MegaSack DRAW - This year's winner is user - rgwb

We will be in touch

I wasn't living in the UK in the late 1980s and early 1990s so the poll tax and the ensuing public backlash weren't really on my radar (In the USA international events were rarely reported in the news back then, not sure if this has changed now). Whenever there is a conversation about the Poll Tax involving my (mostly British) coworkers, people are extremely passionate about it, even some of those who are usually very mild mannered.

Why is this? From what I have read online the government of the day wanted everyone to pay their way for local services, so a single adult would pay less than a household of 5 adults, because they (nominally) use less resources. I also understand that income was not taken into account. This seems fair to me; it costs more to provide services to 5 people than one, and it doesn't cost any more to collect the bins of a wealthy person than someone not so well off.

Am I missing something else? Did you guys see it as an assault on your rights? People I speak to in work about it universally and vehemently decry the Poll Tax as unfair, but looking at it from an outsider's point of view it makes sense to me. Cheers, Keith

It was very good for single occupants of large houses (political persuasion obviously not taken into account) and very bad for multiple occupants of small houses (political persuasion very obviously not taken into account).

It was huge transfer of wealth from poor to rich

my household

rates £250

Poll tax £350 each so just over a grand for one trainee chef, a care worker and a nurse. the first two earned only £90 each

My millionaire girlfriends dad had his rate reduced by more than 5 K iirc and the richest person in Britain [ Westminster dude] probably saved millions

In essence the vast majority of those who save money were either wealthy or rich and those that lost out were poor.

Some thought this was unfair.

Because, apparently, fairness in taxation depends on your ability to pay for services, rather than your propensity to use services 🙄

Of course, this rule does not apply to other things, like petrol, where fair taxation is apparently based upon how much you use, rather than how much you can afford to pay.

A strange dichotomy that the left never really appears to have been able to explain!

I think our rates went from £150pa to £1000Pa - 20 years ago that was a fair hit for a young couple in a one up one down with a young family & multiply that by a few million & you have your answer - especially when the landed gentry were seen to be reaping the rewards

I thought it was fair at the time. I also thought it was difficult to collect, so ultimately doomed.

Not that I wanted to pay it of course. But that's true of any tax.

A strange dichotomy that the left never really appears to have been able to explain!

Do try and stick to the question raised by the OP rather than selfishly trying to derail the thread onto an argument you wish to have. FFS, just for once.

A big part of it up here was that it was introduced for Scotland a year before England.

And also, with hindsight, it started Tommy Sheridan's career, which I think is worth a riot in itself.

A strange dichotomy that the left never really appears to have been able to explain

Most "left" leaning people that I know seem to favour taxation based on ability to pay (direct taxation) and those on the "right" that seem to favour taxation based on cost (indirect taxation). Any apparent dichotomy exists just as much on the "right" as it does on the "left" and only someone with blinkers (or a troll) could see things otherwise.

I was a student at the time and thought it fair enough - though we paid 10 or 20% I think.

Income tax is the only good way to get people on ability to pay, keep everything simple.

I think that there was also an element of "straw that broke the camel's back"...

10 years or so of a Government that had ravaged certain sectors of the population in turn, but not necessarily everyone at once. Poll Tax was something that everyone (who took against it) could focus their pent up discontent, frustration and anger on, all in one go.

This thread, the riots (ie the ransacking of shops etc), reminds me of this...

Going down for all the things you missed

all the love. peace and happiness that don't exist

We've got enpsychopaedias we've got pic 'n' fix

[b]a government freezer full of benefits[/b]

A children's assortment we're bigger than Hamleys

We've got Cabbage Patch orphans from Sylvanian Famllies

Carpets. Iinoleum, holy petroleum,

Chemi-kaze killers, little Hitlers and Napoleans

Ladies and gentlemen, boys and girls

the big shop is open and the world

is wonderful

That line in bold ALWAYS takes me back to that last Tory Government 😥

Because, apparently, fairness in taxation depends on your ability to pay for services, rather than your propensity to use services 🙄

Well clearly the balance is between fairness to society and fairness to the individual. It's weighted against higher earners simply because there are fewer of them; Generally it's fairer to society AND the individual for higher earners to pay more tax.

Because, apparently, fairness in taxation depends on your ability to pay for services, rather than your propensity to use services

If you think that tax should be based on a propensity to use services, poll tax is an extremely poor way of doing it.

Generally it's fairer to society AND the individual for higher earners to pay more tax.

High earners don't pay more tax (in percentage terms).

It's been [i]ages[/i] since someone's quoted Carter in a STW thread.

But they do pay more tax in real actual terms. Actually thinking about it, in percentage terms too - I'm paying 20% on my first 35k (minus initial allowance if that still exists), 40% on my next 115k and 50% on everything else, which could be seen as pretty unfair.

