- This topic has 41 replies, 28 voices, and was last updated 5 years ago by footflaps.

-

Mortgate rates, whats going on?

-

Kryton57Full MemberPosted 5 years ago

Two questions:

We are 1 year from the end of a 2.84% fixed with 13 years remaining. I went on to Nationwides (our provider) site for a renewal quote and the lower rate of 1.44% based 13 years on a 3 year fixed shows the monthly is £20 more – why?

Secondly, I can get a 10 year mortgage for the same rate/payment as we’re at now – is 10 year fixed really a good idea? or do we gamble on repeated 2 years at 1.5% ish?

Note: This could be swayed by the fact I currently am able to make annual 5-10k overpayments.

ampthillFull MemberPosted 5 years agoI can answer the first question. Almost all your repayment is capital. The interest part is tiny with low interest rates and not much time remaining

I had a shock when our interest fell. The amountt saved was so small. I thought it would be pay day

Kryton57Full MemberPosted 5 years agoAh. The variable/reduction I was expecting comes from interest saved, obviously the capital amount is what it is.

So, I’d be better getting the 10 year which bizarrely also has pretty much the same monthly payments as we have now and protecting against the future whilst paying it off…. I think?

dangeourbrainFree MemberPosted 5 years agoor do we gamble on repeated 2 years at 1.5% ish?

Fees fees and fees, don’t be swayed by the rate do the numbers. Looking at mine for later this year a 10year fix is 584 more over 10 years than 5 of the current best 2year deals after fees are accounted for. I’ll likely not be going for the 2 year deals (and given you’re further along than me your loan is likely smaller so the % interest will effect it less)

brakesFree MemberPosted 5 years agoI thought this was going to be a post-Brexit interest rate debate.

Is disappoint.I signed up to a deal 3 months in advance of my current deal ending on the assumption that they would go up later in the year.

andrewhFree MemberPosted 5 years agoJust signed up, well last year, for five year fixed. Rates aren’t going to go much lower are they? Few percentage points, just fixed for as long as you can and don’t worry about the odd 0.1 or 0.2% difference.

Blazin-saddlesFree MemberPosted 5 years agoIf you fix at 10 years, are you still allowed to make your overpayments or do they limit.

I’m currently on Nationwide base rate tracker which has been great for us whilst rates are so low as it’s unlimited overpayments so I’ve been dropping an extra grand a month on it and really reducing the term.

Kryton57Full MemberPosted 5 years agoIf you fix at 10 years, are you still allowed to make your overpayments or do they limit.

I need to check that.

I did another comparison – the total paid over 10 years. The 10 year fixed at 2.84 is £7k more than 5 x 2 years Fixed at 1.44, but of course the gambles in any potential change. As said above, they are unlikely to go down. The best option I feel is to go to 5 year fixed at 1.89, which is £2k more than the 5 x 2 years, but of course does not take into account overpayments. Straight away this lowers our monthly by £38 which I wouldn’t do, I’d overpay by £38 monthly on top of the lump sum injections.

matt_outandaboutFull MemberPosted 5 years agoIf I were in your shoes, I’d check that I can still overpay at the rate you want and take the 10 years fixed to the end.

Or, work out if your £5-10k means you could in fact up payments and take a 5 year (or similar) fix.Paying off debt, highest cost first, is just a Good Thing in my view.

genesiscore502011Free MemberPosted 5 years agoYou can make a 10% overpayment per calendar year no ERC on most fixed rates

Kryton57Full MemberPosted 5 years agoIf I were in your shoes, I’d check that I can still overpay at the rate you want and take the 10 years fixed to the end.

As above I did and I can – up to 10%.

I also made my head spin with APRC – the 10 year no deposit albeit at 2.79% is the cheapest at 3.0%. Of course, the doesn’t take into account the fact the I might get 5 x 2 years at a lower rate as I wouldn’t of course see out the term on a 2 year fixed. Its a gamble on the “might” though.

Or, work out if your £5-10k means you could in fact up payments and take a 5 year (or similar) fix.

I’ll be paying off £10k this year, before we get to the 6 month windo for change (July) so in fact the mortgage will be for circa £138k. I’ll still pay the same we are now while I can, meaning £150 a month overpayment by default.

