Forum Replies Created

-

Fresh Goods Friday 719: The Jewelled Skeleton Edition

-

choronFree MemberPosted 12 years ago

Err, amazed that I need to clarify this, but…

Cut and paste from your own publications (and other unpublished but written up research) only: this way you can put in the results that you want/need and remove the unnecessary and or unneeded ones.

Publication based thesis would have been fantastic, but for me wasn’t an option (edit: depending on Uni regulations, this kind of thesis may or may not be permitted. The OP might have 10 papers in Science and Nature, but that in and of itself doesn’t get you a PhD: you still need to write a thesis.). I was writing from more or less a blank page (in thesis terms) but with ~20 peer reviewed publications.

@chewkw – You have a good point, but my feeling is that if you spend a massive amount of time and effort getting a PhD in order to get rich, you will almost certainly be disappointed. Depending on the field (and to a lesser degree the quality of the research) there are well paid jobs for PhDs out there, but for most people I don’t think that this is a primary motivation.

choronFree MemberPosted 12 years agoJust noticed that this thread was started at the time when I was finishing writing up. My 2p is as follows:

Cut and paste any old crap from papers etc into a rough outline of the ‘meat’ of the thesis. Then you have a good idea of how the overall flow of the results will be. This ‘story’ then informs what you need or can ignore from the literature in your intro/review sections. Next come conclusions and future work (future work is v. important) which should be clear from the content. Lastly, abstract and intro.

I found the best way to work was to fire out a rubbish draft quickly (6 wks) and then spend a significant amount of time refining and reworking it (another 6 wks). This way, you avoid ‘blank page’ problems. Also, don’t be frightened of keeping it short and sweet: 150 pages max IMO (no examiner wants to read 400 pages when 130 would do).

I think of it as taking a truly massive dump: painful and feels like it will go on for ever, but eventually you’ll be left satisfied and a little sore.

Dr Choron (EE)

choronFree MemberPosted 12 years agoahwiles: You could just crop the highest and lowest values. It would be better to know a little of what kind of signals (dimensions etc) you are using and what you will do with them though, I may be able to give you some more sophisticated advice.

IanMunro: LPF design is pretty straightforward if youre using something like Matlab. Are you after a pseudo-analogue filter (approximation of Butterworth, Bessel, Chebyshev etc), or an FIR? Both are fairly straight-forward with the appropriate tools.

choronFree MemberPosted 12 years agoPah, for real ripoffology, you need to look no further than the big S:

Couple of sprockets for your XTR cassette: £140

New carbon cage for your XTR mech: £175

Best of all: 3 bolts for the XTR rear mech: £60!!!!choronFree MemberPosted 12 years agoAlso sugdenr, you sound like a canny investor.

Would you like to buy some magic beans? Subprime CDOs?

choronFree MemberPosted 12 years agoAn interesting problem, personally if I had the money (and I definitely don’t) I wouldn’t go near property with a bargepole. While prices haven’t significantly declined since 2008, volume has dropped massively (maybe 10x?). As a result the ‘price discovery’ aspect of the market is malfunctioning: people would rather hold on to their property and avoid realising a loss, or advertise at an unreasonable rate and simply not sell.

The clear indicator is the price to earnings ratio: if you reckon on a mean reversion to say 3x salary, then prices would have to drop by ~30% or salaries rise by 30%. In all likelihood, some combination of the two would achieve this.

However, as previously pointed out, we have a zero interest rate policy (ZIRP) in operation: the only thing which really can only go up are rates. As soon as wage inflation kicks in (i.e. your 30% salary increase for mean reversion) rates will go up. Historically, interest rates break upwards and very sharply:

While you might think a big house would be affordable now, how about if we get to 20% interest rates? My attitude is that debt is a liability (literally and figuratively) in the current highly unstable climate, and it is better to save and invest across a variety of asset classes (equity, cash, metals etc.) which will leave you much less vulnerable if we encounter significant economic problems.

Such as (in no particular order):

Chinese property crash/recession

Eurozone defaults

Euro breakup

Global recession

Global liquidity crunch (mk. 2)

Competitive currency devaluation/ trade warschoronFree MemberPosted 12 years agoPotential astro-turfing here? A guy turns up to plug a (slightly dodgy looking IMO) company with his first post?

Putting a certain username into google with either the word “bike” or “bike leasing company” throws up a few interesting results too.

Anybody care to do a bit of digging? Should I start sharpening my pitchfork?

Anybody want to pay a shitload of money to not own a bike?

choronFree MemberPosted 12 years agoGuess this depends pretty heavily on the nature of the course: if studying science or engineering I reckon working during term time is asking for trouble. 20 hours a week of contact and 15-20 hours of homework/ lab work leaves no time for a job.

