- This topic has 42 replies, 19 voices, and was last updated 9 years ago by njee20.

-

"Stamp Duty"

-

vinnyehFull MemberPosted 9 years ago

Not seen a cogent reason for the current method of calculating STLD, anyone know the justification?

How long before Westminster is forced to follow Scotland’s lead and remove slab taxation on house purchases? Surely someone will make reform an election pledge.

http://www.bbc.co.uk/news/uk-scotland-scotland-politics-29536022

Mind, living in the SE I reckon the bandings could do with a rejig before reform.

jambalayaFree MemberPosted 9 years agoWe had a discussion on this on another thread.

Scotland has just tweaked the system we already have in the UK, just the bands are different as property prices are lower and the rates at the top end are higher, no ?

As an aside I think the 10% tax on properties from £250 to £1m will result in a big drop in the number of transactions in that sector of the market. I don’t know how much tax they expect to raise but I suspect it could be a lot less than they have modelled.

vinnyehFull MemberPosted 9 years agoScotland has just tweaked the system we already have in the UK, just the bands are different as property prices are lower and the rates at the top end are higher, no ?

Not as I read it..

From the BBC

Under the government’s new Land and Building Transactions Tax, a marginal tax of 2% would apply to the proportion of a transaction between £135,000 and £250,000, while a 10% rate will apply to those between £250,000 and £1m.

aracerFree MemberPosted 9 years agoNo, they’re making a more fundamental change by getting rid of the steps – currently if you buy a £125000 house you pay nothing, but if you buy a £125001 house you have to pay £1250.01. Under the new Scottish system you only pay tax on the amount you’re over the threshold by, so in that instance if they kept the rate the same you’d only pay £0.01.

jambalayaFree MemberPosted 9 years agoOK understood, but that’s not a fundamental change is it really? Fairer in calculation mechanics but really the same thing just with higher rates.

johndohFree MemberPosted 9 years agoOK understood, but that’s not a fundamental change is it really? Fairer in calculation mechanics but really the same thing just with higher rates.

But overall fairer – the current method of calculation in England is absurd and causes artificially-held housing prices – for example, I recently sold a house that was worth around £280k but every estate agent said we would only get £250k because people wouldn’t want to pay the higher rate SD. So you get a whole load of properties hovering around the £250k mark – all those worth £280k sell for £250k, all those worth £220k get priced up to £250k.

DaffyFull MemberPosted 9 years agoThat’s still a fairly hefty price tag once you’re out of the £250k Bracket.

Currently a £400k house would be £12k of duty.

Under the new system that would be £17.5k

aracerFree MemberPosted 9 years agoIt’s a pretty fundamental change if you’re looking at houses around the £250k mark. Instead of a £5k step change as soon as you go over that threshold, you’ll just be paying an extra £1k for every £10k over. No more fiddling around to keep house prices under that threshold and a ~£5k decrease in tax for those just over it.

seosamh77Free MemberPosted 9 years agoDaffy – Member

That’s still a fairly hefty price tag once you’re out of the £250k Bracket.Currently a £400k house would be £12k of duty.

Under the new system that would be £17.5k

From an English perspective what you need to do is look at this comparatively, as the rates and banding wouldn’t be the same for England, and would and should be different based on regions. in Scotland this tax means 90% of people will pay less.

So the rates are fine for scotland, but would be unworkable in England.

You’d need to compare values in England and apply proper rates.

Here’s Scotlands average and median prices for comparison:

http://www.ros.gov.uk/pdfs/ros_statistical_report_apr-jun2014.pdf

Average Residential Property Prices in Scotland

Aberdeen City £205,072

Aberdeenshire £225,135

Edinburgh, City of £227,361

Glasgow City £128,546

Scotland £162,122Residential Property Median Prices

Aberdeen City £175,338

Aberdeenshire £210,000

Edinburgh, City of £177,317

Glasgow City £110,000

Scotland £135,000johndohFree MemberPosted 9 years agoCurrently a £400k house would be £12k of duty.

Under the new system that would be £17.5k

Wow. I didn’t know that, I haven’t followed this closely.johndohFree MemberPosted 9 years agoAnd the whole thing sucks – what was once a tax on the very wealthy is now basically a tax on home buying for the vast majority.

aracerFree MemberPosted 9 years agoAs an aside I think the 10% tax on properties from £250 to £1m will result in a big drop in the number of transactions in that sector of the market.

Really?

Current system, £24k tax on £600k property. New system 37.3k tax on £600k property. We’re talking only just over 2% difference in the total property price in a market where prices can change by more than that in 3 months (and whilst I’ve not picked the worst example in that range, nor have I picked the best – £600k is probably well over the median).

vinnyehFull MemberPosted 9 years agoAnd the whole thing sucks – what was once a tax on the very wealthy is now basically a tax on home buying for the vast majority.

Sometimes I think that this is what they really mean by ‘progressive taxes’

towzerFull MemberPosted 9 years agoIf any politician/party ever mentions crepe like ‘flexible workforce/get on your bike’ you might want to ask them how taxing people to move fits in.

