Subscribe now and choose from over 30 free gifts worth up to £49 - Plus get £25 to spend in our shop

Well, at least around here it appears so...

The house two doors down has just gone on the market for £110k more than we paid for ours in 2010. Same floor plan except they've converted the garage which we're doing later this year, taking upgrades into account that's around a 30% lift in four years 😯

I'd be sceptical if it wasn't for a friends experience, they live just down the road and sold their three bed last week. Went on the market at £475k, had over eleven viewings and sold ten days later for £480k. Here we go again...

Where have you been for the last 3 years?

Whoah 30%, I'd best go and arrange an unaffordable mortgage for the next 30 years.

Sub prime lending encouraged by those who don't believe it'll happen again 🙄

The real problems will occur when we start regarding the health of our economy by the housing market. Oh 😯

There was an interesting article on the bbc news website comparing our economy to others. I think it said unlike other countries 50pc of people's wealth is from property whereas it's 15pc or something elsewhere.

We just moved and between accepting an offer and moving our house went from being valued at £345k to £370k in 3 months and there was no shortage of buyers. We needed to move quickly to get the house we wanted but the new buyers I reckon are nearly £40k up from day one (not bitter 😉 )

It's a two tier society brewing as heaven knows how some people can ever afford these houses when leaving school etc.

It's almost as though Osborne's economic recovery, in anbsence of any meaningful long term reform, is based around a housing boom Required to last long enough to see them through to the next election before the shit hits again

All achieved by keeping interest rates uber low, a huge taxpayer underwritten lending plan (the 20% value already eclipsed by the bubble it helped create) and a huge effort to maintain wealthy foreign investors of questionable integrity to keep pumping up the London housing bubble/crisis

You've got to hand it to George. He's clearly put a lot of thought into this economic 'recovery'.

He's looked at the last global financial meltdown, studied the conditions that led to it, then asked 'how could we perfectly recreate it, yet somehow make it worse this time? Is there a way? It wasn't quite the perfect storm last time around.

By jingo, I've got it!!! We'll lower interest rates to the lowest ever level, then we'll inject billions and billions and billions of pounds of taxpayers money into the resulting credit-fuelled bubble! Its genius! So when it inevitably goes tits up this time, the taxpayer is on the hook directly for the sqillions of pounds of losses as the entire market implodes! Which will be approximately 2.3 milliseconds after the next election, when the Bank of England whacks the interest rates up, and everyone who's paid absolutely stupendous amounts for their massively overvalued properties defaults on their mortgages! And due to the inherent weakness of the real economy, which we've studiously ignored for 5 years, theres no money left for any bailouts this time, so we really are utterly and completely ****ed!!!

It'd actually be laughable, if the forthcoming financial armageddon, which is most definitely already in the post, wasn't going to be so utterly catastrophic for all of us! Oh…. except for George and his rich chums of course. Who somehow always come out of the apocalypse their monumental stupidity and limitless greed cause, smelling of roses

I despair!

The whole help to buy thing is designed to stoke a housing bubble which should peak just before the next general election.

Our friends offered £485000 on a £495000 property it went for £550000.

Yep, it is madness around here too. Houses selling for over the asking price within days of going on the market

What a mess. We aren't entirely alone in having a housing bubble - Canada (thanks to Mark Carney) and Australia also have theirs.

The politicos are certainly behind it all, but we'd expect no less of them. The major problem is central banks, which conspire with the politicians to engineer asset bubbles.

As said above it cannot end well.

Listening to tthe news this morning .

Folks are up in arms about the more stringent and invasive checks for mortgage affordability ....."

Personally its not before time.....

Part of the problem at least is how the Labour government's handled the global credit crunch. In the recession of the nineties, when there was a Tory government, home repossession went through the roof, so to speak, and the construction industry experienced the greatest turnaround from profit to loss in British history.

