- This topic has 72 replies, 37 voices, and was last updated 13 years ago by bratty.

-

Is the recession getting worse or better, our house prices falling or not?

-

StonerFree MemberPosted 13 years ago

You have some very weird ideas about economics TJ.

I agree normally, but in this very simple, un-arguable case, he’s correct. He’s just wrong the rest of the time. 🙂

oldgitFree MemberPosted 13 years agomissingfrontallobe, seeing a lot of that. people are extending or making their homes faultless.

TorminalisFree MemberPosted 13 years agobut in this very simple, un-arguable case, he’s correct.

Okay, so explain to me how these growth figures are going to look in the context of the inevitable inflationary backlash that QE has assured we will have to endure?

The rate of inflation of the currency is currently obscured by the re-capitalisation of the bank but the debt is still a part of our currency. Does growth against an inflating currency still count as growth?

These are all genuine questions as I appreciate I am no expert, it just seems to me that any growth we are currently experiencing is an illusion against the backdrop of unrealised inflationary pressures.

RepacKFree MemberPosted 13 years agoIt’s laughable to think that some people seem to want to blame the current governments policies for putting us back into recession.

What happened in the the decade before the credit crunch, were we prudently putting away money for a rainy day? Paying a reasonable price for a house? Not buying a new car every 3 years on credit?

It’s easy to point the finger at the government, the reality is we all put ourselves in this position by believing that growth could never cease and that houses would continually shite money.

+1

There is a multitude of folk on this forum & out in the real World who love to do do nothing more than export the blame for the current mess on the “condems” (oh so f*cking witty), yet refuse to acknowledge it was the decade or so under Blair that has led us to where we are now..

For me? We are still in the smelly & face a long haul out of it.. The only thing that changes your stance is your political perspective – I very much doubt there is anyone here who really fully understands the intricate economic mechanisations involved (its certainly too damned complex for me to grasp). The truth is cuts needed to be made EVERYWHERE. We have over-spent for years & put nothing aside & now the country has to pay.

rondo101Free MemberPosted 13 years agoThere was a graph on here some time ago, that showed the cyclical nature of house price rise and falls.

It said the bottom would be in about 18 months time. Anyone got a link?

StonerFree MemberPosted 13 years agogrowth is calculated in real terms, not nominal.

Inflation or deflation doesn’t affect GDP output figures (it effects output itself though, obviously)

StonerFree MemberPosted 13 years agorondo, that second graph needs adjusting for inflation in order to be compared with the upper graph as the mean trend in the upper graph is arithmetic, not geometric as it would be if it was in nominal prices.

TorminalisFree MemberPosted 13 years agoit effects output itself though, obviously

So whilst we may be able to say that the economy is growing in terms of GDP, we could actually be seeing negative growth of the actual output of the country?

Rather makes one question the relevance and meaning of the national growth figures that TJ was quoting dontcha think?

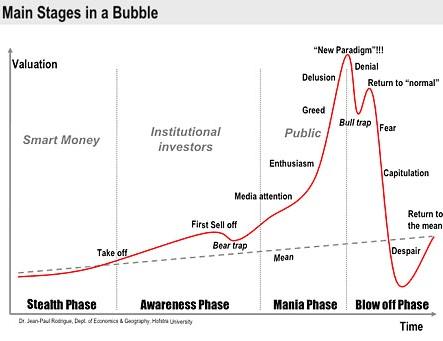

ooOOooFree MemberPosted 13 years agoThat wasn’t the graph I remember….but those 2 certainly share an interesting shape!

hey it’s all about happiness now, not GDP Mr Torm

TorminalisFree MemberPosted 13 years agohey it’s all about happiness now, not GDP Mr Torm

Oh, that’s okay then, I am always pretty chipper so I must be wealthier than ever (in my heart).

nickfFree MemberPosted 13 years agoThere really is a lot of rubbish talked on Singletrack.

TJ is right* to say that we’re not in recession. That doesn’t mean that everything’s rosy; far from it. Recession is typically defined as being a drop in the GDP for two or more consecutive quarters, ergo anything other than a drop means we’re growing.

What happens if GDP’s growing at 2.0% pa and inflation’s growing at, say, 3% and rising? Regardless of what you might think, this does not mean recession; what it might mean is the start of stagflation, where there’s a sustained period of very low growth, coupled with high inflation and high unemployment.

Long term, this would be much worse for us than recession; look at how Japan has suffered economically in the last decade or so.

