- This topic has 304 replies, 99 voices, and was last updated 1 year ago by TheArtistFormerlyKnownAsSTR.

-

Early retirement how much money?

-

stripeysocksFree MemberPosted 3 years ago

https://monevator.com/what-is-a-sustainable-withdrawal-rate-for-a-world-portfolio/

for the 75k earning – I wasn’t questioning this, just stating that if you earn 75k when you retire, you probably want to have a 50k pension to not have significant loss of lifestyle – whereas at 50k income you’d be ‘happy’ with 30k.

Well if you’ve been shovelling 40k pa into the pension and a chunk of the rest into ISAs for years then you’re not likely to notice a dip in lifestyle…

dave661350Full MemberPosted 3 years agoI can’t see where you’re coming from saying you need to earn 60-70% as much in retirement.

You wouldn’t need to earn that percentage IMHO

My wife and I are both retired. We are on 50% of our final salary but take home c 65% of our ‘last working months take home’. In real terms we are better off. We now have no mortgage, no longer pay a huge chunk into the pension, no longer pay NI and have chosen to drop to 1 car from 2, so lower monthly there. Lockdown has shown us what we could live on with no extras.

Planned properly, 6 weeks in Spain or Portugal in February/March can be done very cheaply so getting away from dull and dreary UK is easy enough.

Posh holidays? Not really my thing but easily do-able every couple of years if you really planned for it…same with a new bike etc.steve-gFree MemberPosted 3 years agoThinking about the above and yeah, I dont think I would need anywhere near what my current level of income is to have a lifestyle I would enjoy.

As has been mentioned the obvious big difference would be not having the mortgage and overpayments (soon to be pension payments) coming out – that’s probably worth 30% just there. We bought the house we could afford a few promotions ago and never moved up as we got more money which puts us on a good footing there. Then as above lockdown has made me realise that the simple things and a slower paced life are enough to keep me happy, and as someone said a less manic goal orientated use of free time will be a saving. Not being bound to the school holidays makes those about a third of the price too, and my hobbies are all relatively cheap things like running, hiking, cooking etc

I’ve rung around the historic providers for the pension scheme at work and found I have a couple of amounts so I’m not starting from zero either which is good but looks like I have some work to do if I want to beat the mortgage, squirrel a ton away in pensions and have enough to bridge a gap from say maybe 52 to 57

bruneepFull MemberPosted 3 years agono longer pay NI

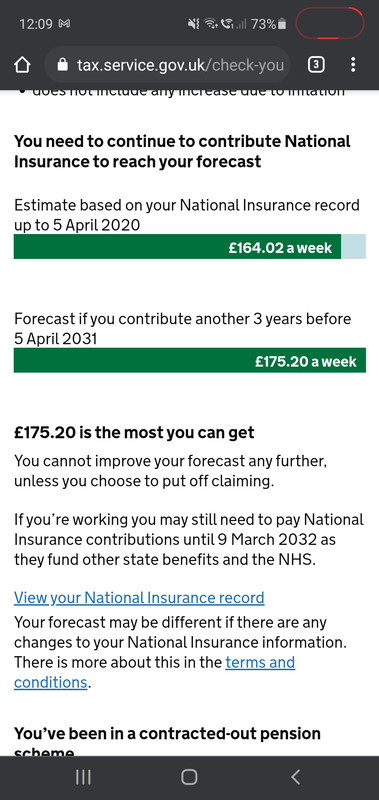

Make sure you keep your NI payments up to date with voluntary contributions if you want to get the max state pension. A simple check on gov gateway will tell you if up to date or short

inthebordersFree MemberPosted 3 years agoMake sure you keep your NI payments up to date with voluntary contributions if you want to get the max state pension. A simple check on gov gateway will tell you if up to date or short

For those of us who didn’t ‘waste’ their years away drinking in the Uni Bar we’re already well passed them – it’s only 35 years.

stumpy01Full MemberPosted 3 years agoThis thread has really got me thinking.

I have got 4 pensions in total from 4 different employers – only one is currently being paid into & is the one that is the largest, so I tend to concentrate on what that will give me in my retirement.

I generally have money left over at the end of the month – normally not a ton of it, but some. Currently with lockdown restrictions & no commute, there is obviously more.

