- This topic has 25 replies, 18 voices, and was last updated 9 years ago by brooess.

-

Fixed mortgage rates – do I go for two years or five?

-

PimpmasterJazzFree MemberPosted 9 years ago

We’re remortgaging and basically have two decent options available.

We can do a two year fixed and save ourselves £200 per month, or we can do a five year fixed and save £100 per month. we have no intention of moving, but can port the loan if required.

I’m personally erring toward the longer deal as there’s a good chance rates will go up after the election, whoever gets into power. But an extra £100 a month would be nice and we could always throw that at the mortgage to reduce the actual loan.

Anyone got any better advice?

nemesisFree MemberPosted 9 years agoYour logic is right – I guess it’d be worth doing the maths over how much interest rates would have to go up between years 3-5 to make the £100 add up sufficiently and see how likely you think that is.

Or look at an offset on the basis that even if they go up, they’re still going to be (relatively) low for a while so it might be worth putting savings against the mortgage.

mudsharkFree MemberPosted 9 years agoI’d do 2 yrs as it’s so much cheaper than 5 esp taking NPV into account.

somoukFree MemberPosted 9 years agoI had a similar option although the figures weren’t as large. I opted for the longer fixed term and known stability.

With the difference being £100 I probably would have opted for the shorter term and as you say save the money and either take it off the capital or go on holiday.

ahwilesFree MemberPosted 9 years agoit’s a gamble, the choice is yours. The only ‘right’ answer will reveal itself in a few years time.

we’ve just had to make the same decision, with more or less the same numbers.

our choice? – 2 years at 2 percent, and overpay as hard as we can. Even if it turns out to be the ‘wrong’ choice, it’ll be a wrong choice that allows us to make massive inroads to our debt.

cruzcampoFree MemberPosted 9 years agoIve just got a 1.29 tracker + boe. With savings I make over closest 2.49 5 year fix ill overpay. No SVR To contend with and more booking fees id get wih a fix whem it ends., and no redemption if I do need to jump ship off the lifetime tracker. The booking fees on some 2 year fixes hardly make them worthwhile due to end of period SVR and moving again.

boe been due to go up for 3-4 years. Massive saving on interest and term of mortgage with overpaying tracker at the moment.

mrchrispyFull MemberPosted 9 years agowhat you need is a massive spreadsheet and play with the numbers.

I went 5 year fixed 3 years ago, on reflection id have been slightly better off on another deal but it was the right choice at the time so no regretsIAFull MemberPosted 9 years agoFixed at 5 here, but that’s because we’ve a _lot_ of work to do to the house and it’s nice to have some long term handle on some of the expenses at least, as it makes budgeting all the work a bit easier as some of the longer term risk is managed.

Not directly relevant to your situation but similar so might help. On the flip side, if I had less uncertainty in the work to do etc I might fix on 2…

biglee1Full MemberPosted 9 years agoHave a look on mortgage overpayment calculators, I’d keep paying the same but the money “saved” can be overpaid to save you loads. I`ve been maxing my overpayments out when I got my 2 year fixed.

kimbersFull MemberPosted 9 years agowe went 5yr fixed but with an offset, which works well for us, the stability thing is one less worry inlife

freeagentFree MemberPosted 9 years agojust went 5-year fixed on ours.

I’m sure we could have got a better deal for 2 or 3 years but liked the idea of the stability/knowing what we’ll be paying out.martinhutchFull MemberPosted 9 years agoHave you accounted for more arrangement fees in two years time?

PimpmasterJazzFree MemberPosted 9 years agoPlaying with calculators now.

So many variables to account for; worse than buying a new bike.

Have you accounted for more arrangement fees in two years time?

I am taking it into account, but we’d have to pay them whatever. I suppose it’s at what point we repay them…

jekkylFull MemberPosted 9 years agoyour mortgage advisor should work out if it’s worth paying a fee, generally it’s at about 80-100k depending on the size of the fee.

