Home › Forums › Chat Forum › Irresponsible lending? overdraft/ CC content.

- This topic has 62 replies, 43 voices, and was last updated 9 years ago by just5minutes.

-

Irresponsible lending? overdraft/ CC content.

-

binnersFull MemberPosted 9 years ago

Its absolutely bonkers! Have we learn nothing? It does seem that we, as a society, appear to be trying to exactly replicate the conditions to led to the last crash.

The fact of the matter is that there is no economic recovery worthy of the name. There has been no rebalancing of the economy. Quite the reverse. So we have a government cynically trying to give the impression that everything hunky dory again through crazy short term policies, which are absolutely guaranteed to go tits up. And opposition parties entirely complicit in this neoliberal facade, offering absolutely no alternatives

So what have we got? Again….

A ridiculous and unsustainable housing bubble fuelled by public money (the frankly insane Help to Buy scheme), and another huge splurge on Buy-to-Let mortgages? (up 26% in 12 months)

Check!

A surge in consumer spending, despite a fall in salaries and ‘real’ income, all fuelled by cheap credit, while rates remain (temporarily) low?

Check!

Banks still ‘Too Big to Fail’ lobbing money around in the same ‘we can’t lose’ manner as pre 2007?

Check!

The return of still totally unregulated, snouts-in-the-trough, big bonus, roulette-wheel, casino banking.

Check!

What could possibly go wrong? 🙄

aracerFree MemberPosted 9 years agoDon’t worry, the Tories are in charge now, and we all know they’re much better at managing the economy than Labour, so won’t make the same mess as Brown and Darling.

MrSmithFree MemberPosted 9 years agoPeople have lost the art of delayed gratification.

They also like to blame others for their predicament instead of looking at the real reason (their lack of judgement and wanting everything on a plate today not tomorrow)jekkylFull MemberPosted 9 years agoBillMC – Member

I don’t have a cc. If you can’t afford it, don’t have it. Debt equals stress and lining the pockets of the bankers.So everyone should rent and line the pockets of the landlord instead?

bigblackshedFull MemberPosted 9 years agojekkyl – Member

So everyone should rent and line the pockets of the landlord instead?

Did you buy your house with a CC?

dereknightriderFree MemberPosted 9 years agobinners – Member

What could possibly go wrong?

Europe (where all the money is suddenly coming from) could fail, Russia could destabilise the Baltic states, labour could get into office with a workable majority, the two former would see the dollar return as safe haven currency increase in value and the cost of energy rising, the latter will see sterling drop in value with a similar effect.

But as far as the banks go, there are the Basle agreements in place keeping their debt to cash ratio regularly stress tested, we have a degree of security here in the property market thanks to years of under supply and influx of population.

So short of ISIS getting their hands on chemical or nuclear weapons I think we’ll just see another bubble for a period until one or other event crack down the finance shutters again, I like that idea up there of borrowing everything you can, hiding it offshore then declaring bankruptcy – nice idea..

ScapegoatFull MemberPosted 9 years agoOr play the banks at their own game. If you shop round you can get interest free credit cards with 24 months intro offers, and cashback deals on groceries and fuel. The same bank offers you higher interest on your current balance than most ISAs. So, use THEIR credit card for 24 months food and fuel, earning 3% in cashback on the fuel, 1% cashback on groceries, and 2% on department store spending, ensure you leave the equivalent in your current account, where it earns a further 2-3% interest. Make sure the balance of the card never exceeds the balance of the current account, and never exceeds the credit limit. Pay it all back after 24 months and trouser the interest AND cashback. Takes discipline, and you have to make a 1% min payment on your card, but basically it’s free money. The sweetest bit is that you are borrowing their money for free, to earn their interest on cash which you wouldn’t otherwise have had

Paying off a credit card debt? Transfer a current credit card balance onto a free balance transfer card, set up a direct debit to pay off the 1% minimum charge on your new 0% card. Divide the total debt into 12 monthly sums, and put those into an interest earning account each month, less the 1% minimum that you’re paying off anyway. At the end of the interest free balance transfer period pay off the credit card with the savings. Quite a difference between earning a few percent interest on the accumulating balance and spaffing 20% AER on the old credit card debt.