IMO much better to concentrate on getting a decent degree and work during the summer.

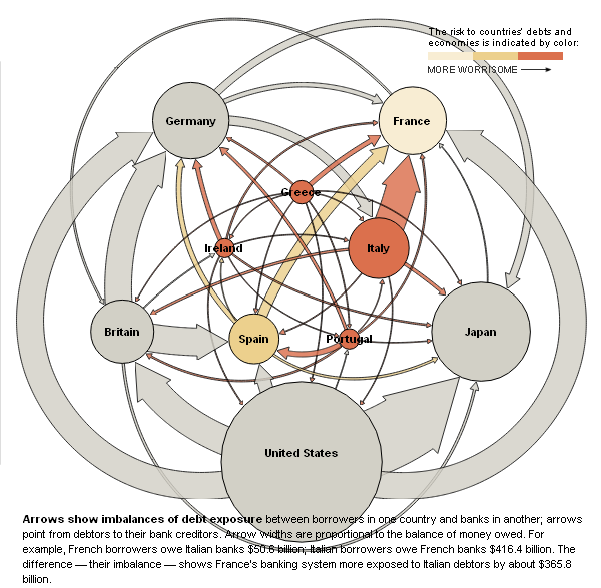

choronFree MemberPosted 12 years agoSorry, things were getting a little dense there. A few definitions and the like:

LTRO – long term refinancing operation (ECB providing short term cash to banks to counteract the current credit crunch that european banks are experiencing).

EFSF – european financial stability facility

ESM – european stability mechanism

(also EFSM – european financial stability mechanism)

These are investment vehicles by which the EU borrows money on the financial markets to lend to lend to countries (PIIGS etc) which cannot finance themselves directly on the bond markets (as their yields or effective interest rates are too high). This borrowing is guaranteed by EU member states, particularly Germany, but also France, UK etc.T1C – tier 1 capital: the amount of ‘really good’ assets (US government bonds, cash, gold etc) that a financial institution holds in case other ‘assets’ bought with borrowed money (or leverage) decrease in value. This is often described as a fraction of the total balance sheet of the institution and can describe the total leverage ratio of the institution. A good example is getting a mortgage with a 25% deposit. This would give you a tier 1 capital ratio of 25%, or a leverage of 4:1. For you to become insolvent (negative equity) your assets (house) needs to lose more than 25% of their value. For reference some really big and structurally important euro banks like Soc Gen now have a leverage of about 60:1, twice that of Lehman or Bear Stearns.

IS/LM – see post above

choronFree MemberPosted 12 years agoThe WW3 comment was a semi-joke. Although it seems like a remote possibility at the minute, financial crises always play into the hands of the nutters (see Hungary et al).

The Ed Balls speech is quite illuminating: it shows the political imperative to sound like a deficit hawk when you know that is not the best idea from a macro point of view. For what it’s worth, I also feel like some of the targets of the cuts are very valid targets, particularly higher education, the NHS and some benefits. The way the cuts have been handled so far seems very amateurish though, and leads me to think that nobody in government has much of an idea.

For my money the Euro breakup (to some degree) is already a dead cert. The interesting question is when and how, and what will be the major consequences. The big players are up for re-election soon and nobody can have any chance of campaigning while being the person who killed the euro. However, the longer the can is kicked down the road the worse things get (see the slow-mo bank runs in Greece and Portugal for evidence of this). For me the really critical moment will be (perhaps in the next year) when we have a major restructuring of the Euro and there will be (~6pm Friday evening) an EU/ECB announcement of capital controls across the eurozone. From that point all bets are off.

Maybe I’m just cynical, but I really don’t see that any politician(s) have the power to stop us getting to that stage. Once capital controls are introduced on a wide-scale basis then the crisis goes from empty shops and high unemployment which can be ignored or downplayed by at least some of the population, to a very real immediate crisis which affects even the very richest.

choronFree MemberPosted 12 years agoteamhurtmore – I completely agree that the monetarist approach isn’t working: it seems to me that all QE has achieved so far is a big chunk of (commodity price) inflation. LTRO seems to me to be an incredible misappropriation of capital/risk as banks either engage in a sovereign carry (spanish bond @7% – ECB base rate @1% = 6% free money), or simply park the money back in the ECB deposit facility and artificially improve their capital ratios. These strategies do nothing for the macro situation, and simply inflate bank profit/T1C for a HUGE risk on the ECB balance sheet.

