- This topic has 35 replies, 19 voices, and was last updated 10 years ago by Dorset_Knob.

-

Freelancers: Getting paid…

-

jambourgieFree MemberPosted 10 years ago

I’m sure there are a few creative freelancers on here. I’ve not long set up on my own and have recently run into the inevitable problem of a non-paying customer. Any advice on how to proceed? The client is a small operation working from home. I’ve sent an invoice about 6 weeks ago, then followed up with a couple of emails after the deadline, then phonecalls. All of which have been unanswered. Ideally, I’d like to keep the client, or at least, want them to recommend me in the future so no ‘go round and kick off’ answers please 🙂

footflapsFull MemberPosted 10 years agoStart charging them for interest, send an updated invoice and a cover letter politely explaining you’re not an overdraft.

misinformerFree MemberPosted 10 years agoYou want to keep a client that doesn’t pay?

IME they are taking the proverbial as they know your still new to this.

nickjbFree MemberPosted 10 years agoIt happens far more often than it should. I’d send a revised invoice with ‘PAST DUE’ on it requesting payment within a week, although TBH 6 weeks isn’t that long to wait and would class as prompt payment for some of my clients. I’d say for now you need to be a little patient.

johndohFree MemberPosted 10 years agoBut surely you don’t want to keep the client if they don’t pay?

Is everything handed over? Are you doing anything else for them at the moment?

jambourgieFree MemberPosted 10 years agoYou want to keep a client that doesn’t pay?

IME they are taking the proverbial as they know your still new to this.

Good point.

jambourgieFree MemberPosted 10 years agoBut surely you don’t want to keep the client if they don’t pay?

Is everything handed over? Are you doing anything else for them at the moment?

No, not all of it, and no not doing anything for them. Seems to have all gone quiet their end.

nickjbFree MemberPosted 10 years agoPeople get funny over money and friendly relationships go out the window. I wouldn’t be too hasty to write them off as a client. It is far from ideal and it would be nice to bin every client that you don’t have a 100% perfect relationship with but the freelance world doesn’t really work like that. Be firm but polite, it could still become a good working relationship long term.

AlexSimonFull MemberPosted 10 years agoMy first email is like this:

Attaching the original invoice.

This goes out as soon as the payment deadline passes.———-

Hi XXX

Hope you are well.

The invoice for the work done on XXX is now overdue.

Can you please make immediate arrangements to pay.You can either send a cheque or by direct bank transfer. The details are on the attached invoice.

Regards

XXX

———Then after another 14 days I send this:

———

Hi XXX

I’ve just checked through my bank statements and can’t see any payments from you since this invoice.I’ve attached the invoice again for your reference.

Please make arrangements to pay immediately.

If payment is not received within the next 7 days, I will be adding Statutory Interest and a Late Payment Compensation amount in accordance with the The Late Payment of Commercial Debts (Interest) Act 1998.

If charged, these currently amount to £XX in interest to today’s date and £40 Late Payment Compensation according to the calculator found here:

http://www.top-service.co.uk/page.php?pid=37If you can only make part-payment or if you wish to pay monthly, then please get in touch.

Regards

XXX

———Then another 7 days later

———

Dear XXXTAKE NOTICE that according to my records the sum of £XXX is overdue for payment for invoice INV-XXX-XXX.

As mentioned in my previous communication, I have now re-calculated the overdue amount in accordance with my statutory rights listed here: http://www.top-service.co.uk/page.php?pid=37 .

The new amount is:

Original Invoice Amount: £XXX

Date original invoice became overdue: XXX

Interest: £XXX

Late Payment Compensation: £40.00

———

TOTAL NOW PAYABLE: £XXX

———Unless payment is made to the above address within SEVEN DAYS Legal Action to recover the debt will be taken against you without further notice.

As the sum is <£5000 I will be claiming using the SMALL CLAIMS COURT HEARING. If you lose the case, this will show up as a CCJ against you and may affect your ability to get credit in the future.

Copies of the outstanding invoices are attached.

