MegaSack DRAW - This year's winner is user - rgwb

We will be in touch

who’s guilty of it in here....

Nope, the exact opposite.

That’s refreshing to hear, the only debt we technically have is the mortgage... I have a lot of wants but try to hold back.

apple watch is currently a want...so far I’m holding back. It’s probably another piece of tech that nobody actually needs

I'm as tight as arseholes, the rest of the population however, it appears to be different.

Me.

It's not a case of 'ooh I have £10 let's buy this thing at £20'. More like, you make plans that should work, but then something goes wrong. More a case of insufficient pessimism. Then shit piles up and before you know it as frugal as you are you can only just manage, then the car breaks down or something.

Not really.

Edit: deleted due to accusations of humble bragging.

In short, no, we have a decent income and we’re tight.

this thread appears to be turning into a "I'm considerably richer than yaw" fest.

What I'm intrigued about is whether that's what OP wanted. I think he did....

It was inevitable...

i have one mtb..not 3 and carbon it ain’t

my car is a 10 year old Ibiza

i have an iPhone but it’s a 6s that’s on its arse

i have an iPad....it’s about 6 years old.

I live in a 3 bedroom end terrace with an apparent leaky roof.

No, it's a fools game. You can still have nice stuff* and live within your means.

*Yes I realise I'm lucky to be in this position and not everyone is.

Wandering around places like Meadowhall it’s absolutely crazy what people appear to be spending...oh and what have you bought posts on here...

No, it’s a fools game. You can still have nice stuff* and live within your means

Not for everyone.

Only last week on the news was stuff about people paying £500 for £250 washing machine via HP. Makes you think doesnt it, if our washing machine broke tomorrow we'd buy a new one the day after without having to think about it and I'm pretty sure most on here are considerably richer than me.

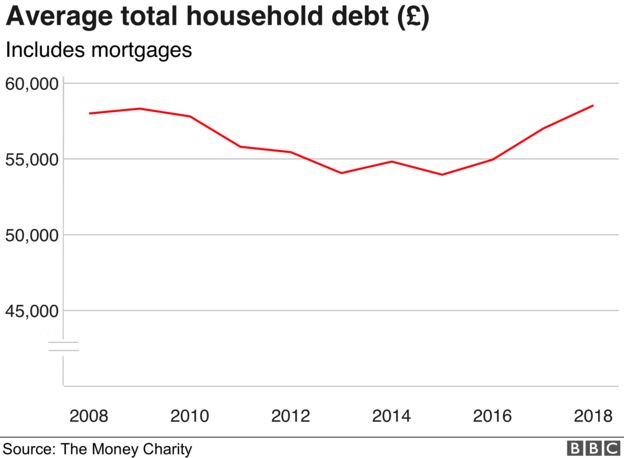

Assuming those figures are accurate, I'm amazed it hasn't changed much in 10 years.

Babies was always the thing that blew me away.

Saw so many young couples that didn’t have a lot of money struggling to buy stuff from “premier” rip-off places like Mamas and Papas because they wanted best for their baby.

Meanwhile we happily picked up pretty much everything second-hand for buttons from family, friends and jumble/NCT sales.

“Only a small poo stain on it. Call it 20 pence then.” 😂

Yes, or at least I will do once interest rates rise.

Student loans (check)

Ridiculous mortgage (check)

Credit Card (check)

Car Finance (check)

items 1 and 2 were an inevitable consequence of going to uni later in life, moving from the northwest to the south-west and not getting on the housing ladder until 2014. Items 3 and 4 were a consequence of 1 and 2 and the costs of childcare.

Got a chunk of mortgage to pay but no other loans.

I've got a heap of wants, most fizzle out but if they remain long enough I look into them.

Not rich, not poor.

Makes you think doesnt it

Yeah that side of it absolutely stinks.

It seems that once you genuinely can’t live within your means, the system conspires to make sure you stay that way.

@scotroutes it would be interesting to see that graph split by age groups, I guess the 50 somethings and 60 plus who got on the housing ladder before the massive uplifts in house prices are considerably lowering the overall, than the next generation decade and so on and so on..