I’m not sure if I agree that the UK government are constrained by the deficit when it comes to pursuing Keynesian spending policies though: we (along with the US and Japan, neither a model of fiscal health) control our own currency and therefore are not at risk of hard default. The bond market knows this and therefore prices our debt accordingly: making us effectively the best looking horse(s) in the glue factory.

My feeling with the real reason for the current trend for austerity is that it is simply political opportunism. Due to the consumer debt overhang a great number of people are worried about their personal circumstances and are currently in the process of deleveraging. I think that there is some overflow from anxiety about personal balance sheet problems to anxiety about national balance sheets: hence the entirely fatuous comparisons between sovereign debt and credit cards / household finances that have been made (initially by Osbourne, but increasingly by Balls & Alexander). These guys know that the comparison is entirely inappropriate, but they can make significant political capital by engaging in this kind of scaremongering around election time. They then have to keep that advantage by setting out on an austerity agenda, even though it is clearly an insane proposition.

More than anything, I’m wondering exactly how much worse things can get before they start to improve. If we really need a big stimulus then maybe WW3 is the only thing that would really push governments in that direction. The fundamental fact is that one man’s saving is another man’s borrowing: sovereign, commercial and domestic deleveraging all at the same time is never going to work.

choronFree MemberPosted 12 years agoErr.. feel like I should point out that the OP was not trolling: I reckon this place can actually be an interesting place for this type of discussion due to the variety of opinions (even TJ, Elf et al), much more so than an econ/finance forum.

One thing that I forgot to mention is the exploding ECB balance sheet due to structures such as LTRO/EFSF/ESM: these ensure that a very real risk is shared by even the most secure core euro countries (Germany etc). When things go wrong, they will really go wrong…

choronFree MemberPosted 12 years agoJust personal experience here, but still…

Technical subjects at a decent uni are HARD, doing something that you’re not into will be impossible to do well enough to make it worthwhile. Given the cost of going (~20k/yr) is pretty huge, it’s good to explore all options before deciding on a course. I made a rash decision and wasted a couple of years doing something that wasn’t right: nowadays that would be another 15k in fees than it cost me.

It’s worth investigating other subjects around the computing/engineering/science area. Personally I’m an engineer, but at the age of 18 I had little or no idea what various flavours of engineering involve. It’s good to talk to both uni folk and professionals to find out about this kind of stuff.

A good degree makes all the difference when getting a job, and in technical subjects this almost always means a masters. Partly this is due to the increase in degrees, but mostly I think that this is simply due to A-levels becoming progressively easier. An integrated masters (4 yr undergrad) is still pretty well universally the cheapest option as far as i’m aware, and is not badly regarded (at least in my field). Also the better the uni, the better the chances of a decent job afterwards. Kind of obvious, but the amount of fees a uni can charge is not necessarily a reflection of the utility of their degrees.

Also, I didn’t like my school and went to an FE college for A-levels (although doing them at the school wasn’t an option). College was great: more people, new people, being treated a bit more like an adult and a far greater choice of subjects.

I would also say that not all A-levels are equal: as previously noted, maths and physics are pretty well essential for anything related to computing or engineering. I would recommend at least two, maybe three technical subjects (personal recommendation: not IT or computing, they’re in general neither required nor expected and sciences give more options later), and also something just for fun.

[/rant]

choronFree MemberPosted 12 years agoBest I’ve heard was the proposed remake of Old Boy.

Made by Spielberg, and starring Will Smith!!!

choronFree MemberPosted 12 years agoBest meal I ever had was at the sea grill sitting outside in manhattan in summer with my dad, eating, drinking and bullshitting. Fantastic skyscraper views and beautiful people, even if the bill came to $800 for two.

My favourite in london is pied a terre on charlotte street. Expensive, but incredible food, good wine, good service and a fantastic atmosphere.

choronFree MemberPosted 12 years agoJust because the balaclava and pipe combo is so difficult to pull off:

choronFree MemberPosted 12 years ago

choronFree MemberPosted 12 years agoPublications are the academic equivalent of undergraduate exams: a metric of limited use which is there to be gamed mercilessly. Why bother trying to write few papers based on a lot of research when you can write many papers based on a little research.

I think I’m guilty of this to some degree and I’m pretty sure almost everybody else is.

The other approach is to get a shed load of PhD students and flog them to death with minimal supervision, thus gaining maximum publications for minimal effort (5 students at 1 hour per week each resulting in 15 publications per year in total or so).

choronFree MemberPosted 12 years agoGenerally, digital communication rates are measured in bits per second (b/s or bps) while stored digital information is measured in bytes (B). The 8-bit byte is a bit of a historical overhang: a byte is related to the size of a computer instruction (32 or 64 in most modern systems).

