Having sold our old house I spent a wee bit of time trying unsucessfully to find out what we would receive from a £13500 profit on the sale..Anybody care to guess the estate agents and their conveyancers bite out of that?

.

.

.

.

.

£4500.

so is their fee based on the 'profit' ?

Yes, easy to forget the VAT too !

We just paid 1.2%, the first "premier" agent was 2%+

I think estate agents fees are a rip off but we do pay quite a bit less than Europe and the US

I think estate agents fees are a rip off but we do pay quite a bit less than Europe and the US

I guess it's down to personal experience. Our estate agents have been great and worth every penny. We sold our house for an asking price which was 25k above what a lot of the other agents told us to put it on the market for. They've been completely efficient and professional throughout and have given us some extremely good advice along the way whilst handling a buyer who fell through because they didn't have the cash to fulfil their offer. I almost feel like giving them a tip.

If anyone's selling a house in South Manchester, give Jordan Fishwicks a ring in Didsbury. If you're buying, stay well clear 🙂

The Vat was not included in the 1.5%, also electronic transfer of the money to us and the original mortgage provider cost £175. What:send the progress detail emails to two different email adds?(we bought it before we were married)£150 to you!

Last house I sold, we didn't bother with one. Just stuck a sign in the window.

Can't really understand how they get away with it in these days of t'interweb n'all.

I would have thought a reasonable fee for advertising a house would be something like £200 but yes I know that's not what they charge. Just seems like no-one wants to adopt a low margin/high throughput business model.

The one that gets me is stamp duty, at least the EA does (some) work for his money, stamp duty is not a small amount either!

I have moaned about the cost of moving for months now. I am however sitting in my new house in a beautiful village and the contentment I'm feeling would still be cheap even if it had cost me double what it did to move.

You know what your getting into from the start.

Stamp Duty is a con. Especially at todays inflated prices. And that's coming from a bleeding heart liberal. What I don't get is why it jumps to 3% on the entire selling price at the arbitrary boundary of 250k instead of the higher rate only applying to the sum above the limit. Also I don't think it should apply on a main home. Seems to me if any political party wanted a quick win, reforming this ridiculously unfair tax would be a good start.

I would have thought a reasonable fee for advertising a house would be something like £200

You're not just paying for the advert though are you? You're primarily paying for instant and easy access to their database of interested buyers and introductions to them. Not to mention all the negotiations, phone calls, liason with solicitors, surveyors etc. Admittedly these are just phone calls but I doubt my employer would have been too happy with me spending half the day on the phone to interested buyers etc.

We sold our house for an asking price which was 25k above what a lot of the other agents told us to put it on the market for. They've been completely efficient and professional throughout and have given us some extremely good advice along the way whilst handling a buyer who fell through because they didn't have the cash to fulfil their offer.

so they didn't actually sell your house then?

We sold our house via house network.co.uk. Goes onto right move. They broker everything via telephone take photos etc and arrange the viewings which you do. All very neat and tidy and costs about £500 all in. Estate agents are rip offs! Go internet selling its cheap

[grave danger of being flamed here]

@dazh on higher price houses it's hard to imagine what the agent is doing to earn £30k especially when the solicitor costs £1k. Just imagine what stamp duty looks like at 5% and 7%.

Don't like Stamp ?

Would you rather pay VAT on your house purchase.

If you can afford a nice big new house ... then pay up sweet cheeks.

Most of them are second-hand, Ro5ey!

Good point Ned

But as a non bleeding heart liberal... it a tax I'm happy to pay

I have payed both estate agent and legal fees here in France, oh how i wish it was as cheap as the UK ,you have it good don't rock the boat.

Don't like Stamp ?Would you rather pay VAT on your house purchase.

If you can afford a nice big new house ... then pay up sweet cheeks.

I'd prefer VAT.

It's a Value [b]Added[/b] Tax. A new £300k house, on £150k of land and £100k of materials and labour (guetimated numbers, i've no idea) would only attract £10k of tax even if it was the full 20%, about the same as the stamp duty.

It would mean money for the exchequer still, it would be progressive (well linear) as everyone would own a house which at some point would have paid 20% of its value to the taxman (the land, the builders rates, the materials and the proffit all being VATed at the same rate).

Chargeing what is in efect a fee for moving house just seems wrong, a mobile workforce, property market liquidity and an end to 'property developers' rapidly turning over lots of low SD properties for big profits are all good things!

I don't object to paying Tax but I do think Stamp Duty is silly as it's a dis-insentive to move which encourages second homes (letting out old house) rather than selling it and freeing up housing stock.

A wealth (property) tax would be fairer....

