- This topic has 34 replies, 11 voices, and was last updated 12 years ago by choron.

-

Victory for the Indignados!

-

mcbooFree MemberPosted 12 years ago

Oh wait

Spain election: People’s party sweeps to crushing victory over Socialists

http://www.guardian.co.uk/world/2011/nov/20/spain-election-peoples-party-victory

Funny that “99%” that thinks the way out of crisis is to keep spending like a drunken sailor didnt actually show up to vote that way. The more I see of the Occupy movement and their “new politics” the more glad I am to live in an actual liberal democracy. With political parties, and free press and elections.

ElfinsafetyFree MemberPosted 12 years agoThe more I see of the Occupy movement and their “new politics” the more glad I am to live in an actual liberal democracy

Except that you don’t live in an actual democracy.

Galileo.

MSPFull MemberPosted 12 years agospending like a drunken sailor

Which party had that on their manifesto?

I am to live in an actual liberal democracy. With political parties, and free press and elections.

where is this amazing utopia? other than in your imagination.

wwaswasFull MemberPosted 12 years agomcboo – a lot of Spanish commentators are saying that people voted the socialists out in protest at the cuts they’ve already made even though they knew that they would end up with a government that woudl actually introduce more cuts.

Nowt so queer as the electorate…

mcbooFree MemberPosted 12 years agomcboo – a lot of Spanish commentators are saying that people voted the socialists out in protest at the cuts they’ve already made even though they knew that they would end up with a government that woudl actually introduce more cuts.

Nowt so queer as the electorate…

Right. Those stupid Spaniards…..they must have a disgusting Right-Wing press down there too….

ohnohesbackFree MemberPosted 12 years agoLike the UK the spanish electorate punished the incumbent ‘socialist’ govt.

Now they are going to learn the hard way about ideologically driven spending cuts, an increased ‘War Against the Poor’, stagflation….

ernie_lynchFree MemberPosted 12 years agoFunny that “99%” that thinks the way out of crisis is to keep spending like a drunken sailor didnt actually show up to vote that way.

Even funnier though, is how little you know about Spanish politics mcboo.

The dire economic situation in Spain has absolutely nothing to do with government overspending.

And “the markets” lack your apparent enthusiasm for the new Spanish government :

Markets braced as fear grows over new Spanish leader

Traders are braced for a turbulent day on global markets amid warnings that Spain’s newly-elected prime minister Mariano Rajoy lacks the policies needed to stave off a bail-out.

I look forward to you calling me a communist mcboo………as you generally do when you can’t think of anything to say.

wreckerFree MemberPosted 12 years agoA cursory google found this beauty;

http://www.guardian.co.uk/commentisfree/2011/mar/27/spain-portugal-economic-crisis-default-debt

Overall, the suggestions seem to be that the govt and councils did overspend (by a lot), the energy policies and investment were a disaster and the cuts have created massive unemployment and left the housing market on its knees.

ernie_lynchFree MemberPosted 12 years agoA cursory google found this beauty

Did you read it ? …..it says the complete opposite, eg :

“More important, Spain has recently demonstrated a great deal of fiscal responsibility. From 2000 to 2008 it often ran budget surpluses.”

wreckerFree MemberPosted 12 years agoYes, of course!

But where did this budget surplus go?

Does that fact that they’re now in trouble after so many good years not point to overspend?

If I’d earnt £10K in October and was in my overdraft in November then I’ve spent too much money have I not?

Simplistic, I know.MSPFull MemberPosted 12 years agoBut where did this budget surplus go?

To reducing the countries total debt.

Does that fact that they’re now in trouble after so many good years not point to overspend?

The point the article is making is they are not in nearly as much trouble as most of the Anglo press are claiming.

jota180Free MemberPosted 12 years agoWho know what lies ahead for the Spanish other than more pain [like the rest of us]?

At least they got to vote who the executioners are going to be, unlike Italy, Greece.jota180Free MemberPosted 12 years agoDoes that fact that they’re now in trouble after so many good years not point to overspend?

No, it points to them being uncompetitive

33% less competitive against the Germans than they were a decade ago, they need to allow their currency to find it’s own level to regain competitiveness

But of course they can’twreckerFree MemberPosted 12 years agoThe point the article is making is they are not in nearly as much trouble as most of the Anglo press are claiming.

The impression I got was that the article was old (March), and that the author has been proven wrong in his opinion of the problems facing Spain.

I’m certainly no expert (as you may have guessed!) just looking to learn a bit more about what I hear in the news without resorting to biased papers.

At what point can the Euro members no longer afford to bail countries out?

If a member nation goes breasts skywards, would it be in their interest to go back to their native currency?jota180Free MemberPosted 12 years agoIf a member nation goes breasts skywards, would it be in their interest to go back to their native currency?

