- This topic has 151 replies, 35 voices, and was last updated 9 years ago by jivehoneyjive.

-

Banker bashing Monday!

-

kimbersFull MemberPosted 9 years ago

those upstanding bastions and heroes of our society have been at it again

are they just inherently corrupt, or once you reach a certain salary do your morals simply evapourate?

how much money does one have to embezzle before they see the inside of a prison cell?

http://www.bbc.co.uk/news/business-31248913

so whos name will be on the list this time?

cookeaaFull MemberPosted 9 years agoThe main “Casualty” will be Stephen Green…

TBH I don’t see why we should be shocked, loopholes and Gaps in oversight are there to allow the wealthy to exploit them, the problem HSBC face is that it’s Evasion not Avoidance (The two seem conflated in the press/politics IMO)…

HMRC are happy enough if owed tax is retrieved with minimal fuss, it’ll only be the press and oposition front benchers baying for blood, and that’s where Lord Green will take one for the team I reckon, it’ll all be donne with by Thursday lunchtime…

jambalayaFree MemberPosted 9 years agoBreaking news from 2007.

Stephen Green appears to have done nothing illegal. He withdrew £2m from his own account, unusual yes but illegal no. He was a major donor to the Labour Party btw, lent them £3m

The various press reports today have also mentioned that Phillip Green (of TopShop) avoided tax on a £1.2bn dividend he paid to his wife in Monaco. Stop complaining and change the law/rules.

As HSBC points out the rules have been tightened since 2007 and they are compliant with todays new rules.

cookeaaFull MemberPosted 9 years agoStop complaining and change the law/rules.

This x1000000

making a convoluted set of rules (with loopholes) and then getting all animated when (Shock Horror) those with means and motive to do so take advantage is a bit pointless…

The Fuss over PWC last week was funny too, faux outrage at financial adisors offering…. Gulp…. Financial advice! whatever next….

kimbersFull MemberPosted 9 years agoHe was a major donor to the Labour Party btw, lent them £3m

well that worked OK- he was made a tory peer

Stop complaining and change the law/rules.

red ed suggested an electorate friendly clampdown on tax havens last week and was rounded on by the press and torries

the problem HSBC face is that it’s Evasion not Avoidance (The two seem conflated in the press/politics IMO)…

i suppose thats the problem the line between avoidance and evasion seems very thin HSBC have been accused of both,

Id just naively like to think that these advisors would have some sort of I dunno, moral code!

ernie_lynchFree MemberPosted 9 years agoThe OP’s link suggests that it wasn’t simply a case of exploiting perfectly legal “loopholes”.

In case you haven’t read the OP’s link, quote :

And while tax avoidance is perfectly legal, deliberately hiding money to evade tax is not.

The French authorities assessed the stolen data and concluded in 2013 that 99.8% of their citizens on the list were probably evading tax.

HSBC did not just turn a blind eye to tax evaders – in some cases it broke the law by actively helping its clients.

And :

HSBC denies that all these account holders were evading tax.

So according to the HSBC themselves only some of these clients were acting legally.

And finally :

The bank now faces criminal investigations in the US, France, Belgium and Argentina.

piemonsterFull MemberPosted 9 years agoor once you reach a certain salary do your morals simply evapourate?

Pretty much. Although how often is open to debate. Humans are flawed. Deeply flawed.

nickcFull MemberPosted 9 years agoStop complaining and change the law/rules.

HSBC are/were breaking the law. The rules are pretty clear. They just choose to ignore them on behalf of their rich clients.

jivehoneyjiveFree MemberPosted 9 years agoOh dear!!

Not only are a good chunk of Tory donors all about the tax avoidance

But it also appears to be the basis for the Cameron Family fortune

Well played Beaker…

jota180Free MemberPosted 9 years agoAside from any legal investigations, any suspected evaded tax should be paid by the bank unless they can show it was perfectly legal. They can then chase their clients for it.

wwaswasFull MemberPosted 9 years agoHSBC are/were breaking the law. The rules are pretty clear. They just choose to ignore them on behalf of their rich clients.

It seems the same official that let Vodafone off £6 billion in taxes has also been closely involved in the decision making re: what’s done to HSBC and it’s customers in this case.

He’s clearly got a big future as a tax consultant and doesn’t want to spoil it by upsettign future customers with inconvenient bills and court cases…

jivehoneyjiveFree MemberPosted 9 years agoNot the 1st time HSBC has been involved in dodgy business

What with laundering funds for drug cartels and terrorists…

Funnily enough the latest chairman of the BBC is tangled up in it all too

binnersFull MemberPosted 9 years agoBest not to ask Dave about the tax affairs of the company his wife works for. I hear Luxembourg is lovely this time of year.

