MegaSack DRAW - This year's winner is user - rgwb

We will be in touch

[url= https://www.theguardian.com/commentisfree/2017/aug/24/austerity-lie-deep-cuts-economy-portugal-socialist?CMP=fb_gu ]Portugal[/url]

it does work, just nobody wants it.

Have we actually experienced austerity?

Well UK citizens didn't play the FPTP game very well then did they, a few months back?

Royston Smith held this seat by a measly 31 votes, I did my bit to try and get Labour back in.

it does work, just nobody wants it.

Care to explain that, given the story in the article?

1. We know this already - the austerity we experienced in the UK (which was austerity on public sector budgets) harmed our economic recovery from the Great Recession.

2. We all know that national economies are not the same as household budgets.

3. That article is written by Owen Jones, who might be vocal but is a little too keen on polemics.

4. The headline reminds me of the lauding of Argentina under Kirchner. Look how that's worked long term....

Have we actually experienced austerity?

No

guardian journalist espouses socialist policies, shocker

and no, we didn't really experience austerity, did we?

and no, we didn't really experience austerity, did we?

Depends if you're disabled...

No, wasn't particularly talking about what happened here. We cut public services but kept borrowing, so the worst of both worlds really.

Good old Owen Jones, always ready to provide the side of the story that props up his argument.

That said, Portugal have dealt with their ongoing debts about as well as any other European country - i.e not at all.

We're all screwed.

Good old [s]Owen Jones[/s] Moley, always ready to provide the side of the story that props up his argument.

The current a/c deficit has been reduced over recent years due to austerity. Portugal has seen more severe change than the uk which is likely to destabilize the economy; eg 23% cut in education. Also, it takes maybe a year for a change in govt policy to affect the whole country so the increase in investment could be attributed to previous policies. Austerity, as I see it, relies on reduced spending. Any spending undertaken must be on essential goods+services. Hence the cuts to welfare, brexit and new roads, hs2 spending. So, it creates work in the road and rail industry. This isn't sexy or interesting but seems to be the reasoning behind it.

What do we mean by austerity? What we have had here is idealogically driven public sector cuts. What we need is to live within our means as a nation and stop kicking the can down the road.

Sadly that requires a mature debate amongst the electorate and politicians. Our recent GE shows however that populism wins every time.

The problem is not poor people, it's not disabled people, it's not migration. The problem is debt. Not government debt. The same debt that caused the 2008 crisis. A threat that has not been eliminated, despite the UK government spending hundreds of billions propping up the system (the reason the deficit got so high in the first place so as to require "austerity").

We need to get the deficit down quickly so that we can be there for the banks when the next bunch of dodgy mortgage investment packages collapse the global economy.

Austerity works brilliantly for the protection of the markets, that's what it's for.

Sorry, did anyone think they were doing it for us?

We need to get the deficit down quickly so that we can be there for the banks when the next bunch of dodgy mortgage investment packages collapse the global economy.

Er, don't conflate the sub-prime asset crash with the credit crunch (the latter is what caused the collapse of the likes of Northern Rock et al.)

+1 mrmonkfinger

Good old Owen Jones Moley, always ready to provide the side of the story that props up his argument.

And why do I have that argument in the first place? I don't like budget deficits any more than anyone else. There were two ways put forward at the time, IIRC - investment in growth or deficit reduction by cuts. The Tories said that investment could never work and cuts were required - however in Portugal at least, that didn't work whereas investment did.

It's just food for thought.

Er, don't conflate the sub-prime asset crash with the credit crunch (the latter is what caused the collapse of the likes of Northern Rock et al.)

Northern Rock, collapsed because of bad mortgages.

Global crash, caused by bad mortgages.

Yeah, totally different.

Northern Rock, collapsed because of bad mortgages.

Global crash, caused by bad mortgages.Yeah, totally different.

Credit crunch caused by lack of availability of the existing cheap, dollar based lending used to capitalise banks.

Problem accelerated by the fact that a lot of these loans had also been used to make dollar investments in US asset backed securities.

When the short term borrowing suddenly dried up, the banks ran out of money very quickly. Hence the Federal Reserve lending money to central banks around the world to then lend on to the banks to bail them out. And, in the UK at least, several banks being nationalised as part of that (note the government didn't provide all of the bailout).

So, no, flaky mortgages didn't cause the global crash. They just helped it to happen faster.

And, no, national debt still isn't a bad thing.

Didn't really experience austerity? LOL we did, and we still are.

https://www.flickr.com/photos/44950467@N06/9559691615/

The figures on that are only up to 2013, but there is massive cuts to govt dept budgets.

[url= https://www.economist.com/news/britain/21715673-amid-painful-fiscal-squeeze-some-authorities-may-soon-be-unable-meet-their-statutory ]£49.5bn cut from local authority budgets[/url]

The Tories said that investment could never work and cuts were required - however in Portugal at least, that didn't work whereas investment did.It's just food for thought.

Agreed.

How can austerity ever work? It's not designed to 'work' - certainly in the favour of the most vulnerable people.

It's just something to keep hitting us over the head with.

Investment is the only way out. And I don't care for debt/deficit arguments I'm pretty sure we could Q/E for infrastructure.

I also think Owen's article is born out of the frustration of Venezuela being constantly held up as 'the socialist failure', so therefore it would never work - that is according to various newspapers. (Yeah 'cos no capitalist economies ever fail.)

I'm pretty sure we could Q/E for infrastructure.

Seems like a well formed plan with no possible drawbacks.

A debt-crisis caused by the reckless practices of the financial sector (encouraged by central banks) has resulted in austerity for the public sector.

That kind of austerity doesn't work, and it's entirely unfair to punish people who had no involvement in causing the crisis too.

And since the crisis, central banks have worsened the problem with measures like QE which largely benefit the already wealthy and financial speculators and penalise responsible savers.

We are 10 years into this crisis. What a depressing 10 years it's been.

Trouble is badnewz the Poor oppressed Brexit voters think it's someone else's fault, yet when you ask them who caused Austerity then just scratch their arses - yet these same people will vote for the very same ** who caused this (both directly and indirectly) think Rees Mogg type people. Most of the Government MPs directly benefit from Austerity (think increased rents)

Yet the uneducated * wits continue to support these very people who prosper due to their circumstance. Seriously there are some very very stupid people in this country.

Councils have experienced quite severe cuts haven't they?

I remember the (Conservative run) Surrey council threatened to hold a referendum to raise council tax in order to protect those who need help, but got a 'secret deal' from the Government to stop it happening...

https://blogs.spectator.co.uk/2017/03/surrey-councils-gentlemans-agreement-undermines-ministers-strategy-social-care-crisis/

... so that we can be there [b]with suitable penalties[/b] for the banks when the next bunch of dodgy mortgage investment packages collapse the global economy.

What austerity?

Where?

UK? 😆

Seems like a well formed plan with no possible drawbacks.

Everything has drawbacks. We are in the middle of one great big Tory drawback.

and no, we didn't really experience austerity, did we?

Also depends if your'e a prison officer. Because we did.

No, you experienced ideologically driven public sector spending cuts. We still expand the national debt every year. Austerity would actually be trying to pay it off.

I am no expert and really don't I understand all the detail here but surely it's not a one size fits all economies type solution. I am in Ireland, we were nearly bankrupt, got bailed out, cut all sorts, introduced a levy on all wages to help pay the debt, still paying but seeing things get better. Don't know if it's austerity but I feel we are getting better, maybe paying for it for a while but we are improving.

I'm intrigued by the investment for growth argument and believe it could work. I was under the impression that's what Blair and brown did but maybe they botched it...Anyhow I think the financial crisis is a srperate issue as it occurred in the private sector but obviously there's a regulatory angle.

