Home › Forums › Chat Forum › Inflation. How high?

- This topic has 34 replies, 23 voices, and was last updated 3 years ago by footflaps.

-

Inflation. How high?

-

flanagajFree MemberPosted 3 years ago

If house prices and used car prices are anything to go by, then it looks like inflation could set to be very high. What are the economists on here predicting?

andrewhFree MemberPosted 3 years agoIt’ll be fine. Gordon Brown abolished boom and bust years ago…

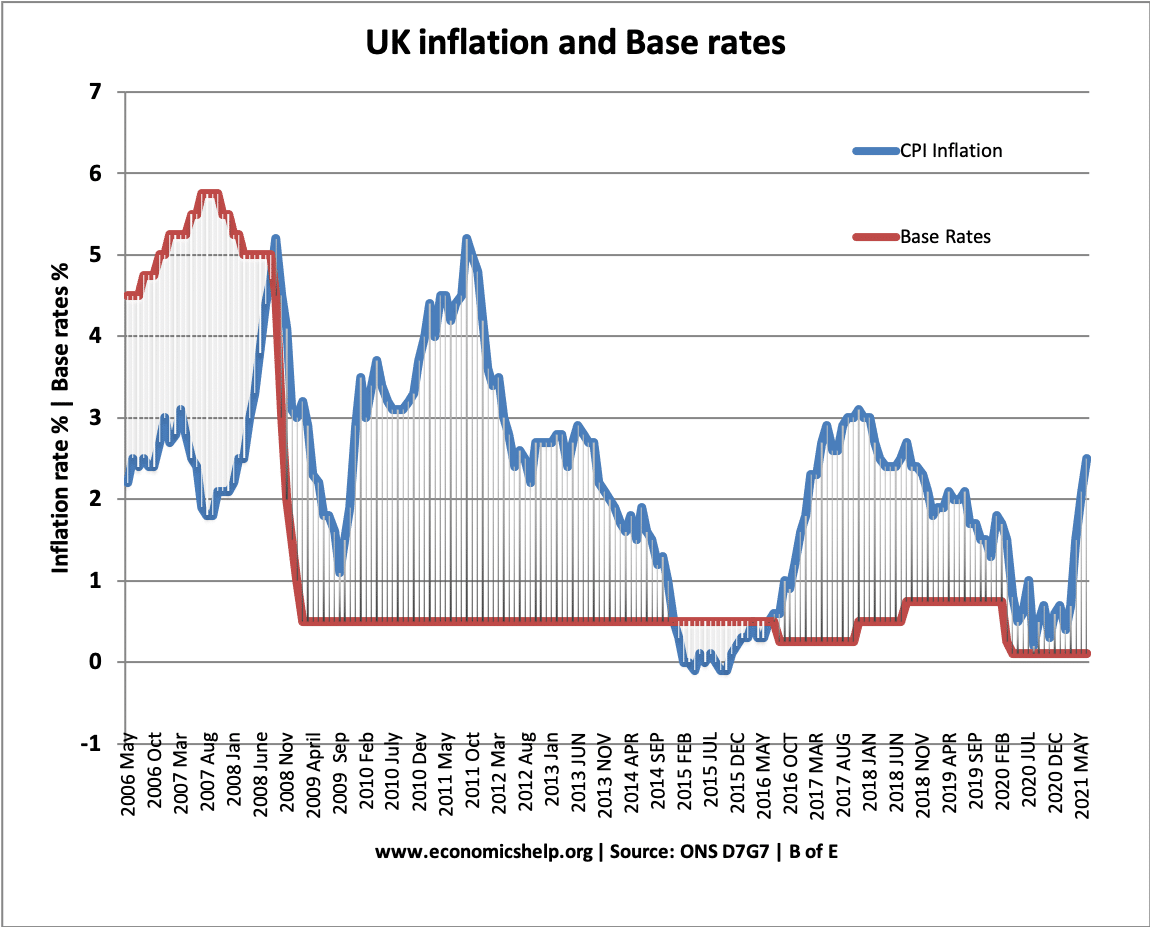

BillMCFull MemberPosted 3 years agoThe government will be quoting CPI rather than RPI and inflation will affect those most who are on low incomes. The Tories should be a bit concerned as inflation often correlates with industrial action.

andrewhFree MemberPosted 3 years agoIt’s not looking good though, and if inflation goes up interest rates will follow. I’m remortgaging just now and locking in for as long as I can, definitely five years, considering ten.

.

Personal inflation rates are interesting, most of what I buy is food and diesel and they are both shooting up, my personal rate is way above the official rate as I don’t buy all sorts which are in their basket and bring the average down, music subscriptions, consumer electronics clothing, all once in a blue moon for meigmFull MemberPosted 3 years agoWell, in a country that imports a lot of stuff, voting to disrupt your supply chains was a bit daft, voting to disrupt your labour supply great on the face of it but ultimately daft.

The pandemic has probably hidden some of the likely outcomes of Brexit, but if it recedes I suspect we’ll start to see them.