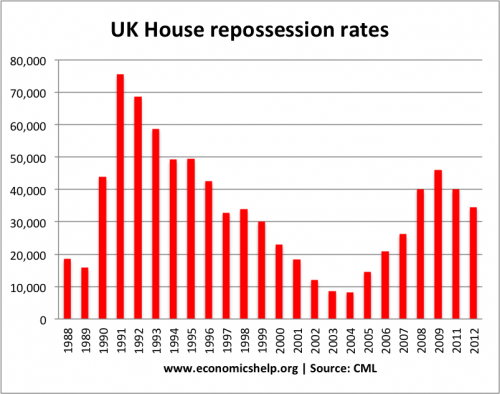

In contrast during the last recession, despite it being far more severe, more severe than anything for over 70 years in fact, there were significantly less repossessions due the policies of the last Labour government. See the graph below.

People are less nervous about repossession and negative equity due to how Labour cushioned the effects of the global credit crunch.

Yes I blame the last Labour government for not allowing the market's revenge....that would've learnt them!

Thing is ernie - it will come ..... They are just delaying it .

Im just working hard just now to try and prevent it being my gaff they reposess

So you're working hard ? That's what the last Labour government did - pumped money into the public sector to keep people working, in both the private and public sector, so that they could carry on paying their mortgages.

Gotta have somewhe to live man , when i say working hard i mean working hard to make overpayments to get it down.

We've either got a capitalist system, or we haven't. The half-way house we have at the moment is insanity. The worst of all possible worlds.

The sub-prime madness is being reproduced, but this time the ludicrous risk-taking for personal gain at the top, is now being done by people and organisations who are safe and secure in the knowledge that they are being effectively underwritten by the taxpayer. There have been no consequences for their previous actions at all. Nothing! In a truly capitalist system, the repercussions of their behaviour would have been personally catastrophic! As they were to large chunks of the population. But like Ernie said, they were effectively insulated from the fallout by the rest of us, who enjoyed no such luxury

I'm just waiting for the phrase 'too big to fail' to start being bandied around again. It will be, once again, after the financial meltdown, not before. When the utter folly of leaving the economy (and especially the banks) unreformed, all comes home to roost

Its like Groundhog day. Depressing 😥

It was just a soft landing until the daft Help to Buy scheme, which has really put a rocket under the whole thing again. Completely daft policy, unless you have an election coming up and need to win at all costs.

God help whoever wins though!

If its not in London/Greater London then let the idiots overstretch themselves.

Que News interviews with people who then blame 'the banks' rather than them using their common sense.

I can afford a 4k road bike on credit. Guess what I'm only buying a 1k one. Same with the house market, why do people want 'the best that they can get'?

This whole thing smacks of [url= http://www.investopedia.com/terms/d/deadcatbounce.asp ]'Dead Cat Bounce'[/url]

Prices are not rising everywhere, only the affluent areas, and the huge price rises in London skew the national % statistics hugely.

Still there is a shortage of homes, easy (sub prime) lending is back in the form of the governments guarantee scheme and interest rates are still at a record all time low. The media are also jumping on the band wagon again to irresponsibly fuel the fire.

The real problem round our way is the lack of 2-3 bed family starter homes. Builders are either building flats - designed to be snapped up by BTL investers, or it's 4 bedroom plus luxury homes with more bathrooms than bedrooms, for people with a lot of money (or the ability to borrow a lot of money). Nothing at all in the middle ground which kind of says something about how massively distorted the market is at the moment.

Hora , i know folk who have just done that - same earnings as me and the mrs , sold their old house bought at the same time as us for a 10k profit and were chuffed with that ( just about paid for moving fees that will have - not inc all the fees from first time round) and have bought a new build for just under 400k. About 3 times what their first house was worth.

I worked out the mortgage monthly to be more than my take home basic.

Their reasoning - well prices are only going to go up so if we cant afford it we will sell

I didnt even argue , theres no arguing with that reasoning. MENTALISTS

The real problem round our way is the lack of 2-3 bed family starter homes. Builders are either building flats - designed to be snapped up by BTL investers

In Manchester there are huge amounts of flats still being built.

In 10-20yrs time many will be empty/desolate and/or being knocked down.

By jingo, I've got it!!! We'll lower interest rates to the lowest ever level

Wait - George did that? I thought it was the BoE?

By jingo, I've got it!!! We'll lower interest rates to the lowest ever level

Wait - George did that? I thought it was the BoE?

