Forum Replies Created

-

Bespoked Manchester Early Bird Tickets On Sale Now!

-

brooessFree MemberPosted 8 years ago

I don’t buy light coloured cycling kit, especially for MTB… for exactly this reason.

Sorry, I know that doesn’t help!brooessFree MemberPosted 8 years agoToo many people are. The amount of conversations I hear to that tone.

I think given recent opinion polls showing, apparently, Osborne is less popular than Corbyn (wtaf! – he’s so far away from the centre and is widely held to be unelectable) the masses are now beginning to realise what has been obvious to those that read the financial papers, which is that the economy is not in a good place and has not really recovered at all from 2008 and this is a long-term problem we have (hence interest rates still being at emergency levels they were put at to stave off total collapse of the banks).

House prices are being clung on to by a massively indebted population like a drowning man to a liferaft – hence the rather religious nature of the discussion – there’s no facts or data from those that think prices will go up forever except ‘they have done since 1995’ (and even that’s only true in London and SE)…

I really worry that when the situation is such that government can’t prevent a crash (as Osborne did in 2013 with HTB and letting the wave foreign money in), how people will cope. We’re so dependent on it for positive sentiment. So many seem to have all their feelings of wealth wrapped up in their house price – and their pensions, that when that ‘money’ disappears, they’ll just be left high and dry. No savings, no pension, stuck in negative equity and too late in life to be able to do anything about it…

brooessFree MemberPosted 8 years agoWho drives the house price increases, excitable estate agents? Talk up the market, win the handling of the sale by promising the highest return to the vendor?

Fear of missing out…

1. A tidal wave of foreign money, much of it speculative, much of it criminal money being laundered

2. Super low interest rates making it ‘affordable’ to get balls-deep in debt

3. Deliberate government policy to limit building (greenbelt) and Help To Buy

4. A historically high level of appetite for debt amongst buyers

5. Older generation willing to get into more debt to pass on their ‘equity’ to their kids

6. Buy To Let buying on interest-free mortgages and passing on the costs to tenants

7. Banks needing to make an income somehow in a low interest rate environment

8. Estate agents with a culture of total dishonesty who can’t quite believe the idiocy of the great British public

9. The myth that ‘you can’t lose with property’. We’re pretty much hypnotised with this one.

10. A willingness to overpay on the assumption that prices will continue to go up forever even though their already beyond the limit of affordability for wage earners

11. Sellers who think they can charge what they like and offload the debt onto the younger generation.In the meantime we’re passing on ever increasing proportion of our post-tax income to the banks and leaving nothing left for day to day expenditure as we watch the economy flatline, and an increasing proportion of our taxes go to landlords and then to the banks in housing benefit…

Utterly stupid – we’re impoverishing ourselves on the altar of super high property prices… as said above if you follow the chain of money it’s only really the banks that get richer… cos that’s who we’re all paying the money to at the end of the day

brooessFree MemberPosted 8 years agoThis is a bunch of nonsense, as usual on here.

It’s just a vehicle that you buy because you want. Talk of inefficiency, marketing and status is pure junk

What you mean is (as per most people) you don’t like the real reasons behind your purchasing choices being analysed and exposed… like most, you find it challenging to admit your need for status, which is fair enough IMO.

At the end of the day how many short men buying sports cars actually admit to desire for the status they feel they lack as being the reason? It would take a superhuman level of self-awareness and maturity…

I work in marketing and if you ever talk to an experienced market research team they will tell you that you never take people’s articulation of their reasons for choosing one product over another, or even their decision to buy in the first place, at face value – few people have the self-awareness to really understand their real needs, decision-making processes and their basic psychology – almost all of it is subconscious and without a lot of therapy and self-analysis you won’t ever get to grips with your own self-talk…

We will post-rationalise till the cows come home in a way which allows us to present ourselves as a caring, thoughtful ‘nice’ human being – but that’s just post-rationalisation. Hence the ‘it’s for my kids safety’ rather than ‘my need for status/my need compete with my friends and neighbours’…