Rather than save yourself 100 per month have you considered keeping your payments at the same level and reducing your term, you might be surprised by how many years it knocks off. Either way I agree the 5yr is the way to go.rondo101Free MemberPosted 9 years agoHaving been stuck on SVR after a fixed rate deal ended in 2009 & our measly 5% deposit had been consumed by the mini house price crash leading to us being stuck for 5 years, I opted for lifetime tracker at 1.49%+base this time round.

We do have quite a lot of spare capacity for increased payments if rates start going up though, so it’s not a “lose you house if rates climb significantly” gamble.nemesisFree MemberPosted 9 years agoI am taking it into account, but we’d have to pay them whatever. I suppose it’s at what point we repay them..

Yes but if you change every two years, you’ll obviously end up paying more arrangement fees (and solicitors fees) than if you do it every 5 years.

nedrapierFull MemberPosted 9 years agoWe went 5 years, was a thinker at 3.09, went to 2.85 by the time we had an offer accepted. Still umming and ahhing over the best option, until the BS released a 5 year fix at 2.39%. £90 to switch to that and we’re stuck in. No brainer for us at that price. Plan to be over paying, but we’ve got plans for the house, so we’ll see.

nedrapierFull MemberPosted 9 years agoWe went 5 years, it was a thinker at 3.09, went to 2.85 by the time we had an offer accepted. Still umming and ahhing over the best option just prior to completing, until the BS released a 5 year fix at 2.39%.

£90 to switch to that and now we’re stuck in. No brainer for us at that price. Plan to be over paying, but we’ve got plans for the house, so we’ll see.

PimpmasterJazzFree MemberPosted 9 years agoStill umming and ahhing over the best option just prior to completing, until the BS released a 5 year fix at 2.39%.

Wow. That is a no-brainer. The two year I’ve been offered isn’t vastly lower than that.

Yes but if you change every two years, you’ll obviously end up paying more arrangement fees (and solicitors fees) than if you do it every 5 years.

There is that. I’m guesstimating around £2k, so the two year above would be a saving in the short term. But – like you say Nemesis – the longer term is quite different, but then situations change too: I don’t expect us to be in the same house in 10 years.

IF you can smell frying, that’ll be my head. 🙂

vinnyehFull MemberPosted 9 years agoNationwide are offering 10 years at 2.89.

That should give you an idea of their expectations for the future.

andylFree MemberPosted 9 years agotbh I think I would take the short term savings and go for the 2 year fixed.

Can’t see rates going up that high any time soon. What happens after your 2 year fixed? Does it go to a tracker and at what rate? Work out what the rate would have to be for the remaining 3 years to cancel out the £2400 savings.

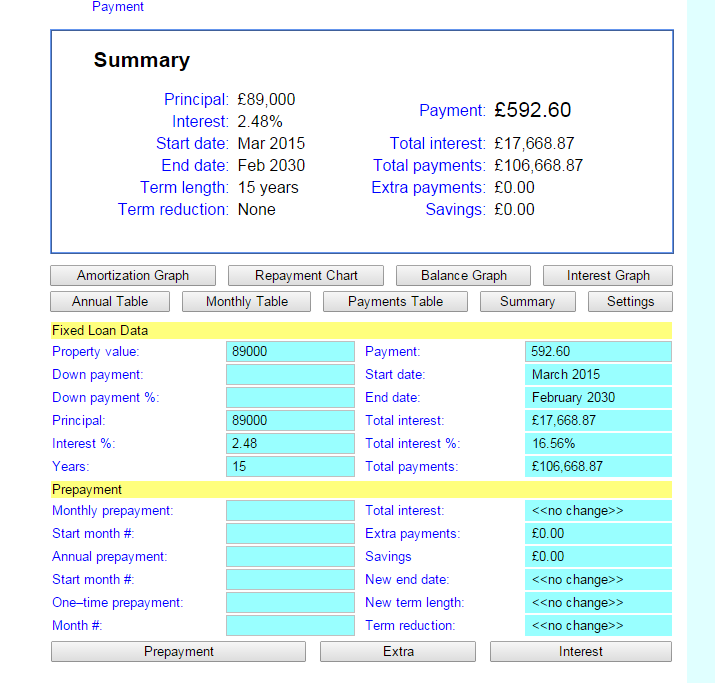

cruzcampoFree MemberPosted 9 years agoStick you current capital into here, with best fixed rate, and how many years left to pay. (Can change to months in settings if req.)

https://www.drcalculator.com/mortgage/uk/

Note down the monthly figure.

