- This topic has 80 replies, 48 voices, and was last updated 8 years ago by teamhurtmore.

-

"Ive paid into it all these years, I'm entitled…"

-

P-JayFree MemberPosted 8 years ago

“I’ve paid in, I’m entitled” is the exact concept behind National Insurance, Tax and the Welfare State.

But it should be seen as an Insurance Policy and not a Savings Account.

Every citizen in the UK is entitled to certain benefits and medical care at the point of need, as Binners said it’s not always perfect because if we handed out Giros to anyone who turned up (the Daily Mail fictional version of the world) we’d be bankrupt.

Certain benefits do require you to have paid in a certain amount, I’m not sure of the exact rules, but I don’t believe you can spend your entire life as a Housewife / Househusband and expect a State Pension, nor can you claim Unemployment Benefits until you’ve paid in a certain amount (based on them checking my file last time I had to sign on) but for the most part is an insurance policy that works by pooling the resources of a large group to pay for the losses of a smaller group.

jimdubleyouFull MemberPosted 8 years agoI’m a carer, I currently work with a 19 year old autistic guy who is on benefits (also goes to college and wants a job in horticulture). Every year, he scrapes together enough for a few days holiday. Is he such a bastard?

No he’s not, and I do believe there are cases where people will be on benefits for the rest of their lives. I’ve been to Romania, it’s not a nice place to be disabled (physically or mentally) and I would not want our country to become like that.

El-bentFree MemberPosted 8 years agoIn reality its a life lived in quiet desperation, unnoticed or actively despised, on the very fringes of a cold and uncaring society.

So **** you!

MSPFull MemberPosted 8 years agoTaxation is far too often sold, especially by the right wing, as a direct money in money out system. They don’t obviously consider peace, security, law and order, a healthy and educated workforce, a transport network etc etc.. as benefits that the wealthier members of society benefit from. So they portray them as losers in the system, when by any obvious measure they are winning in some style.

But the wealthiest are so entitled that they demand the poorest and most vulnerable should suffer even further to increase their margins of victory.

jimdubleyouFull MemberPosted 8 years agoTaxation is far too often sold, especially by the right wing, as a direct money in money out system. They don’t obviously consider peace, security, law and order, a healthy and educated workforce, a transport network etc etc.. as benefits that the wealthier members of society benefit from. So they portray them a s losers in the system, when by any obvious measure they are winning in some style.

But the wealthiest are so entitled that they demand the poorest and most vulnerable should suffer even further to increase their margins of victory.

It’s a shame that the middle ground of UK politics sold themselves to the devil and got **** into a cocked hat at the last election.

binnersFull MemberPosted 8 years agoI’ve been to Romania, it’s not a nice place to be disabled (physically or mentally) and I would not want our country to become like that.

My better half works with disabled charities. Open your eyes. We’re on the way there. But hey…. they’re all just scroungers anyway aren’t they? There are loads of stories in the press about people off work with dodgy backs, spotted out playing golf….

totalshellFull MemberPosted 8 years agoin the same way turkies dont vote for xmas we ve particpated in a democracy that has constantly rejected increases in taxation even while accepting inflation as a way of life and yet we expect more and greater benifits of all types from our meagure weekly contributions..

the number of folks using the nhs daily is beyond everyones ability to comprhend and paying for it from tax receipts alone would raise ni by a factor of about 4..

P-JayFree MemberPosted 8 years agosharkattack – Member

I don’t want to get sucked in to this debate but I will say that I’ve been on Jobskeers Allowance before and it’s no picnic.

It’s like your life is put on hold. It’s impossible to save up, it’s hard enough to stretch it week to week.

Plus you have to go to a Jobcentre and be treated like work shy scum. It’s a horrible situation to be in. No one is doing it for fun.

No I’m with you there, it’s bloody crap, how people live on it long term I’ve no idea – it’s about £10 a day from memory.

