- This topic has 84 replies, 37 voices, and was last updated 8 years ago by surfer.

-

Workplace Pension Scheme – is it worth enrolling?

-

mudsharkFree MemberPosted 8 years ago

IMO when younger best to worry more about saving up/paying for a suitable property to live in then switch to paying into a pension – may as well wait until a higher rate tax payer anyway. Of course take full advantage of all contributions an employer is willing to make though.

Maybe one day the higher rate tax benefit will go from pension contributions? Makes sense to take advantage of it while its there for those that earn enough.

footflapsFull MemberPosted 8 years agoBut do you get to choose the funds or other investments in the Stakeholder scheme?

You can yes, the available range will depend on the Stakeholder provider and what they offer.

Maybe one day the higher rate tax benefit will go from pension contributions?

Could be in a few weeks if the rumours are to be believed. Pension review reports in November…

http://citywire.co.uk/money/hargreaves-game-is-up-for-higher-rate-tax-relief-on-pensions/a844004

My advice is to get a pension early, I know it’s more fun to buy beer and bike bits in your 20s but that is the time that pensions need to be started in order to maximise their benefits

This x1000. You need the cumulative interest to get anything worth having and this only comes after years of being invested.

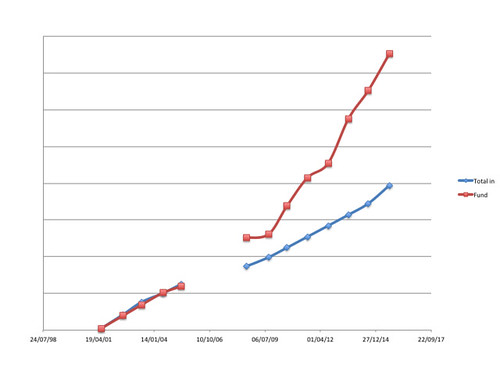

I plotted out one of mine the other day, for the first few years it barely broke even, but over time has been doing better and better…

[url=https://flic.kr/p/zchho3]Slide1[/url] by Ben Freeman, on Flickr

surferFree MemberPosted 8 years agoI look forward to hearing the details of the firefighters scheme. I suspect even the recent changes make it extremely attractive as is the teachers one. I am also interested in why anyone would want to leave it.

mudsharkFree MemberPosted 8 years agoYou need the cumulative interest to get anything worth having and this only comes after years of being invested.

Yeah but paying off debt is good too – depends on the interest rate. At what rate would you be willing to borrow to put into a pension?

freeagentFree MemberPosted 8 years agoYeah but paying off debt is good too – depends on the interest rate

Agreed – we have a hooooge mortgage at the moment, which i’d like to get down a bit before we start loading up the pension contributions.

BazzFull MemberPosted 8 years agoSurfer – don’t get me wrong even with the scheme changes it’s still a worthwhile scheme IF you manage to maintain the fitness/physical ability to keep going until your a minimum of 60.

People are leaving because of the in-flexibility of it, if you leave before the full term then you can’t transfer it any where it is just frozen until 67, and many people are doubtful that they will still be in the job when they’re 60.

So for example if you are found un-fit for work through a non work related illness i.e. cancer you will lose your job and get no pension, people would rather invest their cash in property or a more flexible private scheme.

ircFull MemberPosted 8 years agomudshark – Member

Maybe one day the higher rate tax benefit will go from pension contributions? Makes sense to take advantage of it while its there for those that earn enoughIt could be sooner than you think. Some reckon next year. It is arguably unfair that the wealthiest savers get the vast majority of the pension tax relief. There are rumours that it might go to a standard rate of 33% relief for all taxpayers. Save 2 get one free?

mudsharkFree MemberPosted 8 years agoHL have been saying this for a few years now but it suited me to wack in a chunk of cash so I went with it. Got enough in there now so sticking to ISAs for flexibility for the moment.

surferFree MemberPosted 8 years agoPeople are leaving because of the in-flexibility of it, if you leave before the full term then you can’t transfer it any where it is just frozen until 67, and many people are doubtful that they will still be in the job when they’re 60

Thats rubbish. Why would you leave a scheme that is head and shoulders better than anything you could get elsewhere. The fact that you cant move it means nothing. Why would you choose to move to an inferior scheme or a SIPP given the benefits that it offers.

