- This topic has 23 replies, 16 voices, and was last updated 10 years ago by johndoh.

-

Fixed rate mortgage

-

tinsyFree MemberPosted 10 years ago

I dont want to go into massive detail, but I have two fix rate offers from the same company 2.29% for 2 years or 3.29 for 5 years… Bother revert to the same basic rate after the fixed term.

What one?

tommyhineFull MemberPosted 10 years ago2 years and gamble that the base rate is going to stay at 0.5% and then 5 years after that when the rates are going up a bit.

bit of a risk on the base rates but after last weeks new BOE governer and the statement they have no intention of changing the base rate in the near future it could be a good bet.It is always a bet though.

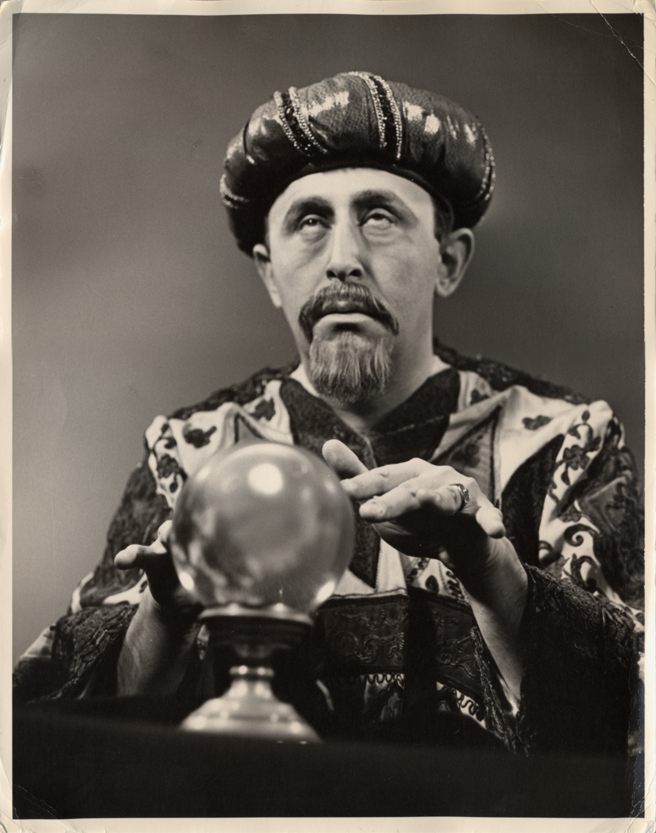

nickjbFree MemberPosted 10 years agoWe fixed ours for 5 years just over four years ago. We were repeatedly informed that rates are so low they can only up so go for the longer deal. Rates then went down a bit more and stayed there. Now almost time to renew again. No crystal ball here. The big plus for long term fixed is it is much easier to budget. Depends if you feel lucky 🙂 Oh and watch out for arrangement fees

tinsyFree MemberPosted 10 years agoArrangement fee is ferkin enourmous, but I am over the barrel a bit with few options… yes crystal ball, now where did I put it.

johndohFree MemberPosted 10 years agoWe were recently in this conundrum and went for the 2 year option – mainly because the lender will arrange a new loan (on another fixed rate) at the end of the term without asking for proof of income again. Had I had to go through the whole income proof rigmarole again I’d have fixed for 5 years (but I am self-employed so it is more hassle).

huwsFree MemberPosted 10 years agoWe’ve just gone for 2 year fixed on the basis that after those 2 years we’ll have paid off enough capital to move us down into the next LTV band and hopefully a lower interest rate. Hopefully.

johndohFree MemberPosted 10 years agoWe’ve just gone for 2 year fixed on the basis that after those 2 years we’ll have paid off enough capital to move us down into the next LTV band and hopefully a lower interest rate. Hopefully.