Signed person who had to move 3 times to have a job.

aracerFree MemberPosted 9 years agoIt’s not exactly a tax on the poor though is it, John, and revenues have to be raised somewhere.

DaffyFull MemberPosted 9 years agojohndoh –

Wow. I didn’t know that, I haven’t followed this closely.

It’s for Scotland only, but it’s only a matter of time before it’s implemented in England.

The new incremental system removes the £5k increase as soon as you move above £250k, but as soon as you’re above £320k you’re now paying an extra £1k for each £10k.

DaffyFull MemberPosted 9 years agoThe heaviest hit will be in the £250-£500k band.

Current = £15k SDLT

New = £27.5K SDLTThat’s almost double.

seosamh77Free MemberPosted 9 years agoFor more comparison

Here’s sales volumes in Scotland by price, vastly different from the rest of uk.

thisisnotaspoonFree MemberPosted 9 years agoFrom an English perspective what you need to look at with this is that the rates and banding wouldn’t be the same for England. and would and should be different based on regions. in scotland this tax means 90% of people will pay less.

I kinda agree, but like car tax (sorry, VED) encourages people to take the bus, cycle, or just drive a smaller car. Stamp duty should be level accross the country to discourage migration into areas with pressure on housing like London and the SE. If you were faced with house prices double and a 10% transaction tax in the SE Vs Manchester, then that encourages people to stay in or move to Manchester.

That is an all round economic benifit as it doesn’t tie up peoples money in houses so it goes back into the economy, and it prevents a brain drain on the rest of the country. Larger disparities in house prices mean only higher earners can move to London, leaving the rest of the country even worse off.

seosamh77Free MemberPosted 9 years agoI can see where you are coming from there, interesting point.

blandFull MemberPosted 9 years agoSurely the best thing to do would be leave it as it was in 2003 when it was introduced, only increase the bands by 41% to reflect the increase in prices

brakesFree MemberPosted 9 years agoI would hope that if these rates were applied to England, that the 10% rate would apply to property purchases of £500k and above.

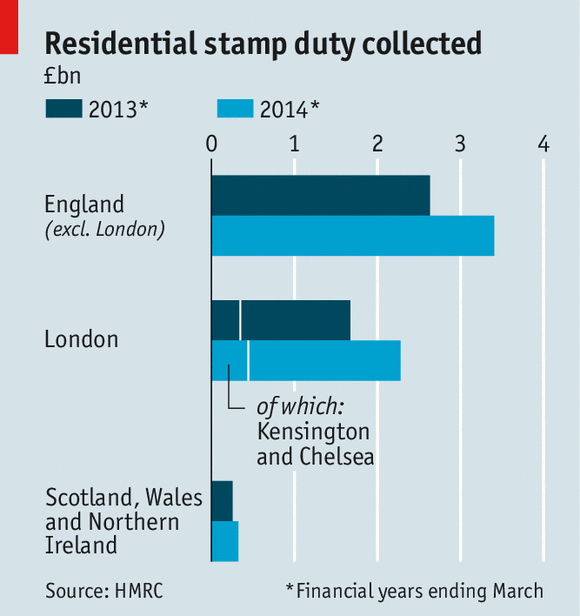

brooessFree MemberPosted 9 years agoThis graph shows you why stamp duty bands are not being changed and, I suspect, a key reason why Gideon threw a bunch of cash at the housing market last year. He got an awful lot more properties through the £250k mark.

Gideon has missed his deficit reduction target by c 50% with an election next year and economic growth slowing. Even more reason to try and find alternative sources of tax revenue…

By creating a bubble he’s probably created a crash which otherwise would have just been a flat market. Unfortunately for him it looks like he went too early and prices are dropping whilst the Tories are in power rather than next year when they are not, and the crash would have been on Labour’s watch.

DaffyFull MemberPosted 9 years agobrakes – Member

I would hope that if these rates were applied to England, that the 10% rate would apply to property purchases of £500k and above.When it can be sold as helping the poor (below £125k) and taxing the rich (those buying an above average house) I’d be willing to bet we’ll all get screwed with our pants on.

MidlandTrailquestsGrahamFree MemberPosted 9 years agoThis is not something I’ve ever really thought about before, but…

Using Aracer’s example of £280k houses selling at an artificially low price, what’s to stop the owner putting up two cheap internal doors in the hallway and selling it as a job lot of two £140k flats?

brFree MemberPosted 9 years agoAnd the whole thing sucks – what was once a tax on the very wealthy is now basically a tax on home buying for the vast majority.

Not sure about the ‘was once’, as I’ve paid stamp duty on pretty much every house since the late 80’s – and nothing bigger than 3 beds.

johndohFree MemberPosted 9 years agoThat’s the point b r – there was a time the vast majority avoided any SD, now the vast majority pay it. In 1980, the average house price was £23k, by 1990 it was almost £60k…

aracerFree MemberPosted 9 years agoI kinda agree, but like car tax (sorry, VED) encourages people to take the bus, cycle, or just drive a smaller car. Stamp duty should be level accross the country to discourage migration into areas with pressure on housing like London and the SE. If you were faced with house prices double and a 10% transaction tax in the SE Vs Manchester, then that encourages people to stay in or move to Manchester.