I am currently overpaying the mortgage by a modest amount, but constantly wonder about the worth of doing that with low interest rates. I could put that money in an investment ISA & make it work harder. It would also be available if needed, whereas the mortgage overpayments are gone once the payment is made.

Or I could put the money onto my pension but again, that money is then not available should the need arise.The rest of the money gets chucked into random savings accounts – one for house renovation work that needs doing (new boiler soon, hall, stairs, landing redecorating & a new kitchen at some point) and another which is just a random savings pot. But they earn bugger all interest so seems like a foolish way of doing things.

I think I need to review all of my spending & have a bit of a re-jig.

For example, I’m currently paying £150 a month into childcare vouchers, but we barely have any childcare requirements. We envisage will we need to use after-school clubs in the future & probably for a few weeks during the summer holidays, but we have a current balance of over £3k of vouchers which should keep us going for a while.Anyway – good thread this. Certainly gives some things to think about.

inthebordersFree MemberPosted 3 years agostumpy01

Eggs and baskets. Don’t concentrate on any one ‘investment’ or investment type IMO.

5labFull MemberPosted 3 years agohave a look at LISAs as well if you want a blend of locked-in and not. LISA is better than an ISA for retirement saving (but worse than a pension) – but the advantage is you can take your cash out of a LISA at any point with a minimal cost (something like 4%) if you have to. There’s a bunch of limits as to how much and who (under 50s, 4k a year) but its always good to get some free money from the government.

as for retirement spending, everyone’s different. I imagine that going from 7 weeks a year of messing around in foreign countries to up to 52 will significantly increase my spending in the first 5-10 years, although it might well slow down after that.

petecFree MemberPosted 3 years agoLISAs

unfortunately for me (and others….)

Anyone aged 18 to 39 can open a LISA

dantsw13Full MemberPosted 3 years agoI would look at pension contributions now as there is a chance tax relief will change in the budget.

I see my pension as long term savings now as I retire (60) in 14 years, and no other investment can come close to the 40% bonus of tax relief.

stripeysocksFree MemberPosted 3 years agoIf you’ve got old DC pensions, folks, check the charges and investments – might well save a few bob transferring them to a low cost SIPP with a decent range of index trackers, ITs etc

breatheeasyFree MemberPosted 3 years agoFor those of us who didn’t ‘waste’ their years away drinking in the Uni Bar we’re already well passed them – it’s only 35 years.

Assuming you didn’t get caught up in the opted-out pensions that were the rage a few year ago that don’t count towards your numbers IIRC (could be wrong).

I checked the gov website about my contributions (like you assuming I’d have my 35 years in in the next year or so). Apparently not, even though I was in full time PAYE employment it came up saying I’d only part paid in some of my early years (no idea how or why) so I’ve potentially three more year that I wasn’t expecting and far too late to get it sorted.

daveyladFree MemberPosted 3 years agoI’m also a bit confused about the 35 years. The gov website says 34 full years so I assume it will tick over to 35 in the next tax year, April? Which will give me full allowance.

I certainly don’t recall having a job and paying ni between 16 to 20 so not sure how it’s hit 34 really.nickjbFree MemberPosted 3 years agoThere are exemptions and years that count without contributing. IIRC my two years at college (16-18) count, but my uni years don’t count (although I got a partial credit for part time work)

daveyladFree MemberPosted 3 years agoYes I wasnt clear it shows me as having 34 full years of contributions in the forecast portal.

34 years of full contributions

17 years to contribute before 5 April 2037

You do not have any gaps in your record.Which is odd as i was in higher education till 20 or so & did some slacking off in my late 20’s.

