- This topic has 35 replies, 23 voices, and was last updated 8 years ago by globalti.

-

This can't be right, surely?

-

MrWoppitFree MemberPosted 9 years ago

Aren’t things supposed to be getting worse under the Conservatives?

shermer75Free MemberPosted 9 years agoIt’s interesting, isn’t it? Instinctively I thought it would be better to spend money at the bottom of the economic cycle, not be austere, but nope as far as these signs of recovery go it does appear to be working. Maybe it’s because being austere encourages outside investment? Or maybe it’s because the economy was due for a recovery round about now anyway. Hmm…

geetee1972Free MemberPosted 9 years agoAren’t things supposed to be getting worse under the Conservatives?

Well Labour want you to believe that, but all the data I’ve read and seen reported in the media recently contradicts it pretty conclusively.

There was a report recently that showed living standards were now back to their pre-2008 levels.

footflapsFull MemberPosted 9 years agobut all the data I’ve read and seen reported in the media recently contradicts it pretty conclusively.

You sure about that?

http://www.theguardian.com/politics/2014/nov/15/coalition-helped-rich-hitting-poor-george-osborne

geetee1972Free MemberPosted 9 years agoI’m very sure about what I have and have not read. Bear in mind that that’s not the same as saying ‘there are no articles to the contrary’. I don’t read The Guardian so I am also sure I’ve not read that article you link to.

Also that article you link to is not about living standards, it’s about relative levels of wealth. It’s entirely possible that living standards for all are at the same level now as they were prior to 2008 and the gap between the richest and the poorest is also wider.

As long as everyone is benefiting, myself included, I really couldn’t give a stuff whether the gap between myself and the richest people is wider. Again, as long as we all benefit, I’ve never understood the preocupation with relative levels of wealth. Who cares if the wealthy are really wealthy? What difference does it actually make other than a perceived sense of injustice (which I firmly believe is just that; perceived).

Colin-TFull MemberPosted 9 years agoIt good to know that the down-turn and recession were due global forces but that any recovery, no matter how small is down to the decisive action of the government. Hmmm.

ShackletonFull MemberPosted 9 years agoHaving read the INdy article I think the headline claims might be a bit…overstated….

Incomes in the North East were the lowest in Britain on the eve of the recession. But the region’s employment rate is now 2.9 per cent higher than before the downturn and it had a relatively shallow pay squeeze –6.1 per cent between 2009 and 2014, lower than the UK-wide figure of 9.3 per cent.

That and the rest of the article seem to imply that the NE was already bad so there wasn’t much further down it could go (therefore “unaffected”) and as things get back on track maybe the NE has managed to attract a bit extra or as it was “unaffected” people spent less time worrying about where they used to be. Either way I think the article headline is a bit disingenuous. You can see how they got there but I’m not convinced by their reasoning.

fin25Free MemberPosted 9 years agoWow, capitalism is essentially cyclical, who’d have thought… 🙄

Even the article is at pains to point out that a lot of the wealth recovery is down to pensioners being better off, hardly the cornerstone of a bright economic future…wreckerFree MemberPosted 9 years agoIt good to know that the down-turn and recession were due global forces but that any recovery, no matter how small is down to the decisive action of the government. Hmmm.

Ever heard of banking regulation?

bailsFull MemberPosted 9 years agoThe thing is, you can’t prove what hasn’t happened. We may well be better off now than x years ago, but a different economic/political approach could have led to bigger improvements, or another crash, or we could be in exactly the same position.

jimoiseauFree MemberPosted 9 years agoFrom the independent article:

Its report suggests that typical incomes rose after the crash and peaked in 2009-10, before falling until 2011-12. They have since recovered and in 2014 were approaching their pre-downturn level. However, the scale and length of the living standards squeeze and the pace of recovery varies widely across the UK.

This suggests that under labour post-crash people were better off and then they’ve been worse off under the Tories since, only recovering to pre-crash levels now, but not back to the peak levels at the end of the last labour government.

scaredypantsFull MemberPosted 9 years agoEver heard of banking regulation?

I’ve heard of it but I’ve never seen it – are we going to have some ?

wreckerFree MemberPosted 9 years agoThis suggests that under labour post-crash people were better off and then they’ve been worse off under the Tories since, only recovering to pre-crash levels now, but not back to the peak levels at the end of the last labour government.

No it doesn’t!!!

I’ve heard of it but I’ve never seen it – are we going to have some ?