@footflaps - how is stamp duty less fair than a wealth (property) tax

@Ropey - why do you pay 7% stamp duty (£140k) on a £2m house bought with £1.9m cash and a £100k mortgage versus 5% stamp duty (£95k) on a £1.9m house. Borrowing a £100k means you pay £45k more tax ? Plenty of examples like this. Stamp duty is creating distortions in the housing market, encouraging people to buy up larger numbers of smaller houses and discouraging people from moving meaning more traffic on roads (commuting further) and higher prices due to people moving less often than they would have otherwise creating supply imbalances. Retired people are more likely to stay put than move away from towns. Stamp duty now raises more than fuel (petrol/diesel) duty.

In today's standard.

"Stamp duty is a tax on London, says. Mayor"

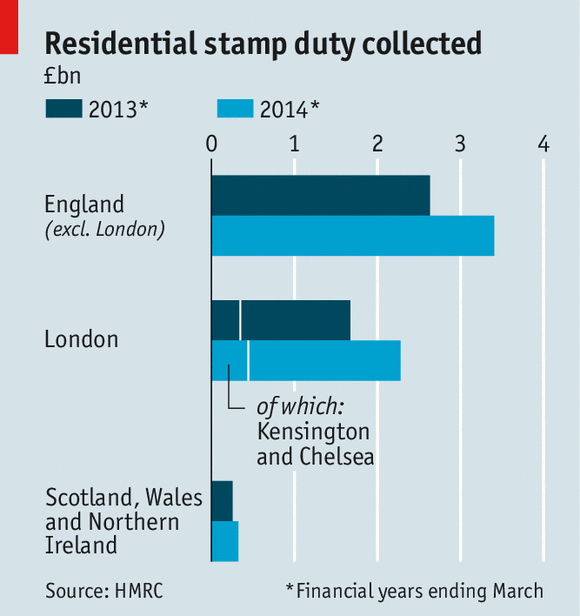

"One london borough alone stumped up £444million, twice as much as Scotland alone. Westminster's contribution was £430 million four times as much as wales and Northern Ireland combined.

devolving London's property taxes is a fair and reasonable solution and would generate the reliable and continuous funding we need to provide the new homes and choices hardworking Londoners deserve"

Indeed Mr Smith. I read the two London Boroughs of Westminster and Kensington and Chelsea pay 7% of the total stamp duty collected nationally. However devolving the use of the to London is clearly never going to happen and frankly isn't a good idea (I live in London)

Yes stamp has many problems.

The point l was trying to make was...

lf you find yourself lucky enough* to be moving... then there are many out there who can only dream of such a life.

And 3/5/7% ... really isn't much money in the total you'll have to pay for your new place.

*lucky enough.... you may well have created that yourself... fair play.

electronic transfer of the money to us and the original mortgage provider cost £175

Estate agents don't handle the money.... that's the solicitors charge.

Seems to me if any political party wanted a quick win, reforming this ridiculously unfair tax would be a good start.

IIRC Gideon has missed his deficit reduction target by 50% - last year's dicking about with the housing market by chucking extra ££ at it was IMO a deliberate ploy to get more houses above the £250k mark. I can't find a source but the amount he took in stamp duty this year is a massive increase on previous years.

I suspect the artificial boost was a) to keep the older generation (homeowners) Tory-happy and b) to increase the tax take cos he was/is massively missing the key thing he's hung his credibility on - debt reduction...

Be interesting to see what tricks he pulls if today's news that prices have seen a small fall turns into a longer term fall between now and election day...

You could be paying CGT if it was a second property.

@footflaps - how is stamp duty less fair than a wealth (property) tax

I don't think Stamp Duty is unfair, just unproductive. Making it easy for people to move helps labour follow demand. Putting obstacles in the way of labour movement is unproductive eg people don't take certain jobs, or commute for hours every day etc.

A wealth tax, based on the value of your home, would be much better as it wouldn't act as a drag on house sales, would provide a financial incentive to downsize (freeing up larger properties) and cool the second home market a bit (reducing BTL).

[i]Stamp duty is creating distortions in the housing market, [/i]

Not really 'is' as it always 'has' - any tax that works on 'bands' will, just by its nature.

The bit that the wealth tax completely misses it that it suggests that people want to spend that money and its optional like buying a Ferrari. I dont want to spend that money, I need a house for my family reasonably close to acceptable schools and work. They are expensive and I will have a huge mortgage and no spare money to pay a mansion tax.

I would happily give back anything that I have "earnt" through my home appreciationg in value if the same was done to the value of the home that I want to buy.

To that end I would support a 50% Capital gains tax on ALL houses which would cost me more making this current move, and really hurt the people who have not moved in 40 years, but It would almost completely remove the cost of relocating to a new job moving to a like for like house.