We managed mass car ownership and raising families from c1950s to the mid-90’s quite happily without them so I’m sure we can manage with smaller cars again… and I’m sure we will eventually – they’ll fall out of fashion eventually and you’ll see plenty of people who felt they were essential magically change their minds when they do :-)

brooessFree MemberPosted 8 years agoCar choice is more about status and desired image than most things we buy. SUVs and the like are British-Keeping-Up-With-The-Jones on stilts…

When they first came through in the 90’s there was a lot of resistance as on crowded and narrow UK roads and car parks they were clearly excessive and anti-social from their sheer size and physical presence. The dislike of them isn’t jealousy or anything new – it’s a pretty reasonable assessment IMO given the detrimental impact they have on the community, and at a time when we’re poisoning our air (9,000 early deaths from pollution in London each year from traffic) and generally killing the planet… they’re a pretty good sign that you don’t think much about the impact of your behaviour on other people…

I’d like to see a study about the psychological effect of isolating yourself from the outside world in such a well-protected vehicle and the impact on empathy and concern for others… their sheer size makes it much easier to feel detached, invincible and likely to bring out the bully in most people

It’s hard to think you’re superior to everyone else in a Renault Twingo!

brooessFree MemberPosted 8 years agoEither or both of:

1. Rip it all to iTunes and play it out of your PC through a USB DAC to your amp for top quality sound – much better than through the headphone jack

2. Spotify and a Google Chromecast Audio – £10 is not a lot to pay for Spotify and the higher quality steam you get for being a paid subscriber is as good as CDSell all your CDs on Music Magpie to provide funds for any new kit you buy – but all the above are easy to find cheaply

brooessFree MemberPosted 8 years agoLots of people out riding round Bucks this morning. Warm and sunny. I guess a lot were getting out while the weather’s good.

brooessFree MemberPosted 8 years agoSome specific thoughts. Not backed up by any medical evidence but some ideas which will hopefully help:

1. MTB I think is very meditative – singletrack requires full focus which forces all other thoughts out of your mind and keeps you living in the moment

2. Road riding with a club is more social and the chat-whilst-you-ride thing really helps you forget ‘stuff’ as well as giving you a weekly regular ride appointment with others that you’re more likely to keep if you don’t really feel like riding that day

3. Riding road with a fixed wheel requires a lot of focus – helping remove all other thoughts from your mind – as well as having a certain meditative effect from the regular rolling along in full connection with the bikeEither way, good luck

brooessFree MemberPosted 8 years agoIt always will be in my mind.

Until it stops being underwritten by deliberate government and central bank policy of course. Or the Millennials tell us all to get stuffed with expecting them to get into life-ruining debt to fund our retirements…

£37k will buy you a small BTL returning £2-3k and at the end your inheritors will have a property that at the very least is worth £37k and likely way more.

So many heroic assumptions in there. I do wonder how many people in or thinking about BTL have actually noticed the last three budgets (lower rate taxpayers may end up worse off because they’re in BTL for e.g. as their tax bill goes up next year) or the BoE’s request to intervene before it causes a massive crash… 8O

The thing about the ‘greater fool’ theory is that by definition, the greater fools don’t know they’re the fools… The last money into the bubble loses the most, especially when they’ve borrowed massively to play the game

brooessFree MemberPosted 8 years agoIf you’re London-based, have a chat with Condor

I have a pair of Condor rims on their Uno hubs which came with my Tempo, which have had 2.5 years of London commuting and been very good indeed – never come out of true. One snapped spoke and another which looks like it has a kink in it which probably needs replacing but given the use they’ve had I’ve been pretty impressed

brooessFree MemberPosted 8 years agoIsn’t this where ‘buy cheap, buy twice’ comes in? As per Freeagent’s experience w/the Arkose?

