- This topic has 67 replies, 31 voices, and was last updated 8 years ago by kimbers.

-

Tax Credits Debate/Vote in the Lords

-

konabunnyFree MemberPosted 8 years ago

Well done on hitting godwins law so soon though.

Well done on calling Tories untermenschen though?

https://en.m.wikipedia.org/wiki/UntermenschDrJFull MemberPosted 8 years agoNot really. There is no free exchange outside of an Ayn Rand fantasy – it all takes place within a context.

footflapsFull MemberPosted 8 years agoTaxing wealth is different. That is interfering with the results of a free-exchange between people (economic agents).

Not at all, we don’t have any innate right to our salaries / wealth, it all exists in the context of the legal and tax framework. Plus, they’re happy to adjust tax rates down (eg Inheritance tax), so why not up?

Interestingly in this case, the head magician proves to be Gordon Brown. Forget the recent trap set by the Tories for Labour, this whole mess was a trap set by Brown for the Tories. And Osborne sprung it and has his snout caught.

Wow, I’m impressed by your attempt at blaming GB for this! I didn’t see that coming in a million years!

The reason we have tax credits is that we have allowed employers to get away with paying poverty wages as successive governments have prioritised shareholder wealth over employee wealth. The current Government have announced cuts to CT, so are actually accelerating this trend (basically making the rich richer at the expense of the poor).

teamhurtmoreFree MemberPosted 8 years agoFF – given that little of that bears up to scrutiny, I will leave those thoughts with you….

Not blaming Brown – he (from his perspective) did a good job. They put the Tories in a pickle and Osborne now reeks of vinegar.

So I supply labour for which I receive a wage and I have no innate right to that – what kind of world it that?

bencooperFree MemberPosted 8 years agoWhat they really said was “we’re thinking about blocking it, but we’ll give you a chance to come up with a better plan yourselves first”.

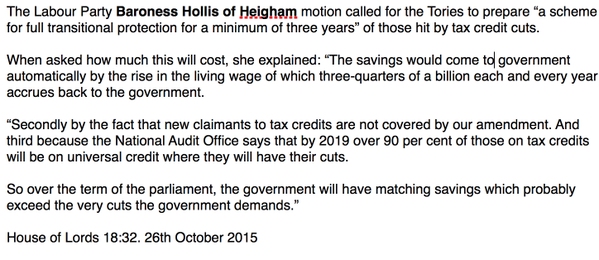

It’s enlightening to see what the Labour Party think of what happened in the Lords (and it’s worth bearing in mind that Labour abstained on the motion that would have killed the bill):

– “new claimants are not covered” – so new tax credits claimants will suffer the cuts.

– the cuts will still happen, just to universal credit not tax credits.

– the Labour plan will result in cuts which “probably exceed the very cuts the government demands”.

brFree MemberPosted 8 years agoWho started the Tax Credit system? it’s been around as long as I can remember, used to be advertised on buses when I was a kid! although it wasn’t originally called Tax Credits was it?

http://www.revenuebenefits.org.uk/tax-credits/policy/research/where-it-all-started/

https://en.wikipedia.org/wiki/Working_tax_credit

Worlds most complicated system, and works on a simple principle that you’ll earn the same each week…

kimbersFull MemberPosted 8 years agoBencooper, so it depends on the differences between universal credit and tax credits as to who gets what cut?

In the meantime, Osborne has to rework ( to try and not make this his ‘poll tax miment’) it anyway so it won’t go through in this manner at all

DrJFull MemberPosted 8 years agoSo I supply labour for which I receive a wage and I have no innate right to that – what kind of world it that?

You don’t have an innate right to keep all of it. You have to give back some to maintain the environment in which you “earned” and spend that money. Alternative systems have been tried – Somalia is the example usually quoted.

chestercopperpotFree MemberPosted 8 years ago@ br – Like the dole it has gone through name changes with successive governments! It’s been around a lot longer than the 2002/03 name change. The adverts I remember where in the 80’s no where near 2002, like I said it had a different title then but was effectively the same, a government subsidy to low paid working families who earn’t under an income threshold.