For me…

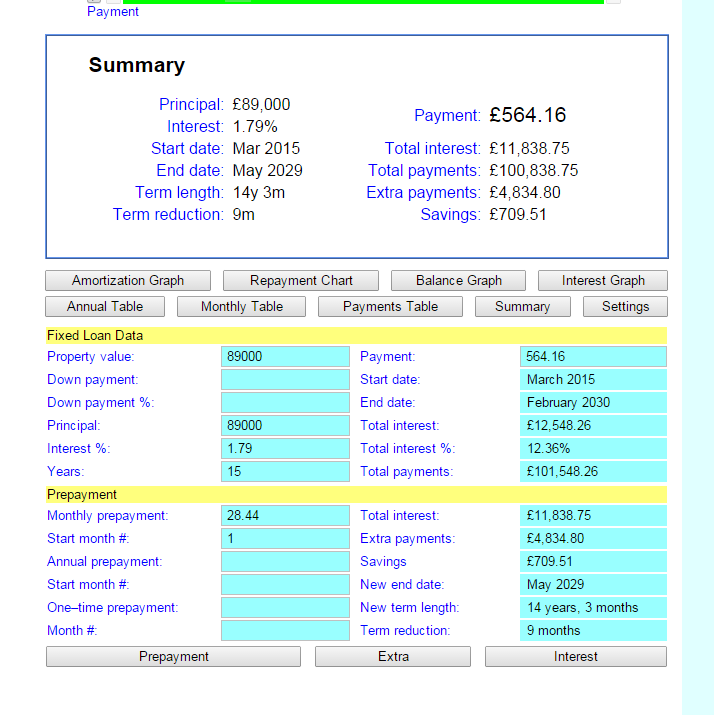

Then change the interest rate to the best lifetime tracker rate you can find and repeat the process. Work out how much your saving versus the fixed and add the difference as an overpayment (monthly prepayment box, start month #1 )

Total interest £17668 VS £11838 😀 Overpay even more if possible to milk the low interest rate and high capital payoff mix. This figure isn’t strictly true once BOE rises, but shows the extent of savings possible if you milk the BOE while the sun shines!

PimpmasterJazzFree MemberPosted 9 years agoTotal interest £17668 VS £11838 Overpay even more if possible to milk the low interest rate and high capital payoff mix. This figure isn’t strictly true once BOE rises, but shows the extent of savings possible if you milk the BOE while the sun shines!

Can’t see rates going up that high any time soon. What happens after your 2 year fixed? Does it go to a tracker and at what rate? Work out what the rate would have to be for the remaining 3 years to cancel out the £2400 savings.

Nationwide are offering 10 years at 2.89.

After lots of talking and some more research last night, I’m putting in an application for a tracker over a fixed that’s even lower, with a view to save as much as possible to either pay off capital or use as a bail out should the rates rocket: basically “milk[ing] the BOE while the sun shines!” 😉

Thanks all for advice and links!

cruzcampoFree MemberPosted 9 years ago@pimpmaster Jazz which rate and bank? Trackers a perfect choice!

brooessFree MemberPosted 9 years agoIndia and China both dropped their rates this week – global economy ain’t looking too good.

I suspect UK rates will go nowhere fast but BoE need us to think they’re going up soon to prevent the property bubble bursting – which it will at some point as people are so massively leveraged – hence they keep reminding people rates will go up to stop even more people overborrowing.

Quite a lot of First Time Buyers appear to be refusing to step into such an overheated market, hence mortgage rates dropping like a stone as hardly anyone wants to borrow and so the banks are missing their sales targets and they have fewer assets on their delicate balance sheets.

The banks are happy for people to think rates will go up as it means they can put them on higher fixed rates and replace some of the lost income from lack of FTBers

The topic ‘Fixed mortgage rates – do I go for two years or five?’ is closed to new replies.