Yours sincerely

XXX

———jambourgieFree MemberPosted 10 years agoAlexSimon – That’s very helpful. Thanks. Mind if I copy that for future dealings?

footflapsFull MemberPosted 10 years agoUnless payment is made to the above address within SEVEN DAYS Legal Action to recover the debt will be taken against you without further notice.

Tut tut.

You need to send a “letter before action” before you issue a summons. The contents of the letter is prescribed and failure to do so will weaken your case….

Example of one is here: http://www.adviceguide.org.uk/wales/consumer_w/consumer_taking_action_e/consumer_legal_actions_e/consumer_going_to_court_e/consumer_taking_court_action_e/letter_before_action.htm

AlexSimonFull MemberPosted 10 years agoMind if I copy that for future dealings?

Of course not.

I should add that it depends on the client a bit. Sometimes there is more communication than that if they replied with a reason they couldn’t pay.In 9 years of freelance, I’ve only ever had 3 late payers and all paid in the end. The CCJ bit tends to get them 🙂

Once a client is late-paying with no reason that I care about, I don’t give them a second chance. If they want me to work for them again it’s payment up-front. Most of the time, I don’t deal with them again though. Not worth it.

AlexSimonFull MemberPosted 10 years agoFootflaps

Thanks for that – so the email doesn’t qualify as ‘letter before action’?

Is there a requirement for it to be physical post?ioloFree MemberPosted 10 years agoGo and visit him, at work. If your work was satisfactory ask why payment is being withheld. Ask him nicely for a bank transfer.

If he refuses ask him why? If he gives you bullshit CCJ his arse.

It takes a bit of fannying around but you will be paid in the end.jambourgieFree MemberPosted 10 years agoAs if by magic, they’ve just been in touch to say sorry for the delay, (one of you must be her)and to expect payment on Monday.

Yes, I’m trying to strike a balance between being too pushy, and being a push-over. I’ve got no problems getting busy if needs be, through the courts, or by camping on their front lawn 🙂 but I’d rather things were done with some decorum.

Thanks for the advice.

AlexSimonFull MemberPosted 10 years agoGood stuff.

After a while you begin to spot the late-payers before you even start work for them 🙂footflapsFull MemberPosted 10 years agoThanks for that – so the email doesn’t qualify as ‘letter before action’?

Is there a requirement for it to be physical post?Nope it wouldn’t qualify and yes you should send it by recorded post, so you have proof it was received.

It all seems a bit overkill but it stops you summoning someone and then changing your demand on the day eg inerest rate etc. The letter before action must explicitly state what it is you want resolved, how it can be resolved, that you would consider mediation and refer the recipient to the relevant legislation.

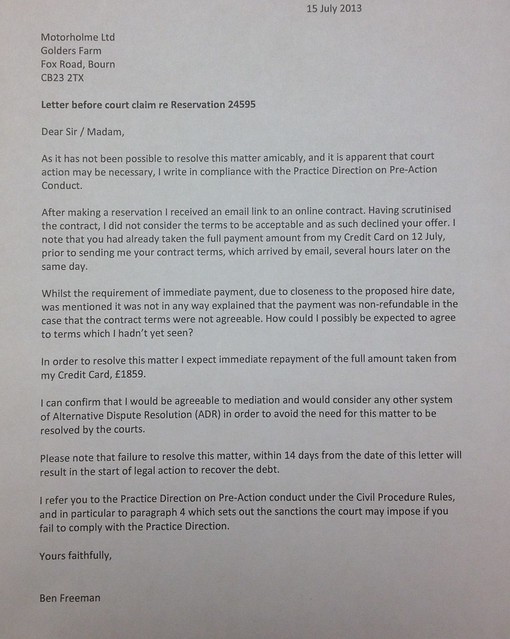

Here’s one I used earlier to get £2k back…

Letter before court action against MotorHolme.co.uk by brf, on FlickrkonabunnyFree MemberPosted 10 years agoFootflaps

Thanks for that – so the email doesn’t qualify as ‘letter before action’?