I was thinking about getting an Arkose but when I look at the one in the bike shed at work, it just looks heavy and thick – nothing like as nice as Cannondale ally frames for e.g.

Best to buy the highest quality frame you can – the one with the best quality and best craftsmanship and design, whatever material it’s made from? Cheap carbon is cheap because compromises have been made, surely?

Great thing about road bikes is with tech changing more slowly than MTB, once you get a good one, it’s a real keeper – so spending ££ on decent quality is better over the long term as you don’t feel the need to buy a whole new bike 2 years later. My Time carbon road bike is 6 years old and there’s no point even thinking about buying anything else – I can’t imagine a bike that would be better to ride even if I spent £4k+

brooessFree MemberPosted 8 years agoIt’s ok – according to your average Brit and average estate agent we’ll all be able to sell our houses in 20 years time to the younger generation for £1m+. No need for any other kind of pension :-)

I might get a SIPP and put it all into Dignitas shares – as they’ll be doing roaring business by the time I get to retirement after the generation before me realise how lousy their pensions are…

I’m not quite sure when UK became so financially illiterate that we decided that not bothering to save, but get up to our necks in debt/speculate on house prices was the best way to manage our finances… I don’t think the next 10 years are going to be pretty as these behaviours come home to bite us. They kind of have already but it’s not fully out in the open yet…

brooessFree MemberPosted 8 years agoI’ve just worn out a pair of Conti Grand Prix GPs after 2 and a half years of city commuting. Very grippy and comfortable, nicer I think than the GP4000s. Cheaper too

brooessFree MemberPosted 8 years agoI agree, that video’s great :-)

Good luck to your wife OP – great to see cycling making some progress towards becoming normalised

brooessFree MemberPosted 8 years agoOK, I stand corrected. Either way – 8 years into a crisis which started with mortgage lending to people who couldn’t pay it back which damn nearly brought the whole global economy to its knees and we think interest-only mortgages and generally getting into more debt is a good idea? 8O Is no-one reading the financial papers before they make decisions about taking on massive debt?

one or two do and they are from well known high street lenders

um, RBS, Bradford & Bingley and Northern Rock were all well-known high street lenders…

Badnews, is right though, I fear. Osborne bought the last election with a deliberate stoking of the housing market with Help To Buy – he know how the Brit mindset works with house prices and mortgages… + I suspect if the housing market dropped now the bad debts would all appear on the banks’ balance sheets and we’d be straight into another crisis with no way out this time.

Meanwhile the younger generation are being expected to get themselves into a lifetime of massive massive debt just to keep us lot feeling rich… I reckon there’ll be a hell of a shock when we realise they aren’t prepared to play that game…

brooessFree MemberPosted 8 years agoScreaming Trees underrated IMO

Mother Love Bone I still listen to. PJ I don’t

Nirvana obvs

SoundgardenbrooessFree MemberPosted 8 years agoInterest-only mortgages were banned by BoE for a very good reason! Serving you well so far does not mean serving you well in future…

I really wouldn’t make any plans based on the assumption that London prices will keep rising… they’re so far ahead of salaries and all historical precedence now… with BTL being sent to the slaughterhouse by Osborne and the stories about prime London coming to a grinding halt, and prices so far out of reach of FTBers I really can’t see where the buyers are going to come from at the bottom end to keep prices rising…

You really really need to do some reading around the global economy and especially prime London before you think about piling on more debt…

brooessFree MemberPosted 8 years ago70 gear inches is a good all round gear. I run 48/18 which can get you up some pretty steep hills if you’re prepared to work hard. I top out around 20mph on the flat and it’s not too hard to start off from stationary.