Molls - the idea that the B of E is an independent organisation, rather than a tool of the treasury, has always been pretty laughable. But the appointment of Mark Carney really did put paid to any pretence at all to that.

Interest rates need to rise to try and put the brakes on this runaway bubble. Do you think they will? Before the next election? Not a chance!!! Yet a truly independent central bank, freed from political interference, would be doing exactly that! In fact, they'd have done it long ago!

As someone trying to buy a (first) house just now these topics are depressing reading...

Though I'm hoping the stringent mortgage rules come in fast, I want more people struggling to borrow, as I'm not planning on stretching myself so a bit less competition would be nice.

Though i do then wonder if buying before a crash is a good idea... (though round here - brizzle - prices didn't seem to actually dip, just sales slowed down. Prices currently at or above the previous highs...)

OTOH, at a 5 year fix of say 3% (or a little over), if prices for a 3 bed round here drop from say 250 to 200 in a crash but then interest rates climb to 6%... over 5 years the extra interest paid on 6% would make that not a huge difference in real terms.

However, that's just all made up numbers plucked out the air if you go into "what ifs" so a bit pointless...I'll be sticking with my strategy of buying something I can afford, that I can still afford if rates jump to say 10%.

Of course I could not buy, and keep on renting, but then in 5 years I fritter away another 50k+ on renting...so I'm "loosing" that anyway...

Thoughts on if I'm mad or not to be looking to buy welcomed...

I can't see rates going up much, they should go up now to slow the bubble, but that's political suicide, so instead they'll let the bubble burst of it's own accord and then we'll need low rates again to encourage growth.....

why do people want 'the best that they can get'

Because if you are going to be in debt for a large portion of your life you may as well push a bit harder - yes it might be tougher in the first 5 or so years but after that the difference will equalise more and you will end up with more equity for when you want to downsize and pay for your retirement I guess. And making a small move means similar sunk costs for relatively little in the way of improvement in living environment.

It's the obsession with housing in the UK that gets me. Partly it's the media to blame for this with endless trash TV convincing everyone they can make money through property.

Very strange considering we have in the UK some of the lowest quality, badly designed and old fashioned housing in Europe. Yet people in the UK seem to value tiny windows, fake wooden beams and chintzy period features over natural light, open plan living space and sustainability?

Beggars belief!

It's no wonder everyone's skint and up to their eyes in debt.

I remember when I was a kid, a top notch mortgage was 3.5 times your salary. Assuming an average current-day salary of £25k, which is a figure I've pulled out of my arse but doesn't sound wildly unreasonable, that gives us a figure of £87.5k.

Around where I live, I can get something that's one of a) an nice house, b) a reasonable size, or c) in a decent area, for around the 150 mark. So for somewhere I'd actually want to live I'd have to spend that 87k twice over.

And you lot are talking about 400k properties. That's well over ten times my salary.

So, aged 42, I'm stuck in a shitty East Lancashire terrace in an area full of people I've little in common with. It's fully paid for, but needs a considerable amount of work doing to it, and is worth something like £50k. I can't even begin to comprehend how I'm going to ever live somewhere nice.

How do you do it? How do people afford to live in these places? Did you all just have the foresight to buy property in the 80s when they were giving houses away with Green Shield stamps?

How is this sustainable?

It strikes me, like so many other people that the London and SE market is going through another period of madness whereby house price hysteria hits and people buy at almost any price. However it's supply and demand. There are undoubtedly people with money to buy (borrow large amounts) in this area and still huge numbers of foreign investors. However the numbers of new houses being built is absolutely minimal. When was the last time you saw anything other than the odd "fill in" development in London and the SE. Now I have friends and family in the SE, who bought houses they could never now afford and are massively asset rich compared the majority of the UK.0

Last week I was in the NE of England. The village where I was staying you could buy a reasonable terraced house for £45k and there were big new developments going up and more seemed to be planned. The housing price "boom" was non existent in the NE.

This was a striking example of the different markets for housing in the UK. However there doesn't seem to be any possibility of any change.

Right, but they'll _lend_ you 3.5 times your salary, you'd have a deposit on top of that.

I'm looking to buy my first house in my 30s...I've been saving a while...