High earners don't pay more tax (in percentage terms).

I find that difficult to understand. Certainly in percentage terms my income tax bill for the last few years has been around the 35% mark which is far in excess of what the average income would pay as the income tax on that sort of salary would be less than 20%. It may well be true for the super rich, but not for those of us who earn high salaries.

But they do pay more tax in real actual terms.

Alan Sugar paying 1% of income in tax is probably a greater sum than a poor person paying 50% in tax. That wouldn't seem to be a justification.

Here's what Adam Smith has to say on the matter:

"The necessaries of life occasion the great expense of the poor. They find it difficult to get food, and the greater part of their little revenue is spent in getting it. The luxuries and vanities of life occasion the principal expense of the rich, and a magnificent house embellishes and sets off to the best advantage all the other luxuries and vanities which they possess. A tax upon house-rents, therefore, would in general fall heaviest upon the rich; and in this sort of inequality there would not, perhaps, be anything very unreasonable. It is not very unreasonable that [b]the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion[/b]"

Interesting that he agrees with Karl Marx on this point!

I actually thought it was a fairer system in principal and I was living on my own in a flat in Crystal palace.

What was extremely unfair was the huge discrepancies in charges between boroughs. I was unfortunate enough to be in Lambeth where corruption and mismanagement was rife and the tax was ridiculous. 50 yards either direction and I'd have been in Bromley or Croydon, where the poll tax was considerably less. If you happened to be in Wandsworth IIRC there was no charge at all.

Luckily I missed it myself by a few years, but i was speaking to my mum the other day about it, and basically, they had rent/rates, and when the poll tax came in, her, my dad and my older brother had to pay it. So that's one household, paying the same rent as the previous combined rent and rates, plus 3 additional poll tax contributions... Sounds like complete bollix to me. Essentially massive extra taxation and very detrimental to low income overcrowded households.

Because, apparently, fairness in taxation depends on your ability to pay for services, rather than your propensity to use services

Gosh, you seem to be learning, well done you. That's the basis of income tax and most other taxes (consumer taxes such as VAT assume that those with more consume more so contribte more).

Now repeat after me

"From each according to his means

To each according to his needs"

...the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion

Which if your income is salary based is already the case.

I find that difficult to understand. Certainly in percentage terms my income tax bill for the last few years has been around the 35% mark which is far in excess of what the average income would pay as the income tax on that sort of salary would be less than 20%. It may well be true for the super rich, but not for those of us who earn high salaries.

You're only thinking about income tax. You need to look at all taxes.

Almost everyone accepts [ even in the USA] that the better off should pay more so that everyone can have an fair standard of living. Most people would find it unpalatable if peoples access to basic health care,education etc was governed by their ability to pay. Fair would mean universally accessible rather than paid for equally.

Personally i would try and free poor people from the tax burden with a much higher personal allowance at an acceptable standard of living. I would then tax anything above this.

Personal view.

I had no issue with it as a concept but the level of charge seemed ridiculously out of proportion to the previous rates.

Rates on a typical family house in a nice place were maybe £300 and you would have expected most of those to have two adult occupants plus kids.

If the poll tax had been set at £150 then there would have been some equivalence and it wouldn't have upset so many people, i.e. for many I think it was more a feeling of being robbed than an objection to the concept IMHO.

Which if your income is salary based is already the case.

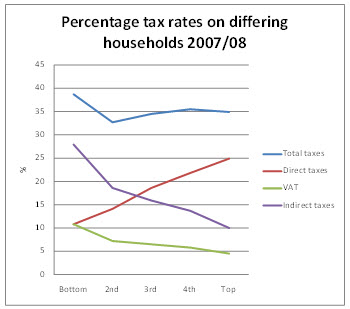

Sorry, you're wrong. The ONS says so: [url= http://www.statistics.gov.uk/cci/article.asp?ID=2690 ]ONS link[/url]

Go to page 55 in the download. The poorest quintile pays a greater percentage of their gross income in tax than do any of the other quintiles.

You're only thinking about income tax. You need to look at all taxes.

Go on then, do the sums and demonstrate it. I'm not saying that you are necessarily wrong, just that I'd like to know how you arrived at that conclusion.

Go on then, do the sums and demonstrate it. I'm not saying that you are necessarily wrong, just that I'd like to know how you arrived at that conclusion.

ONS sums in previous post...