RR is a lovely bike. I miss mine,

brooessFree MemberPosted 8 years agoTo those who smell a rat, there’s this comment on the story in the FT – which is referred to above as an interesting piece of background:

Of course nothing to do with the fact that just today IDS lost his legal battle to keep secret the true extent of the Universal Credit disaster… an ‘on principle’ resignation over disability benefits cuts? Really? Or an opportune opening for an ‘honourable’ exit …with the added bonus of gratifying your Brexit ‘out’ campaign allies (and perhaps colleagues in a future Cabinet)?

I predict that come the next election we’ll have two Conservative parties to vote for and two Labour parties… in the middle of a major crisis and our leaders are running around fighting like I’ve not seen since I was as school!

brooessFree MemberPosted 8 years agoI have some Campag factory wheels which have been 100% problem-free for 4 years and a pair of Hope hoops on my winter bike which have been problem-free for 3 winters now.

I also have some Condor wheels on my commuter which were handbuilt and had no problems either. Overall I reckon if you pay a decent sum you’ll be ok. I generally try and get wheels with spokes that can be easily replaced by any LBS which I’m not sure you get on some factory wheelsbrooessFree MemberPosted 8 years agoSense of accomplishment, the feeling of getting stronger over time and what the laydeez say about my arse as a result :-)

brooessFree MemberPosted 8 years agoi wish i had a solution for young professionals like teachers and nurses in affluent areas because getting onto the ladder is nigh impossible.

We do have a solution. Stop deliberately propping the market up with restrictive planning laws, criminal and foreign money and taxpayer subsidies through Help To Buy and let the market fall back to it’s natural long term level of c 4.5x earnings.

Prob is, existing homeowners will refuse to vote for any government who allows this to happen… it’s an election-loser.

It’s cultural, but why?

Because as per the OP, British are uniquely idiotic about debt and don’t understand that the only real winners from ever-rising house prices are the banks who lend us the ££ to buy… the banks take advantage of our cultural refusal to see a mortgage as the massive debt that it really is. Look at all the posts above…

tbh if I were Chancellor, knowing the British attitude to house prices, I’d also be doing everything I could to keep prices going up. After all, I’ll be long gone by the time the long term damage becomes evident to the electorate

brooessFree MemberPosted 8 years agoThe great thing about the bike is it’s lack of evolution IMO – the original design was so spot on that there’s only really been evolution with materials and accessories rather than the basic design.

I went to the cycling exhibition at the design museum in London before Xmas, they had a Rover Safety from the late 19th century and Wiggo’s hour bike in there – one of the oldest bikes and the most advanced modern bike and they were essentially the same thing – diamond frame with fixed wheel chain drive, hub and spoke wheels and bearing at the bars and bb.

Great stuff :-)

brooessFree MemberPosted 8 years agoIf it was obvious to the masses then the masses wouldn’t be so massive!

brooessFree MemberPosted 8 years agoYour mortgage adviser is the guy who knows each lenders criteria and is working for you, not the estate agent who wants shot of the property and his cash.

As already said, if you have issues getting a mortgage so will buyers further down the line…I’d walk away.

This. You don’t honestly trust a single word the estate agent says over the lender do you? Look at the incentives. EA lies to you and gets his commission – any longer term issues not his problem. The lender, however has your debt booked as an asset and needs you to repay that debt so they get their full return on that asset… there’s a risk for them based presumably on empirical evidence that this kind of property will turn into a bad debt… hence their refusal to lend against it.

Banks may not be nice people but they’re not idiots – they have profits to make. EA’s however are almost always liars – their financial incentives encourage it

brooessFree MemberPosted 8 years agoMortgage was the best investment I ever made!

You mean the biggest debt you ever took out…

Over the lifetime of the loan.. has anyone ever experienced a case where a house did not appreciate significantly in value over 25 years?

