Home › Forums › Chat Forum › Irresponsible lending? overdraft/ CC content.

- This topic has 62 replies, 43 voices, and was last updated 9 years ago by just5minutes.

-

Irresponsible lending? overdraft/ CC content.

-

tymbianFree MemberPosted 9 years ago

Found out today that one of my daughters’ girlfriends ( currently 21 ) has a debt of £12000 amassed over the period of about a year when she 19-20. The bank have given her a credit card and a bank overdraft and she has another credit-card for £3.5k….,lucrative, enticing online offer.

At the time she was earning £18k pa.

Now I know we can all utter ” its her own fault ” etc. but where’s is the responsible lending on behalf of the bank? She’s hardly paying anything off of her original debt just the interest.

Boils ma pi$$, I tell thee. Total disregard for a young persons life.

How many cases of depression or even suicide in young adults can be traced back to debt?

Any advice?

bearnecessitiesFull MemberPosted 9 years agoCan I take a guess at Natwest?

EDIT: Not wishing to make light of issue BTW, I completely agree with you.

esselgruntfuttockFree MemberPosted 9 years agoCan I take a guess at Natwest?

I’m going with

NatwestRatsnest as well. They did similar to me when I was in business. They give you a brolly when It’s sunny then want it back when it rains.tomdFree MemberPosted 9 years agoInteresting, I thought that sort of lending was a thing of the past. Tragic though, as you say. It could be a mill stone around her neck for years.

My current credit card with Santander has a pretty low credit limit (~1 month gross income). It’s paid off in full every month and always has been for years and they won’t increase it any more (I asked as I sometimes need it for business expenses).

Changed days from my first proper job when my bank without asking were offering £10k credit limits as soon as the account was opened!

wanmankylungFree MemberPosted 9 years agoMy advice to her would be to get as much credit as she can possibly get from whoever is stupid enough to give it to her and have one hell of a party, or couple of years travelling, then go bankrupt.

jam-boFull MemberPosted 9 years agobarclays regularly offer me a pre-approved unsecured loan of ~£50k, money in my account by the end of the day.

so much for responsible lending…

jambalayaFree MemberPosted 9 years agoThe various credit card companies have no way of knowing about each other, so it’s easy to build up multiple cards especially if you lie about having no other cards. £12k in debt is £120 a month in interest so that’s affordable, but clearly unwise to have run up the debt. My 21 year old will owe £45k when she finishes Uni

scotroutesFull MemberPosted 9 years agoDoes she think it’s a problem? If not, there’s nothing much you can do.

If she does then get her to get rid of her CCs. Then check out what interest rates she is paying and try to get something arranged at a lower rate. That will mean some sort of loan. She might need someone to act as guarantor – her parents perhaps?

jimboboFree MemberPosted 9 years agomy latest 0% credit card started with an £8k limit and will go up if i make regular payments, which i have to as its direct debit…

leegeeFull MemberPosted 9 years agoA buffoon I know declared bankruptcy in 05 at 27 owing 50K all cards and loans with zero to show for it. Unless you count BB guns and console games as worth while.

His best mate is an architect while he worked for a waste management company in customer service. It was all to keep up with his mate.

He then got married paid for with cards and loans, has 2 kids and is just about done paying off his debts now and I doubt he will ever get on the property ladder.

jekkylFull MemberPosted 9 years agoAt that age it’s entirely the customers fault. I remember myself at that age, me and my then girlfriend used to ring up our CC providers and ask for an extension to the limit and when they approved it we’d go straight down and withdraw it in cash and then go to the students union. I wince when I think what I was like, withdrawing cash from a credit card!!!! I just didn’t care about the consequences. Ending going default on 3 ccs just as I entered the job market.

wanmankylungFree MemberPosted 9 years agoA buffoon I know declared bankruptcy at 27 owing 50K all cards and loans with zero to show for it. Unless you count BB guns and console games as worth while.

I bet he had a hell of a good time pissing it up against the wall though and didnt have the stress of being an architect.

bearnecessitiesFull MemberPosted 9 years agoInteresting, I thought that sort of lending was a thing of the past.

So did I, until I started needing some recently. You really would not believe the amount of unsecured borrowing I have access to, from a very modest income. You really wouldn’t!