That generation never had iPhones and cheap flights all over the world to contend with and more likely saved up than bought on credit, like the younger generations

Yep, kind off but it’s just about under control. The crash was not kind to me as over night my salary went down by 2/3 in 2008 (recruitment- and yes I should of saved money in the good times but I blew it on booze, coke and fast cars - there’s a George best quote struggling to get out there somewhere).

have just about hot and even keel after having living in credit cards for four years post crash. It’s taken a while and only just turned the corner this year, but thank god we have a stable economic future ahead of of us.

oh hang on a minute....

yup. in debt. lots of it.

I basically hemorrhage money. Ill happily give it away, the wife , thankfully, is the opposite.

Not any more, we did when Kid 2 turned up unexpectedly. It wasn’t nice seeing the credit card balance going up at the same time as being potless.

Still, we’re reducing debt by £400 a month and saving at nearly the same rate. We’re actually solvent for the first time in years -yay!

Currently, 1 modest PCP car covered by a car allowance, £2k on an interest free CC, a loan we took to help when baby came that ends in a few months and that’s about it. I’ve enjoyed clearing things off more the last year than I have buying stuff.

Opposite here also.

Without meaning to sound flippant, if I want something I will just buy it - no need to check the bank balance.

But...I will deliberate long and hard before buying - I still respect the value of money and the effort of earning it.

More or less at my means. Which is a shame because I think I need to be saving about 50% of my entire wages if I'm ever going to be able to afford both a house, and retirement.

This society is geared that way, like most western societies.

Sell credit, sell more credit, keep debtors in debt to enable a low wage economy and mental health plummets as a result.

Sell debt, create bad debt economy, sell credit to debtors at vastly inflated interest rates that are “just” bearable, and mental health plummets.

Create chance games that promote easy get out options, create unrealistic expectations, sell more gamble based products, and mental health and families suffer.

Thought you lot would understand how western civilisation works by now.

You know how it is. £5k a month and barely scraping by...

It seems that once you genuinely can’tlive within your means, the system conspires to make sure you stay that way

This is very true.

We have mortgage and a loan that's 1/3 the value of the cars it was taken out to buy.

We do struggle to stay out of the overdraft some months. But you try buying three teens shoes, uniforms and bits in August...

On the edge of my means, probably. It’s bloody hard to adjust going from a 2 salary household, to one salary, which is then cut by £20K! 4-5 years down the line and I still can’t get used to it. Not in debt though, so I suppose I’m managing. Just can’t afford winter holidays anymore! I guess if I was a living beyond type I’d book the hols anyway.

"I'm not tight, I'm saving up to be!"

I'm careful with money, after a an early start of being very flippant with not a lot, followed by 5 years of on and off unemployment, I now appreciate what I earn and how lucky I am.

As AA said up there ^^^^ there are a lot of people, the vast majority I'd say, that would be royaly screwed if the fridge or washing machine went bang, or the car broke down.

I am in an odd situation where whilst being in my mind profligate ie I buy what I want without caring about the price I am not spending all my modest salary each month ( 1900 ish take home). I can't quite get my head around it. all the rest of my life I have struggled to make ends meet but now have money left over. My wants are low tho so I guess thats it.

No debt and my (very low) living expenses can be covered multiple times over by my (decent) salary.

You know how it is. £5k a month and barely scraping by…

Not sure if a flippant comment or not. But not a million miles off myself gross, and while I wouldn’t use the the word ‘scraping’, I would say barely getting by described it well.

awaits the self righteous hordes who’ve never had to lean on debt to get you thougha tough situation and who accuseme me of being a debt monger, whilst knowing nothing of my life situation

yours, the squeezed middle class 😃

In the fortunate position of having cleared our mortgage (I am 47 so I’m happy with that!) and having enough income to live reasonably modestly without debt.

Both drive relatively old cars, and other than my new ebike, both our mountain bikes are 5+ years old (and were bought cheap as last years stock)

So we don’t live the high life, but we don’t shrimp (and crepe) to get by.

(Edited to elaborate on autocorrect errors 👍)

A shrimp getting by, yesterday

no.

kids both gone. mortgage gone. no credit cards.

but in your 50's this is the norm?

in my 20's 30's and 40's it was a very different tale.

We all know we should live within our means but some of the wealthiest people I know live pretty much entirely on some form of credit or other. I'm talking people with multiple properties, driving Bentleys, generous entertainers... they don't see living off credit as a millstone, they see it as a means to an end.

Me? I'm too conscientious and couldn't do it. I do wonder who's the fool sometimes but generally I'm happy with my lot.

but in your 50’s this is the norm?

The way house prices rose between when you bought, and when I (40's) and now 30 something year olds, mortgages won't be paid off in my 50's...

For many years I was severely in the red but that taught me to cut back, pay the debt and get back in the black.

once you have that mentality it’s easy to live within you means.

You know how it is. £5k a month and barely scraping by…

He’s made reference to a comment I made in the last Debt thread, and the one before that and the one before that and so on.

I simply stated that £5k nett isn’t a lot to live on if you reside in London, plenty of folks backed my statement up but typically the backlash was that I was belittling those that didn’t take home that much.

Hey ho 😜

Threads like this always go one way.

And to be honest I think that is indicative of the problem.

For whatever reason, our society tells us that talking about money is terribly crass and boorish, especially if you mention actual figures (gasp) and unfortunately that gets in the way of perfectly sensible conversations about it.

For many years I was severely in the red but that taught me to cut back, pay the debt and get back in the black.

once you have that mentality it’s easy to live within you means.

+1 This for me.

I think its impossible these days for people in their 20-30's not to have to live with some debt bar the Bank of Parents stepping in.

No bikebouy - the point you completely seem unable to understand is that much money makes you amongst the richest in our country. You are not scraping by. You are simply overspending. Scraping by is living on the minimum wage. Scraping by is having to decide between feeding your kids and heating your home. Scraping by is being unable to afford new shoes for your kids, scraping by is having to go to food banks.

You on the other hand have an income that is in the highest few % of the country. £5000 a month take home is what - the best part of £100 000 gros PA? almost 4 times the average wage?

Enjoy your riches but don't bleat you are barely scraping by.

I've got a pre-order on a wodge of Mrs. T £50 notes that I'm going to stuff the bed with. Being plastic they're not so good for the coke.

I just paid off all my debt last week, first time i've not had a loan, cc balance or overdraft in about 20 years. Always fairly low and manageable mind but it's a nice feeling having only a few bills to worry about.

So doing ok, heehaw debt, a wee bit of money behind me, and my monthly out goings are basically pocket change to most stw-alites!

Mind you I don't actually have a job at the moment either, trying the whole self employed thing, which has had an ok of a start, what I'm doing will dip like silly for the next 2/3 months mind, so things can change fairly quickly. I should know by the summer if it's working and if I need to go and work for some bam again! 😆

He’s made reference to a comment I made in the last Debt thread, and the one before that and the one before that and so on.

I simply stated that £5k nett isn’t a lot to live on if you reside in London, plenty of folks backed my statement up but typically the backlash was that I was belittling those that didn’t take home that much.

Ah, fair enough. I can identify. It Take Home £4K gross every month in Sheffield (if London is anything like it was when I lived there in the naughties, I’m assuming an equivalent at worst). No kids or dependents, but c £450 debt servicing every month as a resultant if the 2008 recession (for another year and then debt free), live in a modest terrace house in hillsborough (and not even the “good” bit), but still don’t have anything to save. But that’s the life of being a single person - the economy is set up for being in a couple and you pay s heavy ‘single person tax’ which robs most of my disposable that the debt servicing doesn’t take.

however, I am far more fortunate than most and have a way of working myself out if my current situation and moving forward, but still sucks when you earn £45k a year, don’t livd beyond your means (these days), but at the age of 45 still live not markabley better than I did than when I was in my early 30’s(minus the coke, fast cars and bigger houses in posh areas!)

I’ve always earned a decent wage, but always been surprised by those I know on less with flashy cars and big houses. I guess debt has always been the answer to some.

I was bought up in a very happy but relatively poor household (Dad had polio as a kid so missed education - worked in factories until Ill health early retirement) so have always been tight on my own big purchases.

That GrahamS is like the wise old man (could be in his 20s for all I know) of this thread.

4K a month, single and complaining about single tax when you still take home a lot more than the average household income in the UK.

Some people need a reality check.

Yep. My ingoings and outgoings are roughly equal, but I'm perpetually a little way into the overdraft. I am however, a student in one of the more expensive bits of the UK, and have an expensive bike racing habit to keep up. I go through a yearly cycle of getting a little more money in over the summer, before going back to #debtlife for term time.

4K a month, single and complaining about single tax when you still take home a lot more than the average household income in the UK.

Some people need a reality check.

There we go, the people I was taking about that know nothing about my financial situation have appeared to be all judgey

if you read my post I fully acknowledge that I’m in a far more fortunate position Than most and I’m thankful for that. And I’m also aware that much of my situation is due to not making hay while the shined when times where good and we thought it would go on for years. but I’m still only one pay check away from things getting very difficult and losing the house.Of course if I don’t have the semi crippling debt that I currently have (although not for too much longer - brexit dependant) I would be pretty comfortable. But my point being, is that it’s semi ridiculous that someone who earns well and works hard for a living is not a million miles off not making ends meet.

Now I’m not saying woe is me, of course my debt is my debt and it’s my responsibility to repay it and I should of been more prudent in good times, what I am saying is s lot of people who you wouldn’t consider fiscally challenged just by looking at their salary alone are still finding it very difficult 10 years after the crash and are shitting themselves about the economic precipice we currrntly find ourselves on.

A decent income is good, but when you have s big outgoing it’s faitly meaningless. But again, i’m in The very lucky “things are tight” category rather than the “things are desperate - do I pay the bills or support is he kids whilst trying to have a meaningful life” category

but thank you got your judgement

semi ridiculous that someone who earns well and works hard for a living is not a million miles off not making ends meet.

stop spending so much then, it's not difficult.

stop spending so much then, it’s not difficult.

Player two had entered the game. And good to see @rene59 has a playfriend.

again good that you can judge what I spend with no information and make a decision that I’m profligate off the back of it.

Would it make you feel better if I said my income was low but my out goings were too? If so, how is that different to me saying my income is materially above the national average, but then again my outgoings are too - the vast majority of which are fixed costs which I can’t alter, the biggest of which (debt servicing & mortgage) are a leverage ratio of when my income was far higher (current income taking a significant step towards it - and it’s taken me 10 years to get back to this level - but lived many years earning half of what I do now when previously I’d earn another 50% on top of where is am now)

How is that different?

but again judge away

I'm not judging, just saying stop greeting, it's a choice. If outgoings are high and earnings are high and you are supposedly struggling, well... downsize, you don't have to keep up with the jones'. That is a choice everyone has above certain levels. It's simple arithmetic.

But you try buying three teens shoes, uniforms and bits in August…

Should have had fewer kids, or at least sent them out on the rob, eh Fagin?

I’m in the just getting by group. 42, Earn 32k, have two young kids, mortgage and 3k on a credit card. Funk Jr was ill when he was born which meant taking time off work, hence the credit card debt. Mrs F is a stay at home mum, so just the one income.

If I lost my job tomorrow it wouldn’t be good news. I’ll be paying the mortgage on our old, leaky two bed semi from beyond the grave.

We have an old Zafira and luckily my FIL is a semiretired mechanic. One bike, company phone and a Deezer account and gym membership are my only frivolous monthly spends. I feel guilty for having them, but music and working out keep me relatively sane. Still, I’m much better off than a hell of a lot of people.

but lived many years earning half of what I do now

I've lived my whole life on that, never felt poor.

Thought you lot would understand how western civilisation works by now.

I think they may be in their middle class bubble so probably not.

I prefer the term "Just scraping by"......Apparently the missus expects more ambition...expect another "divorce" thread soon.

I look back sometimes at the things we have purchased and think wtf, then realise that's where the money went.

I could have gone chasing the £££ work wise and still could now but would probably mean lodging away etc, as it is I've seen every milestone for the kids, sports days, nativity plays, parents evenings etc, so that has meant more to me than money.

We've got luckily zero unsecured debt, mortgage is 80k on a 230k house but we still work on the basis of if we haven't got the money we can't have it.

However this remortgage was the first without a little "extra borrowing" and we're looking to hammer and over pay the capital this time with our savings and mrsws' extra earnings if she gets any each month.

What does OP mean by living beyond means?

Is that having CCJ’s, declared bankrupt, debt collectors on the door?

Having loans etc is making good use of finance.

What Ton says, been overpaying what you lot darn sarf would consider a small mortgage for a few years now, in 3 years time at 46 it'll be paid off, and we'll be a grand a month better off.

No credit card debt, relatively small savings, though freeing up mortgage cash will help that.

It's a happy medium, too many people I know have worked like donkeys, looking forward to retirement and a healthy pension, only to fall over not long after said retirement. My dad included, retired with a full FS ICI pension at 50, gone at 52.

I mean by having things you cannot afford.

im a married father of two young children, who is lucky to have parents that have been very generous to me. We’ve been able to do things we deffo couldnt afford, such as buying a new car. Had we not had this we’d be in serious debt.

We just see a lot of folk whom seem to have all the latest and greatest everywhere we go.

I am also the current sole earner and my salary is just under 25k per annum.

Apologies for the briefness, I don’t particularly enjoy typing on the phone.

What does OP mean by living beyond means?

I would guess it means buying things you can't afford. For example you have no spare money but take out a loan for a new £4k bike (even though you already have 3 bikes in the garage).

I don't think I have ever lived beyond my means but I do use up all the money I get. Why wouldn't I?

No. Im the tightest person I know with a small house, old van & generally scruffy appearance. I never made the lifestyle choice to get married or have children as they seem a moneypit.

Earn far more than I need to get by & overpay my pension to remain in the 20% tax bracket. Looking forward to early retirement.

I get huge satisfaction knowing the government arent stealing more of my money that is absolutely necessary.

I used to be careless with money and that led to an awful lot of stress.

6 weeks of unemployment in 2009 was the wake up call and I basically stopped spending, I didn'y buy as much as a magazine for four years and I paid student loans, car etc off early and stopped silly spending.

I'm a bit too far the other way now. Pretty much a tight arse but in the black.

Used to be terrible with money always on the overdraft and credit card buying things I didn’t need. Loans for expensive cars. No savings. Got made redundant during the last recession and the act of being jobless and penniless was a real kick up the ar53. Managed to get a good job a few years down the line after doing a bit of freelance work and cleared my unsecured debts. Now my outgoings (mortgage food bills ) are half what I earn. Car is 12 yrs old and paid for. Only debt being the mortgage. I buy my bikes off eBay and when I have a bit of spare cash it goes in savings or the watch fund.

I live within my means and always have. I think it's down to my parents attitude to money and debt. When I was on minimum wage, young and single I lived extremely cheaply as a lodger in someone's house, thought carefully about every penny I spent, would only have one or two drinks if out at the pub, chose value range food shopping but would get treated by my parents to a holiday or meals out sometimes and a nice birthday present so I felt very privileged and they paid for my uni education so I was lucky not to be saddled with debt when starting out in life.

I did take on a small amount of debt when starting my business and over the years as my income has risen so has my spending though I had to actually consciously tell my self to stop watching every penny and enjoy my earnings once I was better off. Having had a partner with a very good job and no kids for several years now things are much more affordable and I don't really want for anything but we're still sensible as hoping to go part time in a few years.

Mortgage 94k left.

Car loan off in laws £7k left.

Personal loan for kitchen. £3k left

Two incomes in our house. Both earn an average UK wage income Large wedge is spent on childcare.

Never have spare money after we save £250 a month because I do stupid things like buy 4k TVs, run three cars, three mobile contracts etc. Foolish stuff. But we do save £250 a month so it ain't bad.

Pre kids we used to have brand new cars on PCP and stuff. Never again.

I live a nice life in my eyes. I would always like more but who wouldn't?

Out of curiosity, how many are arranging the finances in preparation for Brexit?

How common do you think doing so is for the wider UK population?

Certainly for myself the income stream that justifies my employment is already struggling. Won’t take too much of a knock to receive a P45.

Won’t take too much of a knock to receive a P45.

I know where there might be a job going in Inverness....

😂

Its not me you need to convince

I think it's a cultural thing. In my 20's, I had a good salary but only spent what I absolutely needed to. All my furniture was secondhand, anywhere I went I camped, etc, so that I could build up a buffer. My friends and colleagues were the same; if you couldn't afford it, you didn't spend it. I only borrowed for a mortgage - and yes, house prices were lower, but the mortgage interest rate was 15%.

Student loans have, I think, encouraged debt. If you owe £30k, what's another 5k?

Shed loads of debt here. Built up from loans for cars (used 7yr old ones, not new) and unexpected repair bills, setting up a business for Mrs pp that hasn't done as well as intended, and what must be general living beyond our means. Had a big wake up call this year when we consolidated all the little overdrafts and CCs into one loan and spending has been massively cut back since then.

What is most frustrating is that we don't live some sort of lavish lifestyle. Holidays tend to be camping in the UK or occasional weekends, never had these fancy all inclusive Spanish holidays or anything like that, majority of furniture is bought second hand. Then I look around at all the crap and clutter in our house (3 young children and all the mess that brings) and hate myself for letting it get to the state it's in.

We're now at the point where we are paying off the debt, but will be doing so for the next five years, meaning that it's virtually impossible to save anything at the same time. We have no-one to blame but ourselves and will work our own way out of it.

I earn a good living, and OrangeSpyderWoman works and does decently too. Cost of living in the Paris area is comparable to London, but I shouldn't complain. I do waste a lot on frivolous items that I don't need but want. Debt is only mortgage to pay back and a loan on a car that I could have bought outright if I'd eaten into savings, but money is relatively cheap to borrow at the moment.

I do buy a staggering amount of tat and gadgets that I don't need and if I'm honest I could (and should) change that and start putting more away for a rainy day or for my kids. At one point I improved things just by counting on a monthly basis all the stuff I wasted money on and that was a stark realisation. I should do that again.

Only dept is the mortgage which will be gone in 2 years. Then we squirrel away everything for 10 years and take early retirement.

Cars are old. Bikes are old.

We have "nice" stuff, but that is paid for by saving up front and getting the best deal possible.

Pffft. I'm still riding 26" wheels...

We had this argument tj, and you are taking the same path as the previous arguments which means you can’t make the distinction between a simple pragmatic statement and your whole world view of “stop moaning if you take home more than £5k a month”

The distinction is simple to grasp, and let’s face it you are underneath an intelligent fellow.

Please stop arguing over a pragmatic statement I made that I still believe to be a fair view of income requirements in the Capital.

Obviously I have to again point out that that £5k includes all the subsidies and tax credits and child care allowances..

But hey, you enjoy the stage... off you go tap dancing 🕺

The original question wasn't about debt, or lack of it though - it was living within or beyond your means.

To me, living beyond your means implies spending more than you earn. If you have debt (regardless of the amount) and you're paying it off and it's not getting any worse, then you're living within your means.

For those to whom being financially competent comes easy, it's a skill, just like any other. Some have it, some don't, some work to get good at it, some find the ability to budget difficult. Just because it's easy to you, doesn't mean it's the same to everyone. Some people are naturals at riding bikes and would struggle to understand why someone else might find it difficult. The worst thing you can do is get on your high horse and be judgemental about it as that's what leads people into depression and suicide over (comparatively small amounts of) money. Ask me how I know how that feels..

5k a month net is a good income.

However if you live in the South East/London commuter belt then it won't go very far.

A modest house in a decent area can easily cost £1500 - £2000. Throw in a few other expenses, season pass etc and that 5k quickly disappears.

1st World problem and all that but 5k a month does not make you wealthy. You're not poor but certainly not rich.

How any family can have a decent standard of living on less than £3k a month net, is beyond me. By decent I mean comfortable home, holidays, good food. What any reasonable person would expect a working family to be able to afford.