I bloody hope so!

tinribzFree MemberPosted 9 years agoEver heard of banking regulation?

I heard that my sister-in-law got a 20k bonus this year, she works in banking, in HR. I guess that’s a rise in living standards for some.

ernie_lynchFree MemberPosted 9 years agoAren’t things supposed to be getting worse under the Conservatives?

You were unaware that taken on a region by region basis not all regions would experience exactly the same wage growth, one would experience a greater amount than the others and one would experience the least ? How strange.

And your link talks about “The 3.9 per cent rise in incomes in the North East since 2007-08”[/i] (certainly not an impressive figure) this covers a couple of years of Labour government, and bearing in mind that the effect of Conservative policies would not be apparent for a year or so after assuming power suggests that probably somewhere in the region of half the period was affected by Labour government policies.

Generally speaking severe recessions tend to disproportionately hit middle income earners. Those at the bottom can’t generally go significantly further down, while those at the top generally come out unscathed from recessions**. Middle income earners are in a position to take a substantial hit and generally do. Low earners are indeed severely affected by recessions but this doesn’t translate into impressive statistical changes for newspaper headlines.

What happened in the recent recession and since is unsurprising imo. Apart from the relatively low numbers of unemployed during the height of the recession under the last Labour government, although that isn’t that surprising given the policies they pursued, other than how effective they actually were in keeping a lid on unemployment.

peakyblinderFree MemberPosted 8 years agoWho cares if the wealthy are really wealthy? What difference does it actually make other than a perceived sense of injustice (which I firmly believe is just that; perceived).

Because the government sets things like spending targets and taxes based on average incomes / house prices etc. Which are disproportionately stretched due to a widening gap between poor and rich. It also distorts the figures being discussed here.

I thought that was bloody obvious.

aracerFree MemberPosted 8 years agobearing in mind that the effect of Conservative policies would not be apparent for a year or so after assuming power

Interesting. Does that mean that when comparing statistics at the start and end of a government term it would be more relevant to check the statistics a year after the relevant election?

aracerFree MemberPosted 8 years agoBecause the government sets things like spending targets and taxes based on average incomes / house prices etc.

Do they? Which average?

brooessFree MemberPosted 8 years agoMore weirdness. Just doesn’t seem right, somehow.

Ever heard of the strategy of ‘under-promise and over-deliver’? Set a forecast you’re pretty sure you can beat rather than a realistic one, or the one that’s required for success, publicise it widely and then claim to have over-delivered… gives the impression you’ve succeeded, when in actual fact we’re still massively in debt…

It’s similar fudge to supermarket offers which say ‘was £10, now £7, save £3, when in actual fact after you’ve paid that £7 you’ve spent £7 and you’re £7 poorer…

Smoke and mirrors, we’re 2 weeks away from an election that the Tories thought they would win, and are increasingly looking like they won’t.

The ‘economy’ as the only message they have and they’ve thrown everything they could at driving up house prices, and still the electorate is not convinced… expect increasingly shrill misrepresentations of the state of the economy and between now and 7th May

MrWoppitFree MemberPosted 8 years agoOh yeah, this house price “bubble” thing – wasn’t that supposed to ruin the economy again? What happened?

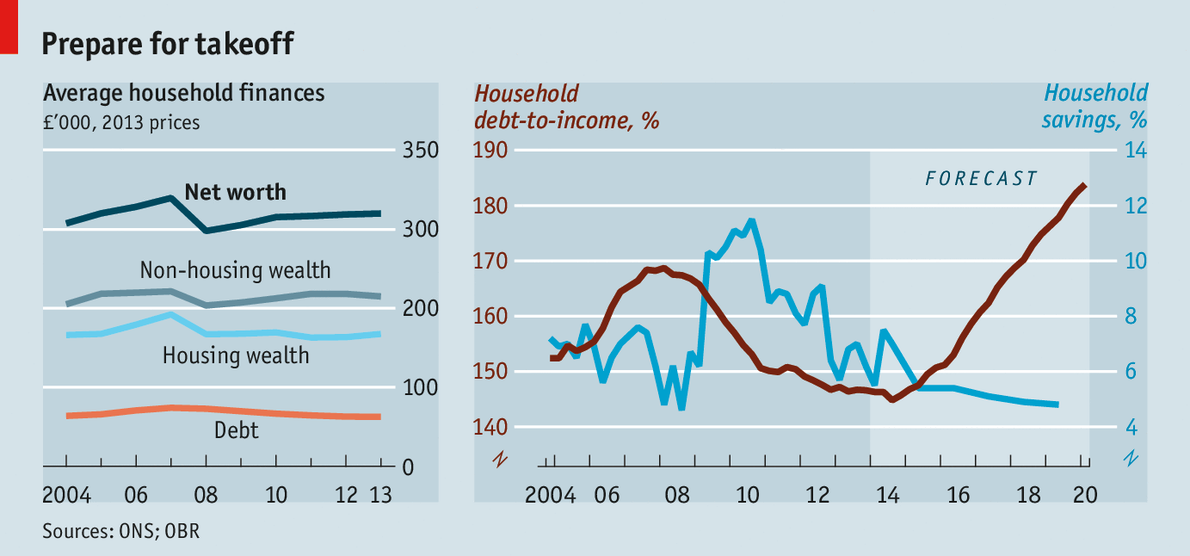

StonerFree MemberPosted 8 years agoand that ^ graph is a perfect illustration of why most forecast models are a load of tosh. If you cant predict a turning point, then stop your model. There’s no point running long run trends set at one point in a cycle in perpetuity.

brooessFree MemberPosted 8 years agoand that ^ graph is a perfect illustration of why most forecast models are a load of tosh. If you cant predict a turning point, then stop your model. There’s no point running long run trends set at one point in a cycle in perpetuity.

Your point being that an upturn in 2016 doesn’t mean debt will increase at the same rate through to 2020? True enough. I would like to see the underlying assumptions that led to that forecast… it’s pretty extreme.

The FT is full of warnings of a slowing global economy and housing bubbles all over the world… and UK political future is very hard to forecast at the moment so it’s anyone’s guess what the next 5 years holds for us economically…

When I first saw this graph my assumption was that it was being driven by people needing to borrow more to pay their mortgage (static wages and higher interest rates) or needing to borrow more to pay for everyday expenses (static wages and higher mortgage repayments from ever-higher house prices). Either way, if it turns out to be true then things are getting worse, not better…

Rockape63Free MemberPosted 8 years agoThe ‘economy’ as the only message they have and they’ve thrown everything they could at driving up house prices, and still the electorate is not convinced… expect increasingly shrill misrepresentations of the state of the economy and between now and 7th May

doris5000Full MemberPosted 8 years agoYeah George realised fairly early on that he wasn’t gonna get borrowing down half as fast as he claimed when in opposition, so massively increased his forecasts.

Now borrowing is coming in ‘below forecast’ but at 90-odd billion it’s still massively high. Before the recession it was about 30-40 Bn.

Rockape63Free MemberPosted 8 years agoJust the thought of Ed Balls running our economy sends shivers down my spine!

A truly horrific prospect! 🙁

brooessFree MemberPosted 8 years agoAlso worth noting…

and

Retail sales unexpectedly dip in March

Personally I think the Tories are more likely to get us through the oncoming slump in global growth than Labour but I would be looking very closely at any stories put out in the run up to an election that suggest the economy is in a good shape… the Tories are under strict instruction from their key strategist to talk only about the economy as they know they’re less well received on all other topics…

… so they’ll be pushing out any story that allows them a positive spin and they’ll be suppressing anything which suggests any underlying weakness despite plenty of data which suggests that we’re really not in a very good shape at all…

doris5000Full MemberPosted 8 years agoAre the figures in that Indy article – the one from the original post – inflation adjusted?

footflapsFull MemberPosted 8 years agoJust the thought of Ed Balls running our economy sends shivers down my spine!

A truly horrific prospect!

Any yet Gideon ended up abandoning his original fiscal plan and actually following Labours original deficit reduction program after grinding the economy to a complete halt for two years…..

DaRC_LFull MemberPosted 8 years agoJust the thought of Ed Balls running our economy sends shivers down my spine!

You seem to have a delusion, shared by the mainstream media and politicians, that politicians ‘run’ our economy rather than a bunch of bankers and global corp’s.

teamhurtmoreFree MemberPosted 8 years agoCheck out income inequality – winners and losers etc

and on the flip side

check out government receipts versus government spending

Delusion? Few glad that this is the case

globaltiFree MemberPosted 8 years agoAs somebody wrote, I think on STW a few weeks ago, there are plenty of people around who could do an excellent job of running the country – they just happen all to be driving around London in black cabs!

The topic ‘This can't be right, surely?’ is closed to new replies.