I have 10 years of a final salary scheme from many years ago. I think I could move it but I would have to stupid to do it given it offers a fantastic (in relation to what I put into it not in monetary terms) pension payment. It has grown each year even though I havent contributed for almost 20 years and I suspect yours is similar. Stop whining it is far better than the majority of people are ever likely to get. If your mates decide they want more “flexibility” good luck to them.anagallis_arvensisFull MemberPosted 8 years agolook forward to hearing the details of the firefighters scheme. I suspect even the recent changes make it extremely attractive as is the teachers one. I am also interested in why anyone would want to leave it.

I suspect as firefighters dont get paid much putting a big whack into a pension is hard. Crazy as it seems I know many teachers who dont pay into the teachers pension for exactly the same reasons and teachers get more than firefighters each month (I imagine, dont know for sure tbh). Its crazy but I suppose house prices have meant a teacher or a furefighter might not be able to afford to buy a home and pay into a pension.

surferFree MemberPosted 8 years agoLots of people dont get paid much and lots of people cant afford to get on the housing ladder. What they put into a pension is their decision. It doesnt detract from what is a very generous scheme, particularly teachers.

Pawsy_BearFree MemberPosted 8 years agoOne thing is sure if you do not do something about retirement YOU will be the one that suffers.

anagallis_arvensisFull MemberPosted 8 years ago. It doesnt detract from what is a very generous scheme, particularly teachers

I didnt say it wasnt I was trying to explain why people might not pay in as you said you couldnt understand why they wouldnt. But it appears you are just trying to hide your envy behind something else so feel free to get it off your chest.

DracFull MemberPosted 8 years agoI suspect as firefighters dont get paid much

Firefighter

Trainee £22,027

Development £22,933

Competent £29,345They’re pension has been messed about with as has pretty much every public sector, they even got mine in the end with another change. It’s not as good as it was meant to be but still pretty good, just very annoying after 26 years of paying in they can come along and change it.

footflapsFull MemberPosted 8 years agoI do think retrospectively changing pension terms for public sector workers is pretty immoral. Shame it’s not illegal.

BazzFull MemberPosted 8 years agoSurfer – I wasn’t aware that I was whining, mine is staying put, but most people who join the job now aren’t joining the pension, that’s a fact, at least where I work, and I think more than half who have been in for five years or less have decided to leave, part of the reason they give that if the government can just come along and make changes this time with impunity then they’ll probably do it several more times again before they get to retire. People want more control of their own money and don’t trust the government to do right by them.

Pawsy_BearFree MemberPosted 8 years agoIf changes do occur to your pension what you have already gained is not lost. If you subscribe to the conspiracy theory approach to life then your heading for a poor retirement. The prudent do the best with the cards they are delt. Life’s like that.

suburbanreubenFree MemberPosted 8 years agoI do think retrospectively changing pension terms for public sector workers is pretty immoral. Shame it’s not illegal.

Not just public sector workers.

The Scunthorpe steel workers thought they’d be comfortable in retirement, only to find their employer had spent their pension pot on coke and ores…surferFree MemberPosted 8 years agoBut it appears you are just trying to hide your envy behind something else so feel free to get it off your chest.

Envy no, and if they are that poor that firefighters choose not to enrol then what have I got to be envious of? I think as we both know these are extremely generous schemes however they are less generous than they used to be.

Get something off my chest? absolutely. I benefit from an extremely good pension scheme I just get tired of this constant complaining and misinformation from those in the public sector about the poor state of their pensions. They are less generous than they used to be but so are many others and private sector pension schemes have also been raided and retrospectively changed.

This thread isnt about those with privileged pension arrangements it is about someone who needs to know some “facts” about how pensions work, and the benefits of investing. If firefighters want to give up the offer of “free” money along with other benefits because they feel that that free money will be worth a little less in future then that is up to them. I think it is a poor decision.

edit: What Pawsy bear said

People want more control of their own money and don’t trust the government to do right by them.

If you mean by “control” the option to give up on contributions from their employer then thats up to them. I would like to see the “guaranteed” alternative that is going to provide a more lucrative outcome at a lower cost in 40 years.

anagallis_arvensisFull MemberPosted 8 years agoI just get tired of this constant complaining and misinformation from those in the public sector about the poor state of their pensions

I dont see many/anyone saying the pensions are not good but like so many in the private sector you seem to only see the pension and not the overall renumeration package.

surferFree MemberPosted 8 years agoI dont see many/anyone saying the pensions are not good but like so many in the private sector you seem to only see the pension and not the overall renumeration package.

Then you are not reading this thread and you are being deliberately selective. Bazz is saying exactly that.

This thread is about pensions it is not about the “overall remuneration package” so stay on track.jam-boFull MemberPosted 8 years agoWhen public sector pensions change, do they transfer everything over to the new terms?

They never used too, I have 8 yrs frozen in a civil service ‘classic’ scheme that is worth a small fortune compared to what I put in. That’s based on 1/60ths and index linked final salary.

DracFull MemberPosted 8 years agoWhen public sector pensions change, do they transfer everything over to the new terms?

Some do yes. I didn’t because of the years I had I never got caught on the previous changes. The 2015 I did but it means I can keep my previous pension on the old skill then start on the new one.

anagallis_arvensisFull MemberPosted 8 years agoThis thread is about pensions it is not about the “overall remuneration package” so stay on track.

Please refer back to your question about why firefighters were dropping out or not joining the scheme and my answer. It also seems obvious to me that when considering the option to join a pension you have to consider if you can aford to.

surferFree MemberPosted 8 years agobut like so many in the private sector

What makes you think I work in the private sector?

surferFree MemberPosted 8 years agot also seems obvious to me that when considering the option to join a pension you have to consider if you can aford to

Of course it does but that does not detract from the generosity of the pension scheme and that is not amongst the reasons given by those who work in the sector is it?

We were 4 responses in to the original question before a public sector worked was complaining about their circumstances. I would like to see the detail of that and maybe we can compare that to the vast majority of private sector workers to make a judgement.anagallis_arvensisFull MemberPosted 8 years agois not amongst the reasons given by those who work in the sector is it?

It is amongst ones I work with.

anagallis_arvensisFull MemberPosted 8 years agobut like so many in the private sector

What makes you think I work in the private sector?I dont know where you work, but you have view like many in the private sector.

surferFree MemberPosted 8 years agoAA you are ignoring the OP’s question. You are choosing to ignore the firefighters on here who have made their opinions clear (yet you know better about their reasons in spite of what they tell you) as you know better.

I think we can conclude that even under changed conditions these offer significantly better value than almost anything in the private sector.I dont know where you work, but you have view like many in the private sector.

And now you are just making stuff up 🙂 maybe the “view” of those you refer to in the private sector is valid, have you considered that?

anagallis_arvensisFull MemberPosted 8 years agoSurfer tou seem like a very angry oerson. I wasnt responding to the op I was responding to you when you questioned why fire fighters might not pay into the scheme. Since then you have just appeared to be spoiling for a fight.

surferFree MemberPosted 8 years agoCharacterising me as “angry” is a nice “passive/aggressive” response and a good diversion technique AA. I am not “angry” at all and as I explained I am not “envious” either but I am interested in comparing schemes given at least two firefighters have come on here and complained about theirs.

How does your scheme stack up?

anagallis_arvensisFull MemberPosted 8 years agoHey all I tried to do was suggest a reason why fire fighters might not pay in. I have no idea how my scheme stacks up. A financial advisor said it was very good I havent really looked into it. Maybe you can enlighten us. Not sure how it helps the op or the discussion though. I’m not sure what you think I’m trying to divert you from either.

anagallis_arvensisFull MemberPosted 8 years agoCharacterising me as “angry” is a nice

Wasnt meant to be

brFree MemberPosted 8 years agoI would like to see the detail of that and maybe we can compare that to the vast majority of private sector workers to make a judgement.

That’ll soon be easy. We’ll be mostly on 8% maximum of salary+overtime+bonus etc (that is, upto £36561 – £42385-£5824).

Which is 4% employee, 3% employer and 1% tax-relief.

So 8% of the average earnings, currently £27k for 40 years, probably works out at a pension of £5k ‘earning power’ (taking out inflation).

surferFree MemberPosted 8 years agoI dont understand that BR. Can you clarify it?

Employee contribution?

Employer contribution?

Benefits in service?

Retirement details ( I understand you are forced to retire at 60?)

Qualifying years?

Is it now “career average” as oppose to final salary?Cheers.

BazzFull MemberPosted 8 years agoI dont see many/anyone saying the pensions are not good but like so many in the private sector you seem to only see the pension and not the overall renumeration package.

Then you are not reading this thread and you are being deliberately selective. Bazz is saying exactly that.[/quote]

Morning surfer, I think you may be mis-representing me there, I never said that our pensions were poor, in fact I agree with your assessment that they used to be very generous and now they are only moderately generous, that is why my money will continue to go into my pension.

What I was doing was firstly explaining the changes to the scheme and then later explaining why so many people are leaving. FWIW I think those leaving are foolish, that said being on the inside I can totally see why people are angry when you hear how government ministers portray our pension arrangements in the press to the wider public compared to the reality.

I think many of them will later in life regret their anger inspired reactions, however if people continue to leave the scheme then it will become totally unworkable and will either have to be propped up wholly by the taxpayer or collapse.

I honestly believe that this country needs some strong laws around pensions that cover both public and private now that they have become a necessity rather than a luxury and many people seem to not entirely trust the people running them.

allthepiesFree MemberPosted 8 years agoHere’s a PDF of the plan.

https://www.yourpensionservice.org.uk/web/viewdoc.asp?id=120876

brFree MemberPosted 8 years agoIt’s the new Govt pension scheme for everyone.

As eventually everyone, in the private sector at least, will be on it. Unless an employer specifically wants to offer more, but I reckon you’ll find this will be the new ‘bottom’ line.

Pensions are easy really. If you want a pension somewhere near what you’ve been earning you’ll need to constantly be investing half your age as a percentage of your earnings. So at 20 y/o, you need 10% going in. Once you get to 50 y/o, it’s 25%. etc.

Few folk ever manage this level of investment, and even few manage it for a long period – but this is really what is needed to finance a DB scheme.

firestarterFree MemberPosted 8 years agoI appear to have missed a lot here 😉 I’m staying in mine because although what I have in is protected now it isn’t if I leave. Yes I’d still get it but the rules and worth would be changed if I leave.

Problem is as buzz said earlier if u get Ill and have to leave I have no pension

Also it’s been changed (for the final time) twice now since I’ve been in how many more times will it change. It’s been suggested that if the pension scheme collapses then it will be easy for government to get rid with privatisation but who knows. I know I’ll be lucky retire while there is still a national fire service as we know it

hugoFree MemberPosted 8 years agoTake the free money and opt in.

That is unless you need the money more now. At 30 years of age, just stick it in an accumulation tracker (if you get the choice), sit back, and don’t overthink it.

The topic ‘Workplace Pension Scheme – is it worth enrolling?’ is closed to new replies.