By that stage, probably not – they need to do sooner than that IMO

mcbooFree MemberPosted 12 years agoI look forward to you calling me a communist mcboo………as you generally do when you can’t think of anything to say.

mmmmmmm……hang on.

ernie_lynch – Member

I seldom mention the fact that my views are Marxist, firstly it actually means surprisingly little in terms of accurately pinpointing someone’s political stance. And secondly, it’s quite pointless – you need to argue for what you believe in, rather than expect a label to do that for you. On the rare occasions that I apply a label to myself I generally describe myself as a Leninist

Just saying like……

ernie_lynchFree MemberPosted 12 years agoDoes that fact that they’re now in trouble after so many good years not point to overspend?

No, not that the government overspent. It was the Spanish consumer who overspent, on easy credit, but the government didn’t overspend. In fact Spain joined the Euro with a lower debt ceiling than Germany.

Of course it could be argued that the Spanish government could have introduced credit controls which would have stopped them getting in this mess, but the Spanish Socialist Workers’ Party is committed to the free-market, and credit controls flies in the face of “the market knows best”. Besides, credit controls are I suspect illegal under EU rules.

Just saying like….

You’re not saying anything mcboo ……care to expand on your claim that the Spanish government was spending like drunken sailors ?

Thought not.

donsimonFree MemberPosted 12 years agoLet’s see if we can work out how the typical Spaniard thinks, eh? I lived there for ten years and I’m buggered if I know, but hey, go for it. 😀

wreckerFree MemberPosted 12 years agoNot saying you’re wrong ernie but what I’ve read (and I don’t know how accurate it is or the sources politics) says that the govts and councils spending was far higher than the tax take. What am I missing?

My head hurts.

Respectful request; could we leave the bitching out please?

I IZ TRYEN TO LERN 😀ernie_lynchFree MemberPosted 12 years agocould we leave the bitching out please?

😕 I’m not having a go at you……. mcboo is a different kettle of fish.

Have a look here, the Telegraph article is particularly good imo.

mcbooFree MemberPosted 12 years agoThis from the Telegraph is impossible to disagree with

It Germany genuinely wishes to save Spain and Italy, it must allow EMU-wide reflation and mobilize the ECB as a lender of last resort to halt the bond crisis, since the EFSF rescue fund does not exist.

To create a currency without such a backstop is criminally irresponsible. If this role is illegal under EU treaty law – and that is arguable – then EU treaties must be changed immediately.

If Germany cannot accept this for understandable reasons of sovereignty or ideology, it should accept the implications and prepare an orderly break-up of monetary union. That is the only honourable course.

In the meantime, one can only watch with grim foreboding as the fifth successive government collapses in Europe’s arc of depression, to be replaced by saviours who can save nothing.

There actually isnt any point in the Spanish tightening their belts further if they cant at the same time devalue their currency. And Germany needs to recognise that it has done incredibly well out of the Euro and that the flip side is a responsibility to the losers, especially the Spanish who it is true did not go completely crazy but got caught up in a nightmareish housing boom and bust.

wreckerFree MemberPosted 12 years agoGreat link ernie, thanks.

Despite not knowing many of the acronyms, I found it very informative.teamhurtmoreFree MemberPosted 12 years agoMcBoo – you are missing the best part of the Telegraph article and its reference to the CER note. The awfulness of Spain’s situation – 23% UN – is a great example of the follow of the European project. Spain was not simple a story of a government overspending. As the article describes, Spain did not cheat like the Greeks, did not breach Maastricht debt ceiling (Italy, Gernmany!), public sector debt was under control and it ran a budget surplus.

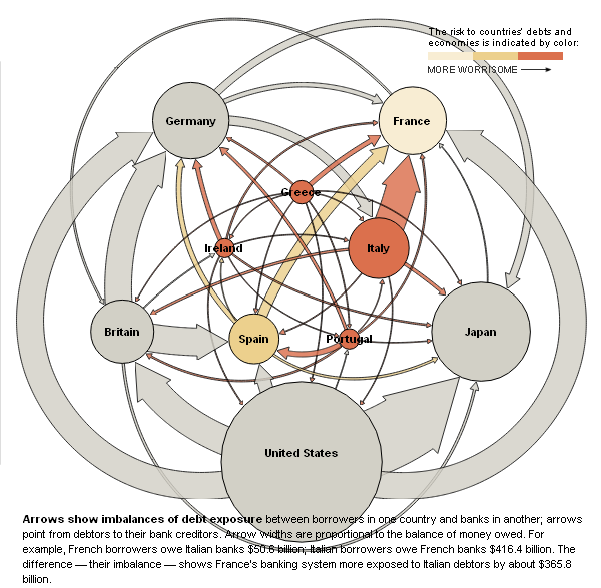

But with the folly of Europe came the toxic combination of -2% negative real interest rates and excess supply of credit from (guess who?) over-leveraged banks in Germany, NL and France. And so no surprise, they had a RE bubble and are now suffering from the massive overhang of new houses and falling prices. But at the end of this folly, the message is, “Spain must help itself”.

Economic and political madness!!!

mcbooFree MemberPosted 12 years agoAgreed. I’m in an incredibly dull meeting so don’t have figures to hand but debt GDP ratio in Spain is not terrible.

Spain shouldn’t be in this position and can get out of it. Lovely people too, who doesn’t love the Spanish.

donsimonFree MemberPosted 12 years agoThe two biggest problems in Spain are the bursting of the property bubble and the banks’ reluctance to do anything and the restrictive employment laws that are slowing any growth in the working population.