Fingers crossed I stay able to continue with that and we might be done before the 10 years is up.

winryaFree MemberPosted 5 years agoI’ve just signed onto the nationwide 10 year fixed after my 4 year fixed ended. (Actually saving £30 a month) I’m allowed to overpay 10% of the original mortgage amount per year.

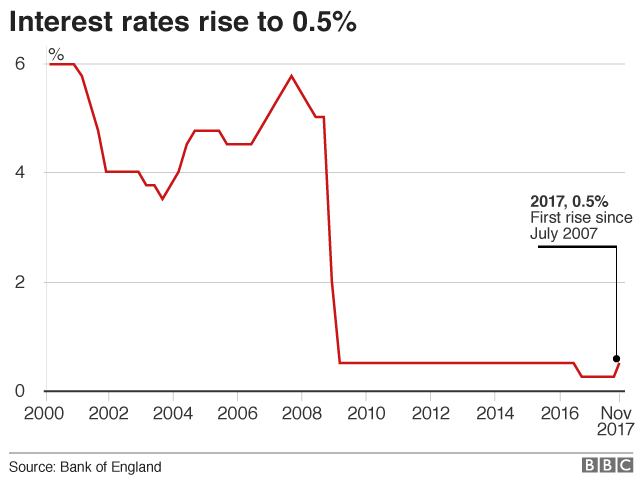

Interest rates are very likely to rise over the coming years(unless we no deal and economy takes an age to recover). Each 0.25 base rate rise equates to a £20 a month increase on my mortgage. Analysts expect the base rate to get back to 2.5% over the next 5 years which would increase my monthlies by £160.

I have 20 years left and overpaying by £500 a month will have my mortgage gone 1 month after my fixed rate is up so is what I’m doing

wobbliscottFree MemberPosted 5 years agoWell interest rates can’t really get any lower so the only way is up and a case of when not if, so now is probably a good time to fix in for a long period of time.

nickjbFree MemberPosted 5 years agoWell interest rates can’t really get any lower so the only way is up and a case of when not if

People have been saying that for ten years now (they really have, search old threads on here or look on other forums) and they kept on getting lower. Not saying that will happen again but I wish I’d ignored that advice ten years ago when I took out a mortgage and again 5 years ago when I remortgaged.

Not offering any advice as I keep guessing the wrong way but with rates as low as they are you can’t go too far wrong.

rockhopper70Full MemberPosted 5 years agoNot advice per se, but I’ve just remortgaged with the nationwide and we used London and Country brokers, landc.co.uk.

They went through all the options and I was impressed with the speed it completed. We used their panel solicitor and most of the comms was through an app and dead easy to use. Open a document, read it, close document and it flags as being read….move on….etc etc ….to completion.

5 year fixed with mortgage. No fee option worked out the cheapest over the five years.

slackboyFull MemberPosted 5 years agoBank rates have been historically low for the best part of 10 years now. That in itself is scary as it gives the Bank of England little room for fiscal stimulus manoeuvre. Even scarier is that rates spike at 15% in the early ’90s – Imagine servicing your mortgage at that interest rate.

I wouldn’t best against them rising over the next 10 years so if you’ve got a good fix that you can afford and its portable if you decide to move house then go for it.

scaledFree MemberPosted 5 years agoHow the hell are you folk paying 1k a month off your mortgages? Are your kids out of nursery or something?

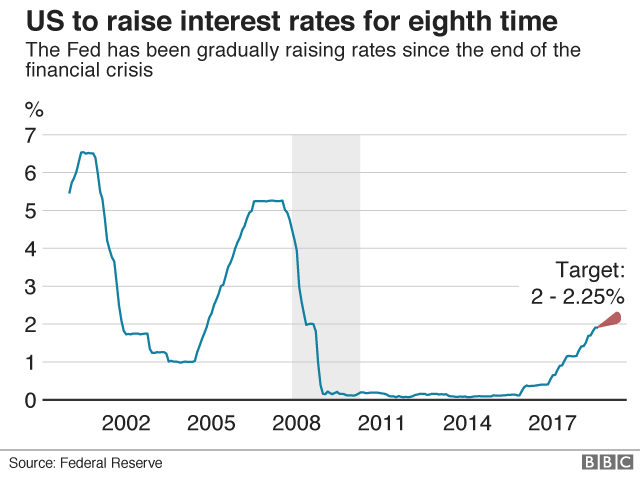

DT78Free MemberPosted 5 years agoWe took out a 5 yr fixed 2 years ago as rates couldn’t get any lower. Despite a rise you can actually get a cheaper 10 year deal now. We would be much better off having done a 2 yr fix, benefit of hindsight. Banks employee hundreds of analysts to work out the % to make sure they will make profit. So if you can get 10 yr fixes at around 2% I’d say it’s unlikely there will be any return to high % of the past.

