- This topic has 170 replies, 69 voices, and was last updated 1 year ago by stumpyjon.

-

The housing market is broken, let’s supercharge it!

-

thisisnotaspoonFree MemberPosted 1 year ago

Nonsense, I am thinking of my kids and society in general. What do you think is going to happen when generation rent gets to retirement age?

Hysteria aside, “generation rent” as we’ve been called, do generally seem to eventually get on the housing ladder. It’s not easy, but you’re ideas of increasing loan to income ratios, and crippling us with interest rate rises aren’t exactly going to solve it for your kids are they.

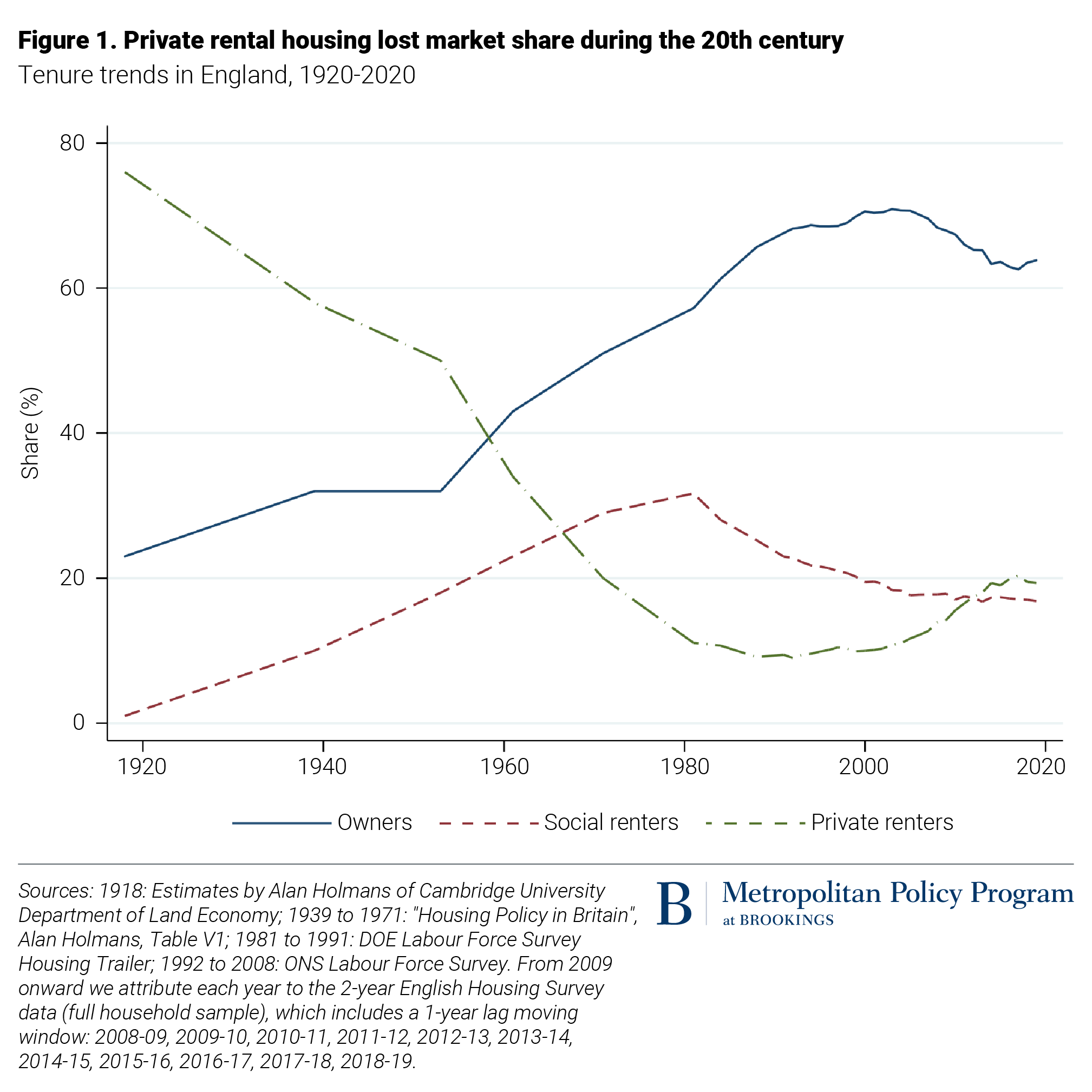

Look at the graph posted earlier, the proportion renting and owning leveled off 2012 ish, so ‘something’ is definitely happening, depending on how it oscillates over the next 50 years or so you could argue that stagnation goes back as far as 1990. Maybe it’ll revert back to going upwards, maybe ~30% is the level of rented housing the market needs after all. Plenty of young people (from my experience anyway) move around a lot, spend time living/working in different cities, before settling down. Buying doesn’t suit a lot of people at that age.

And without a reform of stamp duty* it never will. So there needs to be some level of renting going on.