Austerity is a short term fix, the damage being done to the prison service will have long lasting repurcussions , the current prisoners are more likely to reoffend, ultimately costing the state & society more.

See also closing sure start centres, sell off & collapse of apprenticeship system, under investment in the NHS, decimating local council funding....

The life chances of the generation that are growing up under austerity sacrificed for Tory ideology, not to mention the political backlash against the elites who caused all this, such as the Brexit vote!

. I am in Ireland, we were nearly bankrupt, got bailed out, cut all sorts, introduced a levy on all wages to help pay the debt, still paying but seeing things get better. Don't know if it's austerity but I feel we are getting better, maybe paying for it for a while but we are improving.

The official line is that austerity turned around the Irish economy. Ireland was the poster child Angela Merkel used to beat Greece and Portugal.

However, there is a significant view that the Troika imposed rules probably harmed the recovery, rather than aided it. During austerity exports remained at more than 100% of GDP: Ireland's economic success was built on exports (and low corporate tax and flimsy regulation) before property and construction took over and then collapsed it.

(And, while the feelgood factor might be returning to Ireland, remember that private debt is 300% of GDP, about twice the accepted level in the EU.)

^^^But things 'feel' ok so that can't be a bad thing. Or maybe that's the Guinness.......yes we have debt and yes it will take years to clear but we are moving forward. That feel good factor will help kick start things as well surely? I dont think we have done it totally wrong over here. It seems to be working what ever we are doing. As i said i dont understand the finer detail.

Even by Owen's low standards that's a shocker. The first two lines tell the reader enough. - a nice warning that his grasp on economics is very poor. Then he misses the whole reason why Portugal suffered in the way it did. Brilliantly awful. Owen to a tee...

Not government debt. The same debt that caused the 2008 crisis.

😯

Surely the Portugal method only works if you are relatively unique in implementing it? If everyone does it, what's the point?

I can't help feeling that, ultimately, it might be about time to start burying sacks of rice, pasta, corned beef and dried vegetables.......