Is there a requirement for it to be physical post?The emails are letters before action. They don’t need to be by post. Chasing money debt is substantially different from consumer or contractual dispute. The point of the practice note is to stop people suing people for stuff without having tried to work it out between them beforehand so that the first thing the deadbeat knows about it is when they receivie court docs thru the post.

AlexSimonFull MemberPosted 10 years agoThanks footflaps – I like the look of that.

konabunny – yes, I think you are right, but that letter from footflaps looks like a good way to get paid before legal action, which is always going to be preferable.

footflapsFull MemberPosted 10 years agoAccording to this: http://www.justice.gov.uk/courts/procedure-rules/civil/rules/pd_pre-action_conduct#5.1

Claimant’s letter before claim

2.1 The claimant’s letter should give concise details about the matter. This should enable the defendant to understand and investigate the issues without needing to request further information. The letter should include –

(1) the claimant’s full name and address;

(2) the basis on which the claim is made (i.e. why the claimant says the defendant is liable);

(3) a clear summary of the facts on which the claim is based;

(4) what the claimant wants from the defendant; and

(5) if financial loss is claimed, an explanation of how the amount has been calculated.

2.2 The letter should also –

(1) list the essential documents on which the claimant intends to rely;

(2) set out the form of ADR (if any) that the claimant considers the most suitable and invite the defendant to agree to this;

(3) state the date by which the claimant considers it reasonable for a full response to be provided by the defendant; and

(4) identify and ask for copies of any relevant documents not in the claimant’s possession and which the claimant wishes to see.

2.3 Unless the defendant is known to be legally represented the letter should –

(1) refer the defendant to this Practice Direction and in particular draw attention to paragraph 4 concerning the court’s powers to impose sanctions for failure to comply with the Practice Direction; and

(2) inform the defendant that ignoring the letter before claim may lead to the claimant starting proceedings and may increase the defendant’s liability for costs.

muppetWranglerFree MemberPosted 10 years agoI have a regular client that supplies around 40-60% of my work and they are an absolute nightmare for late payments, 3-4 months is normal for them. I have a fantastic working relationship with them in every other respect, good people, interesting high profile projects, realistic budgets and regular work, it just takes forever to actually get paid. [edit] They have always paid eventually.

Anyone managed to get a similar client to change their ways?

footflapsFull MemberPosted 10 years agoI think you are right, but that letter from footflaps looks like a good way to get paid before legal action, which is always going to be preferable.

In my case they coughed up on the 15th day (1 day late), although I’d forgotten about it so hadn’t issued summons.

nickjbFree MemberPosted 10 years agoI have a regular client that supplies around 40-60% of my work and they are an absolute nightmares for late payments, 3-4 months is normal for them. I have a fantastic working relationship with them in every other respect, good people, interesting high profile projects, realistic budgets and regular work, it just takes forever to actually get paid.

Anyone managed to get a similar client to change their ways?I think maybe we work for the same company, in fact did I just write that! 🙂

AlexSimonFull MemberPosted 10 years agomuppetWrangler – I had similar.

An agency client (Williams Lea) who insisted that by working for them I accepted their 90 days payment policy. There was no room for manoeuvre with them whatsoever.

At the time I was glad of the work and struggled through that first 90 days. Then, because I invoiced monthly, I was paid monthly (3 months behind) so it kind of worked ok.When I finally stopped working for them, it was quite nice to get paid for a couple of months when I was also getting instant payments from my new clients. That was when I bought my last bike! 🙂

binnersFull MemberPosted 10 years agoDepends on the company. If its a big one where your invoice disappears into the black hole of their accounts dept, then you’ve really got a problem. My worst was a job I did for B&Q. 6 months it took to get paid. I’d never do work for a big firm like that again. It was a nightmare trying to get it out of them. Took about a million phone calls, getting passed from pillar to post

If they’re local, and pretty small, and they’re taking the proverbial, then I have my tipping point (after the usual polite requests, gentle, then not so gentle prods) where I phone them up and say “Hello there. I’m over by your office at the moment, so I’ll just pop in and pick up a cheque for that outstanding overdue invoice. Save you posting it’

