Does NI not decrease in its rate dramatically as you get to high wages?

You need to remember that at £50 000 pa earnings you are in the richest few % of the country.

the highest marginal tak rates are actually on the poorest working people due to the rate tax credits are withdrawn at. for some folk this can be over 90% ie for every extra £ they earn they keep only 10p

Anyone earning £50 000 pa and whining about being poor needs a good slap and some time on national minimum wage just to see what the reality is for most folk.

"Anyone earning £50 000 pa and whining about being poor needs a good slap and some time on national minimum wage just to see what the reality is for most folk."

Well said teej.

And im sure we will hear all about regional variance and how people cannot live a minimum living standard in xyz area on 50k ...... Well if that's the case then you'll need to live else where within your means .

I moved out of the family home onto minimum wage i(bike shop)nto a shit flat in a shit(ISH) area , with a girlfriend who'd gone back to uni ... That wasn't fun in the slightest and will stay with me for life.

Aye, well said*

*and well done, editing out that last bit about joining the 'brothers' 🤣

Yup. Having little expendable income left because you’ve got a massive mortgage, kids in private school, lease cars and/or ski holidays to pay for is a little bit different to it being because this month you had to buy some new shoes, or pay the car mot or they ****ed up your benefits payments again...

It sometimes seems that there is an inverse relationship between income and empathy...

Yeah but you can just lob 10k tax free into your pension to make up for it.

Except that your allowable pension contributions also reduce as your income goes up, so probably you can't.

Edited, I appreciate we’ve moved on I’m ending up repeating myself!!

Anyone earning £50 000 pa and whining about being poor needs a good slap and some time on national minimum wage just to see what the reality is for most folk.

Has anyone here whined about being poor whilst being on £50k?

Yes and no.

Whined about being poor..... But it was 80k not 50k.

Anyone earning £50 000 pa and whining about being poor needs a good slap and some time on national minimum wage just to see what the reality is for most folk.

Kryton will be along soon to tell you how tough it is being a higher earner! He works hard for his money!!

to demonstrate the marginal rate of tax (not a complaint, just a demonstration, and based on 2018/19 figures) :

if you earn 100k, you have a taxible income is £88,150 (tax free allowance is £11,850)

on that, you pay £6,900 tax at 20% and £21,460 tax at 40%

you pay national insurance of £5624.12

so total deductions is £33,984.12 and total take home is £66,015.88

now, lets say you earned £10k more

you earn 100k, you have a taxible income is £103,150 (tax free allowance has reduced to is £6,850)

on that, you pay £6,900 tax at 20% and £27,460 tax at 40%

you pay national insurance of £5824.12

so total deductions is £40,184.12 and total take home is £69,815.88

out of your additional £10k earnings, you have been taxed\NI'd an additional £6,200, a marginal tax rate of exactly 62%

you also lose approx 5k/child worth of post-tax savings in the form of free childcare (for 3 year olds), and lose access to tax-free childcare to pay for the rest of it, so the total effective rate can easily top 100% if you're not careful

of course (as long as you're under the £40k and £1mm limits) you can push some of that into your pension, but you'll be taxed on all but £5k it when you withdraw it (the rest of your allowance is taken out by the state pension), and in fact if your pension is over the £50k limit (which I think is nigh-on impossible with current limits/annuity rates - approx £35k is the most anyone can get) then you'd be paying tax at 40% anyway

Good explanation 5lab.

Its always tricky trying to explain Tax to anyone never mind what level of social ladder they perceive to sit on.

Does NI not decrease in its rate dramatically as you get to high wages?

it drops to 2% around the same earnings as the 40% income tax kicks in meaning our effective direct tax bands are 32, 42 & 47%. If it stayed at the same rate the upper rates would be an eye watering 52, & 57%.

Personally I think we should do away with NI and be more honest about the actual rates of direct taxation.

Its always tricky trying to explain Tax to anyone never mind what level of social ladder they perceive to sit on.

OOOO!

Next up we need to include the whole taxation impact to give a clear picture of the overall tax burden.

I do agree with gonefishin that it needs a single rate to keep things simple and avoid the government doing the sneaky fiddles to convince you your tax has not risen.

Perhaps the team doing universal credit could take a look once they are finished.

To be clear I wasn’t advocating a single rate of income tax, different bands do make sense, just we should only one type of direct taxation rather than two.

I am in favour too of abolishing VAT and NI.

Have one single rate tax in a series of bands going up the scale of income..

Make it clear and simple.

We could do away with a whole segment of Accounting industry and Lawyers.

Got to be a good thing riiiight?

You need to remember that at £50 000 pa earnings you are in the richest few % of the country.

Thats the big joke really. The US arm of where I work starts their fresh out Engineers on that... lucky the cost of living is so low in the UK and the development opportunities are so diverse.... but it’s ok in March anyone with a “skill” will be on at least 30k.

when an MP is on around 75k and a cabinet minister 130k with no required qualifications and no real accountability you have to wonder where we are headed.

I am in favour too of abolishing VAT and NI.

Abolishing VAT probably isn’t a great idea as sales taxes can be used to nudge behaviour and manipulate consumption e.g. the high rates on cigarettes to discourage smoking. It’s far from perfect but it can help. Additionally VAT isn’t charged at 20% on everything (food, domestic fuel, rent) so it isn’t as regressive as some would make out. It could do with simplifying though.