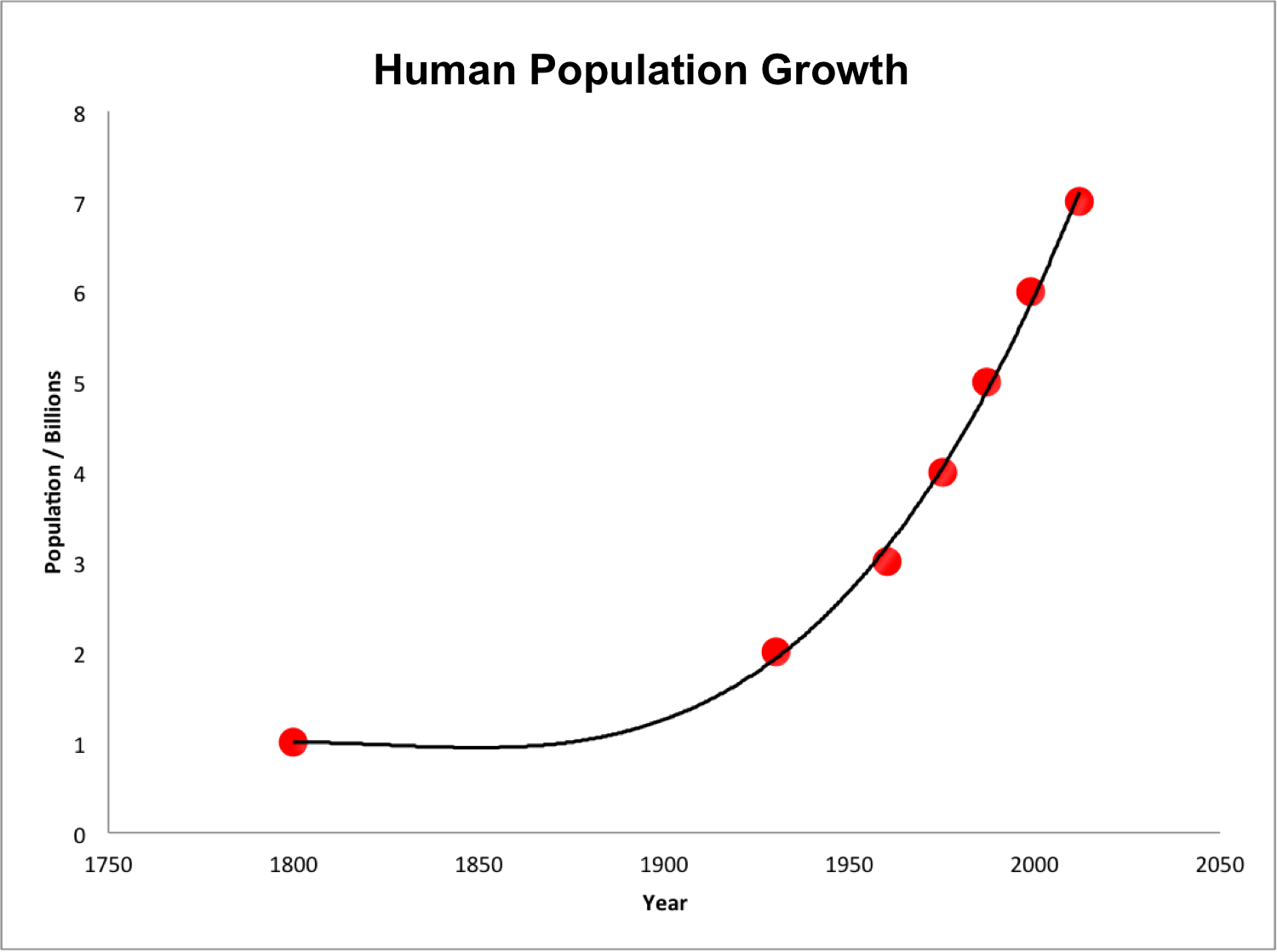

One planet.

Spot the bit we've not got to yet.....

Then he misses the whole reason why Portugal suffered in the way it did.

Enlighten us?

danstw13 said what I meant, better.

"We", the uk, haven't cut debt, just the rate at which it expands. Austerity would be to build a surplus.

I'm staggered by the number of people who still don't seem to understand the difference between the national debt and the deficit. Those who say that austerity isn't working because yet national debt is still increasing clearly don't grasp the very basics of it. The reality is austerity is working for us. We've reduced he deficit by two thirds. But until we completely clear the deficit and start generating a surplus then we will never start to pay back the national debt and it will continue to grow.

I agree to an extent that nations budgets are different to household budgets, but the difference here is what we're spending our borrowed money on. We not spending it on investment, we're spending most of it on paying the interest on the debt we already have. We now pay more on the interest on the national debt than we do on the NHS. Nobody can convince me that that is in any way a good state of affairs.

Anyway those who say austerity is not working or not the answer have yet to explain what the answer is. How big does our national debt have to get before we have to start taking action to address it? Surely nobody is proposing we simply ignore it and allow it to grow indefinitely unchecked?At the moment we're getting away with it because interest rates are so low, but what happens when interest rates start to rise?

In the absence of a credible alternative that doesn't mean our national debt spiralling towards infinity then austerity is the best option. We all have to share the burden even those at the lower end. We're just not as rich a nation as we think we are. All this 5th richest economy in the world is BS. We can't afford our NHS. We can't afford our bloated benefits system. We can't afford our national pensions liabilities. Every day we run a budget deficit we have to borrow more and more and more. One day we will get to the point where people/governments will cease to lend to us, just like Greece.

In the absence of a credible alternative that doesn't mean our national debt spiralling towards infinity then austerity is the best option.