And even if you just started talking about introducing that tax - everyone who was sitting in a big house they have been in for decades would downsize asap which would free up the market further.

Yes I hate stamp duty and the way it jumps up is just stupid. It causes a problem with houses that are at the top of a band as no-one will pay a few k more for a house to then have to pay more k in stamp duty. It's currently stopping me moving house as I can't justify moving given the stamp duty I'd have to pay on my new place - if I paid what I could afford anyway, yes I could afford to pay it but is a disincentive. Anyway, what party is going to reform it given that they'll lose some tax raised? Come on Tories!

High street estate agent fees (1%) don't have anywhere near as much impact in high priced places as stamp duty (5%+)

The bit that the wealth tax completely misses it that it suggests that people want to spend that money and its optional like buying a Ferrari.

It doesn't necessarily have to cost any more, the overall take take could be kept the same....

And 3/5/7% ... really isn't much money in the total you'll have to pay for your new place.

Well as someone who has been "lucky" enough to pay some of these higher amounts I can tell you it is a large amount

I don't think Stamp Duty is unfair, just unproductive. Making it easy for people to move helps labour follow demand. Putting obstacles in the way of labour movement is unproductive eg people don't take certain jobs, or commute for hours every day etc.A wealth tax, based on the value of your home, would be much better as it wouldn't act as a drag on house sales, would provide a financial incentive to downsize (freeing up larger properties) and cool the second home market a bit (reducing BTL).

got it on point 1 and agreed. Point 2, wealth tax has to be on wealth - so its property value less loans. The Swiss have one - it varies by canton but I recall its 0.25% and its only payable if you don't pay other taxes of an equal or higher amount

To that end I would support a 50% Capital gains tax on ALL houses which would cost me more making this current move, and really hurt the people who have not moved in 40 years, but It would almost completely remove the cost of relocating to a new job moving to a like for like house.

And even if you just started talking about introducing that tax - everyone who was sitting in a big house they have been in for decades would downsize asap which would free up the market further.

I am not aware of anywhere in the world that taxes capital gains on your primary residence, never mind a rate like 50%.

Some good info on Wikipedia

http://en.wikipedia.org/wiki/Stamp_duty_in_the_United_Kingdom

Those that have a high value property but a relatively low salary find the tax particularly hard to take.

You have never heard of it because I am not in charge yet 🙂

But maybe we need some kind of big change to stop your home being seen as some great cash cow. If the average house price in London is 450k+ and prices go up 10% in a year, that is 45grand "earnt" tax free ~75grand gross.

which is double the average national salary. That cant be right or sustainable.

45grand "earnt" tax free

Not much good as can't get at it - unless move to somewhere cheap like Wales.

I have just realised the flaw in my master plan - how do you deal with actual added value - like extensions and re-builds etc.

😥

Well what happens with 2nd homes? Anyway, forget about it - never gonna happen!

Those that have a high value property but a relatively low salary find the tax particularly hard to take.

There are many many factors which suggest the market is currently massively overvalued - c 25% against wages and c 30% against rents according to The Economist IIRC. The natural conclusion is that the market will correct itself as that's what markets do (and what UK housing has done every boom since early 70s...)

But the one you mention clearly demonstrates a big problem with property liquidity - if someone bought a house mid/late 90's but didn't really progress in income terms (and most people haven't since mid noughties) then you have a load of people who'd like to move but can't afford to because of stamp duty - let alone the other costs. That leads to a stagnant market - no houses for sale.

The only way to get out of this trap is for values to fall back to a level where stamp duty is affordable... When sellers realise this, will they begin to accept below-current price offers?

Well if of course the stamp duty bands could be adjusted relative to property price inflation - plus make the rates apply to each band rather than the whole like income tax.

There are many many factors which suggest the market is currently massively overvalued - c 25% against wages and c 30% against rents according to The Economist IIRC. The natural conclusion is that the market will correct itself as that's what markets do (and what UK housing has done every boom since early 70s...)

@brooes - look at the charts of house price appreciation. Over the medium term its been one way traffic. Its going to keep going up, supply and demand dynamics show that. Comparing average prices against average earnings is meaningless, anyone who understands statistical analysis can tell you that.

plus make the rates apply to each band rather than the whole like income tax.

Can you imagine the uproar if income tax had the same policy? It's ridiculous, and the upshot of it is that 'normal' (ie. not rich) people, with an average size home, a couple of kids and two incomes end up having to pay a 5 figure tax bill just to move house, which obviously stops a lot of people moving as many don't have 10k+ just sitting around in a bank acct doing nothing but waiting to be handed over to the taxman.

As I started this thread,could everybody who uses it bung me a fiver for marketing your views and opinions. email in profile.