There is also an interesting overlap where information content of things (signals, images, books, clouds…) is measured in bits.

Cougar: who is using baud and for what? might not be old enough to remember, but that seems rather technical for most people (at least to me). For instance: 10GbE => 10.7GBd but 100GbE =>28GBd

choronFree MemberPosted 12 years agoThe Fed is currently extending USD liquidity swaps to pretty much anybody and everybody due to a massive liquidity crunch. Seems pretty clear to me that we are in the early stages of a massive banking crisis.

Like to think I’m normally fairly dispassionate about these things but in the words of Hugh Hendry “I would recommend that you panic”

choronFree MemberPosted 12 years agoAs a rough indication of just how massive an h-index 67 is, have a look at this list of h-index for people working in computer science.

At least in CS, 67 would make you roughly top 50 in the world!

choronFree MemberPosted 12 years agoJust checked the wikipedia article on this, and it seems that self-citations are not excluded from the h-index. This makes me a 7, due to my relentless self promotion.

H-index is not perfect by any means and is heavily biased towards older researchers (famously Galois’ h-index is 2). Field also seems to be very important: I work in a field of engineering where people publish a lot of relatively short papers (15 papers during my PhD while being distinctly mediocre) and have got to a 7 in 4 years, this is pretty much impossible in a field like biology or maths.

67 is really impressive! How long were you at it and what field were you in djaustin?

choronFree MemberPosted 12 years agoHave been avoiding this thread as I can’t be bothered debating “the wall”.

