MegaSack DRAW - This year's winner is user - rgwb

We will be in touch

At least Robert Maxwell had the decency to throw himself into the sea after he'd raided his employees' pension fund.

I thought Public Sector pensions were paid directly from tax revenue rather than a pension fund.

True, but our payments in vastly exceed our drawings out and are predicted to do so for another decade.

Some are some aren't.

I think jon1973s point is that you can't raid a pension fund that doesn't exist (though that doesn't stop you banking some of the excess income).

but our payments in vastly exceed our drawings out

That's quite a statement. Where's that come from?

I sympathise with anyone seeing their future benefits in the NHS scheme reduced but no way would I compare that to what happened to members of the Mirror Group Pension Fund 😕

www.parliament.uk/briefing-papers/SN03281.pdf

Page 6 if you're interested binners....

Cheers Dr Death. So to summarise: The Tories are trying to **** everyone over by moving the goal posts half way through the game, and in the process ensure that the NHS pension scheme becomes "profitable"

Blimey! A more cynical person than me might jump to completely irrational conclusions, like they were trying to make it look attractive to investors in a run up to privatising it

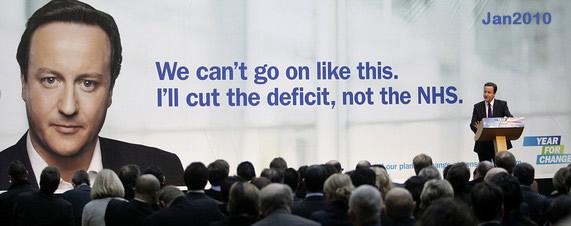

But that could clearly never be the case now, could it? After all....

However, it is worth noting that, as the NAO points out, employer and employee contributions are not in fact designed to balance pensions paid to retired staff in any one year. They are designed to meet the cost of the benefits being accrued by active members. So whether or not an Exchequer top-up is required will depend on the ratio of staff to pensioners

Also from page 6.

In the NHS scheme, it was agreed that the employer contribution should be capped at or just above 14% until 2016, and at 14% after that. Should there be an increase in cost employers will pick up the first part through an increase in contributions up to 14.2%. Any further increase would have to be met by employees either through contribution increases or benefit changes

There's a similar agreement for the teachers' pension scheme, which is also sustainable and self-funding.

The difference is the government is acting in the country's best interests while Maxwell was acting in his own best interests.

You guys in the public sector on an absolute hiding to nowhere if you think for one minute you're going to get any sympathy from the rest of us who face pension impoverishment because we actually have to save for our pension rather than have it gifted to us.

Don't get me wrong, I think that a better pension than you would otherwise get in the private sector is a great incentive for people to work in the public sector.

But when, for example, a teacher retiring from 40 years work in schools can expect a pension of £30k or more get's upset because that's still less than they were hoping for, well pardon me for paying my taxes.

As has been said before on here. To get pension of £30k a year someone in the private sector would have to have a pension pot of around £600,000. Very roughly that's about £9-10k a year, every year.

But when, for example, a teacher retiring from 40 years work in schools can expect a pension of £30k or more get's upset because that's still less than they were hoping for, well pardon me for paying my taxes.

My parents were teachers. Their pension isn't even half of that. Your post is really little more than a series of straw man arguments.

Not this again, when are the public employees going to stop believing in the myth that its a self funding scheme.

The money contributed by the employee and employer simply goes to the gvernment, it isnt ring fenced since Gordon Brown changed the rules.

It is impossible to say its self funding when you have no fixed parameters for what is being paid in v what is being paid out.

I guess the Unions are rather good at spin these days. that or public sector employees are being lazy with their research.

True, but our payments in vastly exceed our drawings out and are predicted to do so for another decade.

So... what happens in ten years time 😯

Divide and conquer at it's best....