Or those who’ll be funding his election campaign

jambalayaFree MemberPosted 9 years agoare they just inherently corrupt, or once you reach a certain salary do your morals simply evapourate?

Plenty of tradesmen doing jobs for cash ?

HSBC are/were breaking the law. The rules are pretty clear. They just choose to ignore them on behalf of their rich clients.

I don’t think that’s the case in the majority of instances. We shall see if they face any trials ?

There is nothing illegal about opening an offshore account. I’ve had 3 over the years, all as a result of working abroad and all with tax paid money. To make things easy tax return wise I put the money in non-interest bearing current accounts.

nickcFull MemberPosted 9 years agoI don’t think that’s the case in the majority of instances.

So, HSBC has admitted it’s broken the law, the French authorities has concluded that 99% of the accounts were for evading tax, HSBC has had to pay hundreds of millions in fines and back taxes, and countries across the globe are investigating this…and you don’t think that’s the case?

Are you wilfully ignorant* or just trolling

* not in pejorative sense, are you just not paying attention to what’s going on?

ernie_lynchFree MemberPosted 9 years agoI don’t think that’s the case in the majority of instances.

😆

So if there is a police raid on some dodgy character and the majority of the bikes in his garage are not stolen that’s fine ?

binnersFull MemberPosted 9 years agoI don’t think that’s the case in the majority of instances. We shall see if they face any trials ?

Don’t be silly! Everyone knows that bankers are above the law. Glad to be proved wrong on this, if you can point me in the direction of a single solitary case of a banker seeing the inside of a courtroom, for any of the banks previous multitudinous fraudulent activities

And we’ll refer to it for what it is eh? its not ‘mis-selling’ its fraud!

GO!….

wobbliscottFree MemberPosted 9 years agoBashing bankers is just attacking the symptoms. The poor have just as much capacity to exploit loopholes and have just as compromised morals, we just call them benefit cheats. I can’t blame anyone for exploiting the system. I do it myself – bike to work scheme for example.

The only way to tackle this issue is by overhauling the system and closing down the loopholes.

wwaswasFull MemberPosted 9 years agoclosing down the loopholes.

that’s avoidance.

HSBC was involved with and encouraging evasion which is a criminal offence in most countries. Just not a crime they’ll be facing prosecution for in the uk despite other jurisdictions taking criminal action against them.

mogrimFull MemberPosted 9 years agoHSBC are/were breaking the law. The rules are pretty clear. They just choose to ignore them on behalf of their rich clients.

I’m far more interested in their rich clients – after all, where does the money used to pay HSBC come from? The bankers are clearly criminal, but where does the money come from? I’m sure there are loads of very worried Spanish politicians at the moment…

El-bentFree MemberPosted 9 years agoor once you reach a certain salary do your morals simply evapourate?

I think you are labouring under the illusion that they had any morals to begin with.

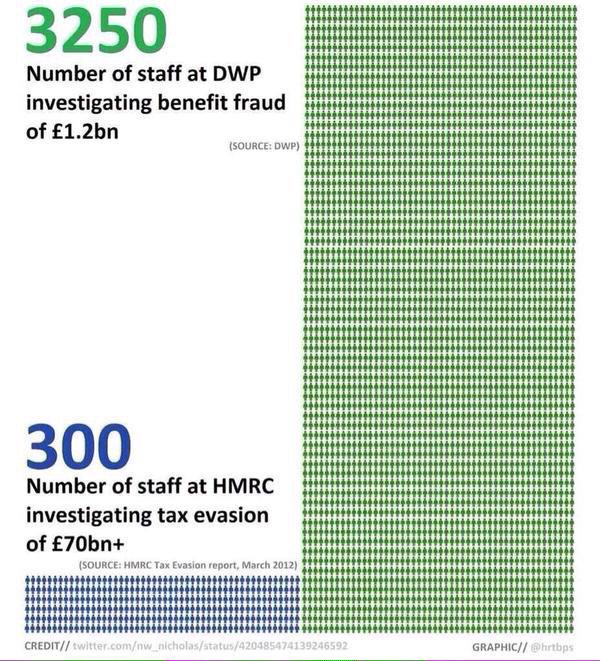

ernie_lynchFree MemberPosted 9 years agoThe poor have just as much capacity to exploit loopholes and have just as compromised morals, we just call them benefit cheats.

Not quite the same capacity :

Tax evasion costs Treasury 15 times more than benefit fraud

“The poor” need to get their finger out if they are going to milk the system as much as tax evaders.

binnersFull MemberPosted 9 years agoThe only way to tackle this issue is by overhauling the system and closing down the loopholes.