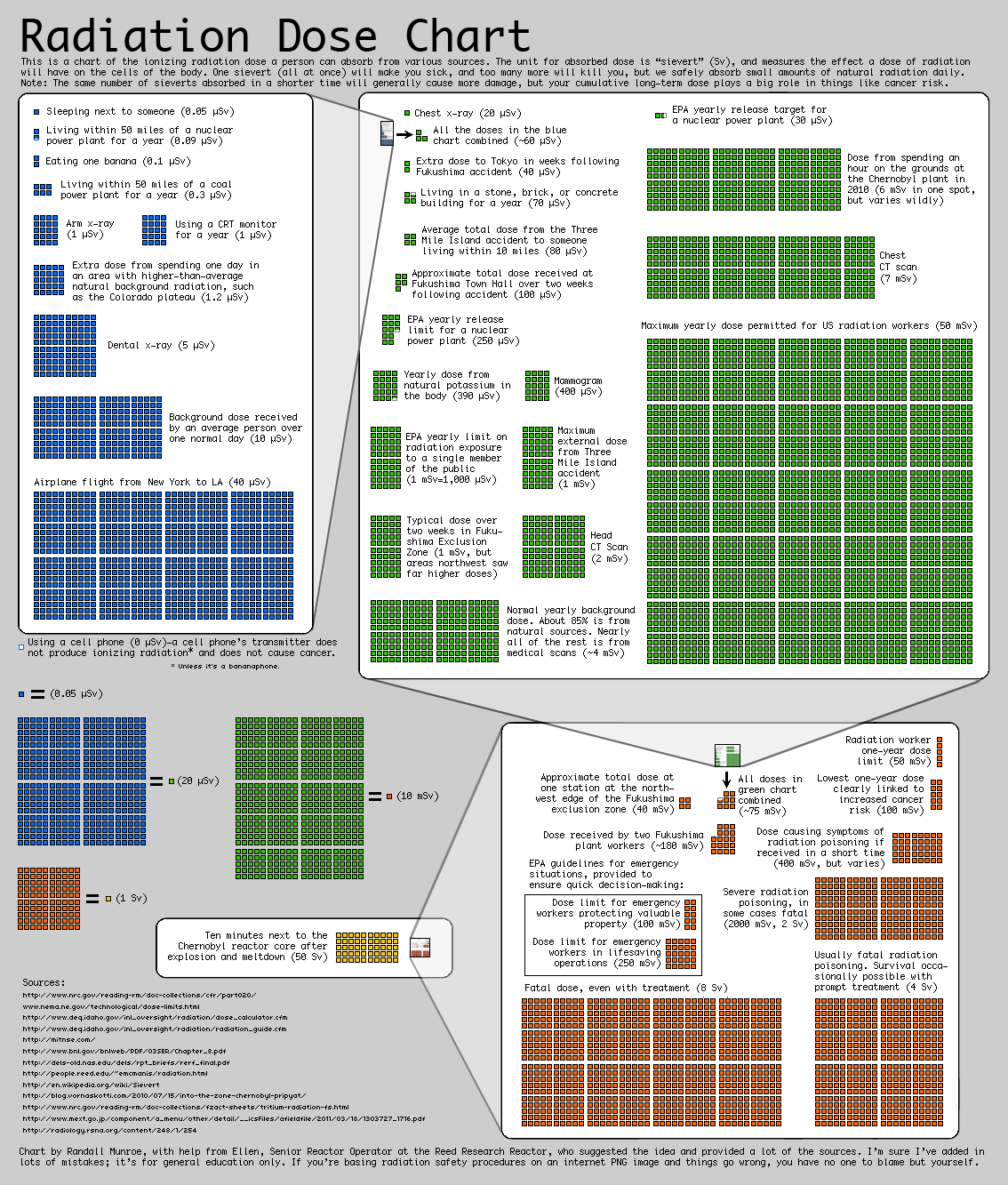

However, the debate about low doses and dose thresholds allows me to post one of my favourite graphics (big pic, might need to look at the original):

Apologies if it has already been posted, couldn’t be bothered to read the entire thread.

choronFree MemberPosted 12 years agoGet hold of BetterTouchTool. Allows much more customisation of gestures/clicks/swipes than the native mac software.

choronFree MemberPosted 12 years agoNot sure how todays market movements can be entirely put down to the spanish election.

General macro environment is terrible and getting worse. Nothing but bad news for months now, and it’s becoming clear just how bad the state of the eurozone is.

The MF global debacle seems to be getting worse and worse, while commodity margins are being hiked again and again leading to big sell-offs. I think this exacerbates things in the US and asia, there are no safe-havens right now globally.

The real worry is the state of euro banks: a shock (likely) or a downgrade (very likely) could totally hammer these guys. Given the capital ratios of the likes of credit agricole, DB, BNP etc. any large event could lead to bankruptcy or more bailouts. Problem is, the governments can’t afford more bailouts and we’ll more than likely be looking at a downgrade/counterparty shitstorm if anything happens.

Just saw the numbers for the exposure of the EIB also: truly terrifying. Second (?) biggest lender in the world, backstopped by the EU and in deep to the worst economies in the eurozone. If I had to put my money on the thing to kill the euro this would be it.

choronFree MemberPosted 12 years agoNowhere too hot, about body temperature is best. Electronics are generally specced to work up to about 50C.

The point is to allow the moisture to evaporate naturally while there is no battery or other stuff that could cause problems with shorting.

If it were me, i’d leave it for a couple of days in an airing cupboard in a bag of rice. If you have problems turning it on after that, clean the contacts with IPA.

If you still have problems after that, you might be looking at replacing bits or the entire phone.

choronFree MemberPosted 12 years agoBattery, sim and memory card out, leave for a couple of days in bag of rice in airing cupboard. Might want to clean the contacts on the battery/cards with some IPA before they go back in.

choronFree MemberPosted 12 years agoAs a long term student/academic/geek, I thought I might like it. But I hate it. Lazy stereotypes and rubbish plots, combined with pseudo-scientific tosh just wind me up.

A much better series about universities is Community.

choronFree MemberPosted 12 years agoNot sure about the hoobs, do you mean these ones?

Even the XC hope stuff is pretty tough: look at Andy Barlow from Dirtschool (would love to see some of you guys giving him sh1t about his lycra…)

choronFree MemberPosted 12 years ago

choronFree MemberPosted 12 years agobut assuming prices rebound a bit over the next 5 years,

this is the problem

choronFree MemberPosted 12 years agoIn my opinion, no. The Euro induced sovereign debt crisis is fast turning to a banking crisis which may well play out in a particularly ugly manner over the next couple of years.

This may well translate into a squeeze on mortgage availability here in the UK. If you are desperate to move, then now could be the right time as you may have trouble getting a loan in the future. However, the mortgage squeeze may well induce a significant drop in house prices. You don’t want to sell one property in order to avoid realising losses, but buying another property is in effect doubling up in the hope that the market won’t drop further.

My feeling is that you might find yourself in negative equity on two loans, while in a highly illiquid housing market (all those people that don’t want to sell to avoid realising losses). In a poor economy with job insecurity and a possible deep recession/depression on it’s way, this is a huge risk.

Maybe not an accurate opinion, and maybe not what you wanted to hear, but worth thinking about.

choronFree MemberPosted 12 years agoIs the wireless phone using ‘digital wireless’? If so, then forget interference from whatever. My guess is a crappy analogue phone degrading after use and abuse. Failing that, either a fault either on the line or in the wiring in your house.

choronFree MemberPosted 12 years agoHow about some lovely electrostatics. Might be a little over budget though…

choronFree MemberPosted 12 years agoWas going to say something profound, but was distracted by tasty mushrooms: