What is the average percentage that employers & employees pay into pension plans these days. Stayed the same of have they fallen?

Mine has increased on both sides, started out 5%, then 7%, now 8% - employers contribution has also increased to 12%

but that is a bit more than the average reckon 5%/11% is more typical - depending on industry and conditions

Annuity rates though, have dropped sharply - something related to the QE the BoE is experimenting with

Current is 5% personal/5% company.

This coming January that changes to 4% personal/21% company.

I suspect the average is somewhere between the two.

6% from me and 9% from them on my scheme. That's final salary tho.

8% and 14% for me, although as a nurse none of this actually goes in a fund but goes straight back to the treasury.

I rely on future governments to not decide that paying my pension is unaffordable and convincing other tax payers that I have a gold plated pension that should be hijacked - bit like now really.

Personally I would prefer an actual fund but that is not going to happen.

What's a pension? Is that one of those quaint 20th century arrangements? The one presently heading the same way as analogue TV

convincing other tax payers that I have a gold plated pension that should be hijacked - bit like now really

we don't need much convincing because it is.

try buying something equivalent on the pension market...

[i]but that is a bit more than the average reckon 5%/11% is more typical - depending on industry and conditions

[/i]

Final salary will be whatever it needs as per the pension pot, but for the now common money purchase its nearer 2%/4%...

yep Br

3% here by me , 3% by company. How ever im younger than most - this figure increases at each decade break as i get older.

think it jumps to 5 and 5 once i get to 30

we don't need much convincing because it is.try buying something equivalent on the pension market...

Well, according to the Office for National Statistics Pension Trends (2012 edition)the average employee/employer contribution for a defined benefits scheme for 2010 is 5.1% employee and 16.2% employer so I think I fit within that range and am compareable to equivalent private schemes started in the same time frame as mine.

If you are talking about what can be purchased now then fair enough, but I bought into mine many years ago. I think its a bit unfair to compare what I bought then with what you can buy now.

You wouldn't expect someone to buy your house from you today based on what they could have bought it for in 1936, would you?

Nor would you expect someone who has paid a private pension for 30 plus years to suddenly have a massive devaluation just because others can't buy a similar product now, I assuume.

Yet you think that should happen to me????

5%-10% is the norm, some pay more with a sliding scale upwards with age although I suspect those arrangements will get withdrawn.

[b]dangerousbeans[/b]

I rely on future governments to not decide that paying my pension is unaffordable and convincing other tax payers that I have a gold plated pension that should be hijacked - bit like now really.

Your pension is more than gold plated. It is impossible for someone in the private sector to buy a final salary index linked pension guaranteed by the state. Each time you get a pay rise you are getting a pension increase too. It would not be in your interest as a nurse to have than money paid into a normal private sector pension arrangement. I fully appreciate the work you do but the state pensions are unaffordable.

I would guesstimate that an index linked state pension would cost circa 2.5% - so £25,000 pa would require a pension pot of £1,000,000

With regard to changing regulations the removal of tax relief within pensions for dividend income reduced my pension value at retirement by approximately 30%

I pay 6%, company puts in 12%. Not final salary though.

Having started my job here (private sector) a few months before the final salary scheme was closed to new entrants, it was 5% employee contributions when I started, went to 7% last year and as of 2013 will be 9% to stay on the 1/60 scheme. I think you can choose to stay at 7% and move onto a 1/80 scheme or go to the money purchase scheme at 5%.

dunno what the employer's contributions are tbh.

I would love a £25K pension, where will I pick that up from?

On current projections it looks closer to £10K to me.

I am no expert however and will be happy to be proved wrong.

As I stated above though I do seem to be making contributions inline with others in the private sector who bought into their schemes at the same time as me.

I would guesstimate that an index linked state pension would cost circa 2.5% - so £25,000 pa would require a pension pot of £1,000,000

Even supposing I got a £25k pension and drew it for 10-15 years the Govt would be keeping the pot once I popped my clogs and would have only been paying me from the interest that million pounds generated. Except they have not saved it for me, they have spent it all -yes?

Over 40 years my and my employers contributions should be about £250,000 plus 40 years interest which should be enough to provide my pension and leave the govt a tidy sum when I die.

Again this is subject to them putting my money in a pot rather than spending it.

Or am I barking up the wrong tree.

And surely they should have invested it for me rather than spending it on other people who are now begrudging me having it back.

I would love a £25K pension, where will I pick that up from?

get promoted and earn more. I have a 4k/yr civil service pension and I only did 8 yrs.