Not sure it was as “radically different” as the link article suggests, possibly less widespread though.

molgripsFree MemberPosted 8 years agoSo I supply labour for which I receive a wage and I have no innate right to that – what kind of world it that?

Your labour earns you some money and the government some money.

I thought you were an economist?

footflapsFull MemberPosted 8 years agoSo I supply labour for which I receive a wage and I have no innate right to that – what kind of world it that?

A very fair one. You are only able to supply your labour taking advantage of all the institutions and facilities which provide the framework you rely upon, eg Education, roads, police, a legal system which you might end up using to enforce a contract.

Whilst you live in the UK you are bound by UK laws and taxes to pay for all the facilities used.

To think otherwise is just being childish….

teamhurtmoreFree MemberPosted 8 years agoI am mol – two separate things though. Not a great idea to confuse.

Google – “circular flow of income”

julianwilsonFree MemberPosted 8 years agoThe Tories are distraught that their PM has been held to account lying multiple times to the electorate about protecting tax credits

…and today Osborne (in Peston interview on r4) is still peddling the excuse that the electorate know the direction he is heading in so what do they expect. (And the answer is still that most people vote for their own financial interests, and the hard working families that voted conservative last time were fed a lie on tax credits which they took and voted on in good faith).

He also repeated himself a lot in that interview just as he did last night with the ‘unelected upper house’ sentence. Really, for such a clever man he should realise how coached and two-dimensional he (along with a few others eg Milliband) sounds when he is briefed by someone else just before an interview and all he can do is drop a coupe of t’s and aitches and repeat the key points verbatim over and over.

kimbersFull MemberPosted 8 years agoOsborne’s obviously flustered, he will look bad whichever way it plays out

He seems to still be pressing ahead with cuts to the lowest paid workers , while keeping tax cuts for inheritance and corporations, even the poor dupes they mugged at the election are twigging that he’s out to only look after his own atnthe expense of the plebsAdd to that, Tory rumblings over reforming the HOL, (despite blowing their chance last term) and threats to flood the lords with Tory peers, all of a sudden Borris is piping up as a champion of the poor and his own leadership hopes all of sudden waxing as Gideon’s wane

athgrayFree MemberPosted 8 years agoI thought David Davis spoke well on the subject on R4 this morning. Speaking against proposal to stuff the HoL with Tory peers, and also attacking the unfairness of the tax credit cuts.

teamhurtmoreFree MemberPosted 8 years agoSo Austerity George drops the whole idea!

More borrowing instead…

Cue, some unhappy teachers – good job education isn’t important, eh? 😯

wanmankylungFree MemberPosted 8 years ago£22Bn in efficiency savings for NHS. Good luck with that.

the-muffin-manFull MemberPosted 8 years agoMy colleague is rather happy his Tax Credits aren’t to be cut.

He really needs them with his family being on the poverty line – it’s bloody hard managing with a new car, new house, couple of holidays a year, every games console going, etc., etc.,

His wife works part time, and has a side-line job which I’m sure she declares to HMRC. 😉

cheddarchallengedFree MemberPosted 8 years agonot a bad budget overall:

– a lot more cash for the NHS

– additional £1/2 Bn ringfenced for mental health

– more hammering of buy to lets to reduce foreign buyers

– no cuts to the police budget

– on housing, more help to buy (demand side) and help for builders with release of public land and working capital (supply side)

– and we still have the living wage and now no changes to tax credit so no-one’s worse offThe look on Andy Burnham’s face was priceless when no cut to the police budget was announced – he’d said he would be “comfortable” with a cut up to 10%!

wanmankylungFree MemberPosted 8 years ago– and we still have the living wage and now no changes to tax credit so no-one’s worse off

Why is the “National Living Wage” significantly lower than the living wage?

outofbreathFree MemberPosted 8 years agoSo Austerity George drops the whole idea!

More borrowing instead…Isn’t it being paid for with Apprenticeship Levy and increased forecast revenue?

DrJFull MemberPosted 8 years ago– on housing, more help to buy (demand side) and help for builders with release of public land and working capital (supply side)

Yes – more affordable houses for poor people and first time buyers.

Oh …

Hang on a mo …

The topic ‘Tax Credits Debate/Vote in the Lords’ is closed to new replies.