Junkyard that's a well thought out post, nice one. I agree with you on your points. I would like to see a much higher taxable threshold with a much stricter discount / benefits regime, so people on lower incomes can survive without needing handouts. I would then stick a flat rate (30%?) tax on all income above the threshold and close the loopholes that allow the super rich to pay almost no tax at all (I'm looking at you Elton John, F1 drivers, Premiership footballers, etc)

(I'm looking at you Elton John, F1 drivers, Premiership footballers, etc

Even the US won't allow their citizens to avoid tax through exile

Gosh, you seem to be learning, well done you. That's the basis of income tax and most other taxes (consumer taxes such as VAT assume that those with more consume more so contribte more).

Why make that assumption?

Fuel is a fantastic example of a commodity where the rich do not necessarily consume more, in fact, as a percentage of income, the rich pay significantly less for their fuel than the poor.

If taxation based upon ability to pay is the only [b]fair[/b] system of taxation, then why not apply the rule to [b]all[/b] taxation?

ONS sums in previous post...

Certinaly seems to, although grouping by quintile like that may well skew the statistics. According to those stats, I'm in the top quintile so my income tax and NI should be around the 24% mark (assuming I'm reading it properly), whereas it is actually much higher than that. Remember, that top quintile has no upper limt, so any average figure there will have much higher potential errors associated with it.

Certinaly seems to, although grouping by quintile like that may well skew the statistics. According to those stats, I'm in the top quintile so my income tax and NI should be around the 24% mark (assuming I'm reading it properly), whereas it is actually much higher than that. Remember, that top quintile has no upper limt, so any average figure there will have much higher potential errors associated with it.

True, but given that the middle 3 quintiles a) have upper and lower boundaries and b) they're all a lower percentage than the poorest quintile, I doubt that any skew in the top quintile average is large enough...

The basic premise that everyone pays for the services that they use was a good concept. The trouble was that it had lots of problems

- a house of five does not consume 5 times the resources that a flat of one uses.

- Lots of services paid by the poll tax are only used by a subsection of the community, e.g. schools.

- it is difficult to collect. A person needs to be registered to pay it. With an property based tax you have a physical item and you know who owns it

- it's implementation was weighted so that it benefited mostly Conservative voters.

- with all taxes you need to consider the ability to pay. You can levy any tax you like, but if the person can't pay the tax then it will fail.

The poll tax was also grasped at what was wrong with the Thatcher government and as such a lot of the anger and violence was against Thatcher and not the poll tax itself

Personally I think that the miners strikes of the 1980's were more violent and more destructive.

Even the US won't allow their citizens to avoid tax through exile

Now now, it's not exile, it's taking full advantage of perfectly legal (if morally reprehensible) non-domicile and monaco-based-image-rights-company rules 🙂

Ransos is quite right. Our total tax rate is not that progressive (although its not as regressive as some would have you beleive).

The main reasons are duty and VAT. VAT is particularly regressive as its only zero rated on a small group of goods so invariably everyone pays VAT, regardless of ability to pay.

In income tax (and NI) terms, the UK tax rate is very much progressive. Did this for another thread (where TJ had got his facts wrong, again 😉 ), might as well put it in here.

Somewhere there's a graph of total tax including VAT etc, but I cant remember who published it.

When poll tax came in I was a naive lefty and I thought what a good idea it was because it brought a lot of extra people into the local tax system who could easily afford to pay; I was surprised that this idea came from a Conservative government. In my naivity I hadn't spotted the big problem, which is that some people just don't want to pay their share regardless and that's the basic reason for its unpopularity.

Those who think poll tax was unfair conveniently disregard the unfairness and anomolies inherent in the rates system it replaced, where the assumption was that your ability to pay was based on the value of your house. So the large family on the breadline who needed a big house got stung for high rates whereas a wealthy single person in a flat paid very little. Little old ladies left in a large house after their family had moved on got stung for high rates even if they only had a pension to live on. And if you inherited a country estate you were completely stuffed even if you had no money at all. The current system has an equal number of anomolies, and I haven't seen any suggestions for any alternatives that I would consider fair regardless of your definition of fairness.

It's been ages since someone's quoted Carter in a STW thread.

sign of the times...

Rio - you do know that the Poll Tax is not the current system????

One of the other issues at the time was that there hadn't been a re-valuation of properties for quite a while and one was due. This would have resulted in various discrepancies cropping up and vociferous criticism. When the Poll Tax was replaced by the current system, this had to be done anyway but the new system was "better" so the re-valuation was accepted with little complaint.

When poll tax came in I was a naive lefty

I think you were a confused right winger reading your post.

I hadn't spotted the big problem, which is that some people just don't want to pay their share regardless and that's the basic reason for its unpopularity.

That is a rather skewed view of it and it is perhaps fairer to say they did not want to pay an unfair tax. Introduced twice riots and overthrown by popular revolt /action both times... this happened with other taxes?

Those who think poll tax was unfair conveniently disregard the unfairness and anomolies inherent in the rates system it replaced, where the assumption was that your ability to pay was based on the value of your house.