8% and 14% for me, although as a nurse none of this actually goes in a fund but goes straight back to the treasury

my understanding is that current contributions pay for currrent liabilities for the NHS pension scheme, it's a type of pyramid scheme that allows the Unions to say ""it's not in deficit"

@dangerousbeans - the way it works for me (in the private sector) is when I pop my cloggs the insurance company keeps the balance (unless I take a lower pension in return for a guaranty that should I die within 5 years my estate gets the money which is then subject to inheritance tax)

With regard to interest you need to factor in the effect of the inflation linked element. For the government to pay you £25,000 (and for that to be inflation linked) that is way above the "interest" they would be earning on the £1m

The way the 25,000 vs 1,000,000 is calculated is such that over a whole population on average there is nothing left over (aside from the profits/running costs extracted by the private sector pension provider)

It has been pretty much impossible for the past 20 years for me to get a job with a final salary pension scheme as those have all but disappeared from the private sector. Whatever you think about the risks of government action over your current arrangements you are much better off than if you had a private pension scheme that you and the government had been paying in to for the last 20 or 30 years.

Have a look at this table - closest comparison is single life RPI gty (from a private company not from the state so more risk) - these are amounts per 100k saved

[url= http://www.ft.com/intl/personal-finance/annuity-table ]Annuity Rates[/url]

it's a type of pyramid scheme

So I'd be best out of it then.

What's the odds on them returning my money with interest. I can spend it enjoying myself and depend on the state in later life like many others are planning to do.

get promoted and earn more. I have a 4k/yr civil service pension and I only did 8 yrs

But I want to be a nurse not a manager. Do I have to have a shit pension then if I dont do a managers job?

I was more commenting on this assumption that all public sector employees get massive pensions, when it's mainly the civil service who do. 😀

Anyway, this is a waste of everyone's time and the discussion will just go round and round.

It's pretty much decided by the general public that I am a workshy scrounger so perhaps that's what i ought to become.

Time to go to work now. Bye.

Unaffordable, unaffordable, UNAFFORDABLE....... We are all going to die!! Judging by the thread about paying off the house on here recently I dont think some of you private sector money bags need to worry too much about the pension.

I pay 11.2% at the moment goin up to 12.6% not sure what employer pays but I know as my payments go up theirs go down. I'm going to be paying for an extra five years now too. I also brought in my army pension so I could leave a bit earlier and get full pension but now as we have to work longer anyway I've lost that and its now gone into the pension pot never to be seen again and I also have to pay around 3 years extra contributions for the pleasure . Deep joy

I cant believe the government are bringing in compulsory work place pensions at the same time as they are currently destroying existing ones, what a way to sell them ??

I put in 6% and my employer another 12% which I think is farily good. My previous job was 5% and 5% and my wife is 3% and 6% (although that is only just less than what I put in in £ terms).

You can put in AVC as well but don't get any extra from the company and need to decide if that isthe right decision for you.

But I want to be a nurse not a manager. Do I have to have a shit pension then if I dont do a managers job?

using that logic, do you want a managers salary for doing a nurses job?

using that logic, do you want a managers salary for doing a nurses job?

But it wasn't me who brought up a £25K pension which is what I was referring to in my post. I am reasonably happy with my job, salary and conditions but not with how they are being eroded and was commenting on jambalaya using such a figure. Not really my fault that you selectively read/quoted.

I thought you were going to work...

Why direct questions at him then complain when he answers?

I have a choice,

can put nothing in and get 1/60th or 10% and get 1/35th of my final salary multiplied by the number of year I have worked. Should be maxed out by the age of 55

@dangerousbeans, I thoroughly support the work you do and can fully appreciate the concern you have over loosing the pension you have been anticipating, particularly as in the past certainly the industries pay has been way below what it should have been. But in some ways the pay is/was low because the pension is generous.

You may be paying in an amount equivalent to the average private sector employee but you are getting a much better pension deal than a private sector person is.

In terms of getting your money back, yes we in the private sector can do that, ie redeem our pensions, but we pay income tax on the the lot as if it were wages.

As you say it will have to be an agree to disagree point.

Enjoy the rest of your day.

crikey, there's some generous employer contributions out there - my employer contribution is 4%.

[b]anjs[/b] - Member

I have a choice,can put nothing in and get 1/60th or 10% and get 1/35th of my final salary multiplied by the number of year I have worked. Should be maxed out by the age of 55

That seems a good deal 1/35th of final salary for 10%

[b]cp[/b] - Member

crikey, there's some generous employer contributions out there - my employer contribution is 4%.