Make this call while you’re parked outside their office. You’ll have a cheque within 5 minutes

footflapsFull MemberPosted 10 years agoWe need debt shaming in the UK

Big thing in Spain: http://www.theguardian.com/business/2013/aug/09/spain-debt-collectors-cobrador-del-frac

maccruiskeenFull MemberPosted 10 years agohttp://payontime.co.uk has useful information – calculators for working out overdue fees and statutory charges and wording you can have on your invoices to make it clear that you’ll be making those charges for late payers

Beyond that you just have to get creative. I’ve had to book a cycle courier to go to carry my invoice from one desk in a clients office to another as nobody in the company seemed to be capable of making that journey themselves. I’ve toyed with the idea of making my invoices incrementally bigger – A4 on date of invoice, A3 for the reminder on the due date, then A2, A1, A0 every week after that.

A friend of mine having worked for an agency in Scotland that is pretty synonymous with late payment would pack a flask, a sleeping bag and book and turn up at their office just as they were about to close for the weekend and make themselves comfortable. Making it clear that they wouldn’t be able to close up the office and go home until she had a cheque.

That said – I find the situation with payment much better than it used to be, I think partly because freelance communities are better networked in the internet/facebook era so more people know their rights and how to exercise them, its also easier for latepayers to get a bit of a flaming and burn their bridges in terms of being able to procure the services they need. I haven’ had to get shouty about payment for quite as few years now.

I have a regular client that supplies around 40-60% of my work and they are an absolute nightmares for late payments, 3-4 months is normal for them. I have a fantastic working relationship with them in every other respect, good people, interesting high profile projects, realistic budgets and regular work, it just takes forever to actually get paid.

Anyone managed to get a similar client to change their ways?The above routine late payer got their arse kicked quite sorely over it (maybe as part of an HMRC audit I can’t remember though) so they’re much prompter these days. It seeming in the past that they’d only bother to pay you when they realised they needed you for their next job.

cheers_driveFull MemberPosted 10 years agomuppetWrangler – I had similar.

An agency client (Williams Lea) who insisted that by working for them I accepted their 90 days payment policy. There was no room for manoeuvre with them whatsoever.I used to work for WL looking after suppliers and you are correct in saying there is no flexibility – it’s due to the contracts they have with their clients. You must have worked with them some time ago though as it’s been end of month + 60 days for a while now. They are more of a mercenary print management company than an agency though. I was glad to get out but am now consulting for Tag Worldwide which is owned by them and the attitude and atmosphere couldn’t be more different. Although I haven’t been paid yet so that impression may change…

AlexSimonFull MemberPosted 10 years agoYes, it was a while ago. 2007/8 I think.

Hope you get paid! 🙂coolhandlukeFree MemberPosted 10 years agoI’m owed £13k from Moulding Contracts ltd. since October and September 2013! They are a £20m business, in a £200k business.

It’s been approved, apparently and so will be paid I’m told recently.

I will be doing a winding up order on them in April.

Although I won’t ever be asked to do work for them again, I’m not too worried as it’s cheaper to sit at home and not get paid than it is to go out to work and not get paid.

FantombikerFull MemberPosted 10 years agoCouple of points, I have worked on both sides of the fence. Make sure that you have agreed the credit term before you start work, and this is documented. You should also put this on the T&C on the reverse of the invoice. In these T&C put the interest rate you will charge on overdue invoices. I always send the invoice to the person I am working for rather than accounts, and ask them to approve it and pass it themselves to be paid.

If you don’t know the company, and can’t access their credit history, you can try and ask for 50% upfront?

Winding up orders frighten the hell out of most companies but they can be expensive ( I think £1.5K), but you will get paid unless the company really is in a bad way.

garage-dwellerFull MemberPosted 10 years agoFantom – minor point an invoice is usually regarded as post contractual and therefore if terms and conditions are only on that they MAY not be enforceable.

Better to have signed and agreed terms and conditions before you start work.

You won’t find decent professional services firms working for someone new before they sign the engagement letter (with t and c).

The topic ‘Freelancers: Getting paid…’ is closed to new replies.