- This topic has 37 replies, 32 voices, and was last updated 12 years ago by anagallis_arvensis.

-

Online banking that doesn't need a physical widget?

-

5labFull MemberPosted 12 years ago

So, HSBC recently forced everyone to adopt a physical key thinger to get into online banking. I understand why they’ve done this, however, I now can’t even check my bank balance without lugging a small calculator with me wherever I go. This has already cost me £20 (couldn’t check my balance whilst on holiday so I was unable to pay my credit card bill in full, as I didn’t know if I had the funds (I did)) So I want to change banks.

Are there any banks out there who don’t require a widget to get online? Or, if they do, don’t require it for simple things (ie checking balance, moving money round my own accounts) but only need it for the more risky jobs, like setting up a new payee, or whatever?

Cheers

H

almightydutchFree MemberPosted 12 years agoMy LloydsTSB doesnt have a widget or anything. Can move money about as and when needed, but sometimes get a call from bank to confirm movements.

sharkbaitFree MemberPosted 12 years agoNat West only require the calulator thingy when adding/deleting payees – plus they have the very good iPhone/ipad apps. Halifax dont use one at all.

Wifey is with HSBC and doesn’t use/have a calulator thingy.

DezBFree MemberPosted 12 years agoI’ve got FirstDirect, Lloyds and HSBC accounts, all without a widget to get into online banking.

FirstDirect’s Internet Banking Plus is great, I must say.randomjeremyFree MemberPosted 12 years agoThis is something all the banks will be rolling out within the next 24 months – some will require a token just to log in, others will require one for certain transactions, and some will let you use your phone as the token receiver as part of the login process; an SMS will be sent to a preregistered device with a keycode attached that you use as authentication).

J-RFull MemberPosted 12 years agoI recently switched to Lloyds TSB. The online banking works very well, and without a widget.

ntreidFree MemberPosted 12 years agoThere are plenty that don’t need a widget, but bear in mind that it makes your banking less secure.

First Direct and Cahoot don’t use the widgets. First Direct are HSBC though, so I guess may switch over to widgets at some point.

Why don’t you use telephone banking? Most accounts allow you to check balances over the phone, which may be useful for when you’re abroad?

molgripsFree MemberPosted 12 years agoJust take the thing with you…? That’s what I do, or I just use phone banking instead 🙂

ourkidsamFree MemberPosted 12 years agoSantander use your phone – they text you a code that you have to input to confirm whatever you are doing.

It’s part of a recent overhaul and beef up of security. You have to answer a number of questions now to get in to your account rather than just acc no/password

bent_udderFree MemberPosted 12 years agoFirst Direct (part of HSBC) doesn’t require a widget. I use a widget (they’re SecurID Tokens, by the way) for HSBC business banking, and they’re very small – about the size of a USB stick. The calculator doohickeys don’t sound terribly practical.

5labFull MemberPosted 12 years agocheers for the replies so far

wrt phone banking – I could do this, but the trouble is around the 1st of the month I have a lot of money go in and out of my account. I don’t really know how much I’ve got until all these transactions have taken place, so I need to see whats happened so far and what hasn’t. This is probably possible when using phone banking to a rep, but would take 5-10 mins and cost me a tenner to do 🙁

I like the idea of first direct, but I agree it seems likely they’ll introduce a widget as well. I do understand the need for it, but one that just uses your mobile (sends you a text or whatever), and only requiring a key for kicking off transfers, seems a much better system than not letting you view your balance/recent transactions without a key :S

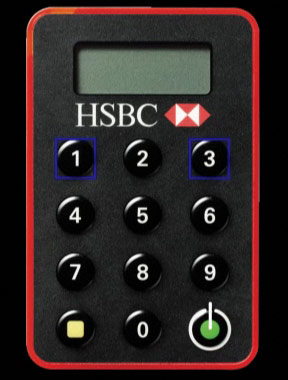

5labFull MemberPosted 12 years agoby the way, this is what the hsbc key is like

too big to fit in a wallet easily, and the whole thing just pisses me off

bent_udderFree MemberPosted 12 years agoA couple of points here;

More secure methods (ie, Tokens, one time pads, mobile based authentication) are less about securing the user, and more abut shifting the burden of responsibility onto the user from the bank. Chip and PIN is the same. Regardless of whether it is more secure, if someone skims your card, and empties your account, the bank can point to its new, more secure (in theory, anyway) system as proof that it must be user error.

Second point is that things like mobile authentication *look* more secure, but are not immune from breaks.

Bruce Schneier is (as ever) excellent on this sort of stuff (don’t forget to check out Schneier Facts) as is Avivah[url=http://www.bankinfosecurity.co.uk/articles.php?art_id=2193] Litan[/url].

SkillWillFree MemberPosted 12 years agoNothing helpful to add just wanted to register how much that HSBC secure key p*sses me off too. I have one for my personal account, a different style one for my business account (also HSBC) a calculator style thing for a Nationwide account. Definitely thinking of changing from HSBC because of it.

Stuey01Free MemberPosted 12 years agoLloyds phone you real time to have you tap in a code from the internet banking screen to authorise new payment recipients. Other than this it is widget and phone free.

nickjbFree MemberPosted 12 years agoHSBC are about to lose my custom, too. They’re on-line banking has been great, much better than Natwest where our joint accounts is. Might give Nationwide a go

NorthwindFull MemberPosted 12 years agoLTSB/HBOS are widget-free and have no plans to go widgetty (they already have the tech to do it but only use it for business customers, and I think possibly opted-in paranoid people). But the personal banking website login’s gone a wee bit faffy.

Santander’s one is just plain infuriating, lots of stuff to remember and doesn’t seem to work reliably. Error messages that mean nothing, too- like placemarkers didn’t get replaced with final release stuff.