DO NOT do either of these things if you can’t spend within your means, or organize your accounts to make sure you don’t miss any payments or balance clearance deadlines.

suburbanreubenFree MemberPosted 9 years ago

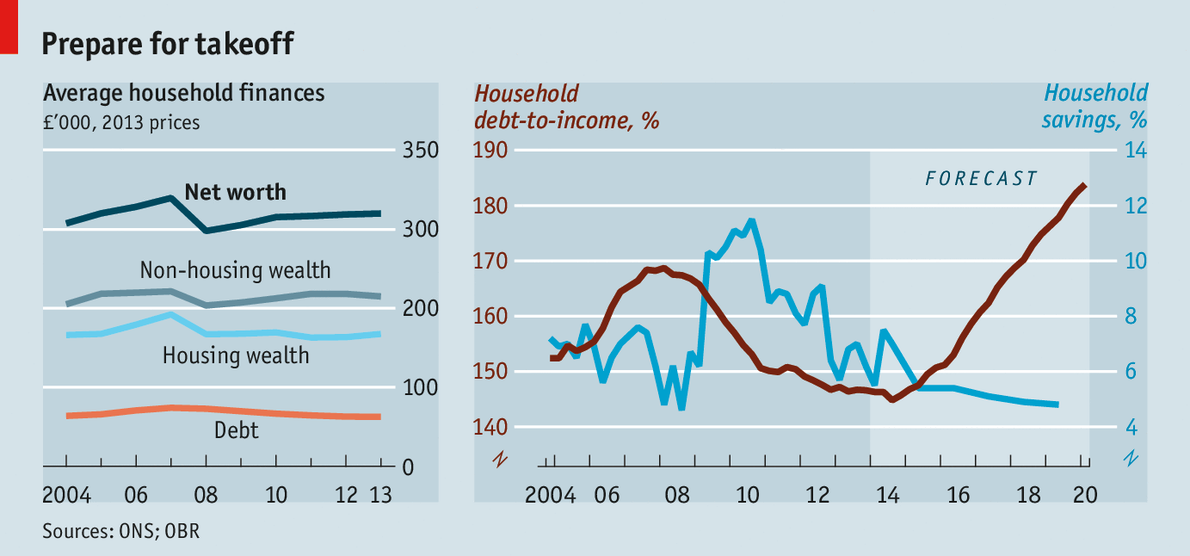

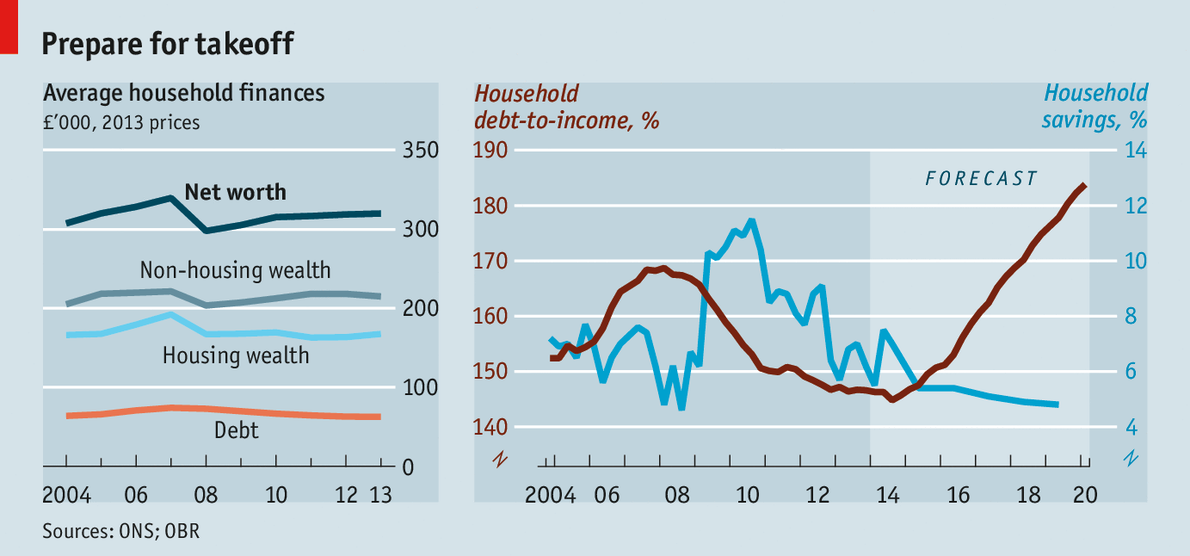

Average non-housing household wealth of £200,000?