It is an extremely dangerous assumption to make that the long-term growth trend that we’ve seen will continue. Right now I think the younger generation are getting themselves neck-deep into debt on the basis of this assumption, ignoring the fact that prices are supported by a number of short-term props which are highly unlikely to sustain over the period of a 25-year mortgage

1. Historically low interest rates

2. Help To Buy (taxpayer-funded subsidy)

3. BTL (fashionable and supported by 1. above)

4. A tidal wave of speculative foreign money (a significant % of which is laundered criminal money) into London

5. Restrictive planning laws and games from developers failing to buildWorth also looking at basic demographics and affordability – baby boomers will soon be looking to ‘cash-in’ on their ‘asset’ ie: sell, either for their pension or to go into care – leading to increase in supply, coupled with a first-time buyer generation who are earning too little to be able to save for a deposit or afford the high prices being asked (+ an unwillingness to get themselves into a massive debt to fund the retirement of the older generation)

Many many people are saying London and SE are massively overpriced – BoE, fund managers, IMF etc etc. We may or may not see a bust but certainly the idea that prices will continue to rise as they have done recently is a heroic assumption and once that assumption turns out to be wrong, you might find sentiment changing quite fast…

Worth remembering that the bigger your debt, the higher your monthly repayments and the lower your disposable income. Worth noticing that wage growth is low and productivity and economic growth are suffering. I’m sure it’s occurred to Osbourne that there may be a link between super high house prices and weakness in all the macroeconomic measures, against which his legacy will be measured… and he’s a political schemer before he’s a Chancellor

brooessFree MemberPosted 8 years agoI don’t think there’s anything wrong with borrowing,

There isn’t necessarily. It’s when you do it to the scale we have (and now the Chinese appear to be too) that it becomes the systemic problem that it now has become.

It also depends what you get into debt for – something which is an investment for the future which provides a firm financial return (e.g. a student loan which allows you to get a better paid job and increases your lifetime earnings is a productive use of that debt. Companies will use debt to fund investments in machinery and people to drive future growth, revenue and profits)

However, our consumer debt appears to have mainly been run up spanking cash on shiny things and general consumerism (mainly depreciating assets), and BTL property (making heroic assumptions about ever-increasing house prices) or just normal property (boosting it to such a level in London and the SE that the repayments dominate our disposable incomes and leave nothing left for the real economy and therefore leave us with constricted economic growth over the long term).

The scale of our debt is the real problem – it’ll be a burden for a very long time and hold back economic growth and living standards whilst we pay it back. Assuming it doesn’t take us under again in the meantime. The nature of what we’ve spent the money on is also a problem as it largely will produce no longer term economic benefit.

We’ve been really quite stupid…

brooessFree MemberPosted 8 years agoFind a new route.

IME people this irrationally angry can’t be reasoned into leaving you alone…

brooessFree MemberPosted 8 years agoPremiums are massive. Ageing population and increasing cost of healthcare is making private healthcare insurance v difficult to provide – cost of claims is higher than premium income can cover without massively high premiums, which most people can’t afford. Look at how much we’re cutting back on supermarket bills, and ask yourself who’s going to try and find £100/month for Bupa!

A massive % of the market is company-paid premiums and companies are all trying to keep costs as low as possible so not willing to pay for it as a benefit either.