Yet the difference in stamp duty is but a mere blip compared to the doubling of house price. Stamp duty isn’t ever going to do anything significant to prevent migration to areas of expensive housing.

I’m still not convinced that the differences in stamp duty we’re talking here are a major factor in people choosing to buy/sell or move house, not when the differences are such a small % of the total cost until you’re well above the price a normal person pays. Would make a difference to pricing around the current threshold points, but that would be a beneficial thing IMHO.

mudsharkFree MemberPosted 9 years agoWell stamp duty is the biggest factor in stopping me moving to another part of the country – moving cost would be about what I earn in a year.

That graph is great at showing the impact the £250k bank has one sales.

trail_ratFree MemberPosted 9 years ago“Using Aracer’s example of £280k houses selling at an artificially low price, what’s to stop the owner putting up two cheap internal doors in the hallway and selling it as a job lot of two £140k flats?”

the regulations that have clamped down on that kind of dodgy flat creationism.

fire regulations , sound regulations just to name a few.

njee20Free MemberPosted 9 years agoI’m still not convinced that the differences in stamp duty we’re talking here are a major factor in people choosing to buy/sell or move house, not when the differences are such a small % of the total cost until you’re well above the price a normal person pays. Would make a difference to pricing around the current threshold points, but that would be a beneficial thing IMHO.

Dunno, it was a huge contributory factor in our (first) house purchase. We could afford the mortgage payments (and get the mortgage) on more than £250k, but with only a 5% deposit, finding an additional £5k upfront meant we had an absolute ceiling of £250k. Because you need the cash there and then I think it has a bigger bearing for a lot of people than an equivalent (or larger) increase in house price, which just means a slightly higher monthly mortgage payment for most.

Whilst the removal of the thresholds would be better, I still think the absolute amounts are significant in people’s motivations.

zippykonaFull MemberPosted 9 years agoIs there any moral justification for taxing people who want to move house?

This also penalises people who want to downsize.DaffyFull MemberPosted 9 years agoThe stamp duty cost was a massive factor when selecting our first house. Should be moving in within 4 weeks.

mudsharkFree MemberPosted 9 years agoStamp Duty encourages big jumps in property I think – it did for me anyway as want to minimize the number of moves going up that crazy ladder. So more likely to borrow more so more risky.

It raises too much cash so it won’t go.

njee20Free MemberPosted 9 years agoStamp Duty encourages big jumps in property I think – it did for me anyway as want to minimize the number of moves going up that crazy ladder. So more likely to borrow more so more risky.

Yep that’s our thought, even with a relative modest move our next house will likely incur over £10k, so you think well sod it, we’ll go a bit harder to avoid having to pay that again!

freeagentFree MemberPosted 9 years agoThat’s still a fairly hefty price tag once you’re out of the £250k Bracket.

Currently a £400k house would be £12k of duty.

Under the new system that would be £17.5k

Which is quite a big reason why I can’t see us moving anytime soon.

aracerFree MemberPosted 9 years agoSome of you need to read what I wrote more carefully, as it was very carefully worded:

I’m still not convinced that the differences in stamp duty we’re talking here are a major factor in people choosing to buy/sell or move house, not when the differences are such a small % of the total cost until you’re well above the price a normal person pays.

You appear to be talking about £250k houses, where under Scottish rules you’d pay less stamp duty.

njee20Free MemberPosted 9 years agoSome of you need to read what I wrote more carefully, as it was very carefully worded:

But the differences aren’t that small once you reach the upper end of the current bands – potentially £6k on a £400k house. I used the £250k example because it’s how it is now, but the same would likely stand if they changed the system.

On a £500k house it’s £42.5k versus £15, I can see that influencing buying habits.

thisisnotaspoonFree MemberPosted 9 years agoYep that’s our thought, even with a relative modest move our next house will likely incur over £10k, so you think well sod it, we’ll go a bit harder to avoid having to pay that again!

I (and I’m going against my own point on the previous page) think that removing it alltogether would be better and introducing capital gains tax on all hosues not just 2nd/3rd/etc. Liquidity in the housing market isn’t nececeraly a bad thing, means epople would move nearer work if they changed jobs by 10 miles for example reducing conjestion and a faster turnover of hosuing stock would bring supply and demand closer together.

If you paid capital gains on a house at say 20%, then moving would only incur a tax on the profit you made on the last house (and the builder would have paid VAT and corperation tax on the new house at 20%), not it’s full value. There’d have to be some cut off though, otherwise moving would become unafordable the longer you lived somewhere.

Either that or scrap stamp duty entirely and make council tax more like 4% of property value (based on the same sort of calculaiton zoopla etc use for estimating), that’d get people downsizing.

aracerFree MemberPosted 9 years agoOn a £500k house it’s £42.5k versus £15, I can see that influencing buying habits.

At which point my second bolded bit applies.

The topic ‘"Stamp Duty"’ is closed to new replies.