*There, I’ve finally said it!

ooOOooFree MemberPosted 13 years agoHere’s the ones I meant:

Ooppps…..I was wrong – maybe buy in 5 years time instead

rightplacerighttimeFree MemberPosted 13 years agoWhy don’t we all listen to In Business on R4 tonight – which questions whether we have reached the limits of growth, then reconvene in the morning?

rondo101Free MemberPosted 13 years agorondo, that second graph needs adjusting for inflation in order to be compared with the upper graph as the mean trend in the upper graph is arithmetic, not geometric as it would be if it was in nominal prices.

yeah, fair enough:

meftyFree MemberPosted 13 years agonickf – the gdp figures quoted are adjusted for inflation so that is growth in excess of inflation, whereas in your example there is no gdp growth.

mcbooFree MemberPosted 13 years agoWe’re not in recession but 2011 aint going to be pretty. How bad depends very much on where you live. Let me tell you, London is jumping, shops are full, so are restaraunts. We’re not in the Euro so we’ve efectively devalued our way out of trouble, the amount of tourists in town are visible evidence of that.

However, if you live say in the North, where public sector jobs can be 50% or more of total employment its pretty obvious whats about to happen.

I dont think you can blame the current government. Labour didnt pay down the national debt in the good years (ran deficits since 2003? someone check that for me) and Brown sprayed money we didnt have in 2007/2008 in as part of his planned takeover of the Labour party, allowed him to look great to the Left.

Read Andrew Rawnsley’s “End of the Party” for a blow by blow account of the TB-GBs. Terrific book.

brassneckFull MemberPosted 13 years agoI think the problem is recession is not necessarily equal to things being tight in the household budget.

This usually lags behind any statement of growth or contraction and is of course highly dependant on employment, location etc.I’ve been through a few recessions now, home owner (mortgaged) in all of them – none of them really made me feel any worse off because I remained employed, kept paying the mortgage, didn’t rack up any unsecured debt etc. But plenty of other poor sods did through often no fault of their own.

HohumFree MemberPosted 13 years agorightplacerighttime – Member

Why don’t we all listen to In Business on R4 tonight – which questions whether we have reached the limits of growth, then reconvene in the morning?The end of economic growth will have massive implications for us all.

I may see if I can tune into this program later on.

Thanks for letting us know it is on.

MSPFull MemberPosted 13 years agoNot sure exactly what those graphs show exactly, looks like a case of lies damm lies and statistics.

Average earnings are inflated by the massive gains at the top over the past 20-30 years, and inflation is twisted by excluding housing and fuel costs etc. neither is a reliable mean for comparison.

StonerFree MemberPosted 13 years agoAverage earnings are inflated by the massive gains at the top over the past 20-30 years,

not really. The distribution curve for earnings has not changed a great deal. It is still skewed in much the same way. changes in both frequency and value at the right hand tail of a skewed distribution do not have very powerful effects on the distribution mean. They do on the median though, but that is not a genuine “average” IMO and certainly isnt the one used in most income analysis.

this graph is Finnish, but the premise still stands.

And just because you dont understand something doesnt make it a lie. It just makes you look like a luddite. The graphs of nominal mean house prices is a very interesting one and illustrates a number of issues such as wage inflation, economic cycles, and even planning policy versus divorce rates or immigration issues.

MSPFull MemberPosted 13 years agothis graph is Finnish, but the premise still stands.

grasping at unrelated straws there.

I would also suggest you look up the meaning of Luddite before you next use it in a sentence.

StonerFree MemberPosted 13 years agoIn modern usage, “Luddite” is a term describing those opposed to industrialisation, automation, computerisation or new technologies in general

I was implying you were opposed to something modern, like, you know, statistical analysis of house prices…..

and if you think a non-UK income distribution graph is clutching at straws in this context, then well you really dont understand it, do you.

nickcFull MemberPosted 13 years agolook at how Japan has suffered economically in the last decade or so.

mainly due to an unhealthy collusion between Govt. and the banking sector which allowed otherwise bankrupt banks to continue trading, rather than recessionary pressure

nickfFree MemberPosted 13 years agoNick, I was merly pointing out how an economy can get stuck in a nasty rut with minimal growth; quite agree with you on the causes of the Japanese situation.

MSPFull MemberPosted 13 years agoand if you think a non-UK income distribution graph is clutching at straws in this context, then well you really dont understand it, do you.

Finland top 10% earn 5.6 times as much as the poorest 10%, top 20% earn 3.8 times as much as the poorest 20%.

