only worth 20p to the recipient whereas an extra pound onto gross salary is worth 80p.

I've ignored NI to keep things simple but the point stands

Edit .... a better answer has been posted

[i]So even though Stump duty has been made far more progessive and fair.

That's right wing is it ??[/i]

Don't rise to the bitterists Rosey!

[i]Why is that a good thing? Increaseing the minimum wage to something that is liveable without the need for additional benefits from the government would surely be a better idea[/i]

I agree - if the minimum wage needs a government subsidy to make it viable then that's just the rest of us giving employers who choose to pay it a subsidy.

I'd far rather see an unsubsidised living wage paid to people.

And wasn't there something about search and rescue teams being able to claim VAT back?

Apparently he's not actually paying off WW1 debt just changing the type of debt it is...

[url= http://www.forbes.com/sites/timworstall/2014/12/03/the-uk-government-is-not-about-to-pay-off-all-world-war-one-debt-dont-be-ridiculous/ ]http://www.forbes.com/sites/timworstall/2014/12/03/the-uk-government-is-not-about-to-pay-off-all-world-war-one-debt-dont-be-ridiculous/[/url]

Will the reduction in stamp duty just add fuel to house price inflation? Good for individuals buying in the short term, but I think benefit is likely to be illusory very quickly. In fact in economic terms it risks reducing govt income and with the benefit disappearing into something which provides no economic benefit - but will be popular just before an election and that's what counts.

In terms of 50% cut (or whatever) in Govt spending excluding health and education - I haven't checked but I imagine it is what is classified as discretionary spending ie exclude welfare (pensions, benefits etc). Basically police (+justice system generally), local govt, armed forces, social care etc

Rock ,

It's not bitterness (well it is But... ) it the Blinkeredness

They can't see the wood for the trees

Although the exact same, of course, can be said of the hard right.

[i] discretionary spending ie exclude welfare (pensions, benefits etc)[/i]

I expect that welfare is exactly where the Tories are targetting the savings from. Having excluded Health and Education it's the only large pot left to work on.

... I've now checked the OBR report - the big cut in spending tweeted by Peston ie more than 50% in real terms from 2010/11 to 2018/19 is in discretionary spending (DEL in Govt finance speak) excluding health and education. It does not include non-discretionary (AME) spending which increases as a proportion of GDP as the DEL spending decreases as a proportion. AME includes welfare and other stuff that is demand led - ie govt can control the unit costs but not directly the volume. This is a cunning ploy that has been used for years to complicate the Govt spending figures

So it is defence, local govt, police and justice etc that are in for even more of a hammering. I hope no-one in the public sector is expecting any sort of pay rise soon...

jambalaya - Member@el-bent 68% of people in the UK and 98% of house purchasers will save money, hardly a right-wing w-fest is it ?

It's costing £800 million, and doesn't benefit the 32% of people who aren't homeowners- a lot of whom can't afford to be. And no, 68% of people won't save money. 68% of people own property already, they'll only make a saving when they buy a house. It looks like that's in the region of 1.2 million sales per year, though of course that includes buy-to-let, second homes etc.

I approve of making it more progressive and fairer but don't lose sight that it's still a tax cut for people who can afford to buy a house, in an attempt to keep the housing bubble rolling and generate big headlines that don't say "Holy ****! The deficit's double what you promised it would be 4 years ago in one of your central policies!"