I should coco!squirrelkingFree MemberPosted 9 years agoPaying off a credit card debt? Transfer a current credit card balance onto a free balance transfer card, set up a direct debit to pay off the 1% minimum charge on your new 0% card. Divide the total debt into 12 monthly sums, and put those into an interest earning account each month, less the 1% minimum that you’re paying off anyway. At the end of the interest free balance transfer period pay off the credit card with the savings.

If you ignore the 3.5% minimum balance charge that usually comes with the “deal”. Know anywhere offering 3.5% savings barring a current account tied deal with minimum monthly deposit? Tarting isn’t the payday it once was sadly. Low interest rates and inflation have knocked that well on the head.

True I know nothing of this girl so i have to make assumptions.

No actually, you don’t, you only feel compelled to do for reasons best known to yourself.

I doubt from the info given she’s borrowed this money to keep food on the table for her family or to look after an elderly relative. My assumption is that she’s pi$$ed it up the wall in bars and handbag shops.

Really? Why’s that? You don’t think there’s a possibility she could have been supporting a former partners indiscretions? It happens more than folk care to admit either through direct manipulation or from thinking they can help them. Abusive relationships aren’t all physical, I’ve met enough people who have been in exactly this situation to know better than to make snarky throwaway remarks as you, and other here, do without understanding the whole situation.

Just because your wife spent beyond her means for the sake of a “better” lifestyle doesn’t mean everyone who ends up with debt problems has.

footflapsFull MemberPosted 9 years ago

Sure they haven’t got “Debt” and “Non housing wealth” mixed up?

ScapegoatFull MemberPosted 9 years agoIf you ignore the 3.5% minimum balance charge that usually comes with the “deal”. Know anywhere offering 3.5% savings barring a current account tied deal with minimum monthly deposit? Tarting isn’t the payday it once was sadly. Low interest rates and inflation have knocked that well on the head.

There are quite a few out there with sub 3% balance transfer charge, Nationwide, Fluid, Barclaycard, MBNA, Sainsbury….. and 0% intros are gradually expanding towards 34 months. So the savings earn extra and the repayments are spread further.

Barclaycard do on with 2% fee and 25 months 0%And no, not many 3% interest earning accounts without monthly deposit. However, if you get a 34 month balance transfer on a card with 2.75 transfer fee, a 1.5%-2% savings account should do the trick. This example isn’t a payday like stoozing can be, but it is a tidy saving on 20% debt.

tonydFull MemberPosted 9 years agoWhy would anyone, banks or overextended borrowers, hold back? They’ve learnt nothing as they’ve suffered no consequences.

The banks are stuffed with public money and the public are cheering the ‘affordability’ of more debt that comes from historically too low interest rates.

Humans only learn from bitter experience and since pretty much everyone was bailed out in 2008/9 the party has continued, and will until something properly goes pop.

stinkingdylanFree MemberPosted 9 years agoI ended up with a £10k CC balance when I was in my early twneties.

Working away and my girlfriend used my CC on a bingo site and spent the £10k in 5 days. I threw up when I found out.

When I discussed it with the CC company (goldfish) they said that they didn’t spot anything unusual!?! The bill was pages and pages of £50 payments to some online casino .com and they though it was fine!