And in two years house prices will have also moved upwards I’d say.

joemarshallFree MemberPosted 10 years agoIf the arrangement fee is enormous, then assuming you’ll re-fix again when it runs out, don’t forget to take it into account in your calculations of the total cost – ie. divide the arrangement fee by the number of years of each fixed rate and add that on. Can make a decent chunk of difference to the effective rate. eg. 1000 quid arrangement fee is £200 a year on a 5 year, rather than £333 a year on a 3 year. Probably not going to be a whole percentage difference but worth considering.

huwsFree MemberPosted 10 years agoAnd in two years house prices will have also moved upwards I’d say.

Quite probably, but the aim is to overpay considerably.

blurtyFull MemberPosted 10 years agoFrom what I read, base rates are expected to rise back to normal levels, circa 5% over the next 4-5years. (Now that quantative easing has come to an end)

mudsharkFree MemberPosted 10 years agoInterest rates are expected to stay low for a while yet hence the recent fall in sterling’s exhange rate. Generally fixing works out more expensive than non-fixed as you’re paying for insurance of knowing what you’ll pay – sometimes having that insurance really works out well though. I’ve never fixed since buying my 1st house in ’96 and worked out well for me.

ononeorangeFull MemberPosted 10 years agoI think Mark Carey tried to do his best recently to keep short term rates low.

Are there any differences in terms and conditions? Most imnportantly, overpayment treatement? Smnall differences in headline rates could be wiped out if there are and you intend to overpay / your situation changes.

brassneckFull MemberPosted 10 years agoQuite probably, but the aim is to overpay considerably.

You wouldn’t need too – if your house value goes up, and your mortgage is ticking down, your LTV gets double doses of win – assuming when you remortgage they accept a current valuation rather than the one you bought at.

That’s how I thought it worked anyway.

trail_ratFree MemberPosted 10 years agoWe fixed for 2 years – i note now that similar products are 1% cheaper – how ever the variable has not come down by anything like as much and could still shoot up.

toby1Full MemberPosted 10 years agoI just fixed for 3 again. I got a much better rate than I was on, it’s only 0.5% above the variable they offered and it had no arrangement fee. Overall I’m happy and about £200 a month better off (which will be going into overpayments – well that is the plan).

All that from my existing provider, and I was expecting to have to switch this month and had saved some cash to cover the cost.

🙂

johndohFree MemberPosted 10 years agoYou wouldn’t need too – if your house value goes up, and your mortgage is ticking down, your LTV gets double doses of win – assuming when you remortgage they accept a current valuation rather than the one you bought at.

That’s right _ couldn’t be arsed explaining it 🙂

fizzicistFree MemberPosted 10 years agoIf you’re planning on overpaying, I’d be inclined to go variable rate and overpay as much as you can. Then at the first sgn of the Tories looking electable, fix your mortgage as the economy is clealrly recovered enough for interest rates to be an issue.

ononeorangeFull MemberPosted 10 years agoFizzicist – why variable specifically if planning on overpaying? You can overpay on some fixed rate loans.

huwsFree MemberPosted 10 years agoMy fixed is at 2.49% with the ability to overpay by 10% of the outstanding amount, or at least it will be assuming all goes well with the survey this week. Variable rates were about the same.

As an aside, we’re potentially looking to rent the flat out in a few years time using the capital to buy the next place. As moving to a buy to let mortgage will require 25% deposit, is it better that the house price stays low so that the required deposit is smaller or that the value goes up increasing the capital? Maths is not my strong point, I much prefer colouring in.

pjm84Free MemberPosted 10 years ago1.32% here. Changed to a life time tracker at base plus 0.82% in November 2008

johndohFree MemberPosted 10 years agoFizzicist – why variable specifically if planning on overpaying? You can overpay on some fixed rate loans.

Usually you can only overpay 10% of the loan per year on fixed rates (although I am sure there are some that are less strict) is what he means I assume.

I am currently on a variable of 3.95% but unlimited overpayments/withdrawals etc. and just about to move and have signed up for a 2 year fixed rate (1.99%) where I can only overpay 10% PA.

The topic ‘Fixed rate mortgage’ is closed to new replies.