This is in place of HIL to do up house, so it’s actually served me well with lots of 0% deals on purchases & balance transfers credit cards.

With age and experience I will not get carried away and use this to my advantage and within my means, but if I was 18?

EDIT: Sorry, just realised this doesn’t answer your question OP, just empathising with the fact ‘irresponsible’ lending is easily believable, still.

djamboFree MemberPosted 9 years agojust as irresponsible borrowing.

she should know better at 21…..a fully grown adult.

are her parents sharing your concerns?

bearnecessitiesFull MemberPosted 9 years agoshe should know better at 21…..a fully grown adult.

..and let’s not have any of this crap, eh?

P-JayFree MemberPosted 9 years ago@jamblaya – actually they do – credit files contain the details off all creditors, balances, limits and of course payment history. They’re supposed to review these periodically.

It’s also a requirement for the financial companies to complete a income and expenditure review at the start of any new credit agreement.

As for the OPs friend – bankruptcy is actually not a bad idea – she’d have no problem proving she cannot afford to repay her debts and have a normal lifestyle and the court will ask her to pay an affordable amount each month for a few years. Yes she’ll be a ‘bankrupt’ for 5 years, but she’s young and the only downside of being bankrupt is you can’t borrow any money – but it sounds like that’s for the best – plus no respecable bank will lend to her with that amount of debt and that income anyway, there’s very few downsides.

FunkyDuncFree MemberPosted 9 years agoNeed to find out why she is spending the money she hasn’t got or the problem will only get worse.

As others have said, her route out may be bankruptcy. It will be no bed of roses, but after 6 years and lots of work she will be debt free and no one will be any the wiser.

Of course that’s the cowards way out as in many ways she’s not in that much debt.

milky1980Free MemberPosted 9 years agoI used to work for Barclays and it was this irresponsible lending practice that made me quit. I even stated that in my resignation letter (although

I used the word immoral). That was back in 2008 and I thought the financial crisis would have stopped this conduct.Sadly not. I’ve heard from former colleagues that it is now worse than it ever was! They will never learn (the banks).

As for how credit cards can balloon in the credit available, I have a credit card that I started with Lloyds back in 2001 as a basic £500 limit one for students. It now has a pre-approved limit of £45k. I recently cancelled my Barclaycard that had a limit of £28k and I still got letters offering an increase. That’s over 3 year’s wages available on plastic immediately! With that kind of spending power available it’s far too easy for young people to succumb.

wrightysonFree MemberPosted 9 years agoIt’s definitely one of those varying company things then. We have a tesco cc and put at least a grand on it each month which gets paid off each month. The limit is still at 5k after what must be three years of doing that.

slackaliceFree MemberPosted 9 years agoYou can of course contact your CC provider and ask for your limit to be reduced.

Which is responsible borrowing, as opposed to egoistic willie waving 😀

njee20Free MemberPosted 9 years ago£12k in debt is £120 a month in interest so t

Surely that depends entirely on the interest rate 😕

Doesn’t seem great frankly, but she’ll learn!

bigblackshedFull MemberPosted 9 years agoThe reason for the ever increasing credit limit is for the type of people who will spend on the card, pay off some of it, preferably the minimum payment, then next month spend some more, and so on.

If you pay it off in full and never incurr interest charges then you’re the worst type of customer. They don’t make any money from you.

On one of my CC that I use for business expenses, the credit limit has tripled in the last five years. That was because I’d put flights and hotel bills for a number of people on it, thousands in some cases, and then not paid it in full because I had not received it all back from the accounts department. (They did start paying promptly when I put the interest payment on the expenses as well).

I can see how it would be tempting to spend the easily offered credit, but there has to be some responsibility held by the OPs daughters friend. She did spend the money, she should pay it back. Going bankrupt is just putting that debt back onto all of the other banks customers. That’s why people who save or take credit responsibly have to subsidise the bad debtors with low savings rates and high CC rates.

The bank or CC company are sure as hell aren’t going to take the loss.

matt_outandaboutFull MemberPosted 9 years agoI just swapped CC to Tesco – expecting the £1500 limit of my old card.

They gave me immediate £10k, and after six months of using/paying off in full (I use it for work travel expenses each month), they just upped it to £15k without asking or requesting.

I also just looked into car loans etc, and could borrow a rather impressive amount over 5 years.