We are no longer together…

MrSmithFree MemberPosted 9 years agoWorking away and my girlfriend used my CC on a bingo site and spent the £10k in 5 days. I threw up when I found out.

still together?

edit well there you go!.

milky1980Free MemberPosted 9 years agojimbobo

And I thought my £8k credit card was excessive and too much! £45k? You could buy a northern terrace for that!I cancelled it this morning and paid off the £96 on it (used it for online purchases only). I now only have a Nationwide card with a £300 balance (0% for 6 months) and have reduced the limit from £2700 to £1000. That’s £47.5k of potential credit gone, should improve my (pretty good TBH) credit score 😀

Now if we could have a housing crash (a proper one please) so that I can afford a reasonable house with a mortgage and a 10% deposit rather than the crummy flats I could get currently I’d be very happy 😈

scotroutesFull MemberPosted 9 years agoI’m not sure it works like that. Having unused credit might show you as a responsible borrower?

milky1980Free MemberPosted 9 years agoSort of, it’ll show as only 1 card and one loan (car) totalling ~£3k rather than 3 cards and a loan totalling ~£3k with £47k of additional available pre-approved. Researched all this when I was working in the bank and my last mortgage advice meeting said it was still the same. Otherwise what would stop me getting a maxxed-out mortgage of £78k and then blowing the £45k C/C on house improvements/holidays/bikes to fill new shed?

Having a small C/C limit of £1k and never going near it and paying off regularly is the best. The absolute worst thing you can do (other than bankrupt) is have no credit history at all!

binnersFull MemberPosted 9 years agoYeah. Credit scores are a perverse thing.

A mate of mine had an absolute nightmare getting a mortgage! He’d always done that crazy old-fashioned thing of saving up for stuff, and only spending what he earned. So because he’d never had a credit card or personal loan, he had no credit rating. Nobody wanted to give him a mortgage, despite the fact he’d saved a massive deposit 😯

milky1980Free MemberPosted 9 years agoTwo of my friends had the same problem, never had any credit. Not even a Contract mobile!

I suggested they should have a word with the CAB and that getting a small credit card to use for shopping and paying it off every bill might help. The CAB said the same thing so they both got a C/C and a contract mobile, lo and behold 12 months later they had a lovely big mortgage and at a low rate too.

Financially penalised (12 month’s rent!) for doing the right thing whereas if you blow it all when you’re young you get it thrown at you! Madness.

flangeFree MemberPosted 9 years agoHaving recently completed a study on Credit cards (I work for a regulator), I can honestly say I’d never ever have another credit card. Lending criteria, terms and conditions on said card, what happens if you miss a payment – no thanks. I’m sure some people are disciplined enough to make sure they clear it every month without fail, but for me personally if I can’t afford it then I won’t buy it and I certainly wouldn’t put it on a CC.

At least the pay day lenders are up front…

scotroutesFull MemberPosted 9 years agoWe pay everything on Tesco CC and pay it off each month. Then we get Tesco Clubcard points and I trade them in for Evans vouchers 🙂

flangeFree MemberPosted 9 years agoWe pay everything on Tesco CC and pay it off each month. Then we get Tesco Clubcard points and I trade them in for Evans vouchers

And to be fair, the affinity provider for the Tesco card probably hates you.

EDIT: To give some detail, because you’re not the type of borrower they want. What they would prefer is that they tempt you in with an offer of 0% on purchases. When the term runs out, you’ve hopefully accumulated a ‘balance’ that needs to be cleared. Rather than clear it, you transfer to another card on a 0% transfer deal. Over the 0% term you add a bit more to the ‘balance’ and the term finishes. You transfer to another card (0% again) and do the same. Rinse and repeat until you have reached your credit threshold and you can’t transfer the balance any further. Term runs out on credit card and you’re suddenly hit with 22.2% on the ‘balance’ you’ve accumulated.

Sounds far fetched, but you’d be amazed how many people get themselves in this sort of mess…

just5minutesFree MemberPosted 9 years agoa bit of discipline is required but credit cards are great. I’ve got around £65K of open credit at the moment and nearly all of that is invested in things that give me more than double the yield than I pay out in balance transfer fees. Same with the mortgage – currently have a base rate tracker mortgage of BOE base rate + 0.49% (0.99% in total at the moment) and rather than paying any capital off just put the capital payments into ISA accounts with the same bank where I earn 1.79% net interest. Effectively the bank are paying me 0.80% to take their money and give it back to them. Nuts!

The topic ‘Irresponsible lending? overdraft/ CC content.’ is closed to new replies.