Teachers pay Scale (Outside London and SE England):

Scale point

1 £21,588

2 £23,295

3 £25,168

4 £27,104

5 £29,240

6 £31,552

Giving them a pension of 15,750 ish when they retire after 40 years of contributions...... Seems fair to me, you'd need a pot of about 250000 for that or £6,250 a year

Is there a Dr's payscale anywhere?

I'd pretty much guarantee that most dont get paid as much as people think they do.

Not sure about doctors, but they are generally paid less than tube drivers

Runs for cover 😉

So... what happens in ten years time

For the teacher's scheme, it gets even more affordable. There were a raft of teachers took especially-early retirement15 years or so ago when previous changes were made to the scheme. So, for the last 15 years, there's been an unusually high outgoings from the scheme. They're all knocking on a bit now, so...

Not this again, when are the public employees going to stop believing in the myth that its a self funding scheme.

The money contributed by the employee and employer simply goes to the gvernment, it isnt ring fenced since Gordon Brown changed the rules.It is impossible to say its self funding when you have no fixed parameters for what is being paid in v what is being paid out.

I guess the Unions are rather good at spin these days. that or public sector employees are being lazy with their research.

It's not exactly rocket science to do some sums though, is it?

In both the NHS and teachers' schemes there's also a cap in place, which limit's the government's liability in the event the scheme does require more cash in future.

Don't tube drivers get paid in Swiss Francs and golden eggs? And swans?

Not sure about doctors, but they are generally paid less than tube drivers

My friend drives trains on the Bishop Auckland to Darlington to Whitby lines. He's paid about the same as I get for teaching.

So... what happens in ten years time

We'll all explode.

The current crop of politicians wont be here in 10yrs time, so they dont care.So... what happens in ten years time

when are the public employees going to stop believing in the myth that its a self funding scheme

When are people going to stop talking about a scheme in the singular when there is no public sector scheme. There are a number of schemes with vastly different contribution rates, accrual rates and funding processes

Pay for doctors

This page describes the pay for doctors from 1st April 2011.

Doctors in training

Doctors in training earn a basic salary and will be paid a supplement if they work more than 40 hours and/or work outside the hours of 7am-7pm Monday to Friday.

In the most junior hospital trainee post (Foundation Year 1) the basic starting salary is £22,412. This increases in Foundation Year 2 to £27,798. For a doctor in specialist training the basic starting salary is £29,705. If the doctor is contracted to work more than 40 hours and/or to work outside 7am-7pm Monday to Friday, they will receive an additional supplement which will normally be between 20% and 50% of basic salary. This supplement is based on the extra hours worked above a 40 hour standard working week and the intensity of the work.

Specialty doctor and associate specialist (2008) (SAS doctors)

Doctors in the new specialty doctor grade earn between £36,807 and £70,126. See www.nhsemployers.org/sas for more details.

Consultants

Consultants can earn a basic salary of between £74,504 and £100,446 per year, dependent on length of service. Local and national clinical excellence awards may be awarded subject to meeting the necessary criteria.

General practitioners

Many general practitioners (GPs) are self employed and hold contracts, either on their own or as part of a partnership, with their local primary care trust (PCT). The profit of GPs varies according to the services they provide for their patients and the way they choose to provide these services.

Salaried GPs employed directly by PCTs earn between £53,781 to £81,158, dependent on, among other factors, length of service and experience.

Teachers pay Scale (Outside London and SE England):Scale point

1 £21,588

2 £23,295

3 £25,168

4 £27,104

5 £29,240

6 £31,552

Which is interesting, because the official figure for 2009 [b]Average[/b] salary of full-time qualified teachers in the maintained nursery, primary and secondary schools sector was £36,640

So I call bluff on your figures since the [u]average[/u] is a fair bit higher than the top figure you listed(also bearing in mind that a teacher with years of experience and therefore approaching retirement would clearly be on the high side of average rather than the lower side)

Source:

http://www.education.gov.uk/rsgateway/DB/TIM/m002016/index.shtml

Which is interesting, because the official figure for 2009 Average salary of full-time qualified teachers in the maintained nursery, primary and secondary schools sector was £36,640

That pay scale won't include promoted teachers, assistant heads, heads and anyone who get's paid for additional duties. In the same way the the majority of people earn less than the average (mean) salary so it will be for teachers.