I do not have any other debts, other than two mortgages on two properties, but this does seem a return to the ‘lend more, make more profit’ days.RockploughFree MemberPosted 9 years ago£1000 every month on top of her wages? I thought I was bad maxing out a £1200 card on clothes at that age, but at least I wasn’t earning. That’s pretty appalling.

imnotverygoodFull MemberPosted 9 years agoIt may be irresponsible by the bank. But she is 21 for goodness sake. She isn’t some helpless victim.

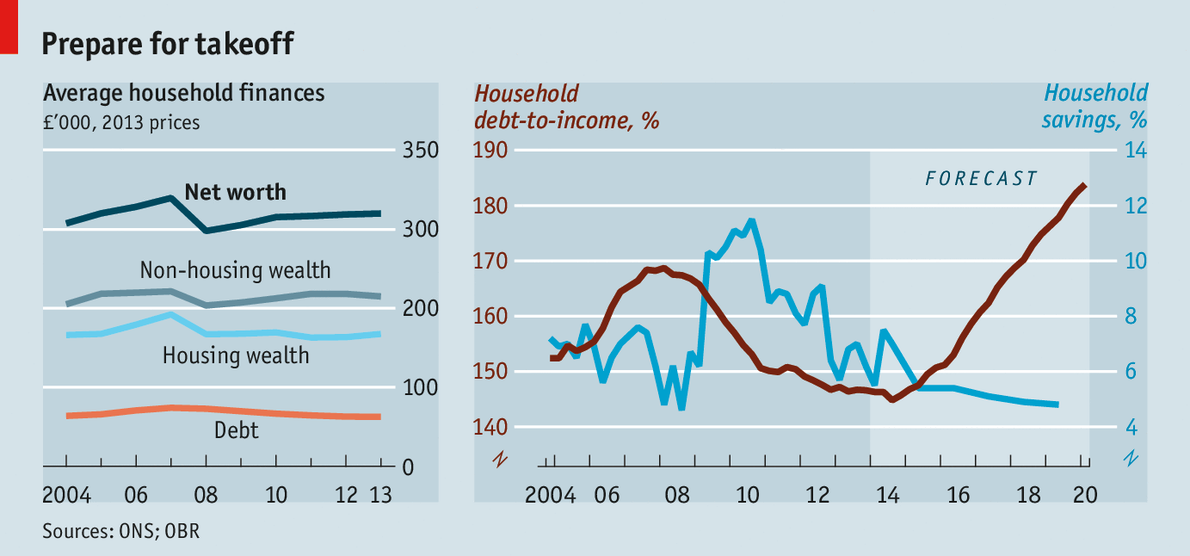

brooessFree MemberPosted 9 years agoThe bad news is the UK personal debt situation is about to get a whole lot worse, believe it or not.

I was talking to a friend last week who works in the Bank of England and asking him what the underlying driver of this forecast is and he simply said ‘increased access to credit’

Personally I’m wondering if we’ve all gone stark, raving mad 😯

sbobFree MemberPosted 9 years agoPoor thing, spunking £30,000 up the wall in a year.

My.

Heart.

Bleeds.squirrelkingFree MemberPosted 9 years agoshe should know better at 21…..a fully grown adult.

..and let’s not have any of this crap, eh?You’re kidding right? The STW collective are too righteous to let this transgression slip, hell, why not just about triple the figure to 30k for good measure in some good old chinese whispers action.

Never mind the fact that you self righteous pricks know nothing of the womans personal circumstances the OPs point still stands, it was irresponsible to lend that amount of money full stop. As for the whys of having that amount of debt, there are plenty of noble, if misguided, ways that folk (and in my experience, plenty of women) end up in these places so why not leave the moral outrage for something you know the full facts on for once eh?

muddydwarfFree MemberPosted 9 years agoNo real help, but I’m wondering about the wider social aspect that says this sort of borrowing is OK.

Years ago, before I got a mortgage & was sharing a rented house with a friend I wasn’t earning very much & was living hand to mouth through too much partying etc.

My friend said get a credit card, its normal, everyone does it & everyone has debt.

I did so & it started to spiral of course, got on top of it & got a mortgage etc. When I split up with my ex & was paying for the whole household costs again I made the decision to address the outstanding cc bill as it was worrying me – it was for £600 & giving me a bit of worry!