Are you suggesting it is not true that rich people live in bigger and more expensive houses than poor people...can you evidence that?

There are fairer ways of eliminating this issue than the poll tax which also meant that the little cleaner of the millionaires house both paid the sameSo the large family on the breadline who needed a big house got stung for high rates whereas a wealthy single person in a flat paid very little. Little old ladies left in a large house after their family had moved on got stung for high rates even if they only had a pension to live on.

And if you inherited a country estate you were completely stuffed even if you had no money at all.

I can only but imagine what it is like to inherent a country estate and have no money at all 🙄

The current system has an equal number of anomolies, and I haven't seen any suggestions for any alternatives that I would consider fair regardless of your definition of fairness.

local income tax?

EDIT: local income tax is the only proper way of doing it. Why it's still not politically acceptable I have no idea. Next step though would be a call for tax on assets like the french and we cant be having that! 😛

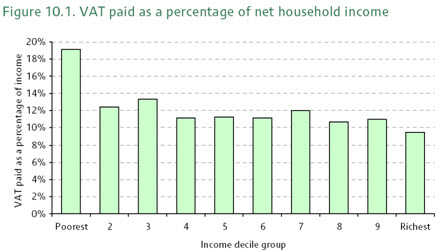

aha, found some stuff on it.

the red line is much like the orange line in my graph.

Green is VAT.

Purple is other indirect tax like alcohol/petrol/fag tax or Council Tax.

The four data points represent household income [s]quartiles[/s] quintiles.

VAT is pretty regressive (not that steeply though, even when you zoom in like the author did), but particularly for the lowest income decile.

[img]  [/img]

[/img]

good article all told.

http://www.taxresearch.org.uk/Blog/2011/01/04/why-vat-is-regressive/

Are you suggesting it is not true that rich people live in bigger and more expensive houses than poor people...can you evidence that?

Yep - For a while I lived in a tied cottage with my job - which due to its location was worth a fortune with a horrific "ratable value".

It was a necessary part of the job to live there, and as such the rent was low, but the council tax was frigging laughable for someone on an agricultural wage!

old boy up the road from me was retired, in the estate house he'd lived in for fifty years - value of the house had absolutely no relation whatsoever to his personal worth or income!

The switch from direct to indirect taxation [ by mainly Tories but not exclusively] by reducing income tax whilst increasing VAT has switched the burden of tax from the rich to poor. That is changing that have reduce income tax have been [broadly]matched by other taxes and the tax burden overall has not changed much.

Even the US won't allow their citizens to avoid tax through exile...

But it explains why most wealthy Americans bank in the Cayman Islands

Rio - you do know that the Poll Tax is not the current system????

🙄

Council tax is effectively banded and capped rates and I can't think of any basis that makes it a fair system; it's a fudge that was introduced when poll tax was removed and if it wasn't there you wouldn't invent it.

Are you suggesting it is not true that rich people live in bigger and more expensive houses than poor people...can you evidence that?

I'm suggesting that there's insufficient correlation between the size of your house and your ability to pay for that to be a fair way of assessing taxes.

One of the problems now with poll tax is that it's become part of the left wing mantra that poll tax is inherently bad. A correctly implemented poll tax with mechanisms to allow for those who aren't able to pay would be a lot fairer than what we have now. Maybe local income tax is the answer but it's hard enough collecting national income tax so I suspect collecting local income tax would be a nightmare.

one of the initial problems with the poll tax, it was illegal to apply different taxation structures in the u.k. and applying it as a trial in Scotland without new legislation basically invalidated the entire process

the poll tax asked those who'd paid little ( large families) to pay more and those alone ( old ladies etc ) to pay less. the loudest voices won.

at the time i was a landlord and as all my tenants could prove they were foreign no one paid!

Oh - and does any recall that the rate of VAT increased from 15% to 17.5% in order to make up the shortfall in revenue when the Poll Tax was replaced?

totalshell - actually large families wouldn't pay more - only two adults.

the real losers were younger folk who shared houses and poor folk with small houses. the real winners were rich folk with big houses - the little old lady with the big house unable to afford rates is a myth - really very rare and benefits were available. used as a piece of propaganda to sell the idea.

One of the most unfair and inequitable taxes ever seen in teh UK

the poll tax asked those who'd paid little ( large families) to pay more and those alone ( old ladies etc ) to pay less. the loudest voices won.

It did this but as TJ notes it also increased the bills for the less well off whilst generating vast savings for the very wealthy . This was what killed it. The loudest voices were the vast majority of the population who lost out.

eyy! Stoner starting with the graphs and charts already!

Tell me there aren't people on here advocating the poll tax 🙄

not only are they advocating it you ought to hear why they think people hate it.

I'm not gonna bother. I can imagine...