Was that too difficult for you?

I was told that the government had been advised not to touch the emergency services(fire service, police, coastguards, prison officers, ambulance service, etc) following the farce they had with the fire brigade. Apparently the NHS replied saying they're not part of the emergency services and will do as they like!

Gonefishin - but the median is higher than that figure too...

Median salaries of full-time employees, selected occupations, April 2008

UK Education

Secondary education teaching professionals £35,300

Primary and nursery education teaching professionals £33,400

Special needs education teaching professionals £34,200

When you say its self funding, it would apear that about a third is paid for by the employee and about 2 thirds by the employer. Thing is, the employer hasn't got any money so wants to cut their share back.

If you work upwards and assume that the employer is the nation then we are running a defecit, each year we spend more than we earn. If a normal company operated like this they'd go bankrupt and you'd all lose. However, it's much harder for a nation to go bankrupt and much more messy so.

Savings need to be made somewhere as the defecit is unsustainable. It would do the public sector cause much better in my eyes (but probably not others) if you stopped argueing in terms of sustainability, fairness, working hard and having earnt your pensions but actually argued on the principle that you signed a contract which is now being altered without your consent.

Has anyone got any grasp of mathematics its pretty simple.

People live longer, people want to save the same for their pension, people want to draw the same pension amount.

Can anyone see the BASIC mathematical problem there?

Answers on a postcard please

People live longer, people want to save the same for their pension, people want to draw the same pension amount.

A woman on R2 last week called in to say that because so many low paid public sector workers live in deprived areas, they have a shorter life expectancy therefore they should be able to retire earlier on a higher pension so they can enjoy their final years 😆

i blame Blair

A woman on R2 last week called in to say that because so many low paid public sector workers live in deprived areas, they have a shorter life expectancy therefore they should be able to retire earlier on a higher pension so they can enjoy their final years

Give them free cigarettes & booze and a massive pension - sounds like a good idea

Which is interesting, because the official figure for 2009 Average salary of full-time qualified teachers in the maintained nursery, primary and secondary schools sector was £36,640

There's an upper pay spine. Progression up this is determined by satisfactory appraisals, one point every two years. This goes up to about £36k.

Has anyone got any grasp of mathematics its pretty simple.People live longer, people want to save the same for their pension, people want to draw the same pension amount.

Can anyone see the BASIC mathematical problem there?

Answers on a postcard please

And a grasp of history will show you that this was considered when the teachers' pensions were reviewed in 2007. At this point, the accrual rate was changed and the lump sum removed.

And a grasp of history will show you that this was considered when the teachers' pensions were reviewed in 2007. At this point, the accrual rate was changed and the lump sum removed.

Ditto the NHS scheme.

Ditto the NHS scheme.

Remuneration and pensions is always a difficult issue. One blessing of the whole mess is that at least the captains of industry who were queuing up a few months ago to moan on the radio about the exhorbitant pensions being paid to public servants seem to have shut up since it was revealed that the self same captains of industry have had a 49% average pay rise this year whilst their workers have averaged 2.9% and those of us basking in the luxury of public service have seen at best 0% and in quite a few cases a reduction - and yes I know that also happens in the private sector as well.

Fact remains that currently the contributions to the NHS pension scheme do exceed the payouts by about 2 billion per year, the employers contribution is capped so we stand the risk in the future anyway and most importantly the NHS scheme isn't just about consultants and GPs, nor even about senior managers who do rather well out of it also, but mainly about cleaners, admin staff and chefs who work damn hard over long hours for not much.