I’ve had to do it twice, in 2009 I was made redundant and managed to smash myself up a few weeks later, I managed to go 8 months on my redundancy money before I had to sign on for 3 months – not because I took some moral high ground, but it pretty unpleasant having to sign on. I was actually unfit for work during all that time, but it seemed much more work to go down that route so they accepted due to my medical condition I could only apply for certain roles.

And again 3 years ago, with a family to support I had not choice but to sign on the day I got made redundant (this time the pay-out was a few hundred quid) thankfully I found a job in a week or two so I only signed on once, on the day I applied.

One thing that does differ though, the people in the JC were lovely, I was always on-time, polite and sober though, unlike most people that day.

mudsharkFree MemberPosted 8 years agoWe need corbyn in charge so the mindset doesn’t need changed.

Why’s that then? Surely the poorer will get money and the richer won’t whoever’s in charge – there’s just not enough left! We ‘need’ to continue the pyramid scheme – more young people needed, just need to sort out how to house them.

El-bentFree MemberPosted 8 years agoin the same way turkies dont vote for xmas we ve particpated in a democracy that has constantly rejected increases in taxation even while accepting inflation as a way of life and yet we expect more and greater benifits of all types from our meagure weekly contributions..

People have been led to believe that there were “efficiency savings” to be made in Government, but instead of using those “savings” to improve the services, it was given away in tax cuts.

As you say turkeys won’t vote for this particular Christmas, so the likes of Corbyn may be too radical for the financially conservative folk who will continue to vote for the other Christmas…the conservative Christmas of diminishing returns.

Country needs a good dose of cold water to snap it out of this regression, I think this particular tory government has shown they can definitely deliver it.

MoreCashThanDashFull MemberPosted 8 years agoIf I e look specifically at pensions, the scheme was set up on the basis that men lived on average to 68, and so only needed to pay in enough to fund three years pension.

If contributions had risen to match life expectancy, our eyes would be watering.

Not saying that other financial embuggerance by all parties in recent years isn’t another big part of the problem.

djamboFree MemberPosted 8 years agonot sure on the details but I believe Switzerland have an interesting way of dishing out unemployment benefits. for 36 weeks you get 70% of your gross salary! after that you’re on your own!

bailsFull MemberPosted 8 years agoWhy shouldn’t someone on benefits be able to go on holiday?

Because it’s meant to be a safety net, not a lifestyle choice.There’s this odd mindset around that if someone is unemployed now they must have always been unemployed.

It’s possible to scrape together enough money from your low-paid job to make a holiday booking in October. By the next summer when the holiday comes round you might have been unemployed for a month, but if it’s all inclusive and you’d lose all your money if you stayed at home then you might as well go.

On pensions, I remember reading something a while ago that said when the state pension was introduced there were twenty workers supporting each pensioner, there are now five workers per pensioner. Have our NI/income tax rates quadrupled to keep up with that?

lungeFull MemberPosted 8 years agoThe state pension was introduced as a support mechanism for those who were physically unable to work due to old age. I think (please tell me if I’m wrong here) that the average life expectancy at the time was lower than the pension age by about 10 years. Very few lived long enough to draw there state pension and even those that did wouldn’t have drawn it for long.

The sensible thing to do would have been to link the pension age to average life expectancy but that horse has now bolted. You’re now in a position where pensioners are a hugely important voting force, you can’t just increase the pension age to 90 without the entire of middle England being up in arms, it’s political suicide in its purest form. Equally, you dare tax them more or take away there public services…