The main thing I’d be concerned about with long fixed terms is the penalties if you have a change of circumstance and need to move. In your circumstances I would probably go with a 5yr deal

burko73Full MemberPosted 5 years agoMate says he was offered a 25 yr fixed at only about half a percent above a 5 yr fix. Says he was offered 2.5% on a 25 yr fixed with a 15% deposit.

Seems nuts to me. I wouldn’t want to fix for that long if there were stringent penalties or reduced portability.

anagallis_arvensisFull MemberPosted 5 years agoHow the hell are you folk paying 1k a month off your mortgages?

I was thinking that!

wobbliscottFree MemberPosted 5 years agoPeople have been saying that for ten years now (they really have, search old threads on here or look on other forums) and they kept on getting lower.

True, but they’re already virtually interest free and you can’t get any lower than zero. Is another quarter percent drop going to make any difference whatsoever? Maybe £10 – £15 a month…but you’ll be protected against a potential 5% or more rise over the next ten years, which is highly likely and signalled their intense with the quarter percent increase a short while back. Over the next ten years they will rise for sure, the BofE is determined. So if you’ve still got ten years to go then you’ll probably be better off fixing in once for ten years at a near zero interest rate than a few bites at a number of shorter term deals accumulating fees and stepping up interest rates as you go.

Also the convenience of doing it once and for all until the mortgage is paid off and not having to worry about it again is worth it. Life is too short.

DT78Free MemberPosted 5 years agoyep no kids would make a massive difference. my angels cost £1k pcm part time

Ro5eyFree MemberPosted 5 years agoHow ??

More like WHY ?

Stick overpayments in your Pension and ISA and make more money than you save.

thegeneralistFree MemberPosted 5 years agoBanks employee hundreds of analysts to work out the %

This.

Don’t over think it. Unless your specifics are very specific and unusual the banks will already have spent millions doing the sums that people are doing above. The 10 year,5 year and 2 year will be set to give almost exactly the same outcome in most scenarios.

If one of their highly paid actuaries had worked out that the ten year was better in more situations in the long term then they’d have bunged another quarter percent on it.

FB-ATBFull MemberPosted 5 years agoOne thing to consider, if you take a new product with Nationwide the 10% overpayment is based on the amount you originally mortgaged with them rather than the balance that you are remortgaging.

wobbliscottFree MemberPosted 5 years agoThe 10 year,5 year and 2 year will be set to give almost exactly the same outcome in most scenarios.

Not really, the I last did the sums there was a big difference in amount paid vs the different options. So yes, do your sums. Its all about risk and risk doesn’t come for free…if you fix in for a long period of time that is risky for the bank so they’ll be covering their backsides for the case where interest rates move against them…and you pay for that. The longer the period the more it’ll cost you.

I ended up going with the lowest interest variable rate product with zero fee’s on the basis I only had a few years left to go so happy to take the risk on the variable rate.

jimdubleyouFull MemberPosted 5 years agoand you can’t get any lower than zero.

Erm… quite a few central banks have base rates below zero. https://en.wikipedia.org/wiki/List_of_countries_by_central_bank_interest_rates

A mate of mine actually had a discount tracker where his nominal rate was less than zero. I don’t think the bank were paying him though…

The 10 year,5 year and 2 year will be set to give almost exactly the same outcome in most scenarios.