To be clear I wasn’t advocating a single rate of income tax, different bands do make sense, just we should only one type of direct taxation rather than two.

Sorry that is what I meant just no extra taxes to confuse the masses, one tax, multiple bands

As above VAT is a good tool for some things but should probably be restructured.

Anyway none of this will happen as people will get defensive about tax and earnings, too many voters are in the mid to upper range and come brexit we are all going to have to get less and pay more.

(which I think is nigh-on impossible with current limits/annuity rates – approx £35k is the most anyone can get) then you’d be paying tax at 40% anyway

You can get more than that - but it is taxed at a horrendous rate. If you exceed the £1M lifetime allowance (this is the value of your DC pot, not the amount you paid in), taking a lump sum from any amount over the limit is taxed at 55%, and taking drawdown (income) is taxed at 25%, and then you pay income tax on top of that. So you may have avoided tax when you put the money in, but you certainly won't when you take it out. I appreciate that this is a problem that the vast majority of people will never have, but it does indicate that this narrative that the wealthy are more lightly taxed is not as straightforward as it might seem.

but it does indicate that this narrative that the wealthy are more lightly taxed is not as straightforward as it might seem.

But it does open it a variety of other investment opportunities, property, art, fine wines or whatever else is going, along with being able to afford a good accountant.

Anyway none of this will happen as people will get defensive about tax and earnings, too many voters are in the mid to upper range

Well higher tax band starts at 87th percentile roughly. This would mean that 13% of the voters would be in the upper range. Obviously does not include non working spouses etc.

There seems to be s generalisation that high income = Tory which may or may not be the case but if true these people will not have a realistic alternative. I mean they won’t go labour and Lib Dem are a cluster.

If there was a data driven analysis and then a plan formulated then there may be some grumbling but could be pushed through.

the current approach of throwing money around with no objectives or performance criteria/monitoring does no one any good.

When discussing taxes like this we really should stop using the word wealthy and use high income/earning instead as what we are talking about are taxes on income (in the case of pensions deferred income) not wealth. Actual wealth, i.e. assets, are actually relatively lightly. The highest marginal rate of Corporate Gains Tax in the UK is 28% and that is only in residential property otherwise it’s a maximum of 20%.

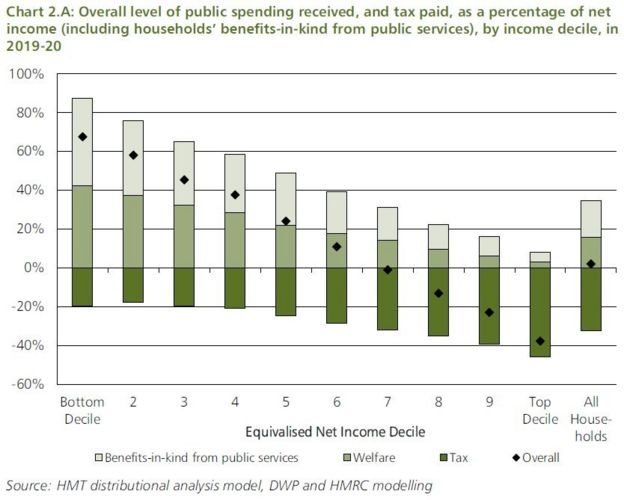

I was looking for the proportion of tax payers in each band and found this graph, which was interesting. It appears that the bottom 10% of earners do pay 20% of their income in tax (which is slightly more than the next 10%), but receive the equivalent of ~85% of it in benefits/welfare. obviously the value of a % increases the further right on the graph you go, so it's hard to understand the exact £ value of each block

And now the Met will be selling image rights to fund itself....

Something is very broken here, though I'm sure anyone who feels like paying extra tax can now buy a novelty copper

how do you get that?

Your referring to a different thing. You’ve quoted the average tax rate not the marginal. The figures you’ve used are useful for answering the question “how much tax do I pay” but not for answering the question if “I earn an extra £100 how much tax will I pay on that £100?” For that you need to know the marginal rate which is not just a function of tax rate but also changes in personal allowances and loss of benefits.

Both are useful numbers as long as they are used appropriately.

Fair do's but the marginal rate is only useful for 2 things, 1 deciding whether you can be arsed working to cream in any more. and 2 to sound like you are hard done by. It doesn't really have any benefit in the conversation. If you are earning 100k, stop waffling about your tax rate and thank your lucky stars.

Well it equally applies to those who will see their benefits being being reduced as a result of increased earnings or should they than their luck stats to no longer be needing as much of a handout?

It’s a very useful number.

If you are earning 100k, stop waffling about your tax rate and thank your lucky stars.

The only thing worse than paying higher rate tax is not paying higher rate tax.

There seems to be s generalisation that high income = Tory which may or may not be the case but if true these people will not have a realistic alternative. I mean they won’t go labour and Lib Dem are a cluster.

I'm not sure I follow that - why can't high earning people vote labour or lib dem? Just because someone earns a lot it doesn't necessarily follow they don't have a sense of social justice and/or don't support progressive taxation. Most of the high earners I know (being an ex consultant, I know quite a few) don't vote Tory and wouldn't in a million years - that may be because I have a selection bias I guess but still.

you can push some of that into your pension,

Assuming you pay £40k into your pension each year using salary sacrifice, you can defer the higher marginal tax rates till you earn £140k a year or over.

Only if your company doesn't also contribute anything...