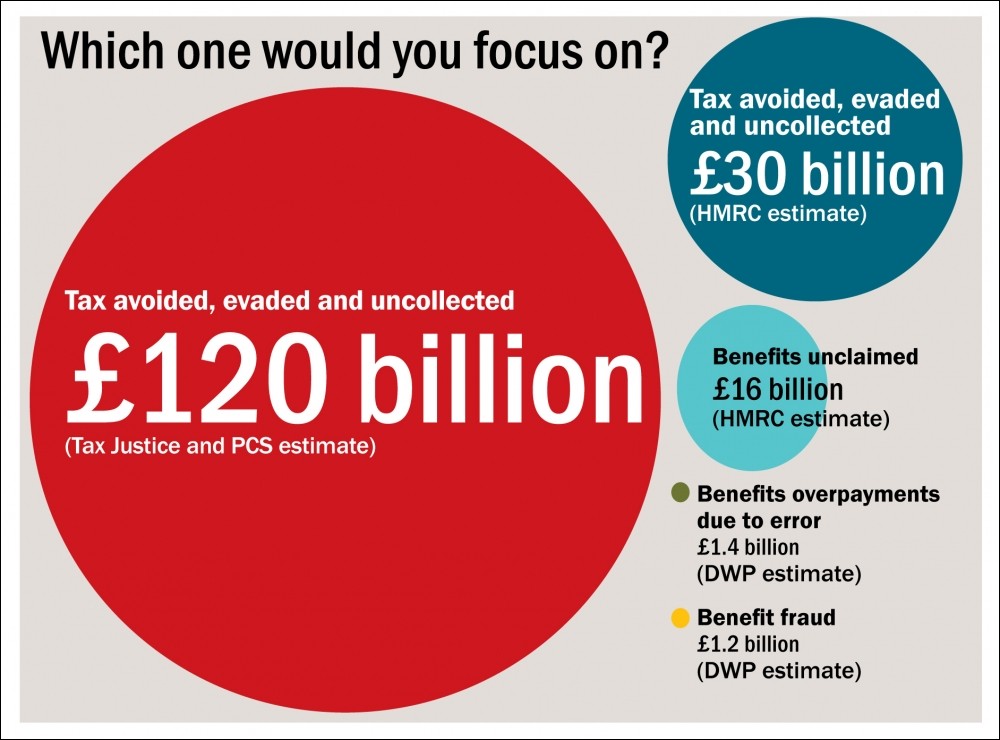

FlaperonFull MemberPosted 8 years ago^^ This is a terribly misleading image, as the largest blob actually represents a value more than 14,000 times greater than the smallest, not 120x as the author intends.

ampthillFull MemberPosted 8 years agoI hear it all too regularly, from otherwise reasonably intelligent people, they seem to exist under the assumption that every penny that they pay in tax is held in a nice little purse with their name on it, growing with inflation, and should be made available on demand

NHS and ‘Dole’ the state pension are the favourites.The Op seems ti have gone but I’m lost

The NHS argument doesn’t stack up at all. Whether your talking about private health insurance or the NHS no one thinks the money is sat in an account waiting to be spent. The cost of your care is met from the money paid in by everyone else in that year. So all my life I’ve been paying for the health care of the elderly (so have those with health insurance). When I’m old i expect the young to pay for my care. If i didn’t believe that why would i bother paying in

Pensions are different in that private pensions have a pot. State pensions are on the same basis as above

I pay tax to so that those not in work receive benefits. If I’m unemployed I hope that the tax of others will pay my benefits. It makes no sense for the tax to be kept until I’m unemployed

mudsharkFree MemberPosted 8 years agoWhen I’m old i expect the young to pay for my care. If i didn’t believe that why would i bother paying in

What choice do you have?

Can’t see how I’ll get a state pension which is the biggest loss I’ll make on this ‘deal’ – I continue to pay my dues.

brooessFree MemberPosted 8 years agoI don’t think it matters what has been promised in the past – demographic changes and 20 years of living beyond our means on excessive debt (government, companies, banks AND consumers) means we’re really nothing like as well off as our lifestyles would suggest we are. Not now and certainly not in the future.

I think the masses are just beginning to realise this as 7 years after the financial crisis and still no wage rises, no growth, emerging stagnation… why else did Gideon stoke house prices just before the election?

We have a very serious pensions crisis – partly because government and consumers have failed to make proper provision/made wrong assumptions about how much will be needed and partly because of simple demographics ie: people don’t die as young as they used to…

As a result of these wrong assumptions many people have failed to make private provision for their pensions, or spent every last penny on a massive mortgage and assumed house prices will go up forever and/or they can ‘downsize’ when they retire, without actually understanding that the assumption about state pension still existing when they retire or that house prices won’t have stagnated or crashed… may or may not be correct.