UK top 10% earn 13.8 times as much as the poorest 10%, top 20% earn 7.2 times as much as the poorest 20%

http://en.wikipedia.org/wiki/List_of_countries_by_income_equality

perhaps you would like to explain your genius in grasping the figures for Finland to prove your point about the UK.

epicycloFull MemberPosted 13 years agoSurf-Mat – Member

…IMO the “official” recession was just a little taster of what’s to come.+1

And for anyone who thinks their house has retained its value – look at how far the £ has dropped in the last year or so. You can buy less bikes per house now even if it’s worth the same as it was 3 years ago.

uplinkFree MemberPosted 13 years agoAnd for anyone who thinks their house has retained its value

I reckon mine has

I paid £31k for it in 1988ernie_lynchFree MemberPosted 13 years agoSurf-Mat – Member

We are not in recession at the moment.

“Someone has a lot of faith in distorted information and government spin.”

I fear that it is you Surf-Mat, who has lot of faith in distorted information and government spin.

It is extremely important for the present government to convince people that the UK economy is in dire straits.

We are not in recession, but thanks largely to the doom and gloom of the Tories, their LibDem stooges, and their mates in the right-wing press, many people believe we are in recession.

So when the Tory inspired recession eventually comes, people will not necessarily blame them. Specially if they have been suckered into believing that the Tories inherited a buggered recession-strapped economy.

And judging by some of the comments on here, the Tory strategy appears to be working rather well.

Of course the British economy is far from being very healthy. But it is quite frankly staggering, that despite the worst global economic crises for 80 years, unemployment only reached 2.5 million……..and almost everyone has managed to hang on to their homes.

In the Tory recession of the early 80s unemployment rose to over 3 million – the highest level since the 1930s. And in the second Tory recession of the early 90s, Britain endured the highest levels of home repossessions ever………and the turnaround in the construction industry from profit to loss was the greatest of any industry in British history.

I fundamentally opposed the New Labour government throughout its 13 years in power. But I cannot deny that I was greatly impressed with their handling of the global recession/credit crunch. Of course they should have done much more ….. as far as I’m concerned, but I am both surprised and impressed with what they did actually do.

Surf-MatFree MemberPosted 13 years agoYes we are not in recession but since the oringinal definition is “two down quarters of GDP” let’s consider what that means – when something is bumping off the bottom, how can it decline anyway?

It’s a bit like someone that’s terminally ill saying “I feel slightly better today.

Ernie – so wreckless spending, spunking everyone’s pensions, giving criminally laissez faire banks and all the rest greatly impressed you?

The rest of your post doesn’t actually have a purpose apart from randomly reciting a few facts. Are you saying the Tories want us to feel things are worse than they are?

Just wait two years – 4+ million unemployed and possible DEpression looms.

ernie_lynchFree MemberPosted 13 years agoThe rest of your post doesn’t actually have a purpose……

Thanks……..I’ll bear that in mind in the future.

Although posts with a “purpose” are not necessarily always my prime concern.

…….as this post might suggest.

grantwayFree MemberPosted 13 years agoNot scene any changes in London

But what i have heard a lot of buyers are waiting

to the signing over and asking for roughly £ 10,000 thousand less

or pulling out.brattyFull MemberPosted 13 years agoHere (SW Eng) things seem OK.

House prices fell about 15-20% then rose a little and now seem to be 10% off peak values. They are holding up as far as I can see. I think now that prices have been reported as falling, more sellers will withdraw and the situation will be similar to before when lower amounts of property on the market will cushion the falls to an extent. Increasing rents may also have an effect too. Of course in the North, things may be different, but low interest rates should be here for a year or two more, so will act against repossession.

I think the cuts will have a mixed effect – areas dependent on Civil Service will suffer more, while the devaluation of the pound and recovery will help other areas. Areas which recover better, eg the South, may see property prices hold up more, or even rise as both jobs are created and pay rises follow recovery. Areas where the cuts hit may not see this.

Overall there is still a net increase in immigration, and a percieved housing shortage – this has not been helped by the lower house building rates recently.

Tradesmen seem busy – prob due to the fixing up rather than selling and moving up trend.

On the subject of the recession, many forget that the trigger for all this was credit shortage caused by bad banking. I am not sure that long term demand across the world will be irreversibly damaged. Certainly not to the level the end of the world tinfoil hatters say.

One thing I am certain of though is that we can talk ourselves back into recession, but we can also work hard, keep on going and with using our intelligence and playing to our strengths, come out of the current troubles strongly. We will only fail if we allow ourselves to fail.

The topic ‘Is the recession getting worse or better, our house prices falling or not?’ is closed to new replies.