Good result though.5labFull MemberPosted 3 years ago40% bonus of tax relief.

whilst the tax relief is good, its worth remembering that its only for the initial ~25% (tax free lump sum) + 3kpa (difference between state pension and tax free limits) of income – after that you’re taxed at 20% or (less likely) 40% on your income – still good but not as good.

impatientbullFull MemberPosted 3 years agoI think he was referring to the tax relief on the money paid in, rather than coming out.

tjagainFull MemberPosted 3 years agoJust to the OP. I am retiring soon on about 1/4 of what you will have. I do not care that i will be skint. I will not be working

5labFull MemberPosted 3 years agoAs what?

its not as good as 40% off. In fact, LISAs, VCTs, and EIS can all be more tax efficient depending on your cirucmstances

onewheelgoodFull MemberPosted 3 years agoits not as good as 40% off

It really is. You pay money into into a pension. The government instantly adds 20%. Then when you do your tax return, you tell them you put money into a pension and then they give you another 20% (assuming you are paying higher rate, of course). Then you get the compound growth on that 20% until you draw on it. I don’t really think you can beat that with any of your other options.

bruneepFull MemberPosted 3 years agoI was auto opted out by work, had no choice so I still have 3 yrs to pay despite 40 yrs of contributions

lb77Full MemberPosted 3 years ago@stumpy01 – re: childcare vouchers, sure you’re aware but you can’t turn them back into cash. I’d have a clear plan on when and how you’re going to spend that £3k

I have £300 in vouchers sitting there now with no way of spending them. Youngest is going to senior school in September so no need for before/after clubs anymore. Only way I can think of using the money is on private tutors who may accept the vouchers

5labFull MemberPosted 3 years agoIt really is. You pay money into into a pension. The government instantly adds 20%. Then when you do your tax return, you tell them you put money into a pension and then they give you another 20% (assuming you are paying higher rate, of course). Then you get the compound growth on that 20% until you draw on it. I don’t really think you can beat that with any of your other options.

Its not as good as 40% when you’re taxed 20% on close to 75% of what you withdraw. Its much closer to 25%.

An seis has a 50% tax claim and an eis is 30%. Both of those significantly beat pensions from a pure tax perspective (although they are generally riskier investments)

andy5390Full MemberPosted 3 years agoI still have 3 yrs to pay despite 40 yrs of contributions

I’m in exactly the same position: years to go, contributions to make.

At today’s rates, Grade 3 contributions would cost £2340 for 3 years worth, @ £15 p/w.

At least I have 11 years to decide if it’s worth it, for £10 a week

iaincFull MemberPosted 3 years agoThis is a fascinating post. I am 55 tomorrow, working in a good job and decent salary, with a fairly poor private pension. No mortgage, nice house, 2 teenage kids, and moderate savings (a year of net income] plus a good planned inheritance which is unfortunately not too far distant.

I haven’t really thought much about all of this until this thread !

stavaiganFree MemberPosted 3 years agoIs there a school of thought that you’re better to spend now while younger and fitter and can enjoy life, work till 67 and accept you’ll be poorer when less able to do the good stuff anyway.

flickerFree MemberPosted 3 years agoThere is, and that’s fine if you are knackered by the time you reach 67. If you’re fit and healthy though 20+ years on the bread line my not be much fun.

nickjbFree MemberPosted 3 years agoIs there a school of thought that you’re better to spend now while younger and fitter and can enjoy life, work till 67 and accept you’ll be poorer when less able to do the good stuff anyway

There is a balance. Whenever pensions comes up here it’s often said that the best thing is to put as much as you can in as early as you can but when young there is so much to spend money on. I worked a bit then blew my savings on some traveling. Came back then did it again. Had some great trips at an age when I was happy to bum around. No regrets at all. Then came buying a house. Not much spare money when doing that. Once settled I’ve got into saving for the future. Definitely started late but not too late I hope. On track for early retirement.

hammy7272Free MemberPosted 3 years agoI think the balance is tricky as mentioned. Also I think it is hard to curb lifestyle creep as earnings typically increase with age and experience. I try and put any pay increase into pension to avoid frittering it away.

Balance of ISA and pensions for me. ISA for the access before 55/57 and pensions for the tax relief. Probably around 15 years off for me but I have an overall pot size in mind to drawdown an annual income. At this point cash flow software would be useful to forecast the increase when state pension kicks in so you can afford to drawdown at a higher rate before the state commences.