I don’t think we can afford to keep the current ‘contract’ going – there isn’t the money in the coffers to pay for our ageing population without massive tax rises – which no-one has the earnings to be able to afford…

Maybe we’ll end up in a new model with communal older communities where people live together, supported by charities or voluntary groups and younger family members. Much how it was before the Welfare State was introduced, and how many poorer countries still do manage it.

The reality of this may not be that bad, but a population that expected retirements spent on holiday in the sun with well-funded pensions will no doubt be rather unhappy with the government which admits to us that the reality’s not too rosy….

soobaliasFree MemberPosted 8 years agothe NHS example i was confronted with today was a coworker who has some hip pain, she has seen a physio who has suggested some exercises, she continues to train a minumum of three times a week, using the theory that it hurts if she trains or rests*

she wants a scan (CAT, MRI, something expensive) and stated, “Ive paid into it all these years, I’m entitled”

*I dont think she has ‘rested’ at any point to fix/recover whatever the issue is, she may need a scan/operation, ianad

as for the rest of the thread, lots of “pay in” statements. Its not a piggybank, the reality is that you pay out.

mooseFree MemberPosted 8 years agob r

Police and Armed Forces seem to think that the rest of us owe them a long and comfortable (early) retirement when the rest of us are having to work longer and put greater amounts in for less return.Really? How so? You may want to check your facts old bean before you make yourself sound slower than you actually may be.

wobbliscottFree MemberPosted 8 years agoOf course you’re entitled. We all are, subject to the rules around claiming. And therein lies the problem. There are people who make living on benefits a lifestyle choice. I know people personally who have. Also I did claim the dole for a short while between finishing Uni and starting a job. As others have said the Job Centre people were brilliant, but I certainly had a bit of an eye opener observing some of the people in the queue to pick up my dole payment. Clearly there were some people with some real issues, like mental health, who appear to have fallen between the cracks and seemed to need proper help, but there were also several people bragging about the benefits they were receiving.

In the UK we spend around 25% or so of GDP on benefits. Almost as much as the NHS and it massively overshadow’s pretty much everything else. Obviously there is a problem in the UK regarding wage levels, but with a benefits system that has been as generous as ours for so long, its like a drug some people need to be weaned off. I think the governments approach of not taxing people at that end of the scale is the biggest part of the solution.

I’m in the classic ‘squeezed’ middle band and completely flumoxxed that I am entitled to Child Benefit. It comes in handy, don’t get me wrong – I wouldn’t be able to fund my mountain bike hobby without it, but I really really think the I or people in a similar circumstance as me should be entitled to any handouts. It’s a safety net and not a wealth re-distribution mechanism.

JunkyardFree MemberPosted 8 years agoThe state pension was introduced as a support mechanism for those who were physically unable to work due to old age. I think (please tell me if I’m wrong here) that the average life expectancy at the time was lower than the pension age by about 10 years.

You are wrong

It was introduced because the average life expectancy was pension age + 1 year and so you had one year to get your stuff in order and die.

Its not a model i would want to revert to if i am being honestfin25Free MemberPosted 8 years agoIn the UK we spend around 25% or so of GDP on benefits

Inaccurate in the extreme…

teamhurtmoreFree MemberPosted 8 years agoThe state pension is in effect a Ponzi scheme. Point that out and the fact that people need to think about the implications and you get flamed.

There is only so much you can do – pity those in positions of responsibility are not honest in their advice to their members or those they are supposed to represent.