The feeling of annoyance well voiced by the OP is prompted by the fact that we agreed to a number of modifications to the scheme only 3 years ago "to make it future proof". This got very little publicity because there was very little fuss about it. Those changes meant longer working lives and higher contributions and are so recent that they won't be in fully in place until 2012. To have the government now portray us and the other public sector workers as somehow trying to protect out of date working practices and gold plated pensions that can no longer be afforded therefore sticks a little in the throat.

The very fact that there is no pension fund as such, means that when the additional contributions have paid off the bankers, bailed our Greek friends out ( and paid the cabinet's pensions which AFAIR are rather better than any of ours ) there is still going to be no more money in the pot to pay my pension in 15 years time than there would have been if I spent my pension contributions on donuts and jellied eels instead - although at least in that case the purveyors of donuts and eels would be saved from penury. I would have more respect for the politicians if they came out and said up front that they were introducing a special higher rate of tax for public employees but I'll be most surprised if they do.

Well I didn't think my post would get quite so many responses, and I must apologise for not chipping in earlier on but I've only just got home from work as there were a few tricky emergency cases that needed my input.

Regarding a couple of points made by others:

1. Of course I realise there's no pot of NHS pension money set aside by the government, and one consequence of that is that the country has had the benefit of being able to use our contributions as just another source of taxation for the treasury. However, although there is no pension fund as such, there is a contractual arrangement which both sides entered into freely and which defines both our contributions and the benefits we will receive. I have honoured my side of the contract.

2. During the boom years prior to 2007 public sector pay rises were by-and-large quite modest when compared to some of the largesse one heard about in the private sector, but we were constantly being reminded by both private sector bosses and ministers that we have our public sector pensions by way of compensation. Well I am incensed that they all seem to have forgotten this principle now that the exchequer are a bit short of cash.

There are some right retarded people on here. Mostly Daily Mail readers who have poster of Maggi on their bedroom walls, and probably pull the head off it to posters of David Cameron.

The reason they are raiding our pensions is because they refuse to tax their rich buddies properly.

Oh and stop moaning about why you poor private sector workers have no pension, pay into one just like us. I pay £200 per month to my pension. And while yo are at it, tell your company to stop paying the directors flecking massive bouses and salaries and just pay the staff a decent pension.

Oh and i will be lucky to get £13,000 a year after 30 years paying in to the scheme.

There are some right retarded people on hear.

Ironing etc....

😆

I work in a company with a (closed to new joiners) final salary (DB or defined benefit) scheme. Everyone new is on a defined contribution scheme (DC).

As a department we are charged an amount for pensions for everyone in our cost centre based on either the employer's contribution to DC, or a share of the company contribution (calculated by reference to the criteria pension would be calculated) for people on the DB scheme.

In terms of pension costs it costs us significantly more for an assistant manager who started before the DB scheme closed to new joiners than it does for a director paid over twice as much who is on a DC scheme. And we have a pretty generous employer contributions to the DC scheme.

The private sector has woken up to this issue already as it actually has to fund future liabilities (if you're a insomniac or have excess will to live Google "IAS19 deficts"), and the public sector is coming round to it as it realises it is basically running a pyramid scheme by spending current "contributions" and hoping future contributions will come good.

Frankly if I have enough for 15 years of half-decent retirement, a single (business class, natch) to Zurich and a trip to Dignitas I'd be doing well.

10, 20, 30+ years is a long time, 30+ years is a [i]very[/i] long time and no benefit provider in the current domestic/global economic circumstances is going to guarantee a defined pay out in 10, 20, 30+ years time.

Get a grip and get over it!

The velocity of change has increased significantly over the last 10 ot 20 years and will continue to increase.

My family and I have adjusted to these new austere times and if you do it over a reasonable amount of time then it isn't [i]too[/i] bad, you just learn to live within your means and be happy.

Part of my job is to read about "emerging" risks and advise my company about them and this is one that scares the willies out of me.

Oh well, my family and I are fit and healthy [i]today[/i] and that is what counts 🙂