- This topic has 917 replies, 155 voices, and was last updated 1 year ago by kelvin.

-

mini budget thread

-

roneFull MemberPosted 1 year ago

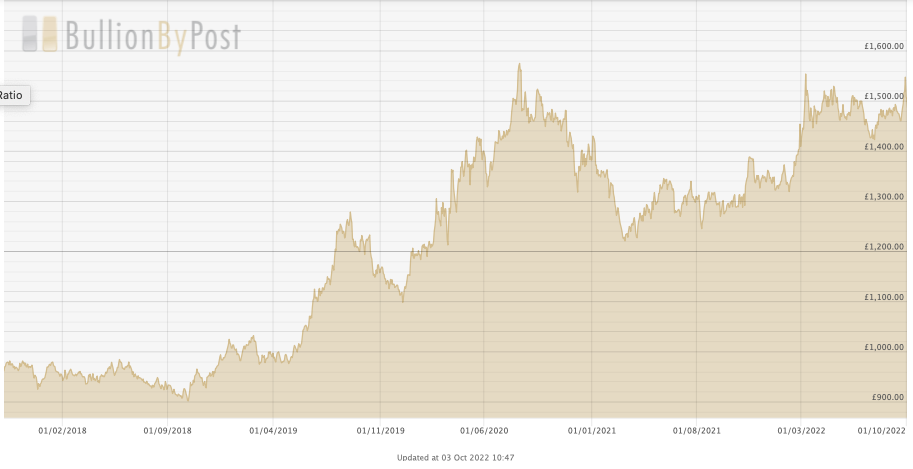

Money from risk-on assets is flying towards the dollar. There is very little that’s safe currently.

You seen gold BTW?

I can’t see what’s going to rescue the macro-picture across the board apart from a serious time-frame of doom and gloom.

ernielynchFull MemberPosted 1 year agoI don’t do FT. Why would I!

I’ve already told you…….No FT. No Comment.

The FT is by far the least biased newspaper. Obviously it isn’t totally unbiased but I don’t know of any national newspaper less biased.

roneFull MemberPosted 1 year agoOkay Lynch.

What’s the latest and best way to post an image on here?

BillMCFull MemberPosted 1 year agoIsn’t the cost going to be higher mortgage repayments, higher rents and a justification for austerity and flogging the NHS?

roneFull MemberPosted 1 year agoIsn’t the cost going to be higher mortgage repayments, higher rents and a justification for austerity and flogging the NHS?

Yep.

High inflation or high interest rates according to ‘them’.

One metric is going to get it – one way or another you can’t hide the mess that is neolibralism. Whether it’s high-inflation / equities / £/$ – something or all of the above is going to tank.

So the plan was deficit spending for tax cuts for the rich or simply just cuts for the rest of us.

It really isn’t complex – spend new money on new things for the benefit of greater society. Generate actual growth and get some money pumping around the system.

ernielynchFull MemberPosted 1 year agoWhat’s the latest and best way to post an image on here?

There are two subjects which for me appear to be too complicated for my lazy mind to even attempt to understand, one is economics and the other is posting images on stw.

If you feel that you’ve cracked economics good luck with posting images.

dudeofdoomFull MemberPosted 1 year agoTBH if you’ve cracked economics you’ll be posting from your super yacht with someone doing the image posting 🙂

dudeofdoomFull MemberPosted 1 year agoI was always in awe of the money people I’d read about in ‘liars poker’ as a kid then got a revised edition years later that showed that they were just insider trading and effectively con artists.

Just because big amounts of money was flying around didn’t mean they weren’t winging it.

PoopscoopFull MemberPosted 1 year agoAssuming your pics are on Google, use this site to post them on here. Free and no need to sign up.

Or use Postimage web site for any pic on your PC/ mobile on Google or not.

roneFull MemberPosted 1 year agoI was always in awe of the money people I’d read about in ‘liars poker’ as a kid then got a revised edition years later that showed that they were just insider trading and effectively con artists.

Like nearly everything in the economic universe – it’s back to front – the state creates the money they manipulate to farm off for themselves – rather than them generating money for our exchequer.

I mean – I say this a lot (sorry Kelvin) – but they didn’t bail themselves out did they in 2008?

roneFull MemberPosted 1 year agoAssuming your pics are on Google, use this site to post them on here. Free and no need to sign up.

Ah great thanks – google didn’t used to work so that’s handy.

roneFull MemberPosted 1 year agoI had my man do it, now he’s finished the pool cleaning.

tell your man to plot gold against the dollar for a medium time period!

kelvinFull MemberPosted 1 year agoIf only there was a way to compare sterling to other currencies, not just usd.

ernielynchFull MemberPosted 1 year agoPaul Krugman has a skill which imo is vital to all economists, which is to not simply be able to understand their subject but to be also able to explain it to a non-economist so that they too can understand.

It is surprising how many economists lack this skill which frankly means that they are shite economists – ultimately it is the job of an economist to explain their theories to those who aren’t experts and pay for their expertise.

In the article below Krugman explains how trussonomics won’t work. The graphics are missing but the fuller article is behind a paywall, and they refer to the Reagan-Clinton era anyway which is less interesting than his comments concerning Liz Truss.

inthebordersFree MemberPosted 1 year agoFrom the ‘Zombie’ article, this is key:

As Martin Wolf of The Financial Times points out, since Margaret Thatcher, Britain has been relatively deregulated and low tax compared with its European neighbors. Its relative economic position hasn’t changed much at all.

jonnyboiFull MemberPosted 1 year agoI appreciate that it has now been retracted, but the basic premise for eliminating the 45% tax rate, in that it disincentives high earners from working in the UK, was never seriously challenged (or was it and I missed it, duh).

Looking at the EU zone, who was he attempting to undercut, the great financial powerhouses of Estonia?

Finland – 56.95%

Denmark – 55.90%

Austria – 55.00%

Sweden – 52.90%

Belgium – 50.00%

Slovenia – 50.00%

Netherlands – 49.50%

Ireland – 48.00%

Portugal – 48.00%

Spain – 47.00%

Luxembourg – 45.78%

France – 45.00%

Germany – 45.00%

Greece – 44.00%

Italy – 43.00%

Cyprus – 35.00%

Malta – 35.00%

Poland – 32.00%

Latvia – 31.00%

Croatia – 30.00%

Slovakia – 25.00%

Czech Republic – 23.00%

Estonia – 20.00%

Lithuania – 20.00%

Hungary – 15.00%

Romania – 10.00%

Bulgaria – 10.00%DT78Free MemberPosted 1 year agothis is an interesting read about the £

https://www.poundsterlinglive.com/gbp-live-today/17607-pound-sterling-record-lows-were-tables-turned-in-market-vs-pboc-punch-up/ampDT78Free MemberPosted 1 year agoCan’t see the article, however in my opinion whacking up interest rates is the foolish thing. Inflation is mostly to do with external factors that will not be impacted by rates. People still need to eat, heat, travel and pay existing debt down. There is minimal choice. Whacking rates up is going to push more and more families to the wall.

So… I think I’m with the government on cutting taxes, but not for those who are all ready comfortably insulated. For those at the sharp end, and increasingly those in the middle too.

martinhutchFull MemberPosted 1 year agohowever in my opinion whacking up interest rates is the foolish thing

While I agree that increasing interest rates doesn’t deal with consumer-driven inflationary pressures when people are shutting down discretionary spend already due to cost-of-living, if the £ continues to slide against other currencies, that almost immediately adds to supply-side inflation by making the stuff we have to buy from abroad – energy, food etc more expensive because we buy it in foreign currencies.

If there is too big a gap between our base rate and, say, the US federal reserve rate, then it makes the pound weaker and more vulnerable to the kind of shocks we saw last week, because sterling is already not an attractive option, and vulnerable to shorting.

Which is why our new Chancellor should have taken advice telling him to tread carefully in that environment. Instead of sacking the person who delivered it.

DT78Free MemberPosted 1 year agoDid you read the article I linked above? It says the reason for the pound sliding is not necessarily directly related to the chancellors mini budget

martinhutchFull MemberPosted 1 year agoWell, yes, there is long-term structural weakness in the £ and many other currencies, but no-one can claim that last week’s sudden movements were not in direct response to his announcements, and it’s hard to say what level the pound would have settled at relative to other currencies without the BofE emergency interventions.

Chancellor presumably was given advice about market conditions, and warned about existing volatility. Then went ahead and pulled the pin anyway.

finephillyFree MemberPosted 1 year agoRaising interest rates will curb inflation, due to reduced spending and more saving. What doesn’t work is having the Chancellor do the opposite e.g. tax cuts. This is inflationary and has forced the BofE to print money (due to the effect on pensions) thus undermining the whole ‘system’ You need government policy and BofE action to be complimentary. Really, Kwasi and Andrew Bailey need to collude on this.

It’s not as if the tax cuts are helping our energy or food security / availability, either. Ironically, the 45% tax rate may actually reduce the tax revenue generated (although we will never know). But I get that it was the wrong ‘message’.

Like I said, i’m keen to see the supply-side reforms. Something like loosening of labour regulations for temporary workers would help on the food availability front.

inthebordersFree MemberPosted 1 year agoAnd the ‘income tax rate’ is a total red herring, here and elsewhere – always has been.

I remember years ago working with a German and a Dane, the German was complaining that nursery fees had gone up because he’d moved from Dusseldorf to Hamburg – from 10DM per week to 50DM per week (basically £3.50 to £16).

The Dane was horrified that anyone paid nursery fees – and then I told them that we paid nearly £75 per week…

Thing is, the Dane’s income tax rate was by far the highest, then the Germans and the mine – But, the overall tax take was lower for both of them. They also got considerable tax reductions for kids, mortgages etc.

And not just income tax, there’s VAT, car tax, fuel duty, National Insurance and for the current generation student loans. Chatting with our middle lad the other week and he works with a guy who went to Uni – both earn the same but our lad is far better off as he’s no Student Loan been deducted.

All tax IMO.

tomhowardFull MemberPosted 1 year agoSo it was the Queen dying that was behind this mini budget being quite so shit.

In fairness, if I’d had enough coke to have me giggling at a funeral, I’d probably not be doing my best work either.

BazzFull MemberPosted 1 year agoQuick question if anyone dares to attempt to answer it, during those car crash radio interviews that Truss gave she repeatedly claimed that their plan to cap the energy costs would by itself reduce inflation to 5%, now i’m not knowledgeable enough to know if that’s true or not, and I certainly wouldn’t take her word at face value, is that at all likely? As far as I can see no one has mentioned it on here and I haven’t seen any mention of it in the press either.

ernielynchFull MemberPosted 1 year agoYes rising domestic energy prices is currently the main driver of inflation, so freezing prices will affect inflation.

Edit: Sorry I have just realised that you were specifically asking whether it will reduce inflation by 5%, I don’t know, but the effect will be significant.

BazzFull MemberPosted 1 year agoThanks @ernielynch I suppose the bit that confused me is that the energy companies themselves aren’t reducing the prices, the government is just paying (by borrowing) anything to them over the cap (I think that’s right) so presumably that just moves the problem to a different pile.

ernielynchFull MemberPosted 1 year agopresumably that just moves the problem to a different pile.

Yes but the definition of inflation which the Bank of England uses refers to the Consumer Price Index.

So it is the cost to the consumer that it is the issue here.

Edit: To be fair the energy price increases aren’t really inflation, otherwise the Bank of England increasing interest rates would have an effect on domestic energy prices, they can’t because with domestic energy prices inflation isn’t the problem. They just add to increases in the CPI.

Does that make sense?

finephillyFree MemberPosted 1 year agoCould’ve made the energy bill help means-tested, or based on Council Tax band. So give more to poorer households and less to richer ones. Might even cost less!

ernielynchFull MemberPosted 1 year agoIMO universal support is always much better than means testing. Firstly it makes it far simpler and cheaper to administrate. Secondly it removes the possibility of deserving people falling through the safety net and undeserving benefitting which always occurs with arbitrary cutoffs. Thirdly it doesn’t require everyone to be fully aware of their latest up-to-date entitlement to help and support. Fourthly it removes any perceived social stigma with applying for help and support. And finally any anomalies caused by unequal incomes and needs can easily be resolved through personal taxation.

It is for all those reasons that I believe that in a social democracy all welfare support should always be universal.

thisisnotaspoonFree MemberPosted 1 year agoCould’ve made the energy bill help means-tested, or based on Council Tax band. So give more to poorer households and less to richer ones. Might even cost less!

Or make it a flat rate per person, say £500 for everyone (so £2k for a family of four, making the anticipated £4.5k bills more like the £2.5k it will be).

It’s a far more ‘conservative’ approach too, less intervention, doesn’t affect the market, encourages people to spend their £500 on insulation where it will pay back more, etc.

ernielynchFull MemberPosted 1 year agoYes rising domestic energy prices is currently the main driver of inflation, so freezing prices will affect inflation.

You must be logged in to reply to this topic.