*my proposal, abolish it as a transaction tax and make it a property tax. Effectively double council tax. The net result would be to encourage more moves as people retire and rather than thinking “I’ve paid off this nice 4 bed house so I’ll keep it” they’ll have to seriously consider whether they should downsize and let another growing family use it.

g5604Free MemberPosted 1 year agoHouse prices coming down or wages going up are the only things that will solve it. To do this requires a complete change in mindset and policy. It’s not fine because people get on the housing ladder later, they are a huge deficient by that point and probably have taken out a massive, 30, 35 hell soon to be a 50-year mortgage to do so.

doris5000Full MemberPosted 1 year agoI’m not sure that wages going up really would solve it. It would allow people to bid that bit more to get the house they really want. which would push prices back up again.

I think a large increase in housing supply would go a long way to sorting things out though.

thisisnotaspoonFree MemberPosted 1 year agoHouse prices coming down or wages going up are the only things that will solve it.

Watch what happens with 2 years of 10% inflation and rising rates, looks like you’re only one looking forward to it 🤷♂️

Realistically though people REALLY want a house, and will pay everything they can afford for it if they have to. We’re taking out >25yr mortgages based on 2 incomes because that’s what makes it affordable. If I didn’t, the next person would have done.

The problem is absolutely on the supply side of the equation, and I think altering the rental market is twiddling in the margins. A dead cat to distract from how far behind we are building new housing. Either through nimbyism or lack of infrastructure. If the rental market was as oversized as you think, then there wouldn’t be parts of the country where you have to rent without even seeing the property first they go so quickly.

Build enough and the free(ish) market would erode those BTL returns, both through competition between landlords who buy them, and because landlords would compete for a smaller rental market.

footflapsFull MemberPosted 1 year agoHouse prices coming down or wages going up are the only things that will solve it.

Well the only way house prices are coming down vs wages is in a deep recession. The long term problem is demand exceeds supply.

5labFull MemberPosted 1 year agoWell the only way house prices are coming down vs wages is in a deep recession. The long term problem is demand exceeds supply.

not really there’s a whole bunch of ways to make it happen, eg

1) higher interest rates

2) cgt on primary residence

3) higher tax on buying btl (currently 3%, ramp it up)

4) higher other tax\conditions on btl (harder to kick people out etc, this is already happening)

5) further borrowing restrictions (multiples of income/ability to pay etc)

6) increase supply

7) spare bedroom taxetc etc. I’m not saying all these are fair necessarily (fairness is a funny thing anyway) – but they would all make property prices drop.

incidentally, increasing supply doesn’t always work either. Places like sydney, phoenix and vancouver have space to grow (less so in vancouvers case) – but still property is in a massive bubble. If you think prices are high here try buying something in aus..

footflapsFull MemberPosted 1 year agonot really there’s a whole bunch of ways to make it happen, eg

Tinkering around the edges. If demand >> supply the market will push the price of the asset as high as it can go, stretching people to the max. It’s not as if housing is an optional asset, like Bitcoin, people generally need somewhere to live.

The only time house prices see significant falls, in the UK, is during recessions.

increasing supply doesn’t always work either.

You sure about that? Supply / demand is one of the most basic rules of economics.

have space to grow

Which is not the same as an increase in supply. One of the problems the UK currently faces is that the combined private sector house building capacity is less than the annual increase in demand.

g5604Free MemberPosted 1 year agoThere are millions of renters that want to be owners, but can’t afford to (despite paying more in rent than a mortgage would cost). It’s not all about increasing the number of houses, but reducing the number of BTL landlords.

thisisnotaspoonFree MemberPosted 1 year agoThere are millions of renters that want to be owners, but can’t afford to (despite paying more in rent than a mortgage would cost). It’s not all about increasing the number of houses, but reducing the number of BTL landlords.

Maybe, but then you’re swapping those 1:1. And therefore doing nothing for prices as for every rental sold you’re generating another buyer. It might work for some people, but not everyone.

And it achieves nothing for those renting bedsits, HMOs, living with friends, family, or flats that were never big enough to be viable long term anyway.

5labFull MemberPosted 1 year agoTinkering around the edges. If demand >> supply the market will push the price of the asset as high as it can go, stretching people to the max. It’s not as if housing is an optional asset, like Bitcoin, people generally need somewhere to live.

The only time house prices see significant falls, in the UK, is during recessions.

the only time they have seen drops in the past is because of that, sure. but prices aren’t supply/demand in the way you think, as the demand side is effectively “the amount of spare cash people have”, rather than just the number of people who want them. Make it tougher to own btl, and you reduce demand, but supply stays constant.

if you put a 50% capital gains tax on primary properties, price rises would grind to a halt really really fast.

stumpyjonFull MemberPosted 1 year agoEasiest way to reduce prices is limit borrowing, job jobbed. Then need to address the supply issues but to an extent excess credit drives the devolpers towards lower density premium housing. Reduce what people can borrow and expect to see a lot more affordable higher density housing.

You must be logged in to reply to this topic.