Lots of variables in 15 years. One thing I’ll never forget a colleague saying to me when I was 20, “early contributions make the dough rise.” Very true and there is a reason Albert Einstein was a big fan of compound interest. https://www.aesinternational.com/blog/is-compound-interest-the-eighth-wonder-of-the-world

tjagainFull MemberPosted 3 years agoI blew all my money travelling when 30. I had to start again when I came back. I am still retiring at 60 but I do not live an extravagant lifestyle. Its going to be tricky living on my small pension but I can do it

For me the key is to live a sustainable life

oldmanmtb2Free MemberPosted 3 years agoJust an observation, many folks in here very focused on “retirement” as in stopping working. I think work in some form is really good for most people be it paid, a business or voluntary.

The real question for me is how do you fill your time during a winter like this unless you have plenty of cash? My Dad retired at 63 and basically sat on his arse until he passed away watching crap TV. My Father in Law also retired early and just drank away the time.

Maybe part time jobs setting up a small business help both financially and mentally?

Digger90Free MemberPosted 3 years agoVery similar thread here with some different ideas and perhaps more emphasis on how to spend your retirement rather than how much is needed.

Pasted my reply/info from that thread:

Some great info on this thread, and some very inspirational thoughts and ideas too.

Fantastic reading the things that people actually DO with their retirement time – and I’d like to find out more, as many people think that once they stop working, that’s it: Boredom. Personally, I don’t get that, as @blokeuptheroad said, there’s an endless universe of opportunity if you think about it.

I’d like to hear more people’s thoughts and ideas about how they actually spend their time in retirement… my ideas below.

But first, for those who don’t know what their financial situation is, or how they’ll fund retirement, I recommend doing the following:

1. Start by tracking what your outgoings are today with your current lifestyle.

– Download some expense tracking software that automatically sucks in and categorises the transactions from your bank accounts, credit cards etc. Make sure you go though it regularly to ensure the categorisations are correct.

– This may sound like drudgery, but it’s actually fun, and there’s tremendous value in knowing what you’re actually spending rather than guessing.

– So far as apps go, I’ve used BankTivity and Quicken in the past, but MoneyHub is my favourite these days – simple, easy, brilliant, UK-not-US centric, and inexpensive at £10/year.2. Do the above for at least 6 months then extrapolate it on a spreadsheet to a full year.

– Obviously, a year or more gives you much more reliable data and takes account of seasonal fluctuations such as Christmas, summer holidays, birthdays, etc.

– Doing this will give you an insight into what your actual spending is.

– Now, project out how you think your spending in each category will change in retirement. For example, in our case we reduced the amounts each year for groceries (as we won’t be feeding a family of 5), child & dependent expenses, clothing, cars (as we won’t need the 3 we currently have), car insurance, telephones & mobiles, and so on – and increased the amounts we’ll likely spend on travel/holidays, hobbies, entertainment, eating out, medical expenses, gifts, etc.3. Get control of your Pensions

– If, like me, you don’t know what your pensions amount to (I had 9 pensions from 6 employers over 29 years), contact all your providers and get statements for retirement income and/or transfer out values.

– Consider carefully whether what your money is actually invested in (the ‘underlying’) and whether it is in the right place(s).

– In my case, once I saw it all laid out I was shocked at how poorly some of my pension pots were performing – then embarrassed/ashamed at how how many years I’d ignored doing anything about it (!).

– As to what your money should be invested in, well, there’s no one right answer for everyone. But if, like me, you’ve ignored it for some time, or if you’re not sure – then clue yourself up! Get sure. Do a bit of reading up on how to invest, what Funds are, what Index Trackers are, what Bonds are, what other investments are. If that all sounds too boring, go and see an IFA – but beware of high fees for some funds.

– Just clue yourself up and start to make better choices. *see point 5 below.4. Project out (again, using a spreadsheet) what all your future sources of income will be p/a (State Pension, personal Pension, investment income, savings income, other sources of income if you have them), and compare it to your projected annual outgoings from Step 2. You’ll immediately see if you’re ‘good to go’ or not.

– If not, consider how you can reduce your current spending in order to save/invest more.

– The financial insight you have gained from step 2. above will be invaluable as you do this.5. Clue Yourself Up.

– I won’t get into the debate here about the 4% rule, where to invest/what to invest in, pensions, savings, etc… there’s a bazillion books and articles out there already. But for anyone who’s interested in retiring early there are some valuable sources of info out there.