This – we recently did the sums on a 5,7 and 10 year rate switch. All cost very similar amounts overall so choosing comes down to your risk appetite. We opted for 7 year fix which will probably put us coming off a fixed rate slap bang into rising rates knowing our luck!

diggaFree MemberPosted 5 years agoHard to see where rates might go. On one side, the US Federal Reserve have raised rates:

Whereas the ECB have only just stopped quantitative easing (QE) which both the Fed and the Bank of England stopped a good while back and their rates are below zero. With all major European economies showing weakening GDP, I really don’t understand what the ECB can/will do.

So it’s hard to see where UK rates will go.

mrchrispyFull MemberPosted 5 years agoI’ve just remortgaged and stuck with FirstDirect, we have 2 mortgages with them (took out more for home improvements) so I did 10 years fixed at 2.49% for the larger mortgage and 5 year fixed at 2.09% for the other bit so I’m spreading my risk.

FD allow unlimited over payments as long as you dont fully pay off the debt in the fixed term.

Kryton57Full MemberPosted 5 years agoThat First Direct offer looks good, I have an FD current account. However I switched the calculator to “offset” and it reduced the payments to £310 – based on equity in the house I presume feels dangerous.

Coventry have a 10 year fixed at 2.25 and Barclays a 7 year at 2.02.

charlielightamatchFree MemberPosted 5 years agoIt wasn’t long ago that interest rates were higher and if you’d have asked someone if a 2.5% 10 year fixed was good value they’d have slapped you and asked why you hadn’t already signed up for it….

If you have no plans in moving I’d fix for as long as I could with the rates they are at now. As long as you can do overpayments then you’ve got lots of flexibility within the fixed period.

winryaFree MemberPosted 5 years agoMember

How ??More like WHY ?

Stick overpayments in your Pension and ISA and make more money than you save.

With interest rates so low pension and isa make very little. Over the next 10 years, my £500 overpayment will save me £23500 in interest charges. I’d never earn that much in any isa or pension account

charlielightamatchFree MemberPosted 5 years agoOver the next 10 years, my £500 overpayment will save me £23500 in interest charges. I’d never earn that much in any isa or pension account

I agree. I also think there is something special about paying a mortgage off, so while there might be a slight advantage doing things a different way paying a mortgage off earlier would always be my first choice.

dangeourbrainFree MemberPosted 5 years agoWith interest rates so low pension and isa make very little

big assumption but if you’re not already putting 40k a year into your pension then the tax relief alone is worth more than the interest savings on your over payments and a decent socks and shares isa really really should be averaging noticeably more than 2.5% over that 10 year period.

belfastflyerFree MemberPosted 5 years agoInteresting thread. My 2p worth is if you’re making over payments make aure there isn’t a savings account with a higher interest rate than your mortgage.

Nationwide do a regular savings account which offers 5%. My advice would be if you meet the criteria, open one and pay into it each month and then pay the lump sum to your mortgage… along with that 5% interest 😉

shintonFree MemberPosted 5 years agoNow that we’re ‘empty nesters’ all extra money is going into AVCs and I don’t expect to have the mortgage paid off before I retire. When that time comes we can either use the 25% tax free lump sum to pay off the mortgage balance or downsize and be mortgage free. If we go for the first option we can still downsize at a later date.

winryaFree MemberPosted 5 years agoInteresting thread. My 2p worth is if you’re making over payments make aure there isn’t a savings account with a higher interest rate than your mortgage.

Nationwide do a regular savings account which offers 5%. My advice would be if you meet the criteria, open one and pay into it each month and then pay the lump sum to your mortgage… along with that 5% interest 😉

The problem with anything with interest rates over 2.1% is that they limit how much you can save and pay in. The nationwide saver is a 12 month term only which you’re limited to £3000 and earns £81 in interest so unless they let you have lots of accounts isn’t really Earning much

Kryton57Full MemberPosted 5 years agoAlso – bear in in mind my maths is crap – over a period of a mortgage theres a greater cost saving by the reduction in compound interest via reduction of the capital. If I’m right, and someone else may need to do the maths, you save more than you’d earn in a high interest account.

kiwicraigFull MemberPosted 5 years agoNothing constructive to add but just an observation that interest rates seem insanely low in the UK and locking in 10 years at 2.2% sounds amazing.

We’re on 4.09 (1 year) and 4.8% (fixed for 3 years) here in NZ. 5% for an offset.

The topic ‘Mortgate rates, whats going on?’ is closed to new replies.