It doesn’t, however, explain why local authorities don’t have the money to pay their bills and have to offer land in place of real cash!!MSPFull MemberPosted 12 years agoThe telegraph article forgot to mention the credit from the over leveraged uk banks, of course that wouldn’t have fitted into its euro sceptic editorial policy so nicely.

mcbooFree MemberPosted 12 years agoThe telegraph article forgot to mention the credit from the over leveraged uk banks, of course that wouldn’t have fitted into its euro sceptic editorial policy so nicely.

Oh puleeeease. The Big Bad British Banks did it. Sure they did.

donsimonFree MemberPosted 12 years agoWith regard to the victory for Los Indignados, the answer is yes they do have a victory. As a goup of individuals that have a variety of gripes and found the only way to voice their grievences was to come together and do it together, they have succeeded, the government has changed and the banks have been forced to rethink their attitude towards repossessions and the news is travelling globally.

I’d say it’s a victory for the little man. The repossession laws in Spain were absolutely brutal prior to los indignados.teamhurtmoreFree MemberPosted 12 years agoMSP – I don’t follow that. Why would quoting the impact of UK banks add/change the point already made about other over-leveraged European banks providing too much credit to Spain.

Add, UK to the list of the German, Italian and Dutch banks and you still have the same message.

The article – which is quoting other CER research – does mention labour laws in passing

ernie_lynchFree MemberPosted 12 years ago….of course that wouldn’t have fitted into its euro sceptic editorial policy so nicely.

😕 I would have thought that quite a bit of that article didn’t fit into the Telegraph’s editorial policy. Is the Telegraph’s editorial policy not in line with the UK government’s, ie, that feckless governments borrowed their way to disaster ? In other words that excessive welfare spending is the root of all economic evil.

Despite the fact that it’s a myth – it’s actually the countries with low levels of welfare spending, as a percentage of GDP, that are doing rather badly, whilst those with higher welfare spending are doing somewhat better.

Of course this might be a change of tack, there’s no point banging on about something which is patently false, even if you do want to believe it to be true – it just won’t get you anywhere in the long-term.

MSPFull MemberPosted 12 years agoWhy mention the German, french and Netherlands banks and not the uk ones? Because they want to blame the rest of Europe and deny the uk is also partly responsible. The markets are causing a massive part of Spain’s problems, constant media bombardment that all Mediterranean countries are financially irisponcable, have driven up their borrowing costs far beyond what their governance would normaly dictate. Spain’s finances are in a pretty equall state to the uk’s. But panicked markets are not treating them equally.

teamhurtmoreFree MemberPosted 12 years agoMSP – (wow, that is some prejudice that you are carrying?!!?) – perhaps because the author is quoting another think tank, that in this case happens to be pro-Europe.

You may have some points that are valid, but the links are failing in this case I fear?

Who are the CER? About the CER

The Centre for European Reform is a think-tank devoted to making the European Union work better and strengthening its role in the world. The CER is pro-European but not uncritical. We regard European integration as largely beneficial but recognise that in many respects the Union does not work well. We also think that the EU should take on more responsibilities globally, on issues ranging from climate change to security. The CER aims to promote an open, outward-looking and effective European Union.

The Torygraph:

Philip Whyte and Simon Tilford argue in a paper for the CER that “the eurozone crisis is as much a tale of excess bank leverage and poor risk management in the core as of excess consumption and wasteful investment in the periphery.”

So perhaps an edit is required – at least in this case?

jota180Free MemberPosted 12 years agoYou’ve got to feel for the Spanish really, they lost what? – 15% of their GDP with the housing market crash

Compounded when the banking crisis bitThey’ve been left nowhere to go, the old mainstay of tourism is suffering

We used to go to Mijas 4 times a year with friends for a long weekend, we did this for almost 20 years, now we’re down to twice a year.

Most stuff is now dearer than it is in the UK and we simply can’t afford it, they aren’t competitive any morechoronFree MemberPosted 12 years agoNot sure how todays market movements can be entirely put down to the spanish election.

General macro environment is terrible and getting worse. Nothing but bad news for months now, and it’s becoming clear just how bad the state of the eurozone is.

The MF global debacle seems to be getting worse and worse, while commodity margins are being hiked again and again leading to big sell-offs. I think this exacerbates things in the US and asia, there are no safe-havens right now globally.

The real worry is the state of euro banks: a shock (likely) or a downgrade (very likely) could totally hammer these guys. Given the capital ratios of the likes of credit agricole, DB, BNP etc. any large event could lead to bankruptcy or more bailouts. Problem is, the governments can’t afford more bailouts and we’ll more than likely be looking at a downgrade/counterparty shitstorm if anything happens.

Just saw the numbers for the exposure of the EIB also: truly terrifying. Second (?) biggest lender in the world, backstopped by the EU and in deep to the worst economies in the eurozone. If I had to put my money on the thing to kill the euro this would be it.

The topic ‘Victory for the Indignados!’ is closed to new replies.