- This topic has 94 replies, 44 voices, and was last updated 1 year ago by cx_monkey.

-

Exclusive Update From Stanton Bicycles: The Recovery Begins

-

stwhannahFull MemberPosted 1 year ago

The news leaking out of a corner of the Peak District is true – Dan Stanton has successfully bought back control of Stanton Bikes (or Stanton Bicycles …

By stwhannah

Get the full story here:

tomhowardFull MemberPosted 1 year agoHopefully that will shut all the ‘ZOMG, he’s screwed eVeRyOnE over11!!!1one!’ Crowd up.

Not that it will, but ever hopeful.

cometFull MemberPosted 1 year agoThere is some misleading information here, I am a type 2 customer who ordered some spares. I received an email today from the administrators PKF Smith Cooper, informing me that since they were unable to fulfil my order and have now sold Stanton Bikes Ltd. to Stanton Bicycles Limited, I should contact my bank to claim a refund.

As it happens, I did receive the spares after some weeks, so don’t need to claim a refund from any party.

mrmoofoFull MemberPosted 1 year agoHim, great news for Dan

Were the old company’s creditors were all paid in full.

reeksyFull MemberPosted 1 year agoThanks Hannah for getting some facts published.

I’m hoping lots more people get the chance to own Stanton frames and support the great people that work with Dan.

the-muffin-manFull MemberPosted 1 year agoI was just flicking through Saturdays Times financial section and was surprised to see it had made the national papers…

2scotroutesFull MemberPosted 1 year ago

2scotroutesFull MemberPosted 1 year agoI’m hoping lots more people get the chance to own Stanton

Give it another couple of years and put in a bid?

reeksyFull MemberPosted 1 year agoSeveral thousand pounds! For a bicycle? Imagine that 🙂

“I’ve heard they’ve fitted electric motors to bicycles now, Marjorie, whatever next?”

wheelsonfire1Full MemberPosted 1 year agoDebts of £2.15 million is perhaps more worrying? And then to set up again?

wheelsonfire1Full MemberPosted 1 year agoAnd, how do you protect a brand and goodwill owing that amount of money? I’m out.

1reeksyFull MemberPosted 1 year agoYes, if someone running an SME makes a mistake they should probably just be made to clean toilets or euthanised.

dirkpitt74Full MemberPosted 1 year agoWhat is an SME in the UK?

The UK government definition of SMEs (Small and medium-sized enterprises) encompasses micro (less than 10 employees and an annual turnover under €2 million), small (less than 50 employees and an annual turnover under €10 million) and medium-sized (less than 250 employees and an annual turnover under €50 million) businesses.

wheelsonfire1Full MemberPosted 1 year agoThank you for the info! Will there be other SME’S who are still owed money and now struggling?

reeksyFull MemberPosted 1 year ago<div class=”bbp-reply-content”>

From another thread on here:

</div>

<div class=”bbp-reply-content”>

Since some have asked and I wondered too … summary of the debts from here

(where named…I am not an insolvency practitioner, and there seem to be two similar but not identical lists)

Employee hol pay : £800.

HMRC: £92K

Trade: £370K

Dan Stanton: £120K

Atkinsons (the recent investor/s presumably): £1.05M

10 Customers: £33K

Paypal: £73K

You Lend (who?): £40K

Redundancy/pay arrears: £60K.

TNT: 43KTrade seems to be a Taiwanese and a Chinese supplier (bulk of it) plus various UK distros.

</div>

<div class=”bbp-reply-content”>

But let’s face it. The last few years must have been an incredibly difficult time to be running a business like this.

</div>

reeksyFull MemberPosted 1 year agoAnd i’m guessing Stanton might be a micro business under that definition above … not bad to have a “global presence” according to the Times.

4tomhowardFull MemberPosted 1 year agoThank you for the info! Will there be other SME’S who are still owed money and now struggling?

According to some accounts on Pinkbike, the owners of a couple of businesses may now be struggling to to pay bills or put food on the table. (PayPal and TNT)

Hope they pull through.

1kayla1Free MemberPosted 1 year agoBut let’s face it. The last few years must have been an incredibly difficult time to be running a business like this.

It’s been an absolute shitshow from the point we had to start putting customs labels on stuff going to the EU. I now have A Job and have scaled what we do (teeny, tiny business, working from home but it paid the bills and put food on the table) right back.

thisisnotaspoonFree MemberPosted 1 year agoThe implication I got from the accounts was the Atkinsons lost the bulk of their investment.

TNT and Paypal lost their debts as a result of the insolvency.

Holiday pay, wages etc automatically get added to the pile during administration because the company ‘owes’ you that holiday pay as you accrue it even if you have no intention of taking it until December, and wages are paid by the administrators / owed by the new company.

The suppliers debts are for orders they’ve placed, i.e. they owe the framebuilder in Tiawan £300k for upcoming batches they’ve committed to, presumably they’ve every intention of still buying those frames as “Stanton Bicycles”.

Basically looked to me like the only people who lost out significantly were TNT and Paypal, the investor made their own decision to pull the plug so hard to feel like they’ve been hard done by. .n.b. reading the accounts and statements it looks like there were other issues with cashflow caused by brexit/ukraine/inflation/whatever than just the investor pulling the plug. So the investor didn’t simply walk away for no reason, they made the decision not to put up any more money to cover the shortfall in cashflow.

the-muffin-manFull MemberPosted 1 year agoI’m amazed TNT let it get so far – they were like rabid dogs in accounts when we used to deal with them. Not paid – then nothing gets shipped.