My employer did 14%, I did 10% - past tense as now self employed. I think those higher employer contributions are going to be a thing of the past.

You may be paying in an amount equivalent to the average private sector employee but you are getting a much better pension deal than a private sector person is.

but is on a much worse wage swings and roundabouts and all that.

A lot of benefits are currently means tested, an awful lot of people will never accrue enough of a pension to have more than they would have got anyway, it's just an extra bonus for the gov.

Who knows what will happen to these benefits?

I officially retire in 12 years time, my company pension [5%/5%] is projected to give me around £6k pa

I have other means but if I didn't, that £6k would come straight off benefits that would have been paid.

Lets face facts here. All but the tiniest minority of people presently under say 45, are going to enjoy anything even remotely resembling the present pension/retirement arrangement, whatever you're presently paying.

The baby boomers have spent all the money on holidays in Tenerife, and Golf Club memberships, that the next god-knows-how-many generations are going to be paying for.

I imaging the arrangement we'll be looking at will more closely resemble the bridge over the river kwai. Where you work until you keel over, then having served your purpose you're discreetly taken aside and shot

My current employer contribute nothing which is about par for the course in my sector and in the small business within it.

Or you could try what the underclass of Eastern Europe are doing in increasing numbers and contribute nothing to the UK treasury throughout your working life then move here when you approach 60 and claim Pension Credit and the associated passported benefits.....

The baby boomers have spent all the money on holidays in Tenerife, and Golf Club memberships, that the next god-knows-how-many generations are going to be paying for.

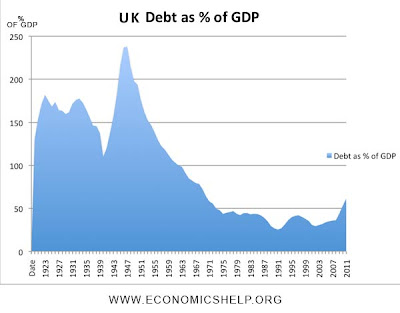

I think you'll find the Boomers spent all the money paying off a much bigger debt than we current have, probably blamed the generation before for going to a war or two for it 😉

firestarter - Member

I pay 11.2% at the moment goin up to 12.6% not sure what employer pays but I know as my payments go up theirs go down. I'm going to be paying for an extra five years now too. I also brought in my army pension so I could leave a bit earlier and get full pension but now as we have to work longer anyway I've lost that and its now gone into the pension pot never to be seen again and I also have to pay around 3 years extra contributions for the pleasure . Deep joy

If all that is true I will show my arse in Burtons shop window. Sounds like the unions up to the usual scare mongering.

pembo that is direct from the office of the dept pm as i emailed for info myself as my army pension had apparently gone awol so to speak. best you get to burtons mate

In thirty years time, when the kids have grown and fled the nest, I'm volunteering for the "Soylent Green" Project. Hope the wife doesn't mind, she can have the house!

You seriously expect me to believe you have lost your army pension firestarter? Sure, there may have been an admin cock-up but you will get your army pension. If I was you I would get some independent advice.

yes its gone but not as in lost but i'll try explain in type easier in conversation lol

i was advised when i started that i wouldnt get my full pension as i had to retire before i could get my full payments in. so to transfer my army one in. that way i would not only get my full pension in but leave 3 years before retirement age 😉 happy days

then retirement age changed so i no longer have the option to go early but have to stay longer , long enough that without transfering the pension in i could have still got full entilement and had my army pension.

so now once i fill my pot a few years before my new retiremnet age i have to keep paying my pension payments even tho it will now go into the pension pot rather than mine as mine is paid up.

so in effect my army pension has been lost, as i will pay 30 years and give them my army pension and get a 30 year pension where as if i had not transfered it in i would have paid 30 years got a 30 year pension and still had an army one

its all legal as ive had it checked out

i wouldnt mind if the 3 years of extra payments were upping my pension but they are not or if once my pot was filled i had to stay on but no longer contribute that would be fine too but to have to continue paying into someone elses pot is rather galling to put it mildly

apologie for off topic 😉

A lot of benefits are currently means tested, an awful lot of people will never accrue enough of a pension to have more than they would have got anyway, it's just an extra bonus for the gov.

Not only is this a good point, its a [b]really[/b] good point

If there is no change in the way 'top up' benefits are applied (for example a pension disregard) then for anyone in a type of career path where they would expect to earn less than the median wage, I'd be willing to bet that its wasted money, so better to spend it and enjoy it.

Personally I'm planning a large bank robbery at retirement - either I get the money, or get free food and board at taxpayers expense 🙂