But cold comfort being told that there is no pot!

aracerFree MemberPosted 8 years agoAre we talking average life expectancy at birth, or average life expectancy at retirement age? Because they’re significantly different.

ircFull MemberPosted 8 years agoThe 120 Billion is a misleading figure. Tax avoidance is legal. If we buy an ISA we are avoiding tax. When we fill in a tax return and claim expenses to reduce taxable income we are legally avoiding tax.

shifterFree MemberPosted 8 years ago“I’ve paid into it all these years”

Something the self-employed never say?

convertFull MemberPosted 8 years ago“Ive paid into it all these years, I’m entitled…”

Equals

“For years I’ve paid my contribution to society so those that are in need can be supported, but now I’m in need. “

I’ve no real wish to be part of a society where this was not at least an objective. I dispare of the lack of empathy some people seem to have. The mean part of me wishes them ill so they could be kicked in the slats in their time of need.

JunkyardFree MemberPosted 8 years agoAre we talking average life expectancy at birth, or average life expectancy at retirement age? Because they’re significantly different.

Retirement age

Your expected death age – one year. Was that clearer?

ampthillFull MemberPosted 8 years agoGot a source Junkyard. You might be right I’m getting

When the first contributory state pension was introduced in 1926, only a third of men and 40% of women were expected to live to see their 65th birthday

When David Lloyd George introduced the first state pension, 105 years ago next month, it was worth around 25p a week and could be claimed at the age of 70. At the time, life expectancy was barely 50 and only one person in four made it to pensionable age. But it laid the foundations of a system that slowly began to reflect the real-life experiences of the working population. The value of the pension gradually rose, while pensionable age fell – to 65 for men and, a little later, 60 for women. By 1945, the average woman could expect a few years of retirement and – before too long – even the average man could expect a year

Any way I thought obesity epidemic was going to solve the problem

I’d love to read something or watch something on whether life expectancy is going up or down. There are 2 competing models and they are never compared

JunkyardFree MemberPosted 8 years agoGot a source Junkyard. You might be right

My best guess is heard it on a Radio 4 programme years ago so I am not prepared to declare it a genuine actual fact.

IN essence no but I have not tried to find one either…the footie is onhoraFree MemberPosted 8 years agoBinners when I lived in London similar happened to me. I walked in, was made to feel like I was a leech, to feel ashamed to ask. So by the time I got the ‘based on your answers you are not entitled letter’ two weeks later I’d found work.

It also said ‘if you want to appeal or need an urgent loan’ etc.

So. I’ve paid tax and N.I OP etc why do you think the likes of me and other workers are entitled to ‘it’?

I think the new Labour leader in someways could temper the Conservatives desire to sell everything and remove everyones (inc Unions) rights in and out of work and be a positive force.

aracerFree MemberPosted 8 years ago…oh and in 1901 a good half of those who made it to 45 also made it to 65 http://www.ons.gov.uk/ons/rel/hsq/health-statistics-quarterly/no–18–summer-2003/twentieth-century-mortality-trends-in-england-and-wales.pdf

edit: from the same doc, the mortality rate in 1901 for 65 yos was only slightly more than 1 in 10 – I think that one pretty much rules out the idea that the average life expectancy at retirement age was 1 year.

wordnumbFree MemberPosted 8 years agoCould somebody confirm this thread is about wishing wells? Don’t want to commit to reading about airy-fairy economic theories and personality politics.

wreckerFree MemberPosted 8 years agoA self employed friend of mine had to claim for a couple of months as he hurt himself at work. To be fair, he did get approved without too much fuss but being in a sling with a hospital note probably helped. When he went back to work they took all of the money back off him. He said that he now doesn’t pay the voluntary NI contribution as a result.

brooessFree MemberPosted 8 years agoONS breakdown of UK welfare spending

42% pensions

only 2% and 11% respectively on unemployment and housing benefit and 15% on incapacity.So if we want to reduce the welfare budget, removing those who are abusing the system will not make as much of a dent as reducing pensioner benefits…

Even as a lifetime Conservative voter I have an increasingly strong distaste for the narrative that our welfare bill is being wasted on ‘scroungers’ and ‘abusers’, especially when you have data like this to observe where the biggest savings could be made…

The topic ‘"Ive paid into it all these years, I'm entitled…"’ is closed to new replies.