- This topic has 26 replies, 11 voices, and was last updated 13 years ago by crazy-legs.

-

UK Debt

-

TorminalisFree MemberPosted 13 years ago

Today we have casually cruised through the 1 Trillion pound mark and it hasn’t even made the news.

StonerFree MemberPosted 13 years agopretty little graphic that it is…the amount of debt owed actually chunters around up and down in big chunks (as bonds are auctioned and redeemed) and that little ticker is just a straighlined time based calculation between the £900bn last year and £1.1tn this april budget 🙂

But dont let the loss of dramatic effect detract from your point 🙂

AshleyFree MemberPosted 13 years agoPerhaps it’s beacuse it went through there at aroudn 5:15pm yesterday and was in news stories last night

philconsequenceFree MemberPosted 13 years agothats nothing, i knew a guy who took 3 years to get out of his overdraft after uni!

TorminalisFree MemberPosted 13 years agoBut dont let the loss of dramatic effect detract from your point

Fair, it is also worthy of note that this infographic includes only those debts which are actually on the books.

TorminalisFree MemberPosted 13 years agoStoner, you seem to be pretty clued up and good at sums, if the country was running at 3.7% inflation, 0.5% base rate interest, how long will it take our government to inflate their way out of debt (assuming they stop borrowing £10billion plus per month every month from now on)?

soobaliasFree MemberPosted 13 years agoso the £25 i owe for those tyres i never paid for isnt counted?

bonus.

CaptJonFree MemberPosted 13 years agoAdd in the debt of firms and individuals if you want a real scare.

StonerFree MemberPosted 13 years agoAssuming running neither deficit nor surplus, and a fixed net deflation of 3.7%-0.5%=3.2%, then it would take about 1,000 years to erode the value of £1tn (also assuming no redemptions)

TorminalisFree MemberPosted 13 years agoAssuming running neither deficit nor surplus, and a fixed net deflation of 3.7%-0.5%=3.2%, then it would take about 1,000 years to erode the value of £1tn (also assuming no redemptions)

Guess they are going to have to let inflation run amok for a bit then…

StonerFree MemberPosted 13 years agoIm being a bit unfair – the progression to zero for £1tn is the same as for £1 🙂 So if, instead we said “how long until the debt is one percent of what it is now” it’s only about 140 years.

(and 70 years to ten percent)

IanMunroFree MemberPosted 13 years agoWouldn’t it be easier if we consolidated it into one easy to pay package via Ocean Finance?

StonerFree MemberPosted 13 years agoOcean Finance?

with their APR? You’ve got to be joking.

As it is, if UK Plc get rejected by one more credit card company, our credit score is going to be terrible.

Captain_CrashFree MemberPosted 13 years agoGuess they are going to have to let inflation run amok for a bit then…

cep that some want to head inflation off at the pass with a round of interest rate increases, which will absolutely crucify the man in the street.

🙁

thisisnotaspoonFree MemberPosted 13 years agoCan someone explain government borowling to me?

Surely we dont ‘borrow’ from the bank of england at 0.5%, do we? Thats like lending yourself an IOU?

I thought we went to the world bank who dished out that funny currency, so devaluing the £ had no effect on the loan (other than increacing the headline figure we owed in £).

Thus an increace in interest rates pushing the value of the £ back up would be good for repaying the debt as we’d pay back more debt with each £.Or am I completely wrong?

StonerFree MemberPosted 13 years agowhich will absolutely crucify

theSome men in the street.higher interest rates are welcomed by those approaching retirement and about to buy annuities, other older people whose savings are to be their retirement income and obviously all other savers.

TorminalisFree MemberPosted 13 years agoCan someone explain government borowling to me?

Not an expert but I think to raise cash the Govt will sell bonds which are worth £X and must eventually be repaid with interest. If deflation wipes out the value of the pound then those bonds will become much easier to redeem.

I am sure Stoner will be along in a minute to explain why I am wrong 😉

StonerFree MemberPosted 13 years agoTINAS

1) The UK “borrows” by issuing bonds over certain lengths to maturity, like 3, 5 or 20 years (and other various terms) in an auction. The market (pension funds, other states, punters, companies) buy the bonds for the lowest rate of interest that they will accept over the life of the bond before redemption.

The 0.5% base rate is the overnight lending rate at which UK banks can borrow from the treasury. Think iof it as a n overdraft, not a long term loan/bond.

2) Borrowing from the World Bank or IMF comes with massive provisos. They get to own your ass, bitch. You dont want to be doing that. It’s like getting a payday loan secured on your V5 from Lenny the Loan Shark.

3) Interest is not the same as amortisation (paying things back). No matter where interest goes, up or down, you still have to pay back the original loan amount. Either through a regular amortising payment, or through a final bullet payment at the redemption date/maturity.

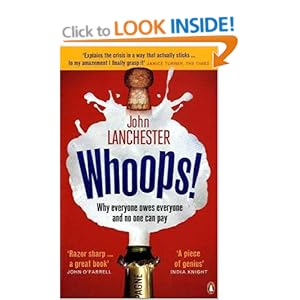

as ever, my No.1 recommendation for anyone who wants to learn more is this very approachable and iluminating book.

thisisnotaspoonFree MemberPosted 13 years agoSo in summary, the UK gov borrows £’s not in $ or euro?

And they need the intrest rate low to keep £’s cheep/devaluing by making them easy to get?

StonerFree MemberPosted 13 years agoUK borrows in £, yes.

keeping interest rates low is in an effort to encourage expenditure and investment – the economic imperative is to sink your money into a business by buying a widget machine that can make 10% returns rather than have the cash sitting in the brank making 3/5s of FA.

The UK has been keeping bond prices low by buying back their own bonds – i.e. increasing demand (quantitative easing) and restricting issuance (reducing supply).

There’s a constant demand from pension funds etc for GILTs and other government bonds as secure holdings for investment funds. Pension funds cant do without them (in fact theyre mandated to hold some) so thats why they bid the yield down so low when there’s so little being issued in the auctions.

IanMunroFree MemberPosted 13 years agoThis widget machine with 10% return, is there a website where I can sign up to invest? Fed up with 3/5s of FA.

CaptainFlashheartFree MemberPosted 13 years agoStoner – Member

I have a snakeoil drilling rig if that’s of any use?crazy-legsFull MemberPosted 13 years agoIt’s worth reading this book:

which explains in generally pretty simple language how the whole financial system works and how the whole credit crunch happened. Bonds, debt, securities, derivative trading, the whole works. Very good.

The topic ‘UK Debt’ is closed to new replies.