I’m going for pretty high.

dissonanceFull MemberPosted 3 years agoThey will desperately stack the figures in order to keep the interest rates low and keep the house prices booming.

Pretty much everything will be sacrificed for that cause.

Used car prices I think will come out in the wash. Those are mostly down to some bad decisions (using my expert knowledge and more importantly a lot of hindsight) made early in the pandemic so its unclear what will happen with them in the short-medium term.oldmanmtb2Free MemberPosted 3 years ago5 to 6% by Christmas then it depends on fiscal policy and our current governments marxist/tory approach to funding the general publics lifestyle.

Odd doesn’t cover it.

roneFull MemberPosted 3 years ago5 to 6% by Christmas then it depends on fiscal policy and our current governments marxist/tory approach to funding the general publics lifestyle.

Odd doesn’t cover it.

It’s nothing to really with that silly comment about Marxism. Money the government has generally issued has replaced wages so the idea people have loads to spend is nonsense. This was done so we could carry on keeping our bills paid.

Temporary.

Inflation is generally driven by supply side shocks.

Personally I think this is very much a transition, and we will be heading back towards deflation (which the press is less excited about – doesn’t affect wealthy people as much) and the long term trend of downwards.

How high ? – not sure as there are lots of supply side shocks kicking in.

Unemployment and lack of cash will eventually act as a barrier to this activity.

Things could be messy around Christmas.

HPI is an accident waiting to happen too. The BoE have pretty much run out of road on that one.

If there was too much money swilling around (go figure) then it can be controlled by taxation.

neilnevillFree MemberPosted 3 years agoGas shortage has energy prices up what? 10%. I find it hard to judge the weekly shop cost increase currently as we’ve gone to online shopping and our habits have changed, but definitely spending more. I would think it’ll climb and above the 2% target but I’ve no idea beyond that.

cheddarchallengedFree MemberPosted 3 years agoI think it will continue to rise in the short term mainly due to:

– global gas shortage stemming from ramp up of industrial activity in Asia

– U.K. / France interconnector fire – c50% of electricity is made using gas so the existing pressure on gas prices makes the impact bigger

– ongoing supply chain and logistics headwinds (container shortage, high ocean freight costs, driver shortages across the U.K. EU and America).At the bottom end of the economy it’s good to see a lot of low paid workers getting decent pay rises / improved pay and I’m happy to pay for that through the price of goods.

Overall the economy looks to be in pretty good shape for long term growth – lots of tech Unicorns in development and inward investment seems to be growing quickly.

MrSparkleFull MemberPosted 3 years agoAt the bottom end of the economy it’s good to see a lot of low paid workers getting decent pay rises / improved pay

Do you have a source for this as it’s not something I am aware of.

HohumFree MemberPosted 3 years agoA period of moderate to high inflation would be good for the economy.

It would help borrowers by reducing the real value of their debts.

It would help savers because interest rates (and hopefully savings rates) would increase to try and curb the inflation.

grumFree MemberPosted 3 years agoWages going up compared to being furloughed? What about actual pay rises?

kingmodFree MemberPosted 3 years agoI think we have got a 6 month period of substantial inflation. Supply chain delays/costs, worker shortages and additional bureaucracy (Brexit). Boris will look to ride this out without increasing interest rates as the tax rises will already be squeezing peoples spending. The risk is that prices continue to rise we have a panic interest rate rise next year.

There will be some low paid works who will do well or at least keep pace with inflation such as HGV drivers, but plenty will be struggling.

HohumFree MemberPosted 3 years ago@kingmod Boris does not set interest rates, the Bank of England does.

If interest rates have to go up to curb inflation then they will.

Any political interference will have grave consequences for the UK gilt market.

thols2Full MemberPosted 3 years agoI don’t believe inflation is really a thing. It’s just prices going up.

finbarFree MemberPosted 3 years agoIf interest rates have to go up to curb inflation then they will.

Your optimism in the independence of the BoE and belief their mandate is still to control inflation is

hearteningnaïve.MoreCashThanDashFull MemberPosted 3 years agoAt the bottom end of the economy it’s good to see a lot of low paid workers getting decent pay rises / improved pay and I’m happy to pay for that through the price of goods.

I agree entirely but I’m not sure it’s those at the bottom seeing the big rises,but they will feel the squeeze of inflation.

We are 2 years into what looked like a generous 3 year pay deal after 10+ years of public sector austerity, and suddenly for those of us hovering around the “average wage” and below it’s looking shakey

cheddarchallengedFree MemberPosted 3 years agoYour optimism in the independence of the BoE and belief their mandate is still to control inflation is heartening naïve.

I know several people who have worked directly for MPC members at the Bank and it’s fair to say that it’s almost a badge of honour that the committee pays very little attention to political noise – which is as it should be. In reality the government has very little direct influence over rate setting because it’s data driven – with the Bank now tracking C1B data points every month to inform their understanding of how the economy is performing.

martinhutchFull MemberPosted 3 years agoI guess we’re going to find out how well the stress-testing of mortgages has worked if interest rates go up and household income effectively falls in parallel.

We have a whole generation which has known nothing but low inflation and low mortgage costs.

BillMCFull MemberPosted 3 years agoHead of Ofgem sees substantial rises in gas prices as being terminal not temporary. The NHS, Britain’s largest employer, is not increasing the wages in real terms of its low-paid workers. I don’t see the government (nor the ‘opposition’) having any answers apart from brutalising people into accepting their lot. Many staple imported goods will become luxuries or disappear altogether. It’s a systemic crisis and it’s very sad to see people on the bones of their arse arguing the case for their oppressors. Who knows, the worm may turn.

duncancallumFull MemberPosted 3 years agoWe got a 1.5percent rise this year as that’s inflation according to our md…

I think in real terms it’s near 7/8%.

Also as Red Diesel ends in march for alot of industry that’ll effect prices on everything

finbarFree MemberPosted 3 years agoI know several people who have worked directly for MPC members at the Bank and it’s fair to say that it’s almost a badge of honour that the committee pays very little attention to political noise – which is as it should be. In reality the government has very little direct influence over rate setting because it’s data driven – with the Bank now tracking C1B data points every month to inform their understanding of how the economy is performing.

Fair play, that is a lot better than my (lack of) sources, but I just cannot envisage going back to, say, >2% interest (maybe 1.5%) anytime in the next decade. The system has fundamentally changed.

kingmodFree MemberPosted 3 years ago

kingmodFree MemberPosted 3 years agoBoris does not set interest rates, the Bank of England does.

If interest rates have to go up to curb inflation then they will.

Any political interference will have grave consequences for the UK gilt market.Obviously Boris doesn’t set interest rates, but government policy and sentiment will still influence Bank of England. Interest rates are used to control economic growth, but much of the inflation we are experiencing now isn’t economic growth. It’s partly a return to previous output with additional Brexit pressures. Added to the mix is a change in our energy use, covid debt, NHS backlog and changing a demographic.

GribsFull MemberPosted 3 years agoWe got a 1.5percent rise this year as that’s inflation according to our md…

Unless you already know you’re overpaid I’d be looking at what you could be earning elsewhere.

duncancallumFull MemberPosted 3 years agoFunny enough I have been looking around abit…..

Brought new staff in on 20% more than me too…. market forces and all that shit…

DT78Free MemberPosted 3 years agoLenders disagree with your sentiment that interest rates will be increasing any time soon, we’ve just had an offer of .99% for a 5 year deal.

I don’t know anyone who has had anywhere near the headline “average” salary increases. Highest I’ve heard is 2%, most have got 0.

Definitely going to be a pinch real cost of living things you *have* to buy are increasing rapidly, whilst wages are not, despite headlines

DT78Free MemberPosted 3 years agoIt would be irresponsible to also increase people’s mortgage repayments at the same time as fuel and food increases.

HohumFree MemberPosted 3 years ago@DT78 I wonder how many of those 5 year deals will be available next week?

The money supporting the product you have now will have been bought a few weeks ago before the impending energy crisis started rearing its ugly head.

5labFree MemberPosted 3 years agoLenders aren’t actually taking the 5 year risk themselves, pricing is based on the swap rates, which move a bit quicker than the mortgage market.

https://www.chathamfinancial.com/technology/european-market-rates

GribsFull MemberPosted 3 years agoWe’ve had some of that but our directors are sensible enough to realise they need to increase current employees pay too.

molgripsFree MemberPosted 3 years agoShould I move to a house that stretches my budget? I’m thinking not.

timfFull MemberPosted 3 years agoIt would help borrowers by reducing the real value of their debts.

It would help savers because interest rates (and hopefully savings rates) would increase to try and curb the inflation.

Inflation can not help both at the same time.

Which it helps depends on if interest rates are higher or lower than inflation.

In recent years interest rates have been lower than inflation.

But complications – some borrowers are borrowing at fixed rates, and some savers are on fixed rates.

Pay rates do not necessary go up with inflation.

So lots of different groups in society are impacted in different ways.

Increased costs of food and energy are likely to hit poorest in society , since they have less scope to cut back spending of non essential goods.

Because of way inflation is calculated the official rate of inflation is likely to underestimate the rate of increase of prices that poorer groups experience.

If the better off have to cut their expenditure on non essential goods this is likely to lead to a dropping of economic activity when measured in ‘real terms’

footflapsFull MemberPosted 3 years agoIncreased costs of food and energy are likely to hit poorest in society , since they have less scope to cut back spending of non essential goods.

Because of way inflation is calculated the official rate of inflation is likely to underestimate the rate of increase of prices that poorer groups experience.

Plus the poorest are about to lose £20 a week from UC, so their purchasing power is going to drop, by being unable to afford food or fuel they’ll help reduce inflation.

The topic ‘Inflation. How high?’ is closed to new replies.