Better to make NHS a means-tested contributory system IMO

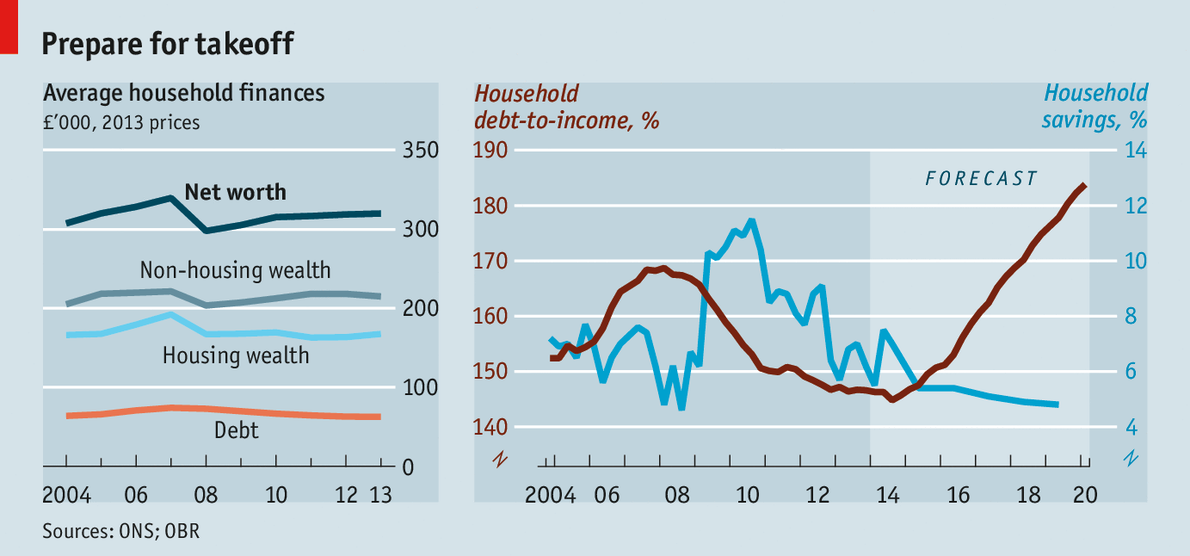

brooessFree MemberPosted 8 years ago8 years into a still unresolved debt crisis and this chart is terrifying…

To be fair we don’t know the driver of the increase. I asked a friend of mine who works as a data analyst at the Bank of England and he said it was availability of credit. Looking at the sums being doled out in massive mortgages and especially BTL, and in PCP deals on cars, I suspect that contributes a lot to this chart. Maybe some people are living off credit just to pay bills, I don’t know.

I guess there’s plenty my mate knows about the state of things but can’t tell me, sadly! He doesn’t subscribe to the ‘economic growth forever’ thesis, I know that.

We’re going to have to pay it all back one day… or in the case of mortgages, we’ll just force the younger generation into a lifetime of crippling debt to keep the whole pyramid going a little longer… I can’t quite believe we’ve got ourselves into such a dire place in such a short space of time.

It’s interesting that we’ve been stuck on emergency low interest rates since 2008 to help keep the debt from overwhelming us but those rates are now playing havoc with banks’ ability to make a profit – so we’re stuck. Raise rates and a load of bad debts lead to a banking collapse, keep rates as they are and see debt increase still further and banks crash as they’re unable to make a profit!

brooessFree MemberPosted 8 years agoWell they’re getting close to what could be the ultimate commuter, which would be:

1. Fixed gear Escapade with forward-facing dropouts for easy removal with full mudguards

2. Discs – with calliper positioned for easy wheel removalAlternatively you could get an Escapade and build it up as a singlespeed with a tensioner I suppose.

Pretty much nothing to wear out and nothing to be adjusted on a day to day basis

brooessFree MemberPosted 8 years agoVery good reason to

a) not be too beholden to materialism and see your possessions as of any great importance

b) not own a car you’re too precious aboutI have two lots of scrapes on my car but it’s 10 years old and I really don’t care too much about it, so it doesn’t upset me. Generally speaking, not thinking about other people does upset me too.

One of my less intelligent neighbours hit my car when parking and hoped I wouldn’t notice. I did when I spotted red paint the colour of their car on the rear wing of my car – and silver paint the colour of my car on the corresponding part of their car. No note, no effort to apologise. Very glad I dont care about my car or that would have massively upset me.

I’d take a different view if anyone knackered one of my bikes of course :-)

brooessFree MemberPosted 8 years agoCan you not ride down to Bletchley instead of MK proper? Trains are between 45 mins and an hour so not that much longer and still into Euston

brooessFree MemberPosted 8 years agoA bit of a generalization. In many ways the world is a better place now because of our parents and grandparents and in many ways its a worse place.