– Start by reading JL Collins’ “The Simple Path To Wealth’ (and/or read his blog), listen to the ‘MadFientist’ podcast (and other ‘FIRE’ podcasts), read ‘Mr Money Mustache’s’ blog, etc.. Just Google ‘FIRE’ and start browsing.Now onto the more interesting stuff: ‘What to do with your time once retired’…

I’m 55 and am in the fortunate position of being financially independent. No, I didn’t inherit a fortune. No, I didn’t make millions in the City. And no, I am not a drug dealer :-). I’ve never been given a thing and have had to work hard – very hard – for everything I’ve got. Often it was too hard, missing my kids birthdays, suffering incredible stress/burnout, nearly losing a marriage.

I’ve always avoided debt as much as possible and lived within my means. That is a core principle. Ok, we had a big mortgage (and miraculously managed to pay it off early), but aside from a mortgage we’ve avoided debt completely. We’re fortunate, in that yes, we could afford nice cars and stuff if we wanted them, but I always looked at my mates driving the latest BMW or whatever and thought “They’re nuts.. that £40k car will depreciate £20k in 2 years. I’d rather buy a £5k or £10k car and drive it for 5 years then sell it for £2k”.

That kind of philosophy goes a long way – and applies to most things in life. Life is not about material possessions: the nicest house, blingest car, the latest iPhone, gadget or doo-dad, a new Sky+ box, or whatever. Life is not about ‘Stuff’. We have more material possessions today than our grandparents or ancestors ever had – yet there is no evidence that they were any less happy. Life is about friendships, love, contribution, happiness, health, etc.

So.. what are those things for you? I’d love to hear what makes people happy.

What are the things you’d do if you retire today?

And for those who are already retired/have achieved FI, what do you do with your time?

For me, these are the things that are important to me:

– Go for walks with my wife & dog in the countryside

– Drink coffee with my wife/visit Cafe’s and just talk

– Continue to be a loving, supportive Dad to my 3 kids

– Ride my bike – with friends

– Spend a season or two (probably in a CamperVan) following the Pro road cycling season: starting with Flanders/Paris Roubaix, then onto the Giro, le Tour, la Vuelta and culminating at the Giro di Lombardia (not slavishly following every stage of every tour, but coming and going as we please, to the stages/places that interest us)

– Spend a month or so in summers hiking around the Alps/Pyrenees with a knapsack on my back

– Ski more, until such time as we’re unable to

– Laugh more

– Contribute more to our local Community (my wife has run the Cubs/Scouts for the past 12 years, I’ve volunteered at camps, village fetes etc… but I want to have more of an impact. I want to make a bigger contribution).

– Do more Yoga. I love it and always feel better.

– Vitality/Health/Fitness/Mobility/Wellbeing: walk, run, yoga, cycle, maybe take up some calisthenics, reading.kennypFree MemberPosted 3 years agoThe real question for me is how do you fill your time during a winter like this unless you have plenty of cash?

I’m intrigued as to why spending loads of cash is necessary to fill your time during a winter lockdown? Unless it’s illegal/immoral travel what would you spend your money on?

Don’t get me wrong, I’d happily (until Mrs Kenny found out and killed me) go onto Wiggle now and spend thousands easily. Or buy loads of other things. However none of them are really necessary to make life enjoyable.

There’s a ton of stuff out there to do that costs nothing or very little, even in the depths of winter.

bradsFree MemberPosted 3 years agoJust an observation, many folks in here very focused on “retirement” as in stopping working. I think work in some form is really good for most people be it paid, a business or voluntary.

Nope. No way.

tjagainFull MemberPosted 3 years agoJust an observation, many folks in here very focused on “retirement” as in stopping working. I think work in some form is really good for most people be it paid, a business or voluntary.

Not meaning to be offensive but that thought to me shows a total lack of imagination

First summer retired me and t’missus are going to do a long walk – several hundred miles

first winter – was supposed to be south america trekking. covid may have effed that up. Second summer – long cycle tour round europe. Several thousand miles. 2nd winter – antipodes for a road trip.Other things planned – tour of the india sub continent to take in some big cricket matches, Highlands and islands bike tour, more walking in Europe

You must be logged in to reply to this topic.