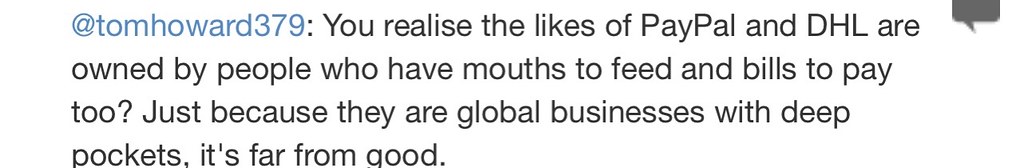

2tomhowardFull MemberPosted 1 year agoBasically looked to me like the only people who lost out significantly were TNT and Paypal, the investor made their own decision to pull the plug so hard to feel like they’ve been hard done by.

posted pretty much the same thing on Pinkbike. Got this response.

The same guy with half a dozen or so accounts is currently downvoting me to oblivion

TheGingerOneFull MemberPosted 1 year agoSurely the likes of PayPal and TNT expect to right off an amount of debt they are owed every year and plan for it, so whilst not ideal, it is a factor in running a business that they plan for.

1MarkFull MemberPosted 1 year agoThose losses will get accounted for in the giant corp accounts they have and will be put to good use offsetting their tax liabilities. It’s still a loss to those companies but unless those companies are running out of actual cash it’s going to affect no one other than shareholders realistically. If these losses become an increasing pattern for these companies they may pass on the costs by increasing prices, which could affect lots of people in minor ways but most large corps will plan for a percentage of these losses in their business plans and forecasts so it will MOST LIKELY have zero affect on anyone at all.

chakapingFull MemberPosted 1 year agoHow do you run up a debt with PP anyway?

I thought they’d just pay a slice of each transaction the moment it was made, like us punters?

Or do they offer other services for SMEs?

scotroutesFull MemberPosted 1 year agoAh, it’s ok to default payments to large companies. Cool. Does someone have a handy diagram/explanation of where the dividing line is?

More importantly, if Stanton couldn’t pay them previously does that means it’s going to be a click-and-collect, cash-only business now?

MarkFull MemberPosted 1 year agoThey lend to businesses. We’ve used their credit facilities in the past. It’s very good. You borrow an amount and repay it via an increased percentage taken from all future transactions.

tomhowardFull MemberPosted 1 year agoMore importantly, if Stanton couldn’t pay them previously does that means it’s going to be a click-and-collect, cash-only business now?

Dan said in the interview that both companies are happy to deal with the new one.

Also, every company that offers credit, be that loans or payment terms will credit check then make a decision based on the level of risk involved in offering those things to customers. They decided it was an acceptable level of risk and priced accordingly to still make money. I’d wager they’ve both still made money over the course of the relationship, even with the hit they are taking now.

MarkFull MemberPosted 1 year agoAh, it’s ok to default payments to large companies. Cool. Does someone have a handy diagram/explanation of where the dividing line is?

Of course it’s not ok. But it happens and it is typically planned for.

the-muffin-manFull MemberPosted 1 year agoAh, it’s ok to default payments to large companies. Cool. Does someone have a handy diagram/explanation of where the dividing line is?

Have you ever run a business?

Big companies factor bad debt in – it’s part of the business. And many businesses are happy to trade with new entities. Google for Pre-Pack Businesses.

Even me running a small one-man band business knows there will always be an element of bad debt. Even good customers can go bad.

kelronFree MemberPosted 1 year agoI know it’s easy to be cynical but he seems to be giving a very clear and honest explanation of who is losing out and why.

chakapingFull MemberPosted 1 year agoThey lend to businesses. We’ve used their credit facilities in the past. It’s very good. You borrow an amount and repay it via an increased percentage taken from all future transactions.

Thanks, makes sense now :)

chevychaseFull MemberPosted 1 year agoThere’s still nearly £200k of liabilities to staff and customers that have been written off.

I don’t know about you – but if my bike order was written off, and the same frame was sold to someone else after being bought by the new entity, I’d be pretty miffed.

And if my pension contributions went down the pan. That’s not great.

tomhowardFull MemberPosted 1 year agoAre there? The article states that customers will be sorted, and staff salaries are normally top of the list to be paid first?

nukeFull MemberPosted 1 year agoI know it’s easy to be cynical but he seems to be giving a very clear and honest explanation of who is losing out and why.

Think he needs to as its clear from this and other threads that the goodwill towards Stanton has taken a hit over this (although as I read it, its the investor pulling out that was the trigger that has led to where they are now) and thats not what you need when rebuilding the business and frankly I do wonder if they can come back from that…going to be a hard slog rebuilding reputation. Regardless of opinion of this collapse/rebirth, if I was in the market for a new bike/frame, I think Id want to be confident they were likely to be around for the foreseeable future and Im not sure at this point Id have that confidence

2DelFull MemberPosted 1 year agoThe guy is hardly hiding, is he? If he thought this episode was going to tarnish his name to the extent some might think he’d just have called the new company something else.

You must be logged in to reply to this topic.