Maybe its me, but I HATE debt & only use cash/debit card nowadays, if I don’t have the money I wait til I have & save up. It seems I’m in the minority.PeterPoddyFree MemberPosted 9 years agoThe bad news is the UK personal debt situation is about to get a whole lot worse, believe it or not.

Who the hell cooks up a forecast graph like that? Low and dropping slightly straight into a massive rise? I reckon they sneezed when the pen was on the paper!

stumpy01Full MemberPosted 9 years agoThere are many situations where people genuinely get into cc debt paying bills, putting food on the table for the kids & paying the utility bill, but equally there are people who use them as a way to fund a desired lifestyle that they can’t otherwise afford. And for these people I have very little sympathy when they get themselves into debt. It’s just greed and burying their heads in the sand so they can have the latest car on the drive or an expensive hand bag draped over a shoulder.

We had a young contractor start at a place I worked at several years ago – lab technician, so not brilliantly paid, but not minimum wage either.

He boasted about how he already had £10k debt that his dad had paid off. He had a Punto that was costing him £330/month to insure as he wrote his last one off when he was 18. He used to go to London with mates straight after work on Friday night every week and stay in decent hotels until Monday morning, they’d eat out the whole time, go clubbing every night and he used to boast about only drinking champagne.

He was back up to £19k debt and was planning a few more blowout weekends before declaring himself bankrupt.He knew exactly what he was doing, but just didn’t care.

Amazed the banks kept lending him the money, but he was completely aware of the hole he was digging for himself and seemed quite proud of it.

helsFree MemberPosted 9 years agoNice infographic. I believe everything it says now, although I would have more faith if it had some green in it, a more reliable color.

I called the bank re a new mortgage last week. After a 10 minute phone call, they were happy to lend me a ridiculous amount of money. Not that I want that much, was just curious.

Why can’t we all learn ??

FlaperonFull MemberPosted 9 years agoPhone companies are the same. Even when in arrears it seems that phone shops have the ability to override all the “computer says no” bits and give people additional new contracts. My sister isn’t the brightest financially and whenever she wants a new phone, just starts a new contract. Every six months or so. Never hear of a rejection even with the list of final warnings piling up by the door.

djamboFree MemberPosted 9 years agoNever mind the fact that you self righteous pricks know nothing of the womans personal circumstances the OPs point still stands, it was irresponsible to lend that amount of money full stop.

True I know nothing of this girl so i have to make assumptions. I doubt from the info given she’s borrowed this money to keep food on the table for her family or to look after an elderly relative. My assumption is that she’s pi$$ed it up the wall in bars and handbag shops.

when I met my wife she was in a similar (actually x3 worse) position. It was all her own fault. She thought she could have it all now without paying for it. In my wifes case I lay the blame squarely on her mother (not the banks) who sat and watched it happen and hadn’t taught her the value of saving rather than borrowing to fund her desired lifestyle.

jimboboFree MemberPosted 9 years agoAnd I thought my £8k credit card was excessive and too much! £45k? You could buy a northern terrace for that!

BillMCFull MemberPosted 9 years agoI don’t have a cc. If you can’t afford it, don’t have it. Debt equals stress and lining the pockets of the bankers.

Kryton57Full MemberPosted 9 years agoAlthough I didn’t have to, it was cheaper for me to borrow £5k to buy my current runaround. However, when on the phone to the bank – which is the bank I use for my direct debits & bills NOT my main account, the conversation went like this;

Bank: “So you can’t demonstrate regular salary onto this account?

Me: No

Them: “Hmm, that means we couldn’t offer you the loan <pause> Hold on though, you do may a regular one off payment INTO the account which is equivalent to the bills going OUT of the account?”

Me: “yes, thats right, by standing order”

Them: “So, for the purpose of this phone, if we pretend that the income was ‘salary’ I would be able to offer you the loan.

Me: “Erm, yes OK….”

Them: “Congrats, we are able to offer you the loan. Once you have responded to our secret password text, £5k will be deposited into this account within the hour”And it was. I never even proved my salary or total outgoings, no wonder people get into debt.

The topic ‘Irresponsible lending? overdraft/ CC content.’ is closed to new replies.