You’re right. After all 20th century saw two world wars centred around Europe, in which we lost literally millions of (mainly) men, so our grandparents and great-grandparents didn’t do a great job either, really.

tbh the real problem is that the boomers grew up in a time of unprecedented increasing economic growth and living standards and mainly absence of war, but forgot it was unprecedented and didn’t do enough to set aside some of the gains for the future. A bit like kids of rich self-made parents spanking the family wealth because they didn’t appreciate it wasn’t a never-ending flow of cash.

We (I’m 43, born 1973) saw what our parents have and expected the same and now we’re finding we won’t get it, we’re upset – when actually it was a one-off time of plenty and we’re just going back to trend in terms of wealth inequality and economic growth…

Maybe gains in automation and technology will simultaneously reduce the cost of living whilst providing higher standards of living. who knows

brooessFree MemberPosted 8 years agoWhen I look at the opportunities/the world left to the Millennials by their parents I can’t help but think of the irony of what their generation was saying to their own parents at the time:

Come mothers and fathers

Throughout the land

And don’t criticize

What you can’t understand

Your sons and your daughters

Are beyond your command

Your old road is rapidly agin’

Please get out of the new one

If you can’t lend your handPlus ca change. Each older generation leaves the world a worse place for their own children… except maybe my grandparents’ generation who got us through WW2 and created the prosperity that followed

I feel massive sympathy for the Millenials – when I graduated, it wasn’t that hard to find a reasonably well-paid job with a good pension and an affordable place to live. I really don’t know why they’re not on the streets. Mates of mine with kids say they’re head deep in social media and just trying to make do as best they can rather than getting angry…

There was a recent article in the FT where, if you read the comments, quite a few were simply saying the odds were so stacked against them, they’re not even going to bother playing the game e.g. why save to buy a house and all the sacrifice that means if prices are continuously pushed out of your reach and leaving you with such a massive debt burden that you’ll have a suppressed standard of living for your whole life.

That alone will bring the system crashing down – if they’re not prepared to put money in at the bottom of the system then those at the top won’t be able to take it out…

brooessFree MemberPosted 8 years agoThey’ll be shovelling us into IDS’s pits en masse!

Is Dignitas a plc? Buy shares in them and their competitors to fund your retirement :-)

brooessFree MemberPosted 8 years agoI’m sure I read the c £30k somewhere reliable recently. Interestingly enough, trying to find some stats from a reliable source has proved difficult – all I could find were these two. Either way, it’s not looking great.

I guess you have to take care who you ask and how you take an average of the pension pot size. A 30-year old with only 50k in their pot is not necessarily in trouble if they continue to fund it before they retire. A 50-year old with £50k has serious problems…

I’ve been saving for nearly 20 years and have c£6k a year to live off according to latest statements, which means I’ll be in poverty despite trying to do the right thing. I’m only 43 though, so there’ll be more in the pot by the time I need it. To be honest, as critical I am of BTL and those who think their house will be their pension (with all the heroic assumptions they’re making) I can see why it looks like a rational decision when I look at the results of my own effort to make a provision for my own retirement.

I’m seriously thinking of emigrating on retirement to a country with cheaper standard of living and warmer climate where my pot will go further… so maybe as all the Arabs and Africans pour over to Europe for work, we’ll all be pouring South for our retirements :-)

Hopefully the robots will have taken over by then and be providing enough wealth for us to all retire in comfort :-)

brooessFree MemberPosted 8 years agoApparently the average UK pension pot on retirement is £30K or so.

meanwhile we’re all buying Audis and 2nd homes on credit

oops

brooessFree MemberPosted 8 years agoWhat brogues does one’s gentleman’s gentleman recommend for enduro?

brooessFree MemberPosted 8 years agoWell, I was thinking about your average rider rather than the pros! My Dad and his mates used Gold Label I believe, mind.