Because if you are going to be in debt for a large portion of your life you may as well push a bit harder - yes it might be tougher in the first 5 or so years but after that the difference will equalise more and you will end up with more equity for when you want to downsize and pay for your retirement I guess

That was our attitude. Could've got something smaller/cheaper, but **** it, we can afford the repayments and maintain a comfortable standard of living. If the interest rates skyrocket it'll be a pinch, but it's doable.

The thing we found (as first time buyers with a 5% deposit) was that there was no meaningful change in the rates until you hit 10% deposit, so actually the repayments on a £200k house (vs a £250k as we ended up with) were very similar, factor in wanting to move sooner because we'd outgrown the house or whatever (coupled with the fact money's for spending and we wanted a nice house in a nice place) and it made no real difference. We weren't going to get something for £130k, and if we'd waited to save an extra £10k the market would've moved on so much anyway that we'd still be priced out.

How is this sustainable?

That's what I was thinking 6-7 years ago, that's what I still think, but somehow, despite the biggest recession in living memory, it would appear to be otherwise?

75% of our MPs are btl mortgage holders - they invented a whole new class of fraud by flipping houses to screw over the taxpayer

These muppets will never break the cycle

I kind of think that Gideon didn't plan to go for the bubble recovery

but when after a couple of years it became apparent that Tory dogma of slash public spending and tax breaks for the wealthy didn't actually do shit to help the economy it was back to the same old- et voila here comes help to buy

so what happens to those of us who ~10 years ago got reasonable mortgages (that we could afford) if the market goes pop?

I assume I'm sorted for a roof over my head but I'm ****ed if I want to move to bigger house/nicer area. Even with the equity in my house pretty sure I'd need to sign up to a hefty new mortgage - something I'm obviously reticent to do.

so what happens to those of us who ~10 years ago got reasonable mortgages (that we could afford) if the market goes pop?

Depends how badly it pops. Given that you're 14 years in, I guess you're unlikely to end up in negative equity so if your house's value drops, the 'bigger house/nice area' prices should drop too and the absolute difference (assuming that the % difference in value will remain roughly the same) in price will be less. So that's sort of good news... though maybe less good if you're relying on the value of your house as part of your retirement income (eg downsizing).

2 years ago we tried to sell our place (3 bed victorian terrace in a nice small town, commuter distance from London). Despite dropping the price a couple of times no bugger wanted it.

Fast forward 2 years and we tried again. Had an open weekend with 25+ viewing. Then had 7 offers above asking price on Monday morning. Come Tuesday all of those offers were increased.

We've accepted an offer 35k above asking price - and 100k above the price we dropped to 2 years ago.

Bloody ludicrous.

Interest rates need to rise to try and put the brakes on this runaway bubble.

If that happened, how many people would default on their mortgages?

Cougar - im talking about a 400 k house but i dont think its a good idea. Its over double my houses value(its double the bedrooms but only 20sqm bigger in size)

How ever its 5% deposit + help to buy to get a deposit together.

I already followed ngees idea of stetching to buying a decent sized house on a decent size plot to save me moving for a long time. 400k would make me so mortgage poor it would be silly.

At 42 and with 10 years of savings and help from my parents and well above average salary and I can't afford to buy in London except in undesireable areas and even then it's something small - unless, of course, I borrow to uncomfortable levels.

Every serious commentator says London/SE is in a bubble. Only the naive first time buyers, sellers and estate agents are quiet on this...

It's so clearly cynical electioneering... and the Tories are supposed to be the party who are strong on managing the economy. It suggests things are in a far more delicate state than we're being led to believe... they wouldn't need to do it otherwise...

When you compare salaries to prices I can't see from where the first time buyers are getting their money which means the demand has to dry up at some point.

The housing market is not a functioning market, it's herd behaviour and sentiment - which can go down as fast as it goes up. The economy is not is as good a state as the headlines suggest - our national debt has increased again.

I'm tired of estate agents playing games, telling outright lies and pretty much refusing to show me properties of any quality so for now, I've decided to keep saving until after the election when Gideon will hopefully stop playing games (I wish) and interest rates rise. Hopefully more and more first time buyers are coming to this conclusion, which will put a brake on the hysteria.