SamBFree MemberPosted 12 years agoJust chiming in to say that HSBC has pissed me off with this widget nonsense as well. TWO new “personal questions”, the calculator widget and a new security code.

NO I’M FINE AS I AM THANKS. I DON’T TELL PEOPLE MY PASSWORD BECAUSE I’M NOT A NINNY.

loddrikFree MemberPosted 12 years agoWe quit Barclays because of these things. I’m quite happy with the level of security and will not use a bank that insists on these bloody things. I like being able to log in as and when.

FlaperonFull MemberPosted 12 years agoNationwide needs a widget. Doesn’t bother me.

Key point is that it’s the chip in your card that does the work, so the reader from any bank will work with your card. Alternatively, Nationwide gave me a box of the things for free when I asked and I have them stashed at home, work, in the car etc.

Also an excellent source of CR2032 batteries. Ahem.

Moot point anyway; Visa CodeSure solves the problem though haven’t seen them hit the streets yet.

BezFull MemberPosted 12 years agoI’m all for hardware keys. I would have considered moving away from HSBC if they *weren’t* introducing one.

disco_stuFree MemberPosted 12 years agoIts smaller than a credit card and about 4mm thick, I’ve not found it any hardship to carry mine around with me for the extra security it gives me.

I would like it if you could have an app on my HTC Desire which did the same function ( ala Google Authenticator )

SamBFree MemberPosted 12 years agoEeeep, sorry mods – I thought the forum automatically censored naughty words. Sorry! 😳

JacksonPollockFree MemberPosted 12 years agoMe too. Just received my ‘widget’. Doesn’t seem very practical tbh.

Interestingly I received a message (through internet banking) advising me of changes to the Ts and Cs, a few weeks back. Further investigation revealed that they where no longer going to be held responsible/liable for fraud on current accounts.

Coincidence?

Anyway time to start looking for a better bank (if thats not an oxymoron) 😉

WillHFull MemberPosted 12 years agoWe quit Barclays four or five years ago because they introduced one of these things, except you had to insert your card into it so it was the size of a small calculator rather than just credit card sized.

We’re currently with HSBC but have heard nothing about this new gadget. We managed to wrangle a free permanent ‘upgrade’ to HSBC Premier though, so maybe they don’t like to bother their economy-plus customers with the widget thingy? I’ll be annoyed if we end up getting them though, although we live in NZ now so only use the HSBC accounts a couple of times a year.

brFree MemberPosted 12 years agowrt phone banking – I could do this, but the trouble is around the 1st of the month I have a lot of money go in and out of my account. I don’t really know how much I’ve got until all these transactions have taken place, so I need to see whats happened so far and what hasn’t

Or you could knock up a simple spreadsheet and keep a check of your spending…

MrSmithFree MemberPosted 12 years agoi’m not using mine when they send it out and will move my business account from hsbc if they insist i use it. they want you to put some software on my macbook too, did a bit of digging on the net and it makes the fans go on and eats the battery life.

i’m not making their problem my problem.iain1775Free MemberPosted 12 years agoEh? Been with hsbc for 27 years tomorrow not heard anything about a widget or any changes

It’s taken me about 5 years to memorise the ‘old’ IB log in code

I’ll be moving for sure if that’s the casesouldrummerFree MemberPosted 12 years agoI have been using the Barclays one for years and have never really considered it a nuisance. I actually quite like the idea that they ask you to verify transactions from your account when you pay someone electronically for the first time. They also use them when you withdraw money at the counter using your debit card. To me it just seems another level of security which I am more than happy with.

CougarFull MemberPosted 12 years agoIt’s taken me about 5 years to memorise the ‘old’ IB log in code

I’ve memorised the 10-digit IB number, so they’ve now helpfully replaced it with a ‘friendly’ name instead.

5labFull MemberPosted 12 years agoI have been using the Barclays one for years and have never really considered it a nuisance. I actually quite like the idea that they ask you to verify transactions from your account when you pay someone electronically for the first time. They also use them when you withdraw money at the counter using your debit card. To me it just seems another level of security which I am more than happy with

that i could deal with, but the hsbc one is required every time you use your account, for anything – you can’t even check your balance without it

Or you could knock up a simple spreadsheet and keep a check of your spending…

could do, yeah, but I have far better things to do with my time than keep track of every time I use my card. That’s my bank’s job

justtheoneFree MemberPosted 12 years agoCoutts Private Bank. It’s the only one…..

C

This isn’t correct. Coutts has been using a security key for online banking for about 9 years.

trail_ratFree MemberPosted 12 years ago“Nationwide needs a widget. Doesn’t bother me.”

no nation wide gives you the option ….

you can still log in using passwords and personal info – its in the tabs at the top

bank ofscotland also lets you sign in with passwords and passcodes – thats the only advantage of banking with the **** – i WAS going to move but decided not to in the end due to the widget shite with other banks

jon1973Free MemberPosted 12 years agoSo, HSBC recently forced everyone to adopt a physical key thinger to get into online banking.

I know it’s on the cards, but I certainly haven’t been forced to do it yet. They said they’d be sending them out over the next few months, and there would be a 1 month grace period before you had to start using them.

GrahamSFull MemberPosted 12 years agoNatWest behaves itself. They have a card reader, but (as per the OP’s request) it is only needed for risky operations like setting up a new Payee. You can log in, check balances, transfer money between accounts etc without it.

They also let you quickly check balances via an iPhone app with just a simple numeric login.

Plus you can set up text alerts which SMS you when balance is below/above a certain point etc, which saves checking them all the time anyway.

anagallis_arvensisFull MemberPosted 12 years agoI bank with Smile.co.uk and dont use a widget thing

The topic ‘Online banking that doesn't need a physical widget?’ is closed to new replies.