Well the alternative is spend to grow. If you do it right, then even though you borrow more the growth pays you back. That's what happened in Portugal, although of course every country is different. But there they tried austerity first and it didn't work.

But spending to grow requires government actually doing something, and doing it well. Two things which we apparently can't manage in this country.

wobbliscott - Member

I'm staggered by the number of people who still don't seem to understand the difference between the national debt and the deficit

But we were promised the deficit would be cleared by now, several times, that's what made austerity worth it.

The young & the poor have paid the most for this is a legacy that will cost us even more in the future

Those who say that austerity isn't working because yet national debt is still increasing clearly don't grasp the very basics of it.

Deficit is reduced, but not cleared. Debt still increasing. "Austerity" was the thing that was meant to fix the deficit and turn around a surplus in order to pay off the debt, such that all that cash you mention that is currently being hosed on interest payments, could be put to a more useful use. Hence why I said we didn't really experience austerity. We got some public spending cuts. It's only a terminology difference. But we didn't get the thing that was promised.

OTOH I don't believe we could get spending to grow right. We had a whole bundle of Labour terms where we spent an absolute ton, which seems to have lead to a rather whopping debt and pretty cheeky deficit to match.

I don't know what the answer is, but sleep-QE-ing our way along, all the while hosing the value of the pound, just all seems a bit like the Greece problem to me.

Anyway, I'm out of my financial depth in this argument.

Obundle of Labour terms where we spent an absolute ton, which seems to have lead to a rather whopping debt and pretty cheeky deficit to match.TOH I don't believe we could get spending to grow right. We had a whole

I would politely contest that and say Labour did okay with growth and having a few surpluses during their middle stint, until the hammer dropped which history should agree wasn't their fault.

I also don't think the analogies to Greece, although often cited are valid at all.

[url= http://www.economicshelp.org/blog/7568/debt/government-debt-under-labour-1997-2010/ ]stats and tings[/url]

First google result and all that, but pretty much the whole labour stint was in deficit.

I know off the top of my head that Labour had more surpluses that the previous Tory government. (3/4 iirc)

The Tories have hardly ever produced surpluses, certainly in the last 30 years.

Your charts fails to show in comparisons to the Conservative party.

Conservative 1991/92 to 1996/97 (6 years): £348 billion (average £58 billion per year)

Conservative 2010/11 to 2016/17 (7 years): £ 720.1 billion (average £102.9 billion per year)

Total Conservative overall deficits for the 13 years: £ 1068.1 billion (average £82.2 billion per year) - yes, over one trillion pounds in 13 years!

Total Labour 1997/98 to 2009/10 overall deficits for the 13 years: £496.4 billion (average £38.2 billion per year).

Tories are borrow monsters.

Can't escape the fact.

Nice piece here:

https://fullfact.org/economy/labour-and-conservative-records-national-debt/

It's all balls anyway. A country that controls its own money supply controls the debt.

Enlighten us?

Are you new here, or what?

In isolation, whether the government is in surplus or defitict doesnt matter. It needs to be considered in the context of whether the other three major players are in surplus or deficit in, households, corporates and the the rest of the world. It is the balance between each of these players that matters, indeed ALL that matters.

Hence the idea that you can't solve a debt crisis with debt was myopic at best, ignorant at worst - but maintsrateam economics is still dominated by the flawed models that makes otherwise sensible people believe this.

If, as in the aftermath of the crisis, the corporate and household sectors are running surpluses (paying down THEIR debt) the government's need to balance this by running deficits as does the ROW (note what happens to £ in this context)

Whether deliberately or not (if believe the latter) the Tories abandoned austerity at birth and correctly (if unintentionally) ran among the highest fiscal deficits in the developed world. Hence the UK (and US) recovered faster and stronger than the EU in complete contrast to the widely abused narrative of "austerity". It was and is a myth but a boon for sloppy journos and politicians, who can't be bothered to understand what happened and is happening.