HSBC were literally doling out suitcases full of cash. No questions asked.Thats not about exploiting loopholes. Thats just criminal behaviour. But from an organisation that also asked no questions when Mexican gentlemen regularly arrived with millions of dollars in similar suitcases, what do we expect?

Well… someone actually being held to account would be nice. If only for the novelty value.

jota180Free MemberPosted 9 years agoThe poor have just as much capacity to exploit loopholes and have just as compromised morals, we just call them benefit cheats.

……and there I was thinking benefit cheats were rich, what with their big London houses and all

jambalayaFree MemberPosted 9 years ago@binners plenty of big fines in the US (inc for the likes of HSBC) for abusing the law regarding money laundering and sanction busting.

“no questions asked” – I think its a bit daft to obsess about this as anyone with an ounce of intelligence can come up with a believable reason they need the cash. The guy in question (Richard XYZ ?) said he wanted to deposit it in another bank but didn’t want to tell HSBC who it was, perfectly within his rights to do that.

@ernie is correct, tax evasion dwarfs benefit fraud. I’d say cash in hand payments to tradesmen cause a VAT loss to HMRC which exceeds benefit fraud then there is the undeclared income with respect to income tax. Then we add on all the larger scale stuff starting with say media bods via sportsmen all the way up to big business.

dazhFull MemberPosted 9 years ago@binners plenty of big fines in the US

Funny I thought the subject at hand is a UK bank helping UK companies and citizens avoid UK tax. Where does the US come into it?

binnersFull MemberPosted 9 years ago@binners plenty of big fines in the US (inc for the likes of HSBC) for abusing the law regarding money laundering and sanction busting.

Any Uk examples? And I’m not talking about fines anyway? They ultimately just get passed on to the customers of organistaions deemed ‘Too Big to Fail’. Or the taxpayer. So aren’t even a punishment at all.

I’m talking about individuals being hauled up in court, for their fraudulent activity. After they’ve personally profited enormously from their illegal activity? You know…. Like, say… someone fraudulently claiming disability allowance would be?

No?

singlesteedFree MemberPosted 9 years agoWhat’s wrong with good old fashioned safes these days fps.

wwaswasFull MemberPosted 9 years agoI’m talking about individuals being hauled up in court, for their fraudulent activity.

that only happens if the victim is a bank…

blurtyFull MemberPosted 9 years agoMy cousin is a ‘Personal Banker’ in Zurich. He is firmly of the mind-set that paying taxes is only for ‘the little people’.

jivehoneyjiveFree MemberPosted 9 years agoWhy is HSBC facing criminal investigations in the US, France, Belgium & Argentina but not the UK?

ernie_lynchFree MemberPosted 9 years agoBecause the bankers managed to get their party/backers/old school tie mates elected to government ?

To be fair a Labour Party scared of its own shadow is unlikely to have behaved any different.

jivehoneyjiveFree MemberPosted 9 years agocheekyboyFree MemberPosted 9 years agoI’d say cash in hand payments to tradesmen cause a VAT loss to HMRC which exceeds benefit fraud

Of course you would !

jambalayaFree MemberPosted 9 years agoFinancial fraud cases have been very difficult to prove in the UK, a long list of failed attempted prosecutions. That’s why HMRC focuses on collecting settlement money and fines and not court cases. Also I don’t see how the UK could bring an effective court case against a banker located offshore.

When this info was handed over, back in 2010 so it’s not even a current news event really, there was much talk of big tax collections but there have been very few as I’d wager the majority of the money was legit or any tax due was relatively minimal.

binnersFull MemberPosted 9 years agoWell when you put it like that, I don’t know what all the fuss is about either?

Cant the pesky HMRC stop hounding and harassing those poor over-regulated wealth creators, and their modestly paid friends in the city. So they bent the rules a little? But Haven’t they suffered enough?!!

🙄

binnersFull MemberPosted 9 years agoRape cases are also notoriously difficult to prove. Perhaps we should stop pursuing those too?

It’s the Tory election fundraiser tonight. I wonder how many of Dave’s guest list will be featuring in future, achingly familiar news reports

scaredypantsFull MemberPosted 9 years agoFinancial fraud cases have been very difficult to prove in the UK, a long list of failed attempted prosecutions

Yeh, and then when they manage it, the poor rich guy has to be let off because of an irreversible* neurological condition

*sorry, did I say ireversible ? I meant invented, by the best doctors money can buy

teamhurtmoreFree MemberPosted 9 years agoBinners, there have been convictions. Just google

But that misses the point. No one noticed that HMRC deal man then went on to work at HSBC. Hmmm,,,,

They could be in real trouble in US – damn I am a shareholder – but looks deserved at this rate. Top heavy, poorly performing juggernaut. Needs bloody big clear out

The topic ‘Banker bashing Monday!’ is closed to new replies.