Hopefully then I'll not be in such a weak position as buyers currently are and will have a fair chance of buying something decent at an affordable price.

The greed on show from sellers is astonishing. We blame media, estate agents, Gideon etc but, no-one's forcing you to go for maximum price and rip off someone less advantaged than you who's dead scared they'll never be able to afford a bit of security to raise a family if they don't dance to your tune...

The greed on show from sellers is astonishing.

100% agree, not right, but then when their agent is telling them they can sell for £££ then can you blame them?

One of the fun parts is that at the same time as setting up a cheap-credit-based housing boom, with the obvious dangers of inflation shooting up, we've also seemingly accepted below-inflation payrises as being normal. "You should be glad you got that!" So mortgages go up, prices go up, salaries effectively get cut.

Whilst I do very much sympathise with you Brooess historically prices don't particularly crash in the SE and London. I've heard people making similar statements as yours - I'm waiting until the crash- in the 90's, 00's and now in the present and have house prices ever gone down as opposed to plateauing? No. We've just been through the worst recession for centuries and what effect did it have on SE property prices, almost nothing.

This sudden buying frenzy is partly being fuelled by the new pension rules, even if punters are 10 years away from pension age they know they can get their hands on a large wodge of cash and getting a mortgage in the meantime to buy an investment property.

I made a few enquiries out of curiosity and was offered 50% loan to value on existing property, interest free, i can see that being too tempting for some people.

I'm two days into paying back my mortgage and by Tuesday I'll no longer have to pay for a place to live.

The gaff is currently worth three times what I paid for it. Problem is, so's everywhere else.

How do you do it? How do people afford to live in these places? Did you all just have the foresight to buy property in the 80s when they were giving houses away with Green Shield stamps?

Low interest rates and buying & selling 3 times. Threw all our money at the house, drive 10 year old cars, no foreign holidays etc. House is now worth probably 8-10 times my take home depending on which estate agent you believe and where you market it (commutable to several urban centers in under an hour which seems to be the benchmark these days).

It might sound like I was being canny or knew something but the truth is it was the only way I could live somewhere I wanted to live and own it - having been kicked out by a landlord at the start of the mid 90s bubble, wanted to be sure it was in our hands going forward.

I can afford my current home on 6% as I was on a fixed at that when I moved there. But it wasn't pleasant to do so, and still live any sort of a life.

Sadly there appears to be no end. A crash won't help, most people will suffer now. No idea how my children will buy somewhere. Maybe it''l return to a rental market with those already owning property getting richer and those who don't making them so.

No idea how my children will buy somewhere.

My kids buying houses might co-incide with my parents inheritance. Provided it's not all spent on care. My grandparents however lived in either council houses or a heavily mortgaged property so I got nothing.

Did you all just have the foresight to buy property in the 80s when they were giving houses away with Green Shield stamps?

Sums it up. Most folk in decent sized houses have been there a while now.

TBH I wish I'd gone for a massive (at the time) mortgage as soon as I left college in 99. I didn't, I rented, saved for a few years, ended up buying our first place in late 2009. Waste of time, got me nowhere, in fact, got me far less far than just overextending and waiting for few pay rises to catch up with the cost of a 110% mortgage from inventasalaryforselfcertifiedmortgages.com.

I reckon that the buying frenzy is also brought about by a lot of people having stayed put during recession because they couldn't sell for what they reckoned they should be able to get (or what they paid) but now with the recession 'over' that pent up demand to move has burst out and people are getting silly again.

We had six offers at or over asking price when we put our house on the market last June. We've finally found somewhere now (having not been willing to play the 'pay silly money over asking price to secure a house' game and got a good bit of extra money for our house without any question from our buyer to reflect what's happened to prices since June.

Stagnation rather than crash seems more likely to me at the moment given the amount of pent up demand that's still there and is likely to be for some time.

I'm not expecting a crash, just a cooling off of the hysteria and outright greed which puts me in a very weak negotiating position...

Although, the bubble has gone up so fast this time, it's clearly being manipulated rather than a properly functioning price rise based on demand.

Interestingly though, Land Registry data (for Bromley at least) shows prices not going up at anything like the headlines and estate agents' evaluations would have you think... maybe a few % but certainly not 10+.

. Yes, I can. You know full well you're screwing over some young couple who've stretched to pay a price way more than you paid. That's a conscious decision to enrich yourself at someone else's expense100% agree, not right, but then when their agent is telling them they can sell for £££ then can you blame them?

How do you do it? How do people afford to live in these places? Did you all just have the foresight to buy property in the 80s when they were giving houses away with Green Shield stamps?

Not me - like mrmonkfinger, I made the mistake of not buying straight out of uni when it was cheap.

Research has paid off for us - bought twice in places that were ok to live in but not really desirable at the time but seemed very likely to go up in value well over the norm over a few years. Did the places up without spending silly money and that seems to have worked well.

They need some hefty tax disincentives for people buying multiple properties and those buying from abroad. Then hopefully there will be less speculative investment (my parents are talking about cashing in pensions and buying a three bed investment property...) so the housing stock is there for people trying to buy their home. We want to sell but I'm really worried about interest rates and negative equity. Meanwhile all our friends are trading up to even bigger mortgages....

Am overpaying our (to us!) large mortgage while watching friends get caught up in the property 'race'. In the last 6 months I've seen 4 families we know move up to larger / more expensive houses with eye watering mortgages which are really squeezing them.

Round our way there has been a real flurry of housing market activity. With the current low interest rates you can't help but think a lot of people will be exposed when interest rates start to climb again.

I made a decision a while ago that our mortgage would never be bigger than it is today and am on track to get it payed off by the time I'm 45. This means falling behind 'The Jonses' today but hopefully a more comfortable life later. (Unless I get knocked down by an Antelope or something 🙂 )

There is an inevitable crisis brewing with housing. Governments of any persuasion will need to continue the policy of financial repression to erode UK debt. This will keep interest rates below their correct level (some free market?) for an very extended period. This will distort the housing market even more and problem exacerbated by specific gov support for housing.

If and when interest rates normalise, the pain will be severe except for those early birds who benefit from asset inflation.

. Yes, I can. You know full well you're screwing over some young couple who've stretched to pay a price way more than you paid. That's a conscious decision to enrich yourself at someone else's expense

I agree 100% with you, I think its morally wrong, however were I in the same situation then I'd probably need all the money I could lay my hands on for my place to buy the next over inflated place further up the ladder.

The pensions thing is crazy (puts down his Lamborghini catalogue to reply) but I agree that there have been a lot of people staying put in the SE for the last five years who now think know that they can get more money from their houses and so are looking to move. Of course unless you move outside the SE your next move costs you even more.

when I got my place it was a joint mortgage with my gf, we split a few years later I could still afford the payments on my own but the bank nearly didn't let me take it on, had to get a parent to be a guarantor. If we'd been a bit more ambitious I'd have been homeless after the split and reckon I'd have struggled to buy anywhere even half decent on my own.TBH I wish I'd gone for a massive (at the time) mortgage as soon as I left college in 99

Feel like maybe I've lost out a bit not moving up when my wages went up but I definitely made the right decision when stepping onto the market and the experience (and horror stories of potential double digit interest and negative equity) have made me cautious.

When we were looking to buy our first home in 1985 we viewed a three bed semi £17500, we went to the building society and they wouldn't lend us the money, they said we needed to look for a more expensive house. That house however fell through and we found something else for £25000, our joint income was £12000. A mid terrace in those days was about £11000.

The average wage in 85 was £9000.

^ 3.5x main income or thereabouts, I guess.

If only that'd been stuck to.

My kids buying houses might co-incide with my parents inheritance.

What inheritance 😥

Or without the self pity:

[img] https://encrypted-tbn1.gstatic.com/images?q=tbn:ANd9GcTF7UTl67PFQdYUxEyACc1iAvA6fZ7M0PtG_GbRZdhwTS4gVbfeeQ [/img]

Inheritance, you say ???

You're not wrong, houses in our street have risen by nearly £80k/25% in a year.

Another factor in all this rank stupidity is that the mortgage market is sucking any investment out of the real economy. All those billions that were pumped into the economy were meant to be to aid the development of real business. Unfashionable things like making stuff, providing services, etc

But instead of lending to business, the banks just took the money, saw that it was miles easier to just put it into mortgage lending, and fuel a nice little housing bubble instead. Again: safe in the knowledge that when it goes tits up - as it surely will - that it won't matter, because the same poor sods who'll get clobbered with repossessions, negative equity etc, will be the same ones who's taxes will be used to bail them out! Again!

That the government not only failed to put any guarantees in place to stop them doing this, but then actively encouraged them is absolutely criminal! Especially after all Gideons flannel about the 'March of the Makers' and re-balancing the economy. Once again the interests of the financial sector are being put at the top of the agenda, and **** everyone else!

Binners, the other silliness also means people have higher mortgage repayments or have to put more of a deposit down. That means lower consumer spending and pension saving.

So the additional tens of thousands I'm going to have to put down into a deposit because I didn't buy a year ago is just disappearing - into no-one's pocket anywhere. Instead of spending it on bikes, new car, home improvements, eating out, trips to the Lakes, saving it, investing it etc etc

It really is utterly moronic. Especially as even those people in silly expensive houses are no better off in any way at all, they just have an illusion that they're richer - it's 100% illiquid.

That house however fell through and we found something else for £25000, our joint income was £12000. A mid terrace in those days was about £11000.

The average wage in 85 was £9000.

That makes me sick!

Out of interest... what is 'crippled' by mortgage payments? Ours are c30% of our net income, which to me is high, but not ridiculous.

Yes, I can. You know full well you're screwing over some young couple who've stretched to pay a price way more than you paid. That's a conscious decision to enrich yourself at someone else's expense

Hmmm would have to be pretty altruistic to sell a house for less than what is obtainable. It's the gazumpers and gazunderers who are the real g!ts but we've had them defending themselves on here before.

25% here nick which considering rents round here for a 2 bed flat can easily be more than my mortgage - assuming you don't want to live in Northfield or mastrick,I consider that not bad.

Hmmm would have to be pretty altruistic to sell a house for less than what is obtainable. It's the gazumpers and gazunderers who are the real g!ts

+1 on that.

There was something on the beeb a few weeks ago - might have been the religious reflection bit on Evans' show - about a new block of flats in Chelski going for planning permission.

It was accepted, and the outcry among the locals was huge with lots of questions about parking - and the church goers were also asking how they would be able to park near the church on Sunday, etc etc.

The council replied that there would be no parking issues, as they expected none of the flats would be occupied.

I find this utterly fascinating!

25% here nick which considering rents round here for a 2 bed flat can easily be more than my mortgage - assuming you don't want to live in Northfield or mastrick,I consider that not bad.

That was the thing we were gutted with, rent wasn't all that much less (not when trying to save too) and you had absolutely nothing to show for it! Yeah ok we're basically paying interest unless we over pay, but at least we're getting something. Fairly sure we own a door knob or something by now!

Had our house valued this morning, asked the estate agent about potential value of adding an extension. (leaving aside other motivations she may have had) the answer was not to try to improve the value to keep it "affordable" for a young couple.

Proposed value was 60% more than we paid in 2006 - West London.

Happy and conflicted at the same time - obviously its just silly, but we want more space and if prices are going up, the price gap to a bigger house is only going to get worse, but proportion of your money do you want tied up in an asset that might devalue?

Not complaining - nice problem to have.

Points for Concern:

The media has many people convinced that their house is primarily an investment, and secondly a place to live.

Planning process is slow, antiquated and unfit for purpose - too much red tape, too many NIMBY's objecting to new housing anywhere near them.

Not enough investment in social housing.

Renting viewed as dead money and a second class option because they is no long term protection for tenants.

No restrictions on the amounts people can borrow to secure a mortgage, or the percentage deposit they have to save.

No real disincentive or prohibitive tax on second home ownership meaning that young people are being priced out of their own communities.

Out of touch politicians coming on telly to support hair brained scheme after hair brained scheme to prop up house prices (thinly veiled as a help to buy scheme for young families).

I could go on, but I've lost the will. It's no wonder prices are going through the roof. Our national housing situation is dire!

Renting viewed as dead money and a second class option because they is no long term protection for tenants.

Renting [b]is [/b]dead money... I know it's how large chunks of the world do it, but because we don't, the stock for renting is small, so they command a serious price (as I said, comparable to our mortgage payments, which will invariably come down when we can remortgage on a lower rate, plus the potential equity benefit) and leave you with nothing to show for it at the end, not to mention the constant risk of being shafted by a landlord.

We rented two places, both were abruptly sold from under us, luckily the second time we'd already bought somewhere, but could do without that stress. Not to mention the fact it's never really 'yours' to do as you want, although that obviously has its benefits too.

Not so sure about the "second class citizen" part.

As has been proved time and again, you can buy a house and it could be paid for in 25 years or so - so if you buy at 30, you own it at 55. Rent at 30 and you will still be paying rent until you die – which could be another 30+ years

And when you die, you have nothing left to pass on to someone else either (of course this isn't important to everyone, but it is to many).

Renting is dead money

Only in the same way that paying interest on a mortgage is. It's the fact that when you buy a property most people are heavily geared so the price increases we usually get result in significant wealth increases. When house prices do fall people can get wiped out pretty quickly.

Another approach is to invest in equities and you could end up with greater rises than an equivalent property owner - but no gearing here so safer but less of an upside.

[i]At 42 and with 10 years of savings and help from my parents and well above average salary and I can't afford to buy in London except in undesireable areas and even then it's something small - unless, of course, I borrow to uncomfortable levels. [/i]

I bought my first flat at 20. At the maximum of the earnings multiplier as it was then, paid £21k. Sold 6 months later for £30k. Went from there onward, upwards/sidewards. But, sometimes the mortgage cost was more than I earnt a month (went to 16% at one time, but for a long time it was +10%) - so it wasn't always the easy world people think.

Been mortgage free for the last few years.

[i]Renting is dead money[/i]

and so are interest payments.

It's not a housing bubble, it's a lending bubble. As ngee20 says people are less economically stressed by their mortgages than in many other periods.

Current green belt policy in inconsistent with a predicted rise in population (though population growth is almost impossible to predict IMO)

There has been excess demand for decades in many parts of the country with prices reflecting people's ability to borrow rather than any changes in demand which remains consistently above supply.

The lending bubble developed a leak in 2007 but the hole was taped over with monetary easing and low interest rates. The bubble is now safe until someone decides growth is strong enough to admit inflation is as high as it really is and do something about it. Something they may never do preferring to live with the ills of inflation. After all:

Inflation ills:

redistribution of wealth from poor to rich

no incentive to save

no incentive to invest (but only if interest rates are used to combat inflation)

Inflation benefits:

depreciation of borrowed capital, including government debt

while interest rates and salaries remain below inflation anyone who can raise the price of their goods or services at inflation will make more profit and invest.

I can't see Cameron doing anything about inflation, money supply, lending criteria or anything else that might burst the lending bubble just yet. A market has never gone far enough until it's gone to far.

Renting really is dead money, not only are you still paying rent well after you could have owned it, the rent will keep going up

I can't see Cameron doing anything about inflation, money supply, lending criteria or anything else that might burst the lending bubble just yet.

But whoever ends up winning the next election will have to do something about it pretty sharpish. I reckon you can put your (ridiculously over-valued) house on Carney raising interest rates about 3 seconds after the election result is announced. Then the real fun and games is going to start.

Look out for the stories in the outraged middle market tabloids - due to appear by about May next year, I reckon - about poor Jemima and Tim, with their 2 kids, who live in a nice London suburb, with a very good school close by, but due to the increase in their mortgage payments are having stop poppy's riding lessons, and are only weeks away from relying on food banks, who don't even provide organic vegetables from Waitrose.

Only in the same way that paying interest on a mortgage is. It's the fact that when you buy a property most people are heavily geared so the price increases we usually get result in significant wealth increases. When house prices do fall people can get wiped out pretty quickly.Another approach is to invest in equities and you could end up with greater rises than an equivalent property owner - but no gearing here so safer but less of an upside.

Yes house prices can fall, but so long as you are borrowing comfortable amounts, then you should be safe from having to sell - which is the only time you will lose money.

And if you rent instead of mortgage, how do you afford to invest in equities? Unless of course you can afford to do both, but then why don't you just mortgage and invest?